TON Ecosystem: A Deep Dive into Potential Projects & Airdrops

The Open Network has become the center of attention in the crypto space. The emergence of various new projects in its ecosystem, followed by airdrops, has fueled its rise. This has even helped propel the Telegram-affiliated protocol into the top 10 protocols by market capitalization. But what is the current state of the TON ecosystem? What are the potential protocols within it? Find out more in the following article.

Article Summary

- 🔥 The Open Network (TON) demonstrates its potential to compete with other L1 competitors. They successfully broke into the top 10 cryptocurrencies with the largest market cap.

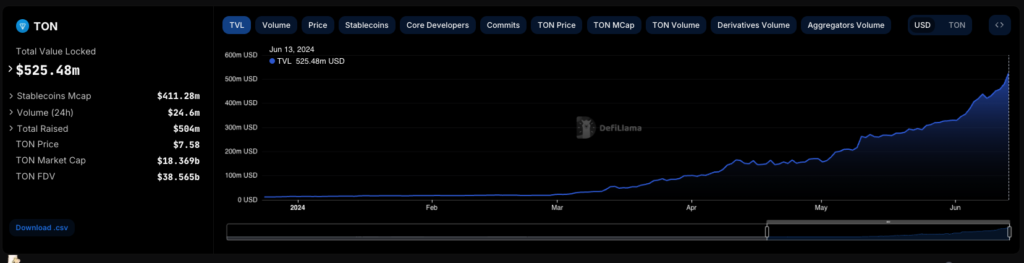

- 🚀 This year, TON has achieved a TVL growth from $13.8 million to $525.48 million.

- 🏆 TVL TON’s growth is due to the flourishing of their ecosystem, which is filled with potential protocols such as Tonstakers, STON.fi, and Notcoin.

- 💪 TON’s affiliation with Telegram gives it a large and solid user base, making integration and adoption easier and smoother.

About TON

TON, or The Open Network, is a decentralized and open source layer 1 protocol consisting of various components with specific functions. These components include TON Blockchain, TON DNS, TON Storage, and TON Sites. It utilizes a Proof-of-Stake consensus mechanism that provides a scalable network for financial activities.

TON Blockchain is the core element, connecting all components and forming the TON ecosystem. It features two main chains: Masterchains for validator nodes and Workchains for smart contracts and dApps. A Ton Virtual Machine (TVM) plays a similar role to the Ethereum Virtual Machine (EVM).

Telegram initially developed and managed TON, but the TON Foundation later took over. However, the TON Foundation is documented to have an affiliation with Telegram.

You can learn more about TON and how it works in the following article.

TON Ecosystem Development

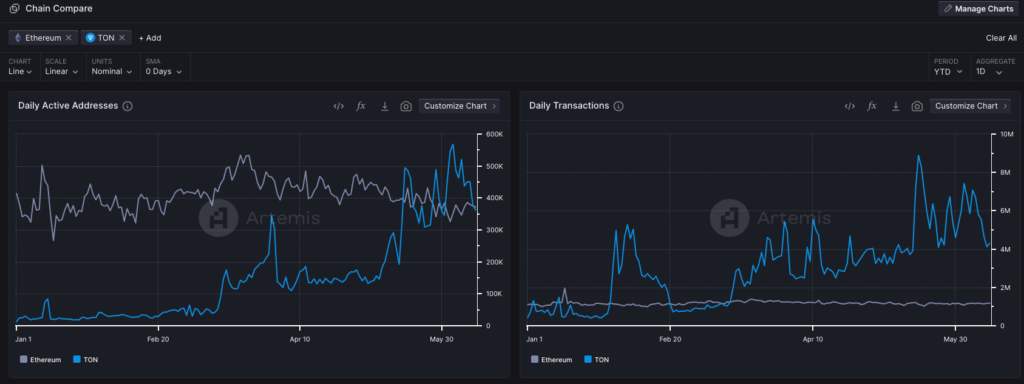

On-chain data from Artemis reveals that TON has been experiencing an upward trend in transactions and daily active user metrics throughout 2024. In fact, on some occasions, TON’s metrics have surpassed those of Ethereum. However, it should be noted that these Ethereum metrics do not include its Layer-2 network.

A key factor driving this growth is the existence of Telegram’s 900 million users, the social media platform behind TON. With such a large user base, TON can leverage Telegram’s distribution capabilities.

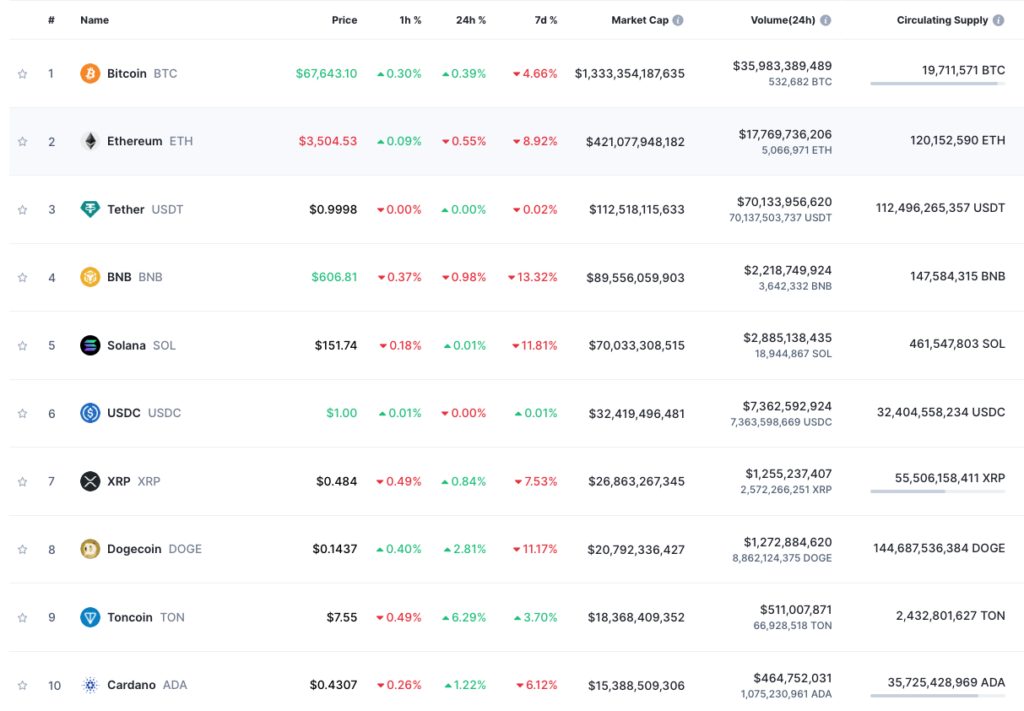

Another factor is the massive development of the TON ecosystem. Recently, TON has been a hot topic due to the numerous native protocols for TON distributing airdrops. TON’s market capitalization has successfully broken into the top 10. As of this writing, TON is ranked 9th with a market capitalization of $18.36 billion.

One of TON’s native protocols, Notcoin, has recently attracted market attention. Following its airdrop, Notcoin experienced a price increase of up to 219%, with a market capitalization of $1 billion. Moreover, Notcoin has also contributed to crypto adoption on Telegram with a trading volume of $1 billion and a user count of 40 million.

In addition to Notcoin, TON has recently integrated with Telegram Stars, a digital payment system mini-app. Telegram Stars users can make payments for digital services through in-app purchases on iOS and Android. The app’s development team then swaps their Stars for TON.

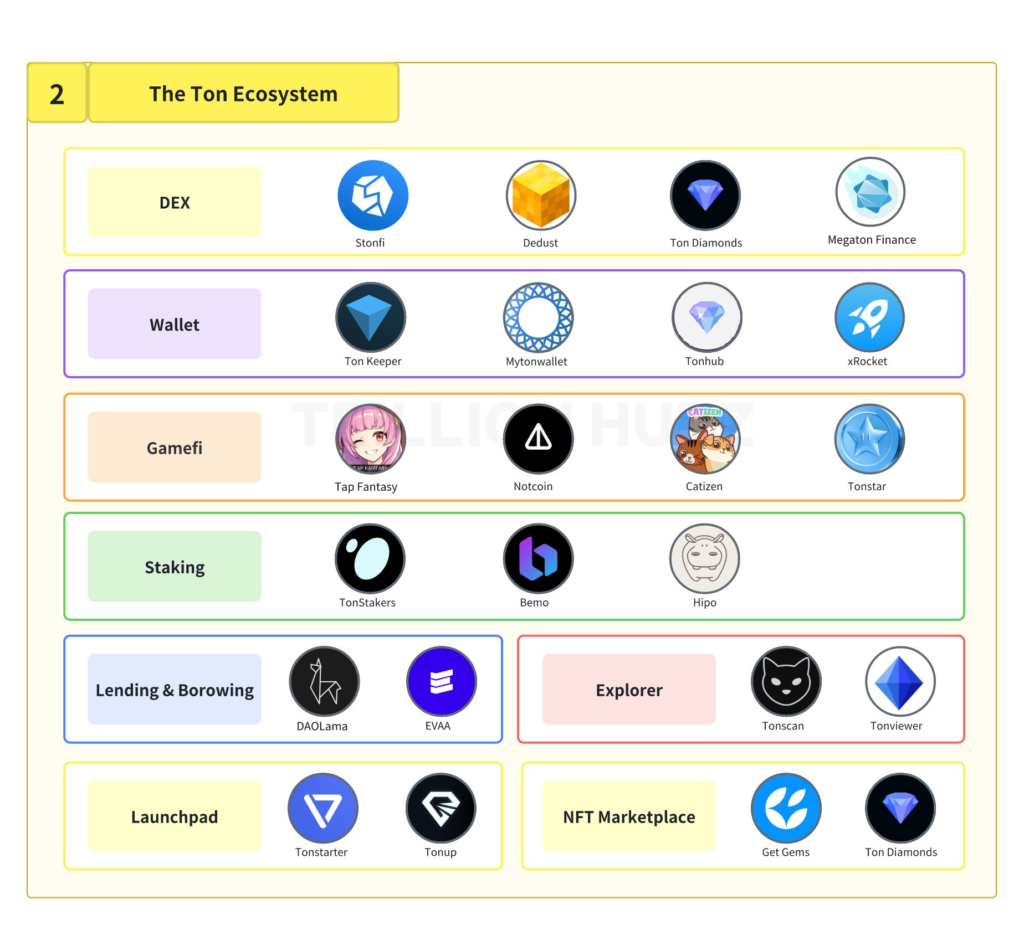

TON Ecosystem

After having minimal development, entering this year, the TON ecosystem began to show its potential. The emergence of a new native protocol followed by TON’s Total Value Locked (TVL) growth is the proof.

Based on DeFi Llama data, TON had a TVL of $525.48 million when this article was written. Compare that to earlier this year when it was only $13.8 million.

The following are some of the potential protocols that exist in the TON ecosystem:

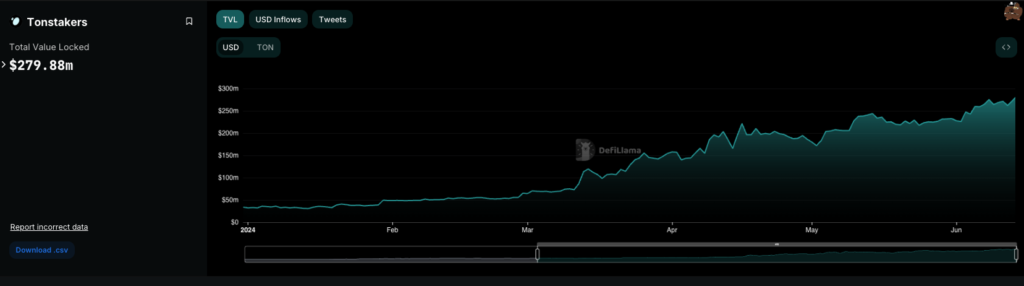

1. Tonstakers

Tonstakers is a native protocol on TON that focuses on liquid staking derivatives (LSD) services. It is the protocol with the TON ecosystem’s largest TVL (Total Value Locked). According to DeFi Llama data, Tonstakers’ TVL reaches $279.8 million. Currently, more than 61,000 users have staked their TONs on Tonstakers.

As an LSD protocol, users can stake their TON tokens and receive tsTON in return. These tsTON tokens can then be used on DeFi platforms within the TON ecosystem to earn rewards. This lets users earn two rewards simultaneously, from staking TON to tsTON.

Currently, Tonstakers offers an APY (Annual Percentage Yield) of 2.94%, with rewards distributed daily. There is no minimum staking limit, and users can unstake at any time instantly. Tonstakers also allows users to stake directly from their wallets (Tonkeeper, Wallet in Telegram, and OKX).

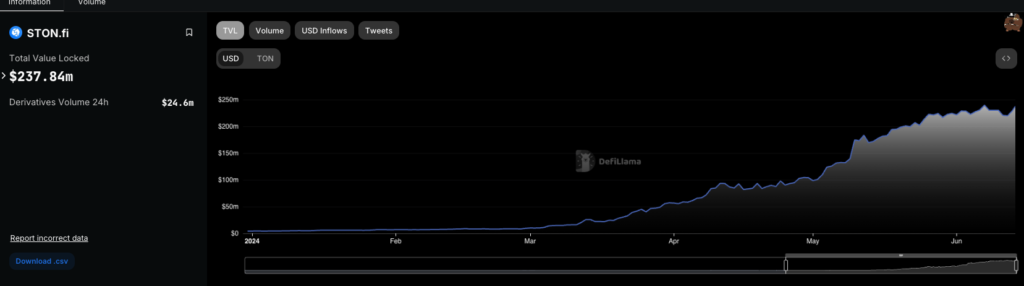

2. STON.fi

Ston.fi is a native Automated Market Maker (AMM) protocol directly integrated with TON Wallets on the TON network. As a decentralized on-chain exchange, it allows users to swap various tokens within the TON ecosystem.

To provide a more satisfying trading experience, STON.fi has partnered with DEXScreener. Users can search for important information about tokens and their liquidity pools through this partnership. Furthermore, users can filter based on criteria to find better trading opportunities.

In addition to swapping, users can utilize various features available on STON.fi. These include becoming a liquidity provider, staking, and farming. By farming on available token pairs, users can earn additional rewards, with amounts reaching up to 300% for specific token pairs.

In terms of TVL, STON.fi records a value of $237.84 million, making it the second-largest protocol in the TON ecosystem. In its roadmap, STON.fi aims to become a cross-chain protocol connected to networks such as TRON, Polygon, and other EVM chains.

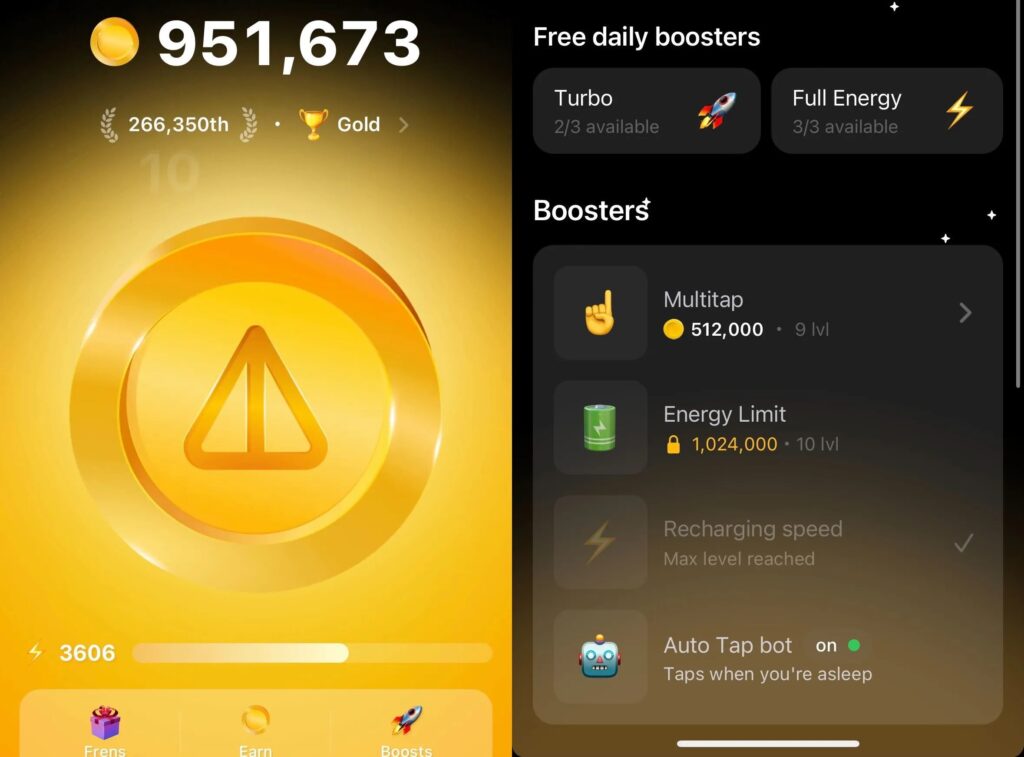

3. Notcoin

Notcoin is a native GameFi project within the TON ecosystem. Initially, it was launched as a game on Telegram for experiments related to user engagement. Participants could participate by mining Notcoin by tapping the screen (tap-to-earn).

To prevent exploitation, there is an energy mechanism for players. If their energy runs out, players must stop and wait for their energy to refill. Additionally, there is a ranking for each player, calculated based on the amount of Notcoin earned.

Notcoin has over 40 million users, with daily active users reaching 6 million. This number is far higher than most existing crypto games. Initially, Notcoin was intended as a memecoin with no use case. However, this did not affect the interest of its players.

Things got frantic when Notcoin distributed an airdrop of NOT tokens on May 16, 2025. At launch, the price of NOT reached $0.010. However, it then corrected to its lowest level of $0.004. Currently, the price of NOT tokens is in the $0.018 range.

Notcoin’s popularity as a memecoin has placed it at number 51 in terms of market caps. As of this writing, Notcoin has a market cap of $1.82 billion.

TON Potential in The Future

As a Layer-1 protocol, TON holds immense potential for the future. TON boasts a solid and large user base due to its integration with Telegram. This robust community is a valuable asset that supports TON’s growth and adoption. There are already at least 10 million active users of Tonkeeper, the native wallet for TON.

On the one hand, Telegram has over 700 million monthly active users. This signifies that there is still significant room for growth in TON adoption. Moreover, TON and Telegram are collaborating to transform Telegram into a super app. Recently, Telegram has implemented a digital payment system.

In terms of transaction speed and scalability, TON has proven to surpass L1 protocols like Ethereum. While there remains a significant question about whether TON’s sharding technology can achieve the large-scale scalability of centralized systems, TON and Telegram’s technology and user base at least provide the foundation to achieve this goal.

The TON ecosystem is also relatively young and has ample room for further development. In the near future, at least seven games on Telegram are expected to follow in Notcoin’s footsteps. These games inlcude Yescoin, Hamster Combat, Blum, Memefi Club, Dotcoin, W-coin, and Catizen.

With its transparent mechanisms and fair distribution, Notcoin has succeeded in increasing the number of active users and building trust and loyalty within its community. Taking a cue from Notcoin, the enthusiasm for the potential airdrop of a project can drive transactions and daily users on TON.

Furthermore, the increasing number of users will also accelerate the adoption process of TON. At the same time, it also introduces more people to the TON ecosystem. This is a positive factor in driving the growth of an ecosystem.

Challenges such as network stability, interoperability with other networks, and other technical issues will remain the primary hurdles for TON. Nonetheless, it will be fascinating to see what developments and innovations TON will bring in the future.

Conclusion

The TON ecosystem shows remarkable growth with a surge in transactions and active users. It also saw the emergence of numerous new protocols. Those factors have propelled TON’s market capitalization to $18.36 billion, securing its position as the 9th largest cryptocurrency.

The development of TON can also be seen from the growth of their native protocols, such as Tonstakers and STON.fi. Meanwhile, GameFi protocols on Telegram, such as Notcoin, have also garnered many active users. Notcoin’s success has subsequently inspired similar GameFi projects to follow its path.

Beyond its ecosystem, TON is also continuously expanding its use-case value. Most recently, they have integrated a digital payment service through Telegram Stars. This move aligns with TON and Telegram’s goal of becoming super apps bridging the Web2 and Web3 worlds.

How to Buy TON Token on Pintu

You can start investing in TON by buying it on Pintu app. Here is how to buy crypto on Pintu application:

- Create a Pintu account and follow the process of verifying your identity to start trading.

- On the homepage, click the deposit button and top up the Pintu balance using your preferred payment method.

- Go to the market page and look for TON.

- Click buy and fill in the amount you want.

- Now you have TON!

In addition to TON, you can safely and conveniently purchase a wide range of cryptocurrencies such as BTC, ETH, SOL, and others safely and easily on Pintu. Pintu diligently evaluates all its crypto assets, highlighting the significance of being cautious.

Pintu is also compatible with popular wallets such as Metamask to facilitate your transactions. Download Pintu app on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

Aside from buying and trading crypto assets, you can expand your knowledge about cryptocurrencies through various Pintu Academy articles. Updated weekly, all Pintu Academy articles are made for knowledge and educational purposes, not as financial advice.

References

- Joel Agbo, **What Is The Open Network (TON) and Toncoin? CoinGecko,** accessed on 12 June 2024.

- STON.fi Docs, About STON.fi, accessed on 12 June 2024.

- Tonstakers Docs, What is Tonstakers?, accessed on 12 June 2024..

- Reza Jafery, What is Notcoin? The Telegram-Based Game, DeCrypt, accessed on 12 June 2024.

- Tim Delhaes, TON is Paving a Path to The Future for Crypto, Coin Telegraph, accessed on 12 June 2024.

Share

Related Article

See Assets in This Article

TON Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-