Total Value Locked (TVL): What Is It and Why Does It Matter?

In the world of crypto, Total Value Locked (TVL) is a popular metric used to evaluate the size and activity of decentralized finance protocols. TVL represents the total value of all assets locked in a DeFi protocol, such as tokens staked in liquidity pools or deposited in lending markets. So how important is this metric when it comes to determining whether a particular crypto asset is worth investing in? Read on to learn what TVL is and why it’s important for crypto investors.

Article Summary

- 🔒 Total Value Locked (TVL) is a measure of the total value of crypto assets that are staked or locked within a DeFi protocol.

- ✍🏻 Three important aspects in measuring TVL include the combined value of all locked assets encompassing assets that are staked or lent, the maximum circulating supply of the DeFi protocol, and the current price of the DeFi protocol.

- 💰 Lido dominates the TVL market share with up to 20%, where there’s approximately $13.775 billion in TVL.

- 🦾 As of September 12, 2023, the total TVL across all DeFi protocols reached $36.931 billion.

What is Total Value Locked?

Total Value Locked (TVL) is a measure of the total value of crypto assets stored and available in smart contract applications. This value refers to the amount of assets staked in DeFi protocols, and the asset value is typically measured in US dollars or in crypto asset quantity. TVL serves as one of the metrics used to assess the health of the DeFi space because blockchains operate on a peer-to-peer network that is not controlled by a central authority to regulate, develop, or improve its ecosystem. Therefore, the TVL metric is an important measure of the overall DeFi market.

How to Measure Total Value Locked?

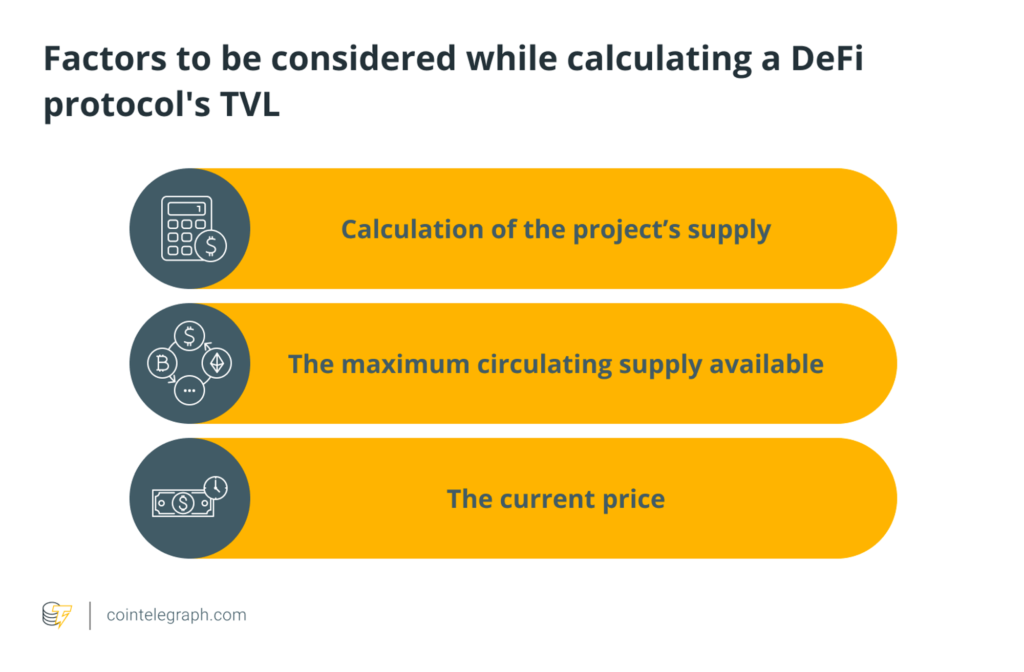

To measure TVL in a DeFi protocol, there are three important aspects to consider:

- The combined value of all locked assets, including assets that are staked or loan.

- The maximum circulating supply of the DeFi protocol.

- The current price of the DeFi protocol.

Once you know these three things, you can calculate the TVL in a DeFi protocol by taking the total number of tokens staked in the protocol and multiplying that number by the current value of each token in USD. By summing the total value of all assets, the TVL of the protocol can be determined. The formula for this would roughly look like this:

Market Cap

TVL Ratio = __________

TVL

The TVL ratio can help evaluate whether a token is undervalued or overvalued. If the TVL ratio is less than one, the token is generally considered to be undervalued, and vice versa.

Read more: Formulas and How To Calculate TVL Ratio

However, with the rapid development of DeFi, there are many tools that can be optimized to track the TVL in DeFi, such as DeFillama, DeBank, Defi Pulse, Zapper, TradingView, and others. Using these tools can simplify the calculation process, monitoring, and overall adoption rate of the DeFi ecosystem.

Why Total Value Locked Matters?

Performing analysis on an asset is something that needs to be done by an investor or trader. The role of TVL becomes crucial when measuring DeFi platforms as it serves to indicate how much capital is being used for profit and the utility of the DeFi application for traders and investors. In addition, there are four other factors why TVL plays an important role for investors, including:

- Trust Indicator: A high TVL may indicate that people trust the security and reliability of a DeFi protocol because its users are willing to spend a significant amount of money to use the protocol. However, investors still need to be cautious when interpreting a high TVL and should continuously monitor user activity on the DeFi platform to see if it is active or not.

- Protocol Growth: A relatively stable upward trend in TVL can be a sign of positive growth for a DeFi protocol. As more users participate and lock their assets, the network effect becomes stronger, attracting even more users and creating a positive feedback loop for protocol expansion.

- Investor Interest: TVL can be used to gauge the level of investor interest in a particular DeFi protocol. A high TVL can attract more investors and traditional institutions.

- Risk Assessment: TVL can also serve as a risk indicator for current investors and users. Protocols with very high TVLs are generally considered to be safer, as many others entrust their assets to that DeFi platform. On the other hand, a low TVL indicates that the platform is less established or untested and carries a relatively high risk of use.

5 Crypto Assets with Highest TVL

Reporting from defillama.com, here are the five crypto assets with the highest TVL as of September 12, 2023, as follows:

| Name | Chain | Category | TVL |

|---|---|---|---|

| Lido (LDO) | Ethereum, Solana, Moonbeam, Moonriver, Terra Classic | Liquid Staking | $13.775 billion |

| MakerDAO (MKR) | Ethereum | Collateralized debt position (CDP) | $4.83 billion |

| AAVE (AAVE) | Ethereum, Polygon, Avalance, Arbitrum, Optimism, Base, Metis, Fantom, Harmony | Lending | $4.478 billion |

| JustLend (JST) | Tron | Lending | $3.675 billion |

| Uniswap (UNI) | Ethereum, Arbitrum, Polygon, Optimism, Celo, Base, BSC, Avalance | Dexes | $3.164 billion |

- Lido is a DeFi protocol designed to provide a solution to Ethereum’s staking issues, which limit economic activity and prevent users from seeking additional profits. In addition, Lido provides an alternative to Ethereum staking, which is dominated by centralized exchange staking that is custodial in nature. Lido has become one of the largest liquid staking platforms on Ethereum with a market share of 74.1%.

- MakerDAO is a crypto asset lending and borrowing platform operating on the Ethereum network. Maker offers loans in the form of the DAI stablecoin, backed by a surplus of crypto assets locked into smart contracts.

- Aave is a protocol that allows its users to deposit crypto assets to earn interest, as well as borrow crypto assets for investment or other needs.

- JustLend is a lending protocol specific to the Tron network. The JustLend protocol has two functions: lenders (those who lend) and borrowers (those who borrow). Both can interact directly with the protocol to earn variable interest rates determined by algorithms.

- Uniswap is a decentralized exchange application that facilitates the exchange of ETH and ERC-20 tokens, or the most commonly used token standard on the Ethereum blockchain.

A high TVL means that the protocol has healthy liquidity with more capital locked up in its smart contracts. This makes the protocol or token popular with investors looking for incentives and rewards. Conversely, a lower TVL indicates a reduction in the availability of funds, resulting in lower returns for investors.

5 Blockchains with the Highest TVL

Besides the highest TVL cryptoassets, there are also high TVL blockchain networks, as summarized by defillama.com:

| Name | TVL | Market Cap |

|---|---|---|

| Ethereum (ETH) | $20.585 miliar | $187.13 miliar |

| Tron (TRX) | $5.6 miliar | $6.93 miliar |

| BSC (BNB) | $2.819 miliar | $31.73 miliar |

| Arbitrum (ARB) | $1.637 miliar | $976.94 juta |

| Polygon (MATIC) | $764.68 juta | $4.72 miliar |

The Ethereum network is the main and largest force in the creation of DeFi applications. TVL in DeFi plays a crucial role in directly showing the potential of a given DeFi protocol. TVL also serves as a better indicator than market capitalization for a given DeFi project. TVL not only informs investors about the true value of new or existing DeFi protocols, but also paves the way for easier adoption of DeFi.

Conclusion

Since the explosion of DeFi in 2020, the path has been paved for crypto users to maximize profits on their asset holdings by locking crypto assets into various DeFi protocols that offer rewards, generate interest, and provide liquidity for various crypto-related activities. Understanding TVL is undoubtedly a valuable metric for investors and DeFi users, as TVL plays a critical role in providing a quantitative overview of the overall health of the DeFi ecosystem.

Currently, more than $70 billion in crypto assets are locked in over 1,800 DeFi protocols, ranging from staking and lending to liquidity applications. For example, popular ether staking provider Lido Finance has over $14.15 billion in staked deposits locked on its platform, contributing to nearly 20 percent of the total DeFi TVL market share.

Ethereum’s Layer 2 (L2) rollups are also attracting attention with a TVL that has grown 300 percent since the beginning of the year. The current TVL across all rollups is $9.73 billion (5.14 million ETH). Arbitrum One dominates with over 60 percent market share and a TVL of $1.637 billion.

As of September 12, 2023, the total TVL across all DeFi protocols has reached $36.931 billion. With an increasing number of new investment options, interoperability features, and product launches, DeFi will continue to attract many crypto investors to use its platforms. Especially as we approach the bitcoin halving and welcome a bull market, a gradual acceleration and influx of greater activity is expected to flow into DeFi and the broader crypto ecosystem.

References

- Emi Lacapra, What is total value locked (TVL) in crypto and why does it matter?, Cointelegraph, diakses pada 12 September 2023.

- Payel Bera, What is total value locked (TVL)?, Capital, diakses pada 12 September 2023.

- Unchained, What Is TVL in DeFi? A Guide to Total Value Locked, diakses pada 12 September 2023.

- Georgia Weston, Importance Of TVL (Total Value Locked) In DeFi, 101blockchains, diakses pada 12 September 2023.

- Ledger, Total Value Locked (TVL) Meaning, diakses pada 12 September 2023.

Share

Related Article

See Assets in This Article

LDO Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-