Understanding Total Supply, Market Capitalization, and Fully Diluted Valuations in the Crypto World

When conducting crypto investment analysis, there are metrics that can be used, such as total supply of a crypto asset, circulating supply of tokens, market capitalization, and fully diluted valuation. For those new to the world of crypto investing, understanding the definitions and uses of these terms can provide insight into the potential of a particular crypto asset in the future. Read on for more details!

Article Summary

- ⚖️ Total supply refers to the number of tokens or coins created minus the amount burned. The total supply figure takes into account tokens or coins that are currently locked and not circulating in the market, so it often differs from the circulating supply.

- 🪙 Market cap represents the value of all coins in circulation multiplied by the current coin price. A high market cap indicates the relative popularity and stability of a crypto asset.

- 🧑🏻💻 Fully Diluted Valuation (FDV) is an estimate of what a project’s market capitalization would be if all tokens were released to the market. FDV provides insight into the potential inflationary impact and selling pressure from the release of new coins.

- 🗒️ Market Cap focuses on the current value of tokens in circulation. FDV projects future value based on the total supply of tokens.

- 🧠 Using metrics such as total supply, market cap, and FDV can help investors and traders evaluate and decide whether to invest in specific crypto assets.

What is the total supply in terms of crypto assets?

When talking about an asset, questions about its quantity and size are inevitable. In the crypto world, there’s a term called “total supply,” which refers to the number of tokens or coins currently available in the market, including those that are locked away. The total supply includes the circulating supply and even tokens that are not yet freely traded in the market. For example, Solana has a total supply of 554 million SOL, while its circulating supply is only 406 million.

The overall supply can affect the value of a cryptocurrency. Going back to basic economic principles, when supply is limited and demand is high, the price tends to rise. Conversely, when there’s an abundant supply and relatively low demand, the price of the asset may decrease.

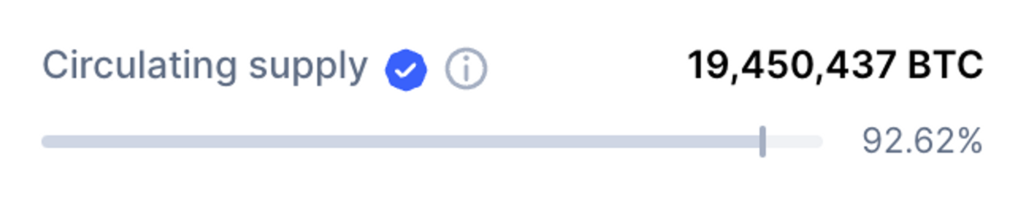

Circulating supply

The circulating supply refers to the number of tokens or coins currently circulating on a blockchain network. As shown in the image above, the circulating supply of BTC as of August 2023 is 19,450,437. The circulating supply is a percentage of the total supply, and a higher percentage is generally viewed favorably. For example, BTC has a circulating supply of 19 million, which is 90% of its maximum total supply of 21 million. This means that the value of Bitcoin cannot be significantly diluted by a large influx of new Bitcoins entering the market.

What’s the Difference between Total Supply & Circulating Supply?

In simple terms, total supply refers to the maximum number of coins or tokens that can ever be available in the market. On the other hand, circulating supply refers to the number of tokens or coins currently circulating in the market. These two metrics can play a pivotal role in determining the value of a crypto asset.

As mentioned above, if a coin’s supply in circulation is far from its total supply, there’s a risk of dilution. This is because as more coins are put into circulation, their value can decrease, especially if there’s no new demand to support the price. To assess whether an asset is not at risk of dilution, make sure that the crypto you choose to invest in has at least 50% of its total supply in circulation. Otherwise, it’s likely to be at risk of dilution and a potential drop in price.

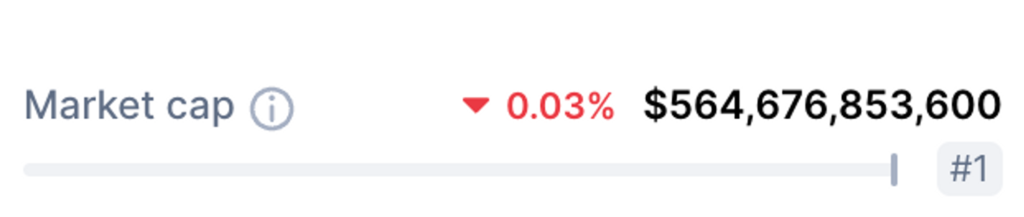

What is Market Cap?

The discussion of total supply and supply in circulation also relates to market cap. Market cap, or market capitalization, represents the total value of a crypto asset at a given point in time, which is calculated by multiplying the current price of the coin by the number of coins in circulation. Market cap is often used to determine the ranking and size of a crypto asset. A crypto asset with a high market cap is perceived as more popular because there are more holders willing to hold the coin, contributing to its increased value.

Crypto assets with a high market cap tend to be more stable investments compared to those with smaller market caps, as the latter are more susceptible to price fluctuations.

What is Fully Diluted Valuation (FDV)

Now that we understand the definition of market capitalization, let’s take a closer look at fully diluted valuation (FDV), also known as fully diluted market capitalization. These two terms are often thought to have the same meaning, but in fact they have different definitions.

Fully Diluted Valuation (FDV) or Fully Diluted Market Cap refers to the market capitalization of a project once all of its token supply has been released into circulation. Essentially, FDV is an estimate of a project’s market capitalization in the future. If a crypto asset has an unlimited supply or has reached its maximum supply, the FDV amount will be equal to its market cap.

To calculate the fully diluted valuation, multiply the maximum supply of the token by the current market price, resulting in the fully diluted market cap. By determining the market cap and understanding the fully diluted valuation, one can get a sense of whether a crypto asset’s price is considered too high or too low.

The Differences between Market Cap & FDV

| Market Cap | FDV |

|---|---|

| The total value of all tokens currently in circulation in the market | An estimate of the market value of a token if all existing or issued tokens are already in circulation |

| Calculated by multiplying the number of tokens in circulation by the current price per token. | Calculated by multiplying the total maximum number of tokens that will be in circulation (whether currently in circulation or not) by the current price per token. |

| Cannot predict changes in the popularity of a crypto asset over time | It can help gauge the valuation and potential of a crypto asset once all of its tokens or coins are in circulation. |

By understanding the fundamental differences between market cap and FDV, investors can actually use both metrics to gain a lot of insight into the valuation of a crypto asset.

The Effect of Total Supply, Market Cap, & FDV Metrics on Crypto Assets

Analyzing a project or crypto asset using these simple metrics can help investors or traders evaluate the crypto assets they are considering investing in.

Total Supply

The first metric, total supply, can be a crucial indicator for gauging the profitability of a crypto asset and whether an investor should invest in it. For example, if there’s a significant gap between total supply and circulating supply, it could potentially impact future profitability.

Market Cap

The second metric is the market cap, a measure that can influence a crypto asset and make investment decisions more measured. The formula for market cap is to multiply the total number of tokens in circulation by the current price. By using this formula, investors and traders can gauge the true size of the crypto asset. A higher market cap can ensure the relative stability of the crypto asset.

Fully Diluted Valuation

There are two possible effects on a crypto asset that can be observed through the FDV metric. Firstly, FDV can provide insight into the potential consequences of a large supply of tokens being introduced into the market, which could lead to selling pressure or token inflation. Secondly, if a crypto asset or token has a hard cap or token locking mechanisms, this can mitigate the potential sudden inflationary pressure due to the release of new coins.

Conclusion

In the world of crypto investing, there are numerous metrics and tools that can provide the necessary insight before making an investment decision. However, these three metrics are not the primary determinants. There are many other metrics that need to be examined and observed, such as the tokenomics of the asset, whether the project has a clear roadmap, and its utility or use cases.

However, as a prudent investor and trader, it’s wise to study these metrics carefully. Utilizing various tools and metrics before deciding to invest in a crypto asset can increase the effectiveness and accuracy of predictions in determining the right investment strategy, ultimately leading to returns that meet established goals.

References

- Daniel Phillips, Fully Diluted Valuation (FDV) — The Great Dilution Dilemma, Coinmarketcap, accessed on 8 August 2023.

- Russian DeFi, FDV: The Main Metric, m6labs, accessed on 8 August 2023.

- Jacky Yap, The Difference Between A Market Cap And A Fully Diluted Market Cap In The Crypto World, Chaindebrief, accessed on 8 August 2023.

- Rahul Nambiampurath, Market Cap vs. Circulating Supply, Thedefiant, accessed on 8 August 2023.

- Unchainedcrypto, How Token Supply Affects the Price of a Cryptocurrency, accessed on 8 August 2023.

- Emi Lacapra, Crypto token supplies explained: Circulating, maximum and total supply, Cointelegraph, accessed on 8 August 2023.

Share