What is an Earnings Call and Its Impact on Stocks

Earnings call is one of the important agendas for investors or stock traders in determining future steps, whether buying, selling, or holding positions. The results of the Earnings call provide important insights into the company’s performance as well as the strategic plans that management will carry out. In this article, we will discuss what an Earnings Call is, how it differs from an Earnings Report, and why this event can have a significant impact on stock price movements.

Article Summary

- 🧠 Definition of Earnings Call: A meeting between the board of directors and investors, analysts and media to provide a broader context to the company’s financial statements.

- 🔎 Difference between Earnings Call and Earnings Report: Earnings Report is the official financial report released by the company, while Earnings call is a presentation and Q&A session discussing the report. Both complement each other in providing transparent information to investors.

- 🔑 Why Earnings Call is Important: Earnings calls provide a more detailed explanation of the company’s financial condition, including cash flows and factors behind changes in performance. It is also important because it allows investors to assess management’s credibility through the way they present information and answer analysts’ questions.

- 💸 Effect of Earnings Call on Stock Price: Investors often use Earnings call results as a reference in making investment decisions, so this session can affect stock price movements.

What is an Earnings Call?

Earnings call is public conference held by company to discuss quarterly or annual financial performance, including factors that influence the rise and fall of revenues and profits.

This conference is typically led by the CEO and CFO, who present a concise summary of the company’s financial results.

The following is a series of Earnings Call events that are commonly conducted by companies:

- Opening.

The event is opened by the moderator or the company’s investor relations department (Investor Relations), then the board of directors present are introduced. - Presentation of financial statements by management.

The board of directors or executive team summarizes the financial statements, explains the main factors affecting performance (both positive and negative), and provides the company’s outlook and strategy for the next period. - Q&A session.

Following this, financial analysts from large institutions, investors, or the media will ask questions related to the company’s financial statements, business prospects, and strategies. Then, the board of directors will answer the questions according to the capacity of each role. This session helps provide clarity for the public and investors.

As a result, with such a conference series, shareholders and the public will get a deeper context of the company’s financial results.

While not all retail investors are generally able to interact directly with directors during earning call sessions, they can still access all the information such as financial statements, transcripts, and presentation materials and participate in these sessions through company websites or platforms such as Yahoo Finance and NASDAQ Earnings. Investors still get the full context to understand the company’s condition and direction without having to attend the session.

Earnings Call vs Earnings Report Difference

Earnings reports are financial statements that are publicly released by companies, usually on a quarterly or annual basis. Meanwhile, Earnings call is a conference session held to discuss the report.

For public companies in the US, these reports are associated with official documents such as Form 10-Q (quarterly) and Form 10-K (annual). Both documents are complete financial statements that must be submitted to the Securities and Exchange Commission (SEC).

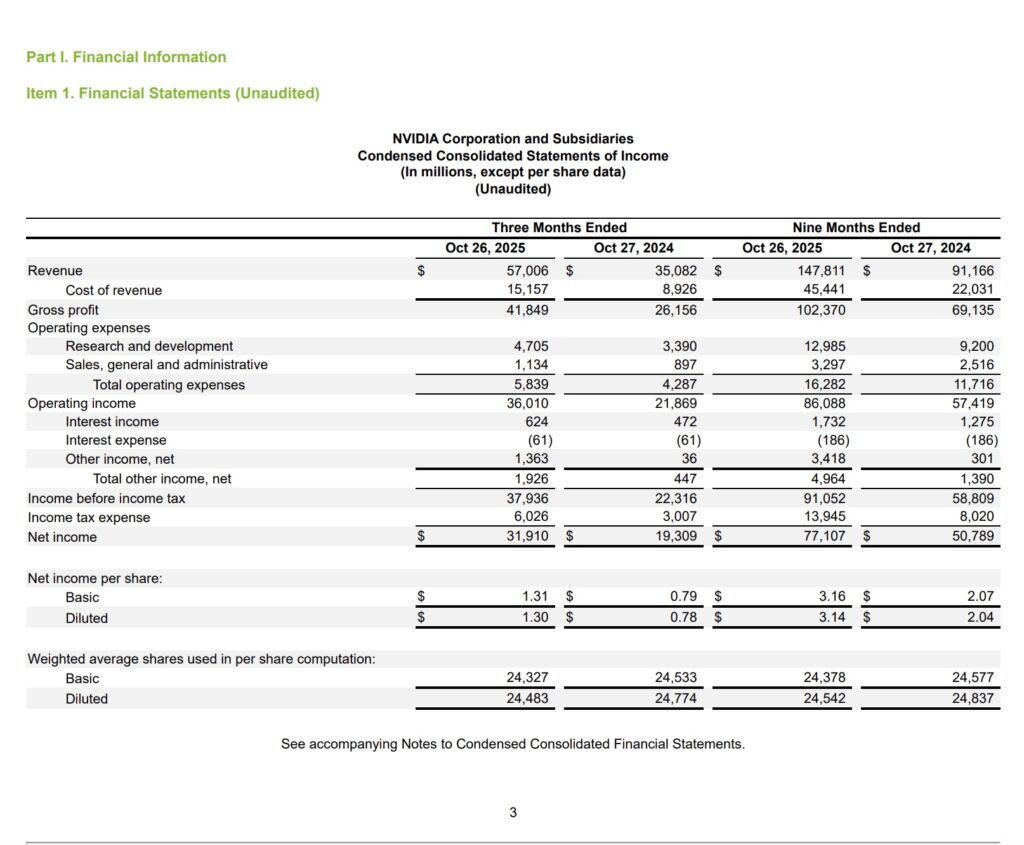

The Earnings Report contains the company’s financial statements. Include revenue, gross profit, operating expenses, net income per share, and other important metrics. This report also includes a comparison of performance with the previous period to show whether there is growth or not.

Earnings reports are generally published along with other information such as:

- Press Release

- Earnings Call Presentation Material

- Earnings Call Transcript

Please note, each company can present the Earnings Report in a different format and order. There are also companies that release the Earnings Report first, then hold an Earnings call.

Why Earnings Call is Important

These sessions provide investors with a broader context of the company through management presentations. That way, investors can get a more complete picture than just reading the numbers in the financial statements.

Here are the reasons why.

1. Understand the Company’s Financial Condition Contextually

Investors can assess a company’s financial health and cash flow with additional context. For example, explaining why operating expenses rose, what triggered the increase, and whether the change is temporary or long-term.

This session also reveals the company’s future revenue projections and the key factors expected to drive its growth. During the Q&A session, analysts will usually highlight parts of the report that are unclear or require further explanation. That way, investors get a stronger rationale behind any changes in the company’s numbers or strategy.

2. Assessment of the Credibility of Company Management

Management’s credibility can be seen in how they answer analysts’ questions in a Q&A session. The way they explain strategies, respond to risks, and answer crucial issues such as how the company deals with fierce competition, are important indicators of whether management is competent, transparent, and worthy of investors’ trust.

3. Company Transparency

This session encourages management to explain the financial statements in more detail, clearly and transparently. In other words, these explanations indirectly shape investors’ perceptions of management competence and credibility.

Effect of Earnings Call on Stock Price

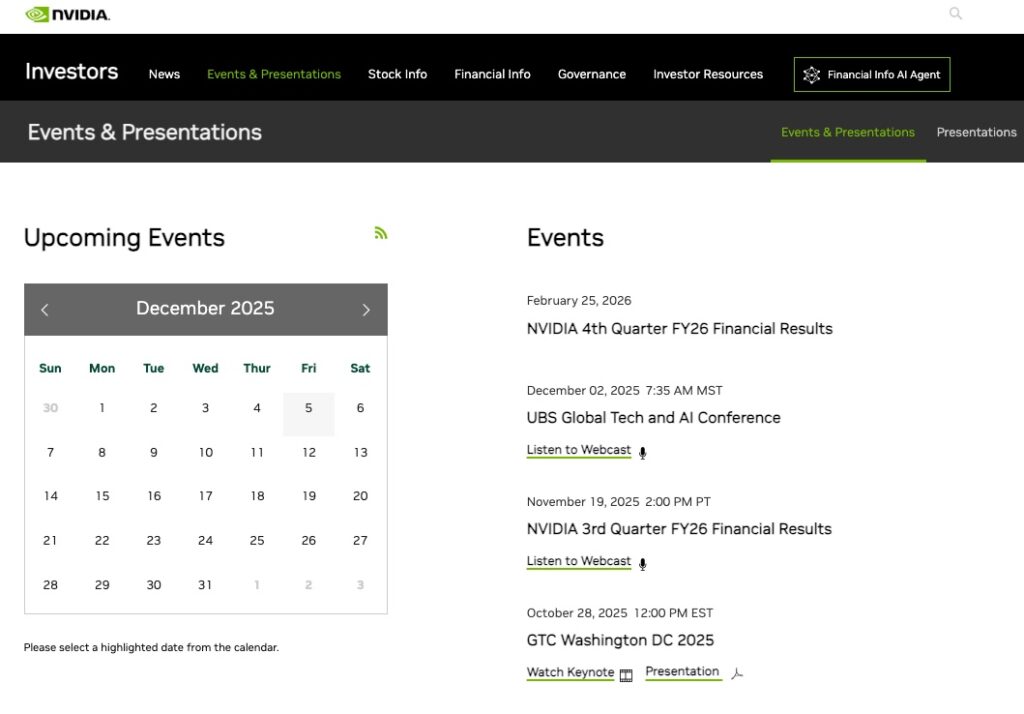

One example of a company that saw its stock price rise after an Earnings Call is Salesforce Inc. On December 3, 2025, Salesforce released its third-quarter financial results and held an Earnings Call. The report showed revenue of $10.3 billion, up 9% year-over-year (YoY) and 8% in constant currency (CC).

During the session, in addition to presenting positive revenue growth, Salesforce CEO Mark Benioff also expressed optimism that advancements in AI could be leveraged in business operations.

Therefore, earnings calls can be a catalyst for stock price movements as the financial statements presented by management can provide insights that influence investor sentiment.

Factors such as financial health, business projections, the level of optimism of the board of directors towards the company’s growth and market expectations, to implied statements that provide certain signals regarding the company’s prospects can encourage investors to make buying or selling decisions, thus potentially affecting its price movements.

In addition, there are various variables that can affect stock price movements such as macroeconomics, major events, and many more.

Also read the full article on Stock Catalysts at Pintu Academy

How to Buy Tokenized US Stocks on the Pintu App

You can start investing in tokenized stocks like Tesla, Nvidia, Apple, and Microstrategy right on the Pintu app.

- Open the Pintu app.

- Go to the Market section and search for the stock you want to buy (TSLAx, AAPLx, NVDAx, MSTRx).

- Enter the amount you wish to purchase after logging in.

- You can follow the same steps to buy other tokenized stocks in the Pintu app.

Download Pintu app now on Play Store or App Store! Your safety is guaranteed, as Pintu is supervised by OJK (Financial Services Authority) and CFX.

Besides that, Pintu also allows you to learn more about crypto through various educational articles on Pintu Academy which are updated weekly. All articles published on Pintu Academy are for educational purposes only and are not financial advice.

Disclaimer: All articles from Pintu Academy are intended for educational purposes and do not constitute financial advice.

Conclusion

Earnings call is suitable for investors who want to capitalize on stock market volatility, as price movements often occur after this session. Of course, this becomes more effective when combined with technical and fundamental analysis. This session not only provides a potential “signal”, but also opens up a broader insight into the company’s business conditions. Through these sessions, investors can assess the quality of management, understand long-term strategies, and see how the company responds to market challenges and opportunities. Ultimately, this can help investors make more informed decisions for their investment objectives.

References

- James Chen, “What Is an Earnings Call? Understanding Key Financial Conferences“, Investopedia, accessed on December 3, 2025.

- Sean Bryant, “What Is an Earnings Call? Here’s What New Investors Should Know“, NASDAQ, accessed on December 3, 2025.

- Brent Radcliffe “Master Decoding Earnings Reports for Smarter Investment Decisions“, Investopedia, accessed on December 4, 2025.

Share