4 Promising Altcoins in the Layer-1 Blockchain for The Next Bull Market

While Layer-2 blockchain altcoins have captured considerable attention and witnessed rapid growth in recent years, the significance of Layer-1 blockchain altcoins persists, making them intriguing assets to hold within the crypto ecosystem. This article identifies four promising Layer-1 blockchain altcoins, Ethereum, Solana, Near Protocol, and Injective Protocol, based on their individual on-chain data.

Article Summary

- Layer 1 altcoins are cryptocurrencies operating on their own blockchain. Examples are ETH, SOL, ADA, and NEAR.

- Ethereum continues to be a leader in developing smart contracts and decentralized applications (dApps) across the crypto ecosystem.

- Solana is a Layer-1 blockchain with a high speed of up to 65,000 TPS thanks to Proof of History (PoH) technology. Even with Solana Firedancer, transaction confirmations can reach 1 million TPS.

- Near Protocol recorded high growth after introducing Dapps with innovative technologies such as KAIKAINOW.

- Injective Protocol offers a fast and gas-fee-free cross-chain DeFi solution. Injective has also shown strong adoption in the DeFi space with many transactions and users. INJ is one of the best-performing assets in the past year.

Altcoins with Layer 1 Blockchain Technology

In the next bull market, the potential of altcoins in the crypto market is viewed with enthusiasm and high expectations. Along with blockchain development, altcoins are increasingly important in the global crypto ecosystem. Despite their volatility, altcoins have shown tremendous growth and technological innovations.

The potential of Layer-1 blockchain altcoins in the next bull market is reflected in various aspects, such as the development of more complex dApps and the strong growth of the DeFi ecosystem. The combination of these factors makes Layer-1 blockchain altcoins important in realizing the future of digital finance. Some of the Layer-1 blockchain altcoins that we will discuss are Ethereum , Solana , Near Protocol , and Injective Protocol .

Layer-1 blockchain competition is an attempt to overcome the scalability (transaction speed + transaction fees) of the Ethereum network. Several blockchains with their technological innovations have emerged, so they are often regarded as Ethereum killers.

1. Ethereum

Ethereum is a pioneer in bringing smart contracts to the blockchain world. It has fueled the growth of a vast ecosystem of decentralized applications (dApps) across the blockchain industry.

This blockchain was introduced by Vitalik Buterin and his team in 2015. In September 2022, Ethereum made a major change in blockchain history by shifting the consensus mechanism from PoW to PoS.

This change allows Ethereum users to do staking and delegated staking to maintain network security. It gave rise to various dApps for liquid staking (LSD) to unstaking platforms in the Ethereum ecosystem.

Read also: What is Ethereum and How Does It Work?

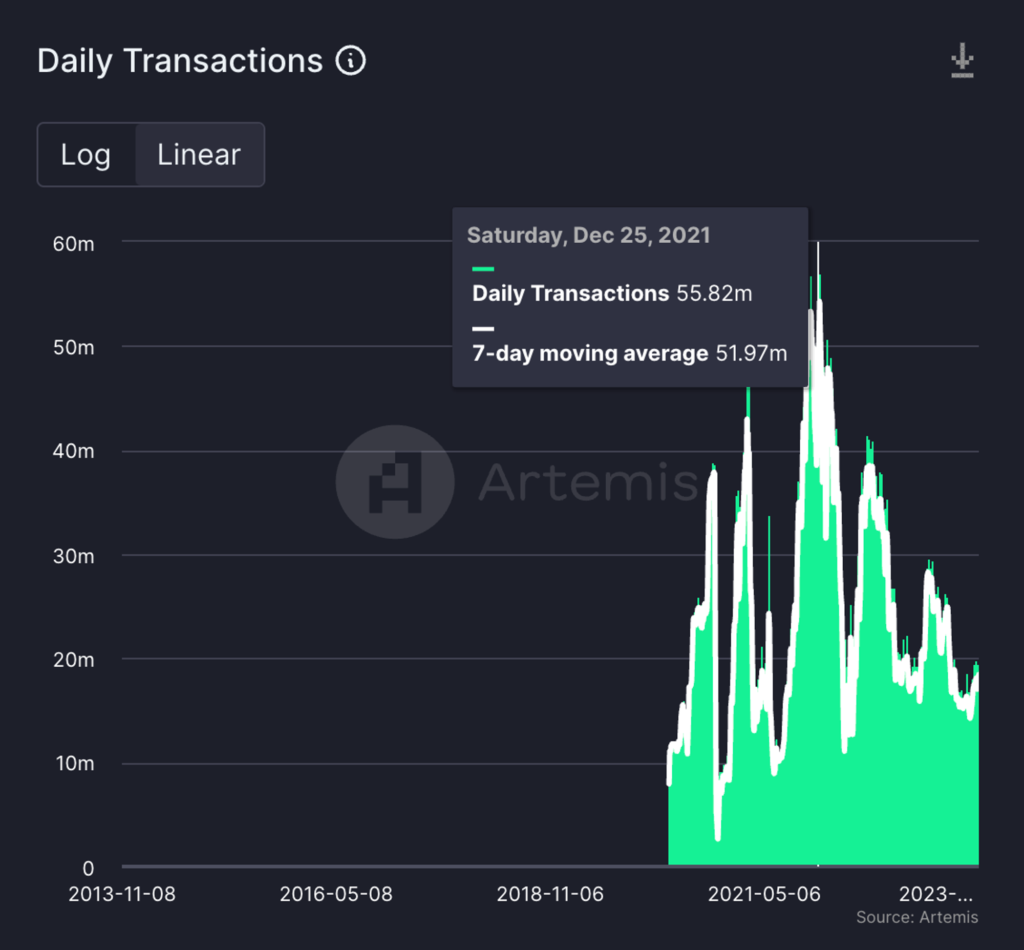

Ethereum Daily Transactions

Since March 2020, the number of daily transactions on the Ethereum network has fluctuated, reaching over 55 million in December 2021. Despite facing market fluctuations, Ethereum transactions have remained stable above 1 million and shown significant resilience.

Ethereum Active Wallet Addresses

From the image above, the number of active addresses on the Ethereum network has steadily increased to the current number of over 412K wallets. However, active wallet addresses are slightly lower in Q3 2023 than in Q2 2023, dropping by about 4%.

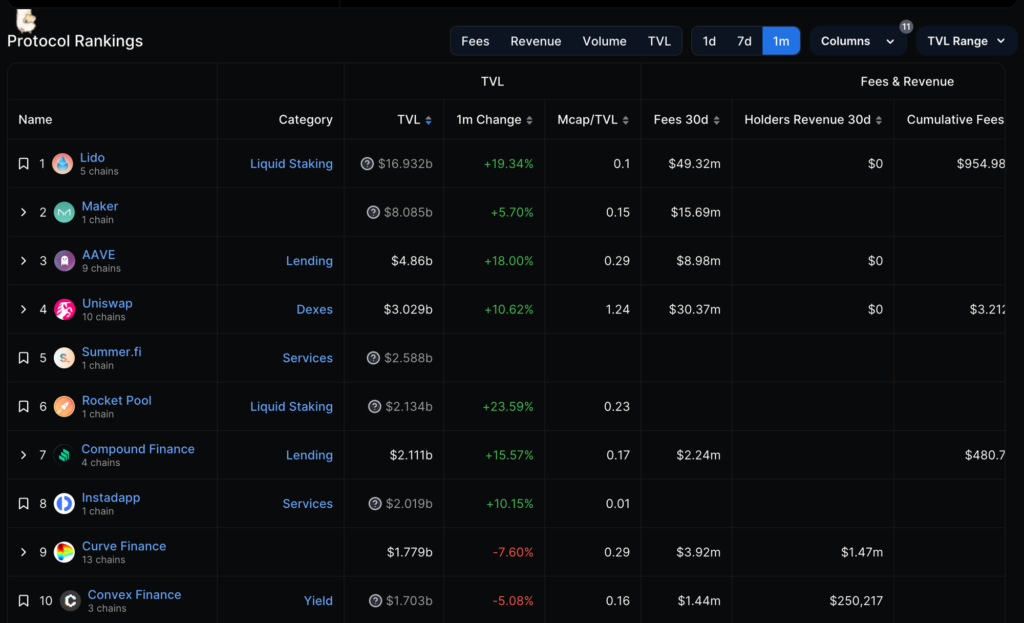

dApps on the Ethereum Network

The Total Value Locked (TVL) on Ethereum reached 23,887 billion US dollars. Of all the dApps on Ethereum, Lido controls the TVL with almost 17 billion US dollars or 70.89% of the total. Lido is a liquid staking platform for several crypto assets.

Some other popular dApps on the Ethereum network include Maker, Aave, Uniswap, Summer.fi, and others. Based on the TVL of each platform, they all reach an impressive amount of over 1 billion US dollars! It reflects the high level of trust and user adoption of applications on the Ethereum blockchain.

Ethereum’s Potential in the Next Bull Market

In the third quarter, Ethereum’s price and market capitalization decreased by 10%, although it outperformed Bitcoin by 2%.

Ethereum’s Layer-2 (L2) transactions increased significantly, reaching double the Ethereum mainnet transactions by the end of the third quarter. One of these was Base. Driven by the popularity of friend.tech, Base experienced explosive growth and even surpassed the number of Ethereum mainnet transactions at times.

Additionally, Ethereum is expected to implement the Cancun-Deneb (Dencun) Upgrade later this year. This update will significantly reduce the cost of Layer-2 transactions (rollups) and lay the foundation for improved performance in Ethereum.

2. Solana

Solana is a Layer-1 blockchain that aims to improve scalability, speed, and transaction performance. This blockchain has an innovative consensus called Proof-of-History (PoH) that enables transactions to be ordered automatically, making Solana one of the fastest Layer-1 blockchains with transaction confirmations reaching 65,000 TPS.

Solana was founded by Anatoly Yakovenko. The launch of the Solana mainnet in 2020 was an important step in the evolution of blockchain technology.

Learn more in the article What is Solana (SOL)?

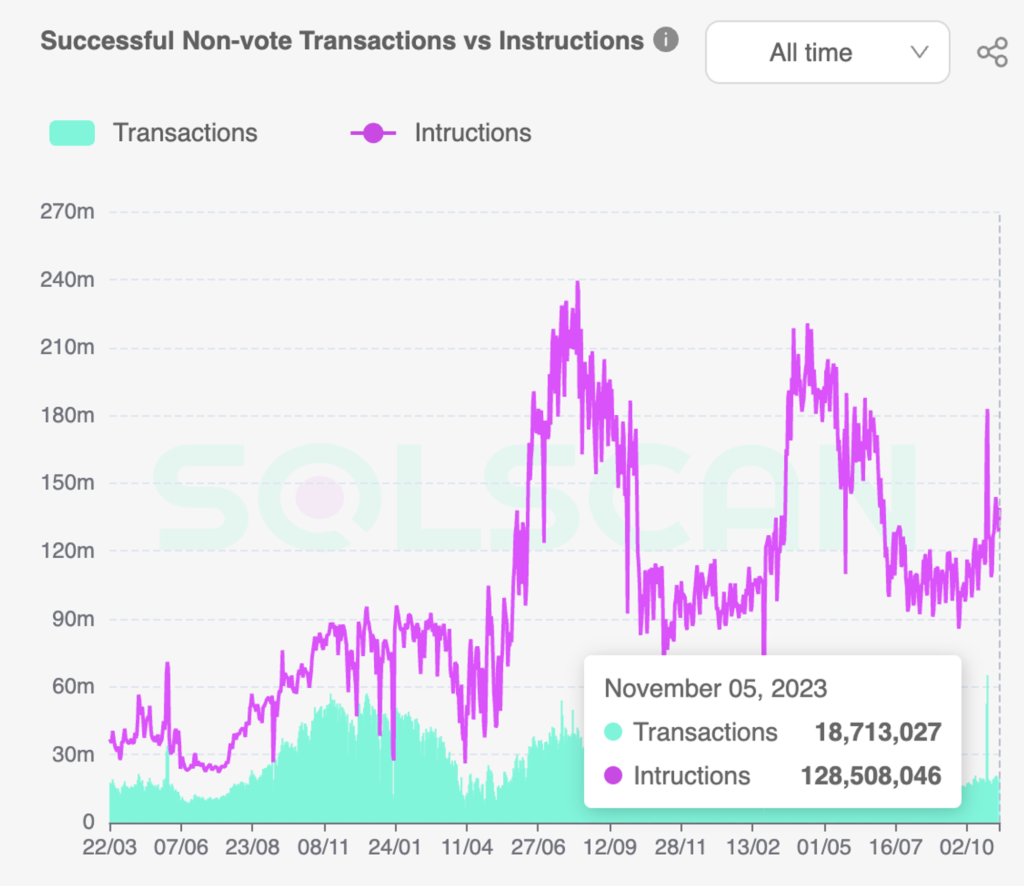

Solana Daily Transactions

Solana has two types of transactions on its network: vote and non-vote.

Vote transactions are transactions executed by validator nodes to maintain network security and consensus. All internal consensus messages are considered transactions, so decision-making and network management activities are transparently recorded on the Solana blockchain.

Meanwhile, non-voted transactions are an important part of the Solana ecosystem that allows users to participate in various activities on the network, such as trading, application development, or even NFTs.

Compared with other blockchains, we use non-vote transactions to view Solana’s network activity.

In the past two years, the number of non-voted transactions on Solana has steadily increased. From the data above, on March 22, 2021, there were more than 17 million transactions, and currently, as of November 5, 2023, there are 18,713,027 transactions.

The Solana network experienced a significant decline on February 25, 2023, showing that the number of daily transactions was only around 4 million. This was due to a technical problem that caused the validator to only process 93 TPS. However, this did not last long; the network was active again and showed an increasing trend.

Solana Active Wallet Addresses

Since its launch, Solana has become one of the blockchains with the fastest user growth through its native wallet, Phantom. It recorded a 4,400% growth from 4,000 users in July 2021 to 1,8 million in December 2021.

As of November 6, 2023, Solana’s daily active wallet address reached 102,466 wallets. From the chart above, the number of Solana users is stable at around 100k to 200k.

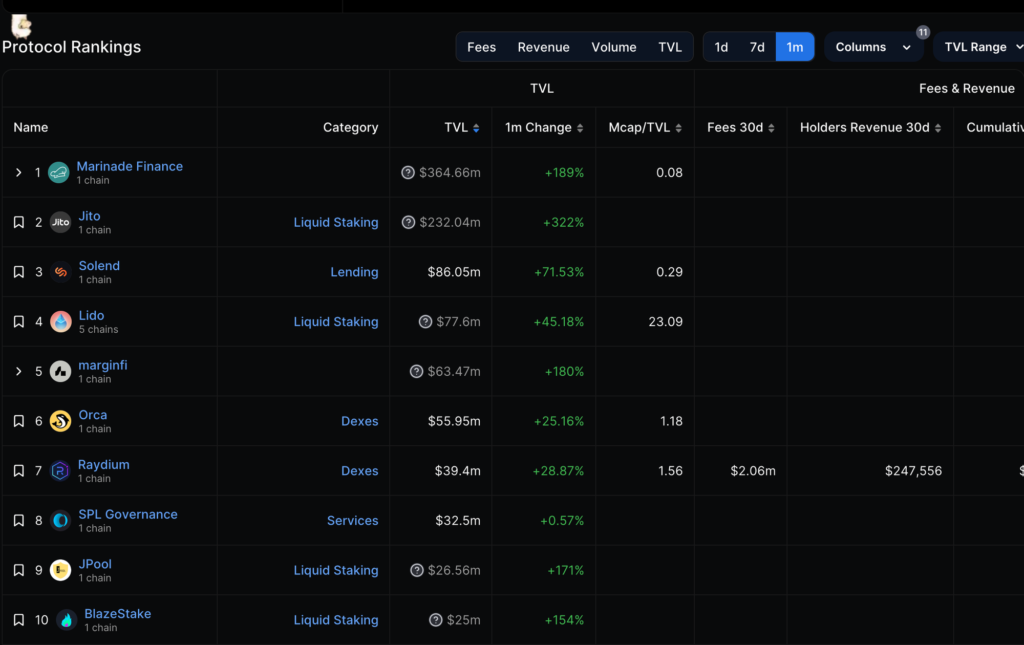

dApps on the Solana Network

Solana’s DeFi ecosystem is experiencing a recovery period after the turmoil caused by the fall of crypto exchange FTX. Many new protocols are emerging in Solana, offering various DeFi services such as DEX, lending protocol, etc.

Solana has a TVL of approximately 443 million US dollars as of November 6, 2023. Marinade Finance is the dApp with the highest TVL in the Solana ecosystem, with 164.66 million US dollars. Marinade is a SOL staking automation platform that monitors all Solana validators and delegates them to over 100 top-performing validators.

Other dApps with high TVL on the Solana network include Jito, Solend, Lido, Marginfi, and Orca. Orca and Raydium are the most popular DEXs within the Solana network ecosystem.

Solana’s Potential in the Next Bull Market

The Solana ecosystem shows significant growth and activity, especially in Q3 2023. It includes various aspects such as technology upgrades, DeFi, and liquid staking.

Solana’s foundational technologies are gaining more attention and adoption. Some examples are the exploration of the Solana fork for MakerDAO, the launch of L2 Eclipse powered by Solana Virtual Machine (SVM), and Firedancer, which can increase transactions up to 1 million TPS. In addition, Visa is in the early stages of integrating payments on the Solana network.

Read more about Solana Firedancer in this article.

Solana technology also continues to evolve with the V1.16 update, which reduces validator memory requirements, introduces the ability for confidential transfers, and improves support for zk-proof.

Total Value Locked (TVL) in Solana’s DeFi sector increased by 32% compared to the previous quarter. This growth was largely driven by the launch program of DeFi and liquid staking protocols, led by projects such as MarginFi, Jito, Cypher, and BlazeStake.

3. Near Protocol

Near Protocol is a Layer-1 blockchain with smart-contract capabilities that can support its own DeFi and DApps ecosystem. This blockchain is designed as a low-cost, fast, and developer-friendly blockchain.

Near strives to be an important player in the global blockchain ecosystem with an approach that focuses on scalability, simplicity, and PoS consensus. The Near network is powered by an innovative sharding technology called Nightshade. Sharding can increase network speed and scalability without compromising security and decentralization.

Read more in the article What is NEAR Protocol (NEAR)?

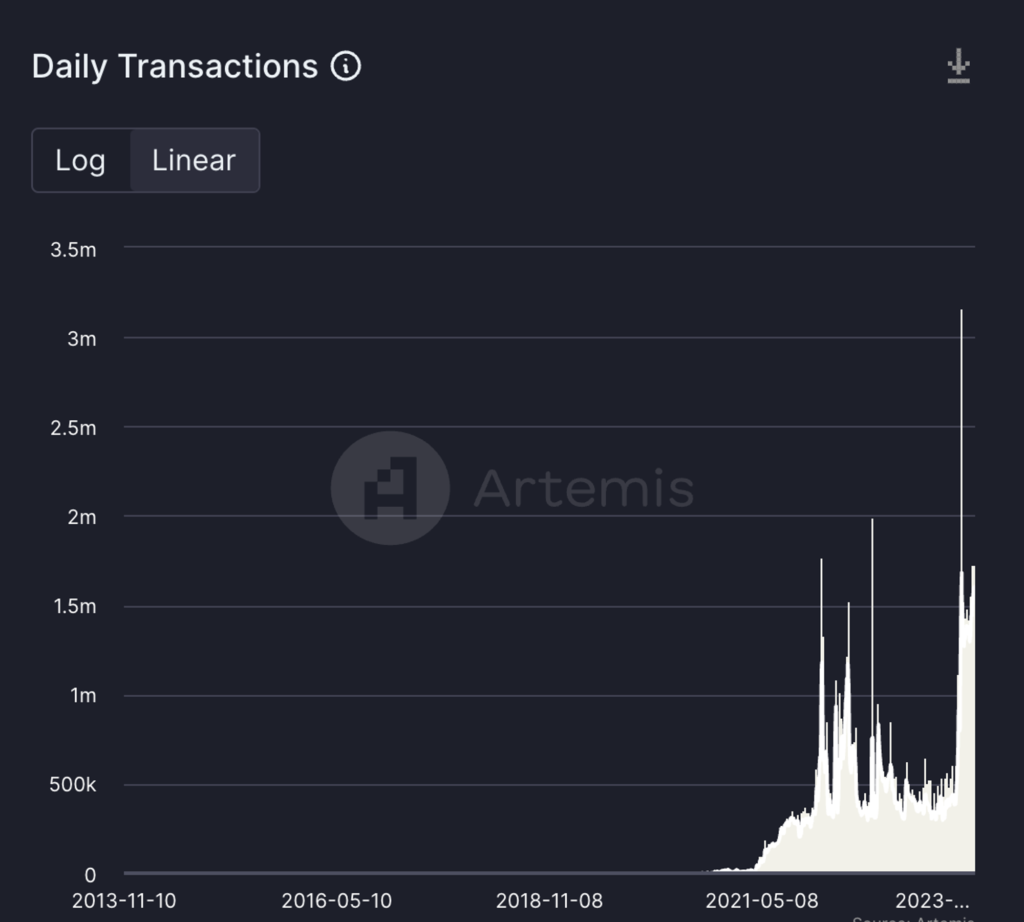

Near Protocol Daily Transactions

Since the Near ecosystem went live in 2021, the number of daily transactions on this network has continued to increase, with an average of nearly 400 thousand daily transactions. Daily transactions reached an all-time high of 3.1 million on September 5, 2023. As of November 6, 2023, Near transactions reached 1.6 million due to KAIKANOW, a technology introduced by Cosmos AI.

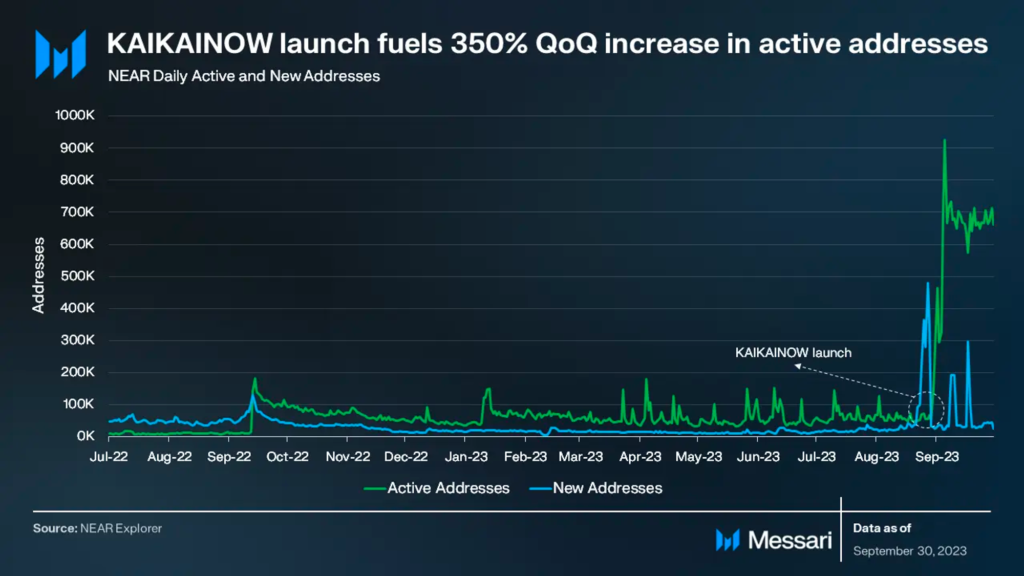

Near Protocol Active Wallet Addresses

In Q3 2023, NEAR network activity was a major highlight, with a 350% rise in active addresses (from 60,000 to 260,000) and a 117% rise in transactions compared to the previous quarter. As of November 6, 2023, the number of active users on the Near network increased to 817K.

As mentioned earlier, this increase was largely due to the introduction of KAIKAINOW. KAIKANOW is an innovative technology that combines blockchain and artificial intelligence to transform the smartphone screen lock experience by delivering customized content. Furthermore, KAIKAINOW is the most used protocol in the crypto space in September 2023.

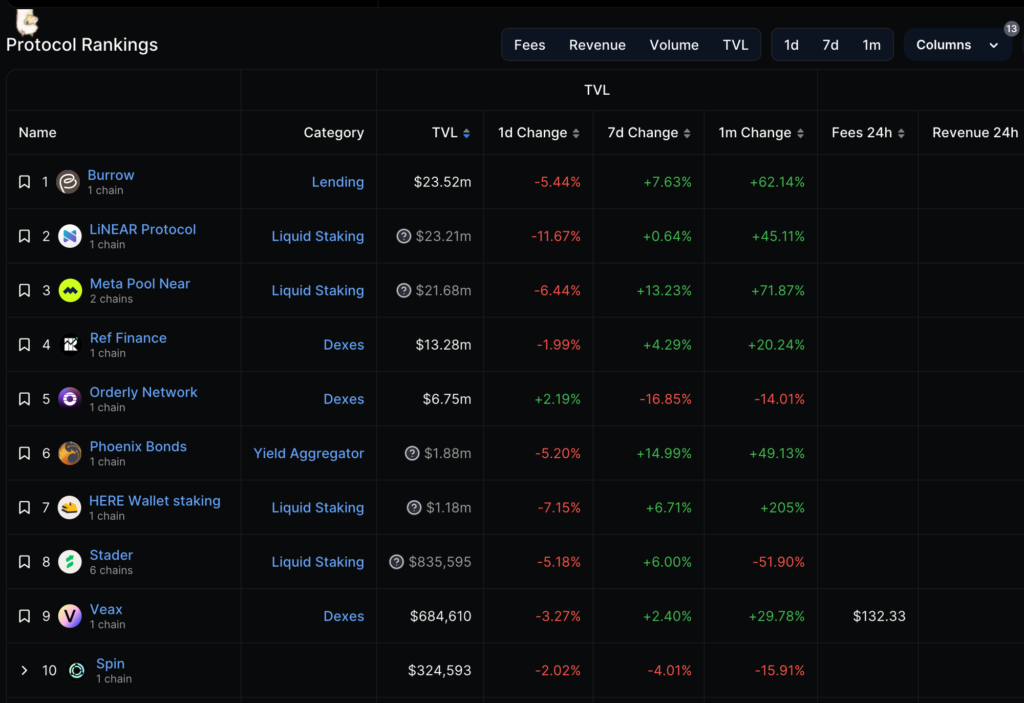

dApps on NEAR Protocol

With a TVL of 44.72 million US dollars, the Near ecosystem was dominated by three dApps, namely Burrow, LiNEAR Protocol, and Meta Pool Near, with TVLs of 23.52 million US dollars, 23.21 million US dollars, and 21.68 million US dollars, respectively.

In addition, Ref Finance is the most popular DEX in the Near ecosystem, followed by Orderly Network.

Near had an interesting performance in the gaming sector as many games were adopted on the Near blockchain. One of the most popular games is Sweet Economy, which has a TVL of 162.3 million US dollars. Other games include PlayEmber, Jump.trade, ZomLand, Land to Empire, and others.

NEAR Protocol Potential

Near is a Blockchain Operating System (BOS). BOS provides a platform that overcomes the complexity of Web3 and the centralization limitations of Web2. Some BOS implementations in the third quarter include FastAuth SDK Beta, Web Push Notifications, and NEAR Query API (Beta).

Near is also ready to launch NEAR Data Availability (NEAR DA), which offers secure and cost-effective data availability for ETH rollups. With NEAR DA, it signifies that Near has become a modular blockchain with low-cost DA in the Web3 sector.

In partnership, NEAR Foundation and Polygon Labs worked together to develop a zero-knowledge (ZK) prover for the Wasm blockchain that bridges the gap between Wasm-based chains and the Ethereum ecosystem. Through this innovation, Near can get closer to the Ethereum ecosystem.

NEAR Social, a peer-to-peer network for social interaction and content creation also recorded encouraging metrics. It recorded 5,000 monthly active addresses (22% increase QoQ), 43,000 monthly transactions (67% increase QoQ), and 267 monthly active developers (30% increase QoQ).

In the future, NEAR’s core developers remain focused on developing the Blockchain Operating System (BOS). Their vision is very clear: strengthening NEAR’s position in the blockchain industry, with the center of attention around the BOS that will collaborate with artificial intelligence technology.

4. Injective Protocol

Injective Protocol is a blockchain specifically built to facilitate the creation of DeFi applications such as cross-chain derivatives trading. The blockchain uses a Tendermint-based consensus mechanism and utilizes the Cosmos-SDK. The main advantage of choosing this Tendermint consensus is that it makes Injective highly scalable (10,000+ TPS).

Injective Protocol offers the benefit of asset trading within its ecosystem without gas fees. Moreover, developers can effortlessly create a variety of dApps, including spot, perpetual, futures, and options, as Injective provides a comprehensive framework. This enables developers to concentrate on the development of their applications.

Read also: What is Injective Protocol (INJ)?

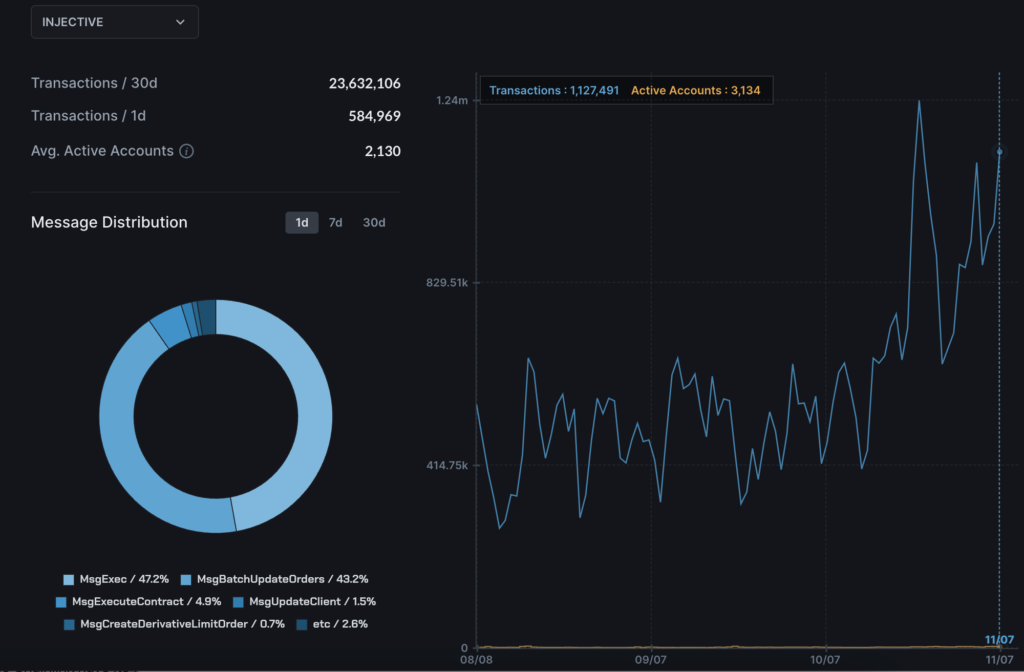

Injective Protocol Daily Transactions and Active Wallet Addresses

As of November 7, 2023, Injective recorded a daily transaction count of 1,127,491 transactions, comparable to the Ethereum mainnet. Over the last 30 days, the Injective network has confirmed more than 23.6 million transactions.

In terms of users, the number of active wallets as of November 7, 2023, is more than 3 thousand active users, with an average user of 2,130 users. In the comparison of transactions and daily active users, each user on average engages in over 500 transactions daily. This indicates strong activity within Injective’s DeFi sector.

dApps on Injective Protocol

Injective has a TVL of 12.19 million US dollars. Helix is the most popular DEX on the Injective network, dominating almost 90% of the TVL. Despite Helix’s dominance, an alternative DEX called Astroport also has a strong user base in the Injective ecosystem.

Potential of Injective Protocol

Injective strives to build a strong Web3 finance ecosystem and attracts growing interest from developers and users. Injective continues integrating its system with many parties such as Polygon, Kava, Trust Wallet, Klaytn, Galxe, and others. No wonder INJ has shown the most positive price performance in recent years.

In October 2023, Injective introduced Injective Nexus, which enables sharing of Injective’s core blockchain data with a wider audience via BitQuery in Google Cloud’s Analytics Hub. In addition, BitGo, one of the largest Web3 institutions, has also integrated its system with the Injective mainnet.

Furthermore, Injective is undergoing ecosystem expansion in dApps statistics. One of them is the introduction of Trading Bots and Pre-Launch Futures on Injective’s largest DEX, Helix.

In addition, Injective’s strategic partnerships and support from investors such as Pantera Capital, Jump Crypto, and Binance strengthen its potential and credibility in the blockchain space.

Comparison of 4 Promising Altcoins in the Layer-1 Blockchain

| Daily Transactions | Daily Active Wallets | Top 3 dApps | |

|---|---|---|---|

| Ethereum | 1 milion | 412k | Lido, Maker, Aave |

| Solana | 18.7 million | 102k | Marinade Finance, Jito, Solend |

| Near | 3.1 milion | 817k | Burrow, LiNEAR Protocol, Metapool |

| Injective Protocol | 1.1 milion | 3k | Helix, Astroport, Levana Perps |

When considering which crypto is worth holding until the next bull market, you must consider some important factors. Here are some key points that can help in your decision-making.

- Ethereum: Ethereum remains a major player in the blockchain ecosystem, with improvements in Layer-2 (L2) transactions promising more efficiency and ecosystem growth. Despite competition from other Layer-1 blockchains, Ethereum has the largest application ecosystem and steady growth.

- Solana: Solana is showing significant growth in transactions and technology adoption, particularly at the DeFi scale. The presence of technologies such as the Solana Virtual Machine (SVM) and Visa payment integration are positive indicators. However, monitoring the development of Solana technology and the ecosystem is important.

- NEAR Protocol: NEAR shows a significant growth in network activity and adoption of KAIKAINOW technology. The platform offers scalability, efficiency, and ease of use, which could be a plus for developers.

- Injective Protocol: This protocol focuses on building a robust Web3 finance ecosystem that attracts developers and users. Injective continues to expand its ecosystem through system integration with various protocols and dApps. Also, INJ is one of the best-performing assets in 2023.

Conclusion

Although Layer-2 crypto assets have gained huge attention, Layer-1 altcoins remain attractive in the crypto ecosystem. Ethereum (ETH), Solana (SOL), Near Protocol (NEAR), and Injective Protocol (INJ) show potential in the blockchain ecosystem. Each of the altcoins has its advantages, from a high number of daily transactions to strong user activity and the growth of the DeFi ecosystem. Monitoring technological developments and partnerships to make informed investment decisions is important.

References

- Wheatstones, State of Layer-1 Blockchains: On-Chain Fundamental Analysis, Medium, accessed 6 November 2023.

- Kunal Goel, State of Ethereum Q3 2023, Messari, accessed 6 November 2023.

- Peter Horton, State of Solana Q3 2023, Messari, accessed 6 November 2023.

- Nicholas Garcia, State of NEAR Q3 2023, Messari, accessed 6 November 2023.

- Injective Labs, The October Community Update: Rapid Ecosystem Expansion, accessed 7 November 2023.

Share

Related Article

See Assets in This Article

ETH Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-