Weekly Spot Signal Pintu X Volubit – February 9, 2026

Signal Trading Summary:

1. Zilliqa

- Entry: IDR 76.24 ($0.00452)

- Cut Loss [CL]: IDR 54.31 ($0.00322)

- Take Profit [TP]:

- TP1 = IDR 98.85 ($0.00586)

- TP2 = IDR 122.97 – IDR 138.49 ($0.00729 – $0.00821)

2. Parcl

- Entry: IDR 338.37 ($0.02006)

- Cut Loss [CL]: IDR 202.92 ($0.01203)

- Take Profit [TP]:

- TP1 = IDR 468.59 ($0.02778)

- TP2 = IDR 550.91 – IDR 630.53 ($0.03266 – $0.03738)

3. Berachain

- Entry: IDR 10.205 ($0.605)

- Cut Loss [CL]: IDR 5.296 ($0.314)

- Take Profit [TP]:

- TP1 = IDR 15,130 ($0.897)

- TP2 = IDR 17,812 – IDR 20,056 ($1,056 – $1,189)

1. Zilliqa (ZIL)

Tags: Layer-1

Zilliqa (ZIL) managed to record a rebound after the price drop touched the support area which was the lowest price on January 31 at IDR 62.24 ($0.00369). In this zone, a liquidity sweep was formed, indicating the absorption of selling pressure by buyers and the emergence of strong buying interest.

As long as the price of ZIL is able to hold and move above the support cluster in the range of IDR 56.68 – IDR 62.24 ($0.00336 – $0.00369), the price movement structure is still constructive and opens up opportunities for the continuation of the uptrend.

In this scenario, the medium-term upside target is at $0.00586, while the primary target is in the range of IDR 122.97 – IDR 138.49 ($0.00729 – $0.00821) as a continued resistance area.

ZIL Potential Buy Setup:

Entry: IDR 76.24 ($0.00452)

Cut Loss [CL]: IDR 54.31 ($0.00322)

Take Profit [TP]:

- TP1 = IDR 98.85 ($0.00586)

- TP2 = IDR 122.97 – IDR 138.49 ($0.00729 – $0.00821)

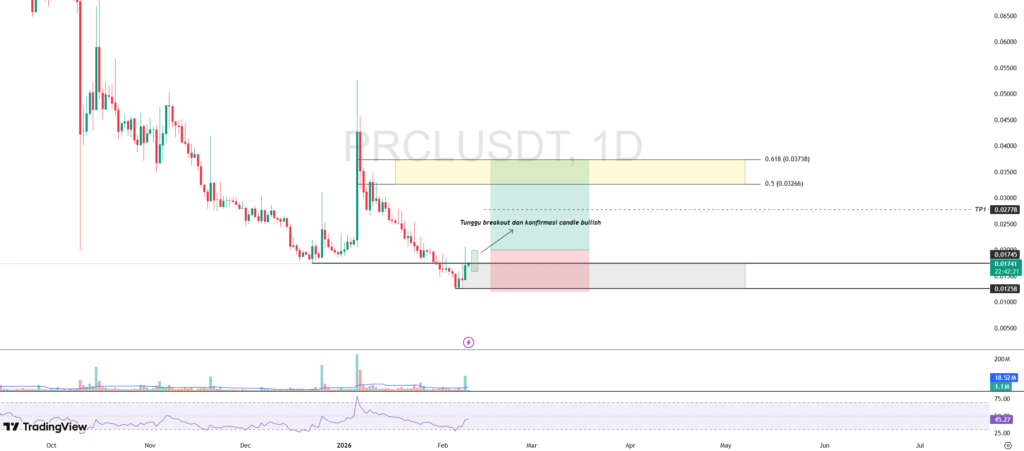

2. Parcl (PRCL)

Tags: RWA

The selling pressure on Parcl (PRCL) started to lose momentum after the price printed an all-time low (ATL) at IDR 212.20 ($0.01258). This area, along with the support cluster in the range of IDR 212.20 – IDR 294.35 ($0.01258 – $0.01745), is a potential demand zone if the price is able to move above the area.

However, the validity of the bullish scenario requires a clear breakout from the cluster support area, accompanied by the formation of a strong bullish candle (such as a marubozu) to confirm the entry of dominant buying pressure.

If this confirmation occurs, then the potential for strengthening PRCL prices is open with an upward target towards the IDR 550.91 – IDR 630.53 ($0.03266 – $0.03738) area as the next resistance zone.

PRCL Potential Buy Setup:

Entry: IDR 338.37 ($0.02006)

Cut Loss [CL]: IDR 202.92 ($0.01203)

Take Profit [TP]:

- TP1 = IDR 468.59 ($0.02778)

- TP2 = IDR 550.91 – IDR 630.53 ($0.03266 – $0.03738)

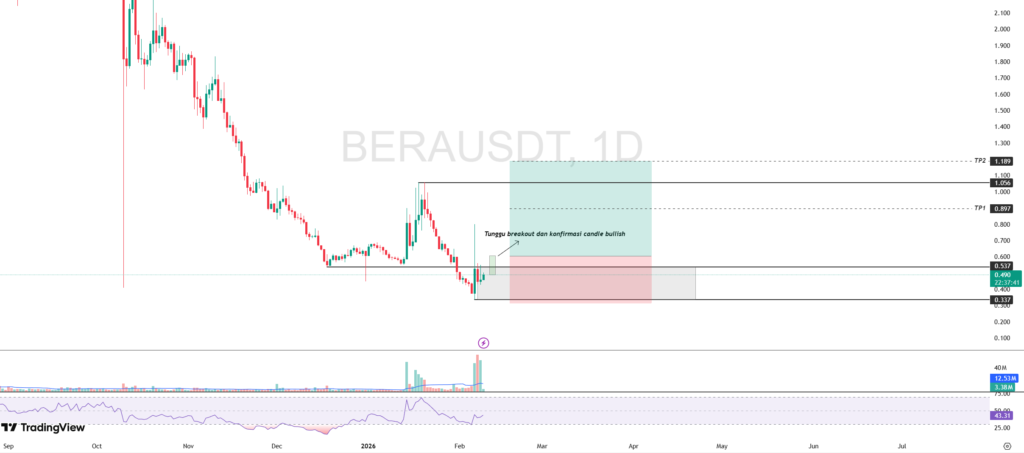

3. Berachain (BERA)

Tags: Layer-1

BERA’s trading volume showed a significant increase in the last three days, being above the 20-day moving average (MA20). This reflects increased market participation.

Breakout of the support cluster area of IDR 5,684 – IDR 9,058 ($0.337 – $0.537) is the key factor to confirm the change in sentiment to the positive direction. If valid, BERA has the potential to continue rising with the main target at the January 18 high of IDR 17,812 ($1,056).

BERA Potential Buy Setup:

Entry: IDR 10.205 ($0.605)

Cut Loss [CL]: IDR 5.296 ($0.314)

Take Profit [TP]:

- TP1 = IDR 15,130 ($0.897)

- TP2 = IDR 17,812 – IDR 20,056 ($1,056 – $1,189)

Important Notes:

Always apply risk management and capital management with discipline. For trading, especially those using leverage, we recommend using a risk per transaction of: 1% of total capital.

Share

Table of contents

Related Article

See Assets in This Article

0.0%

0.0%

0.0%

ZIL Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-