Market Analysis Aug 25th, 2025: ETH Hits ATH After The Fed Signals Rate Cut

A dovish signal from Fed Chair Jerome Powell at Jackson Hole sent Ethereum surging to a new all-time high (ATH) at the end of August 2025, reinforcing bullish sentiment in the crypto market. Read the full analysis from Pintu’s Trader Team in the article below.

Market Analysis Summary

- 🗒️ Bitcoin is struggling against resistance in the $122,000–$123,000 range and is forming a double-top pattern.

- ⚠️ ETH broke its ATH at $4,900. Despite the overall bullish sentiment, traders remain cautious amid rising profit-taking after the rally.

- ✅ Fed Chair Jerome Powell, in his speech at the Jackson Hole Economic Symposium, opened the door to a potential rate cut in September 2025, citing growing risks in the labor market even as inflation remains a concern.

Macroeconomic Analysis

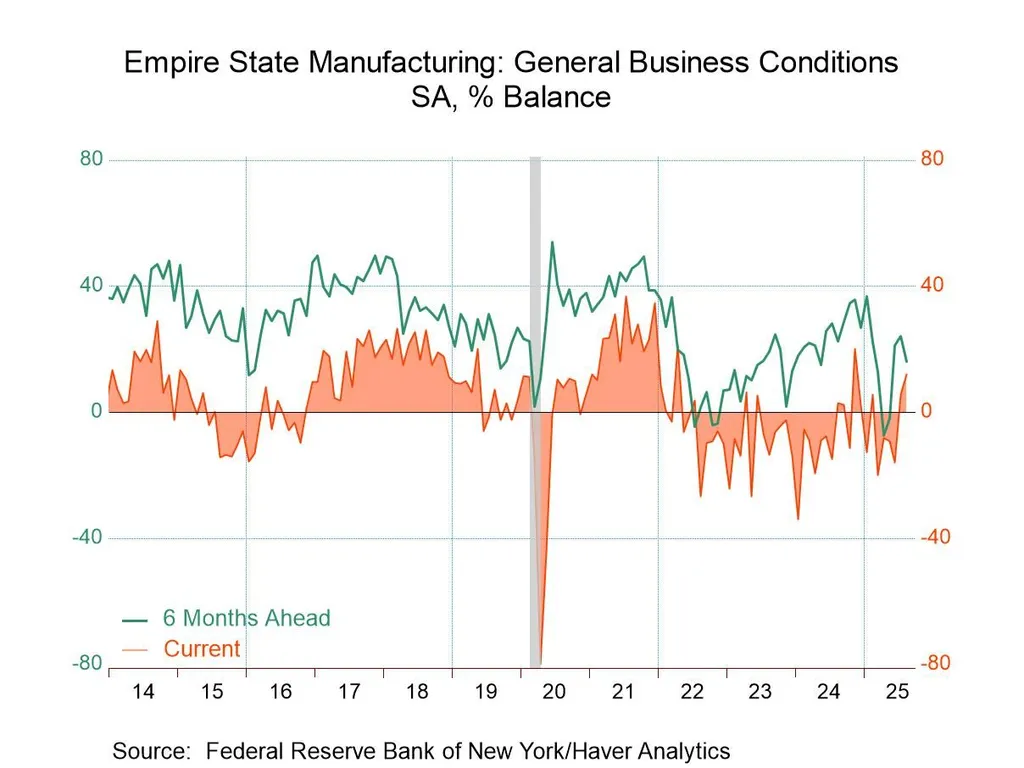

NY Empire State Manufacturing Index

The latest August 2025 New York Empire State Manufacturing Index rose sharply to 11.9, the highest level since November 2024. This represents a significant increase from July’s reading of 5.5 and well exceeds market expectations, signaling a strong rebound in manufacturing activity in the New York region.

This surge in the Empire State Manufacturing Index suggests a broad-based expansion in manufacturing, which is a positive sign for the overall economy. It indicates strengthening business conditions and could signal higher production levels and job growth in the manufacturing sector.

The impact of this robust manufacturing performance extends beyond New York. It can influence broader U.S. economic growth by boosting industrial output, reinforcing supply chains, and supporting labor markets.

Other Economic Indicators

- Retail Sales: The US Retail Sales in July 2025 increased by 0.5% month-over-month, reaching $726.3 billion. On a year-over-year basis, retail sales rose by 3.9%, indicating solid consumer demand despite some caution among shoppers

- Michigan Consumer Sentiment: The latest University of Michigan Consumer Sentiment Index for August 2025 dropped significantly to 58.6, down from 61.7 in July and below market expectations of around 62. This decline marks the first monthly drop in four months and reflects growing concerns among consumers about rising inflation and deteriorating buying conditions for durable goods, which plunged by 14%.

- Building Permits & Housing Starts: Housing starts rose by 5.2% month-over-month to an annualized rate of 1.428 million units, reaching the highest level in five months. This increase was led primarily by multi-family housing, which grew 11.6% to about 470,000 units, while single-family starts increased by 2.8% to roughly 939,000 units.

💡

In addition to the indicators above, last Friday the Fed held the 2025 Jackson Hole Global Central Bank Annual Meeting, an annual symposium sponsored by the Federal Reserve Bank of Kansas City since 1978.

In his speech, U.S. Federal Reserve Chair Jerome Powell delivered a dovish signal by opening the door to potential interest rate cuts in the near future.

Financial markets reacted positively to Powell’s dovish remarks. Following his speech, ETH surged 15%, reaching a new all-time high at $4,884.

BTC Price Analysis

Bitcoin’s price showed notable volatility while maintaining a generally bullish trend. From August 13 to August 20, 2025, the price fluctuated between a high near $123,561 on August 14 and a low of around $112,778 on August 20. Despite some downward moves toward the end of this period, Bitcoin remained well above $110,000, signaling strong underlying demand compared to the previous year when prices hovered near $59,574. Bitcoin’s market capitalization stood around $2.38 trillion during this period, indicating sustained institutional and retail interest.

BTC Technical Analysis

Technical analysis during the week suggested Bitcoin was wrestling with resistance around the $122,000 to $123,000 price levels, forming what some traders identified as a potential “double-top” pattern. A successful breakout above the $122,250 resistance could fuel further gains, potentially pushing Bitcoin toward the $125,000 psychological mark and beyond.

ETH Price Analysis

In the past week, Ethereum (ETH) has experienced a noticeable downtrend, with its price falling below the $4,300 mark to around $4,238 as of August 20, 2025. This decline contrasts with the strong rally seen earlier in the month when ETH surged above $4,600. The recent price drop has raised concerns about a potential short-term correction or deeper pullback, as Ethereum struggles to maintain its momentum amid resistance levels near $4,350. However, on August 23, 2025, ETH finally broke through its all-time high from November 2021, reaching a price of $4,867.

Support levels around $4,200 are being closely watched, as a breach could trigger further declines toward the $4,000 range.

ETH Technical Analysis

Despite the overall bullish sentiment fueled by positive on-chain activity, institutional interest, and network upgrades, traders have become cautious amid rising risk concerns and profit-taking after rapid gains earlier in August

Altcoin Analysis

Over the past week, the wider cryptocurrency market faced a downtrend, reflecting a broader market pullback after weeks of strong gains earlier in August 2025. Despite BTC and ETH maintaining substantial market capitalization, many altcoins saw notable price declines as investors reduced risk exposure amid persistent macroeconomic uncertainties and inflation concerns. The downtrend was particularly visible among mid-cap and smaller-cap altcoins, which are generally more volatile and sensitive to shifts in market sentiment. This has led to a contraction in altcoin prices, impacting overall market liquidity and trading volumes.

Several factors underpinning this altcoin price downtrend include tightening global monetary policies and cautious investor outlooks on economic growth. The crypto market’s correlation with traditional tech stocks has increased, and the recent sell-off in overvalued tech stocks weighed on risk appetite for cryptocurrencies. Additionally, with Bitcoin dominance dropping from around 65% to near 59%, Ethereum gained some market share, but the spillover liquidity supporting altcoins diminished. This uneven market performance has caused selective rotation, where capital flows favor the more established tokens while riskier altcoins face selling pressure, leading to a temporary but significant pullback across the wider crypto sector.

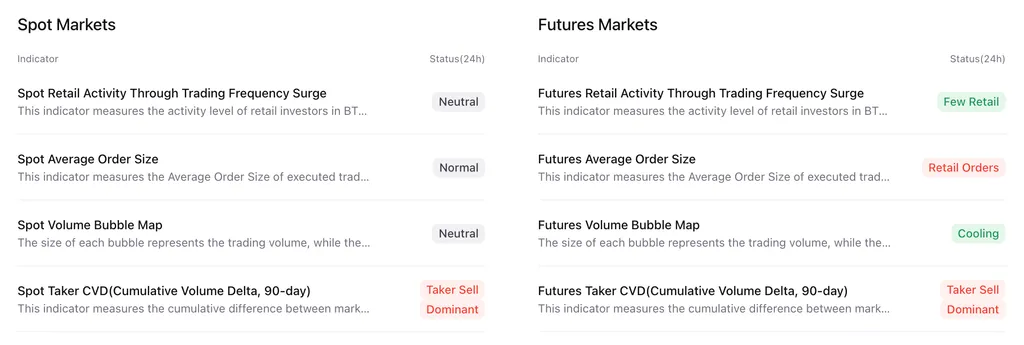

On-Chain Analysis

News About Altcoins

- VanEck Files for First JitoSOL ETF as U.S. SEC Clears Path for Staked Crypto Funds. VanEck has submitted an application to the U.S. SEC for a JitoSOL ETF, the first proposed Solana spot ETF fully backed by a liquid-staking token (LST). JitoSOL represents Solana assets that have already been staked, providing both exposure and staking rewards.The filing follows REX-Osprey’s recent integration of JitoSOL rewards into its Solana ETF.

News from the Crypto World in the Past Week

- PINTU Showcases Innovation and Adoption at Coinfest Asia 2025 with Cyberpunk Crypto Museum and Satoshi Sunset Party. At Coinfest Asia 2025, Indonesia’s all-in-one crypto app PINTU showcased its growth and innovation by launching the country’s first cyberpunk-themed Crypto Museum, hosting a $5,000 Futures Live Trading Competition, and closing with the Pintu x AWS: Satoshi Sunset Party. CMO Timothius Martin highlighted Indonesia’s supportive regulatory framework and revealed PINTU’s record July 2025 results: over 10 million downloads, the highest Monthly Trade Users since 2021, and Futures trading volume up 170% MoM. The event gathered nearly 1,000 participants, including regulators and leading crypto firms.

Cryptocurrencies Market Price Over the Past Week

Cryptocurrencies With the Best Performance

- Arbitrum +22.88%

- Aave +18.82%

- Chainlink +13.80%

- Jito (JTO) +13.75%

Cryptocurrencies With the Worst Performance

- Pump.fun (PUMP) -12.67%

- Mantle -8.67%

- SPX6900 (SPX) -7.94%

- Four (FORM) +5.30%

References

- Liz Napolitano, VanEck Files to Launch ETF With Jito’s Liquid-Staked Solana Tokens, decrypt, accessed on 24 August 2025.

- Bloombergtechnoz, Perdana di RI, PINTU Hadirkan Crypto Museum di Coinfest Asia 2025, accessed on 24 August 2025.

Share

Related Article

See Assets in This Article

ETH Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-