Market Analysis Sep 18th 2023: Bitcoin Surges 3.2% in One Week Amidst Stable Macroeconomics

During the past week, Bitcoin witnessed a 3.2% surge in value, due to stable macroeconomic factors. This upward momentum, if sustained, has the potential to catalyze a broader upswing across the entire cryptocurrency market. But, the question remains: what are the odds of this scenario unfolding? Check out our full market analysis below.

The Pintu trading team has gathered critical information and analyzed the general economic situation and the crypto market’s movements over the past week. However, it should be noted that all information in this Market Analysis is intended for educational purposes, not as financial advice.

Market Analysis Summary

- 👀 The rise in CPI (Consumer Price Index) and PPI (Producer Price Index) is putting pressure on the Federal Reserve to consider further interest rate hikes.

- 🦾 Unemployment benefit claims indicate that the labor market is still relatively stable, which could be a positive signal that the economy is strong enough to withstand further interest rate hikes.

- ⚔️ The increase in gasoline and food prices has become a politically sensitive issue, complicating the situation for the Biden administration ahead of the general election.

- ✍🏻 BTC has risen due to two supporting factors: the slowing of CPI and the increased accumulation by long-term investors when BTC prices are below $20,000.

Macroeconomic Analysis

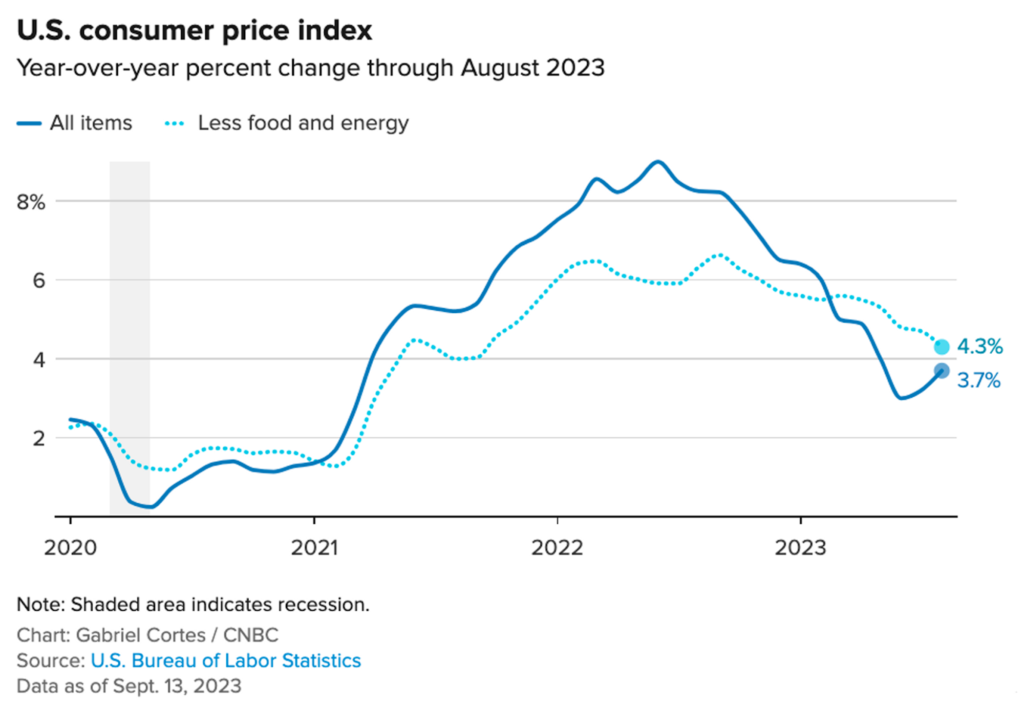

The Consumer Price Index (CPI) has recorded positive growth, which are:

- A significant monthly increase in CPI over the last year, rising by 0.6%.

- The annual increase in CPI surpassed expectations, surging 3.7% compared to the previous year.

- The core prices, which exclude energy and food, increased by 0.3% on a monthly basis, exceeding estimates.

Meanwhile, the increase from the previous year was 4.3%, which was in line with forecasts, and marked the smallest increase in the past two years.

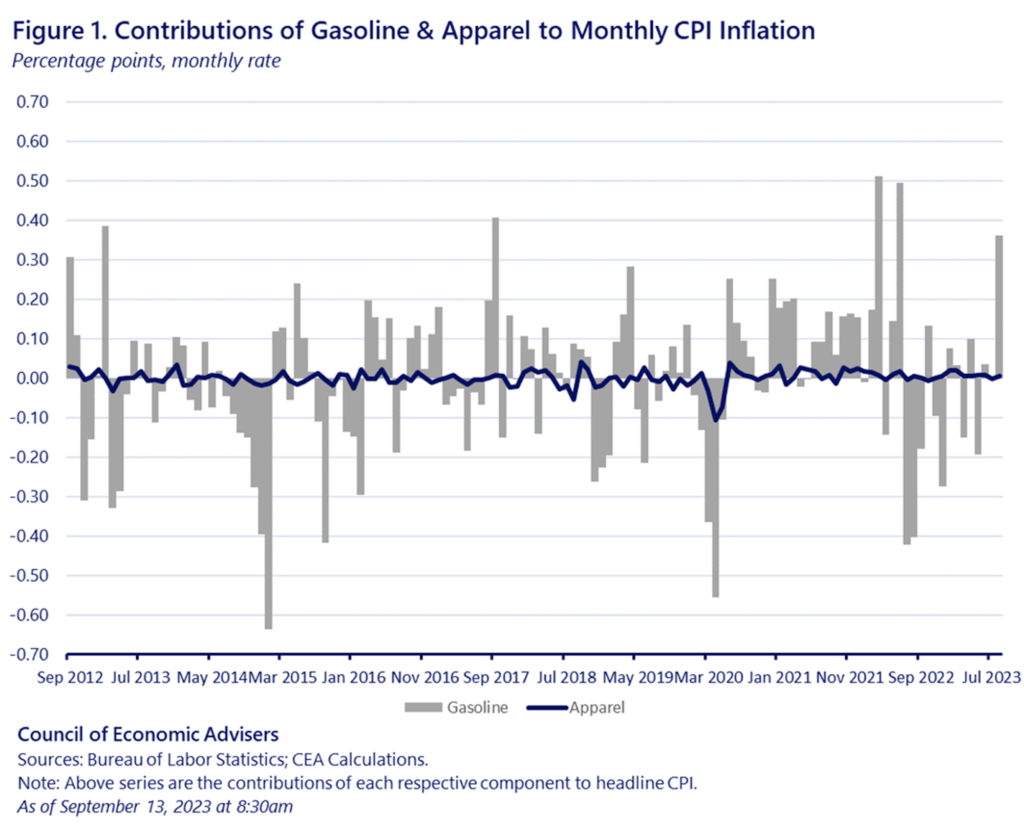

Gas prices caused over half of the monthly CPI increase. Housing costs also went up for 40 straight months. Additionally, airfare, car insurance, new car prices, and food also saw significant increases.

The Federal Reserve may ignore short-term energy price increases when considering the CPI report’s impact on interest rates. Nevertheless, the increase in housing expenses and other sectors could prompt the Fed to abstain from making any further interest rate hikes.

The CPI report poses a significant challenge for President Joe Biden’s administration in communicating it to consumers. This is because consumers are feeling the impact of high price increases, particularly in gasoline and grocery stores, which have become a focal point for the Republican Party. Although inflation is largely influenced by monetary policy rather than government actions, as the general election year draws closer, consumers are hoping for further political debate and discussion surrounding the CPI report.

In addition to the CPI report, the Federal Reserve must also review other reports. These reports include:

- Futures stocks and Treasuries that briefly fell and incurred losses, but later recovered.

- S&P 500 Contracts experienced a 0.4% drop at one point.

- Two-year yields dropped by 2 basis points to 5%.

- There are conflicting opinions in the futures interest rates regarding the Fed’s next steps for raising interest rates.

These reports add complexity to the decision-making process for the Federal Reserve, which is scheduled to meet at the end of September to determine the direction of interest rate policy.

Producer Price Index (PPI)

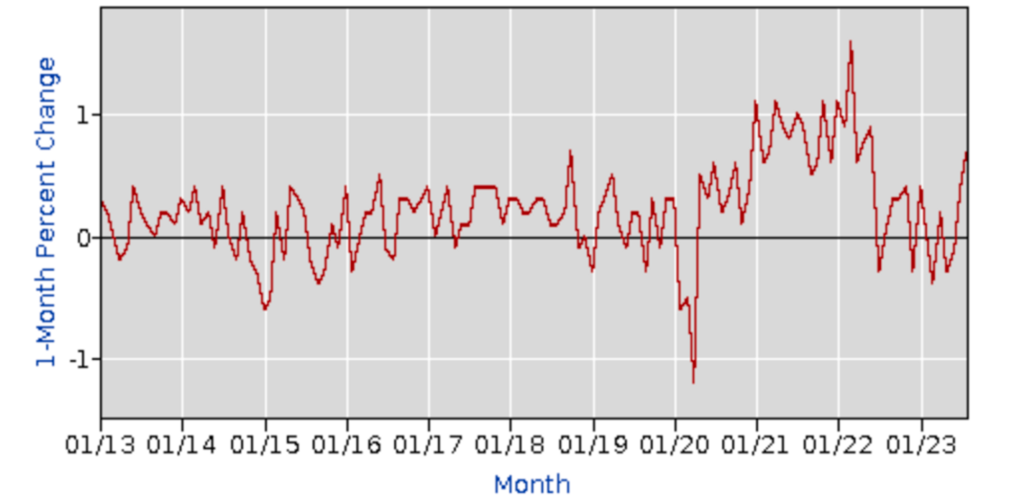

According to the U.S. Department of Labor, the Producer Price Index (PPI), which measures what producers receive, particularly for goods and services, rose 0.7% on a seasonally adjusted basis in August and increased 1.6% on a year-to-year basis. This monthly increase exceeded Dow Jones estimates of 0.4% and marked the most significant one-month increase since June 2022.

However, excluding food and energy, the core PPI increased by 0.2%, in line with estimates. Over a 12-month period, the core PPI rose 2.1%, the lowest annual rate since January 2021. Excluding food, energy and trade services, the PPI increased by 0.3%.

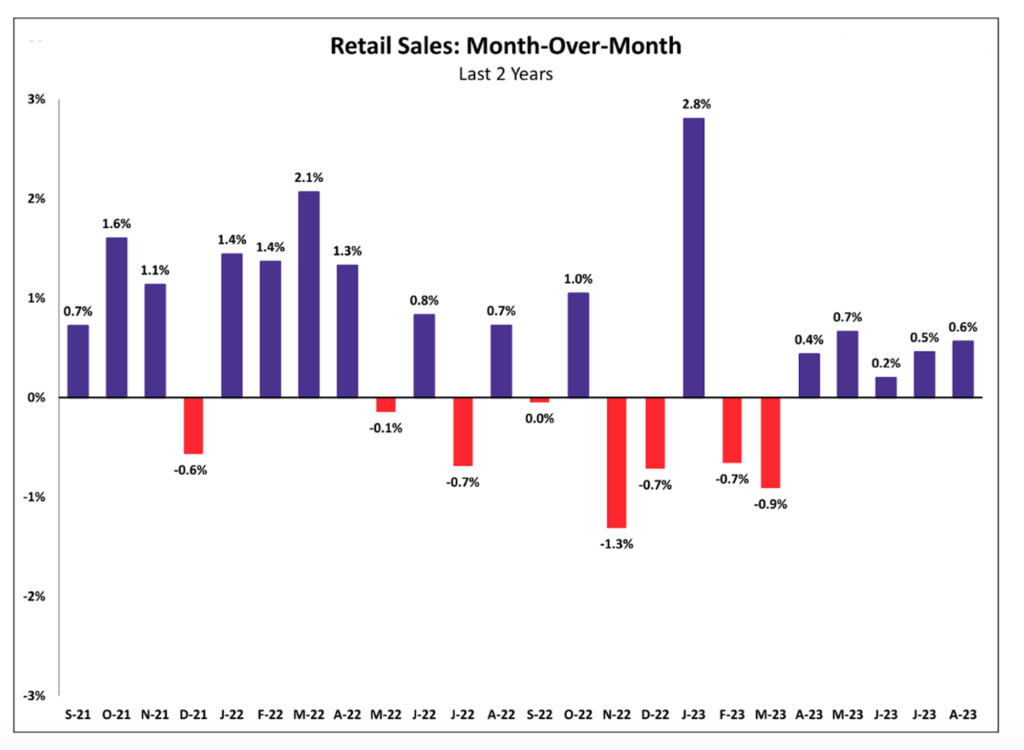

The Commerce Department released data showing that retail sales in August beat expectations with a significant increase of 0.6%, far exceeding the Dow Jones estimate of 0.1%. Even excluding auto sales, the numbers remained strong with a 0.6% increase versus an estimate of 0.4%.

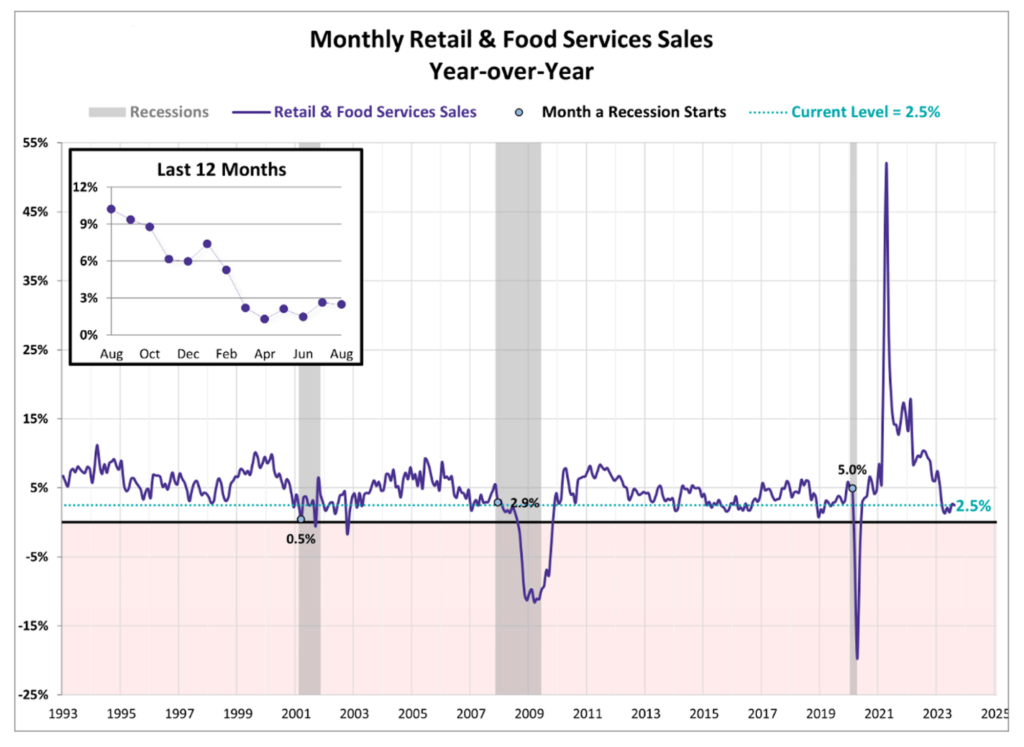

It’s important to note that these figures are not adjusted for inflation, suggesting that consumers are maintaining their spending patterns despite rising prices and increasing credit card debt. When inflation is taken into account, real retail sales were flat for the month. On a year-over-year basis, sales were up 2.5%, which is below the annual CPI inflation rate of 3.7%.

The retail report also reflects the impact of higher energy prices, with gas station sales up a significant 5.2%.

💡 The PPI focuses on domestic prices, which represent the costs associated with the production of goods and services. In contrast, the CPI measures what consumers actually pay for goods and services in the marketplace, including the price of imports.

Both indices suggest that while inflation remains a concern for American households, the rate of increase appears to have generally slowed in recent months. This trend has become an important factor for the Fed in determining its future policy direction, especially after 11 rate hikes totaling 5.25 percentage points.

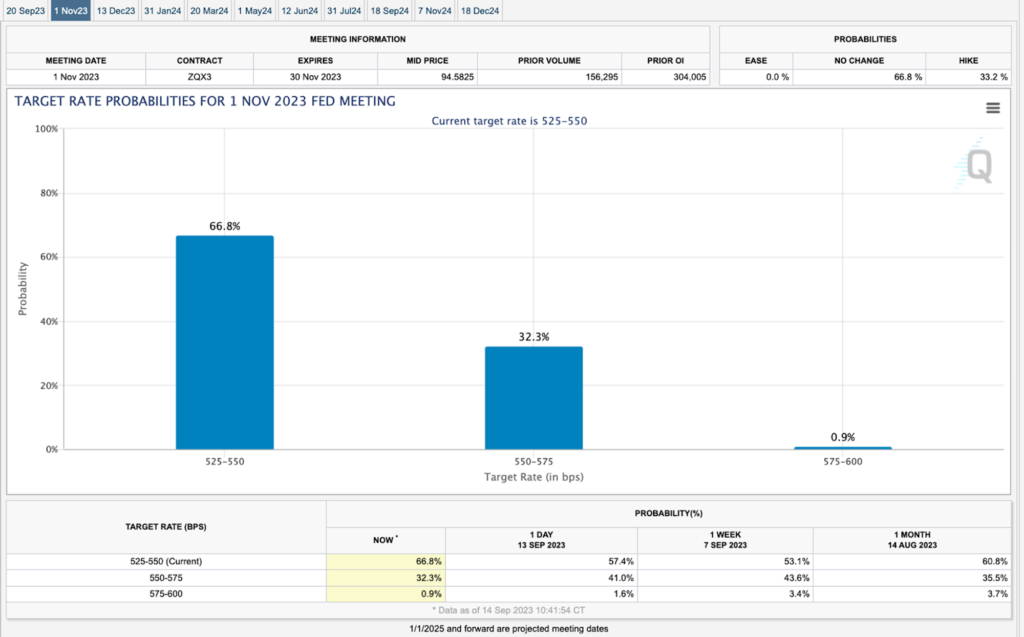

Market expectations are that the Fed will not raise rates in the coming weeks. Although central bank officials had previously signaled one more rate hike before the end of the year at their June meeting, futures market data from the CME Group on Thursday morning indicated a 32% chance of a rate hike in November.

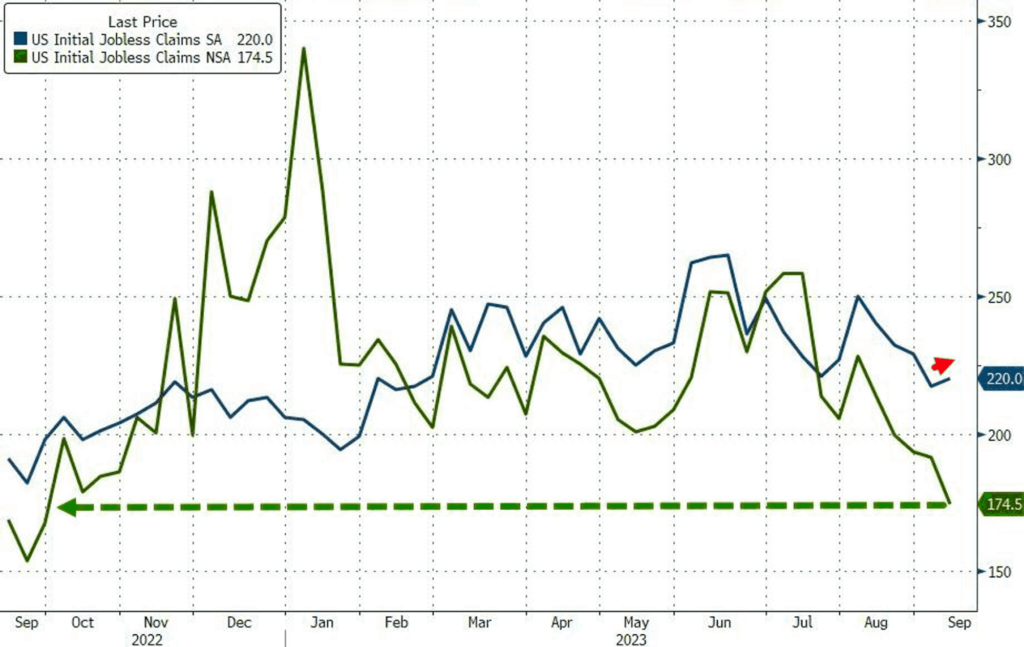

The number of Americans filing for unemployment benefits rose slightly last week after falling to a seven-month low the previous week. The trend suggests that companies are holding on to their workforces despite the Federal Reserve’s efforts to cool the economy.

Thursday’s report from the Labor Department showed that U.S. initial claims for unemployment benefits rose slightly by 3,000 to 220,000 for the week ending September 9th. These unemployment claims serve as an indicator of the number of layoffs that occur in a given week.

The four-week moving average of these claims, which is a less volatile measure, decreased by 5,000 to 224,500.

In total, there were 1.69 million people receiving unemployment benefits for the week ending September 2nd. This data represents an increase of about 4,000 people from the previous week.

BTC Price Analysis

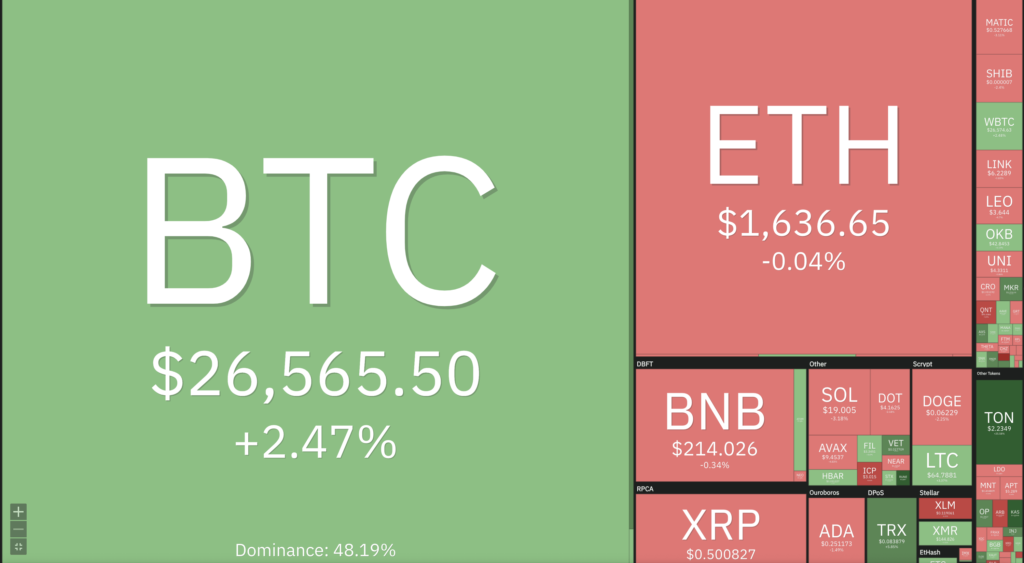

BTC experienced a price increase of 3.2% during the week, reaching $26,600. There are several factors contributing to this price increase. Recent inflation data has shown a slowdown in the rise of the Consumer Price Index (CPI), raising hopes that the Federal Reserve will take a less aggressive approach to raising interest rates.

This development has helped to stabilize equity markets and has created a positive backdrop for riskier assets, including BTC and the broader crypto market. If the trend of declining inflation continues, bitcoin could benefit from a better macroeconomic environment.

Another factor is on-chain data showing that long-term holders have been accumulating bitcoin over the past month, especially when prices fell below $20,000. This indicates strong demand from investors with longer investment horizons. As more bitcoin is moved from exchanges to cold storage wallets, this increased scarcity could put upward pressure on prices.

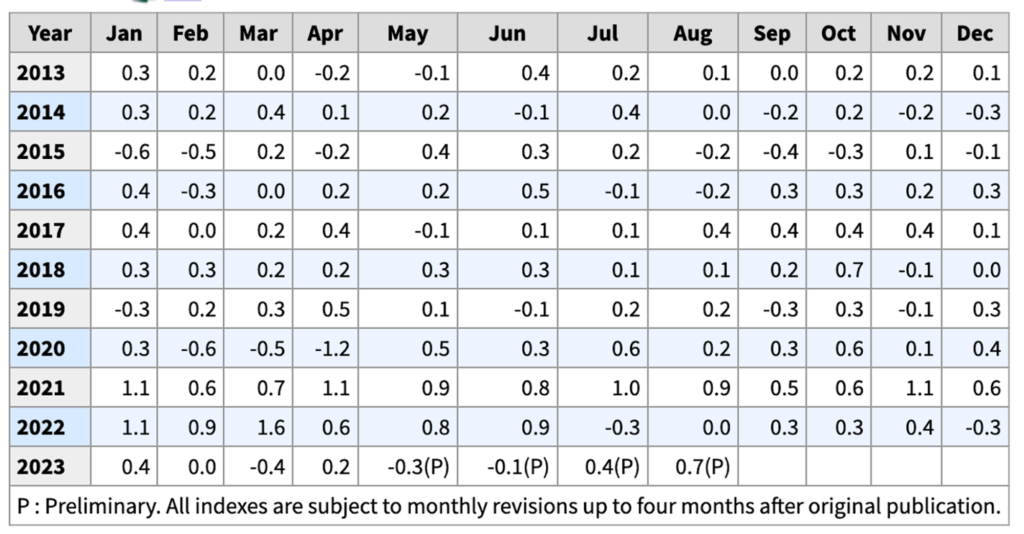

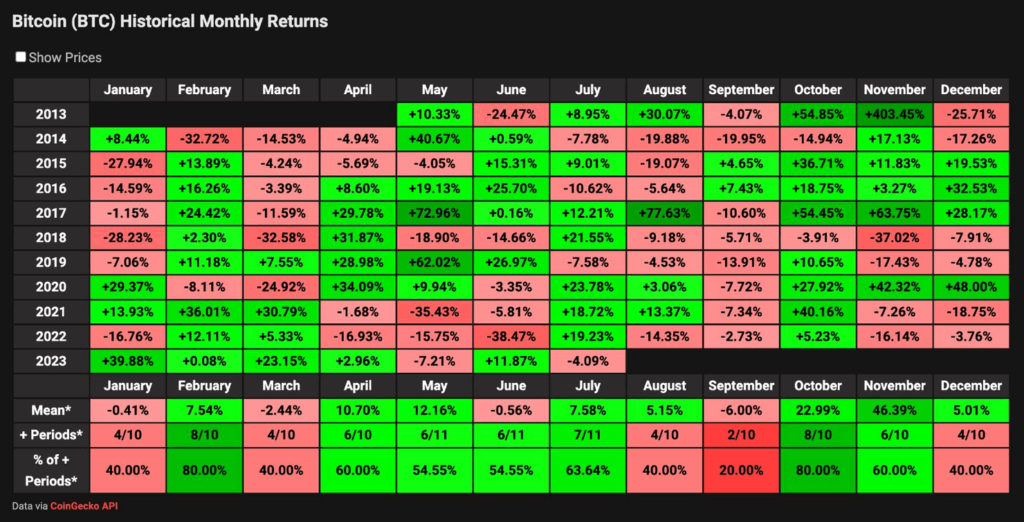

In terms of the historical performance of BTC and the broader crypto market, September has consistently proven to be a challenging month. Data from 2013 to 2022 shows that September has only produced positive monthly gains in 2015 and 2016.

On-Chain Analysis

- 📊 Exchange: As the exchange reserve continues to fall, it indicates lower selling pressure. Net deposits on exchanges are high compared to the 7-day average. Higher deposits can be interpreted as higher selling pressure.

- 💻 Miners: Miners’ are selling holdings in a moderate range compared to its one-year average. Miner’s revenue is in a moderate range, compared to its one-year average.

- 🔗 On-Chain: More investors are selling at a loss. In the middle of a bear market, it can indicate a market bottom. Long term holders’ movement in the last 7days were lower than the average. They have a motive to hold their coins. Investors are in a fear phase where they are currently with unrealized profits that are slightly more than losses.

- 🏦 Derivatives: Long position traders are dominant and are willing to pay to short traders. Buying sentiment is dominant in the derivatives market. More buy orders are filled by takers. As open interest increases, it indicates more liquidity, volatility, and attention are coming into the derivative market. The increasing trend in open interest (OI) could support the current ongoing price trend.

- 🔀 Technicals: Relative Strength Index (RSI) indicates a neutral condition. Stochastic indicates a neutral condition where the current price is in a moderate location between the highest-lowest range of the last 2 weeks.

News About Altcoins

- Binance has announced the launch of its mainnet for opBNB. opBNB is an Ethereum Virtual Machine (EVM) compliant layer 2 solution based on the Optimism OP stack. Since the testnet launch on June 19, more than 150 decentralized applications (dApps) have been used to process more than 35 million on-chain transactions. Developers have previously stated that opBNB will support over 4,000 transactions per second, with an average transaction cost of less than $0.005.

- The messaging app Telegram has officially endorsed TON as the blockchain of choice for its web3 infrastructure. At the Token2049 event, a TON-based crypto wallet was unveiled for Telegram’s 800 million users. Although the service will launch globally in November, it will not be available to users in the United States and some other countries. The feature is a custodial crypto wallet, which means that the private key is not managed by the user. In addition, the TON Foundation announced that crypto projects built on the TON ecosystem will receive priority access to Telegram’s advertising platform. In response to this collaboration, the price of Toncoin has increased by approximately 13.9% in the last 24 hours.

News from the Crypto World in the Past Week

- According to Token Terminal data, Friend Tech surpassed the daily revenue of Tron and Ethereum, recording earnings of $1 million. With this record, Friend Tech secured the top position in the rankings across various protocols and applications. The revenue refers to earnings minus token incentives. For Ethereum and Tron, the primary revenue consists of network transaction fees consumed, while Friend Tech’s revenue includes transaction fees captured by the protocol. It’s worth noting that on that day, Friend Tech collected fees totaling $2 million, with an additional $1 million allocated to creators. Transaction volume and fee earnings reached an all-time high for two consecutive days.

- Chairman of the U.S. Securities and Exchange Commission (SEC) Gary Gensler commented on the review of Bitcoin Spot ETFs. As reported by X user @EricBalchunas, Chairman Gensler stated during a hearing about Bitcoin Spot ETFs, “We are revisiting that decision. We are also reviewing several other spot bitcoin ETP applications (besides Grayscale), and I have asked for recommendations from the staff.” This comes after a court decision that sharply criticized the SEC for having no reason not to approve a spot bitcoin ETF while approving futures-based ETFs.

Cryptocurrencies Market Price Over the Past Week

Cryptocurrencies With the Best Performance

- THORChain +19.91%

- VeChain +13.93%

- Maker (MKR) +13.37%

- Bitcoin Cash +11.98%

Cryptocurrencies With the Worst Performance

- ApeCoin -15.39%

- IOTA (MIOTA) -10.94%

- Stellar -8.48%

- Arbitrum (ARB) -8.29%

References

- Lousia Chou, opBNB Mainnet Is Live!, bnbchain, accessed on 16 September 2023.

- Godfrey Benjamin, Friend Tech Outranks Tron and Ethereum in Daily Earnings, coingape, accessed on 16 September 2023.

- EricBalchunas, Sen Hagerty brought up SEC’s loss to Grayscale, X, accessed on 16 September 2023.

- Ahmad Rifai, Crypto Wallet TON Lakukan Integrasi Baru dengan Telegram, Harga Toncoin Meroket, beincrypto, accessed on 16 September 2023.

Share

Related Article

See Assets in This Article

XLM Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-