What Is Crypto Futures?

Crypto futures account for over 60% of global crypto trading volume in 2024 and just hit an all-time high. Crypto perpetual futures let you bet on an asset’s future price without owning it, using leverage to control positions much larger than your initial capital. They offer the chance to profit in both up and down markets, but carry liquidation risks. This article will explain what is crypto futures, how they work, and compare them to spot trading.

Key Takeaways

- 💸 Advantage of Crypto Futures: Crypto futures let you control large positions with small capital through leverage but at the cost of magnifying risk. If done right, futures trading can net you significantly higher profits compared to spot trading.

- ⚠️ Margin Maintenance is Important: You must maintain the value of your maintenance margin or risk getting margin calls and even automatic liquidation.

- ⚖️ Perpetual Contracts vs. Spot Trading: Perpetual futures enable long and short exposure without asset ownership, higher liquidity, and lower fees.

- 🧠 Risk Management Is Crucial: Use stop-losses, monitor mark price, top up margin proactively, and never go “all in” to protect your account from sudden market swings.

What is Crypto Futures?

Crypto Futures is a contract to buy or sell cryptocurrencies at a future date. Traders and investors use futures contracts to speculate on the future price of cryptocurrencies such as Bitcoin.

The futures market is essentially where two types of traders bet on the future price of an asset. The side that believes the asset will go higher in the future is opening a long trade, while those who believe it will go lower are opening a short. Traders profit if the price moves according to their prediction. On the other hand, traders get liquidated and lose all their assets if the price moves too far against their bet.

Think of it like this: You believe the price of Bitcoin will go up next week. With a futures contract, you can lock in a deal today and potentially earn a profit if your prediction is correct—even if you don’t have any Bitcoin.

Crypto futures is the most popular derivative product because of the potential profits for users through leverage. With leverage, traders can instantly 10x or even 100x their initial capital. Futures now account for more than half of crypto’s trading volume.

Why Do People Trade Crypto Futures?

- Profit from either direction: Whether the market goes up or down, futures traders can always benefit from the market.

- Trade with leverage: Opening a 10x, 25x, or even 100x bigger position than our capital. This multiplies potential profit significantly.

- Hedging: Crypto futures trading is a good hedging tool for anticipating potential losses from spot trades. Traders usually hedge by opening up a short position in other assets that are more likely to fall.

Start exploring Crypto Futures safely and easily with Pintu Futures!

How Crypto Futures Work

Crypto Futures contracts are fundamentally different from spot trading. Futures trading doesn’t directly involve the underlying assets, users instead trade the value of each contract. Traders never need to buy or sell assets such as BTC as the gains and losses are usually settled in USDT or USDC. Additionally, crypto futures contract is usually called perpetual contracts because they don’t have an expiration date.

There are three key elements of trading crypto futures contracts:

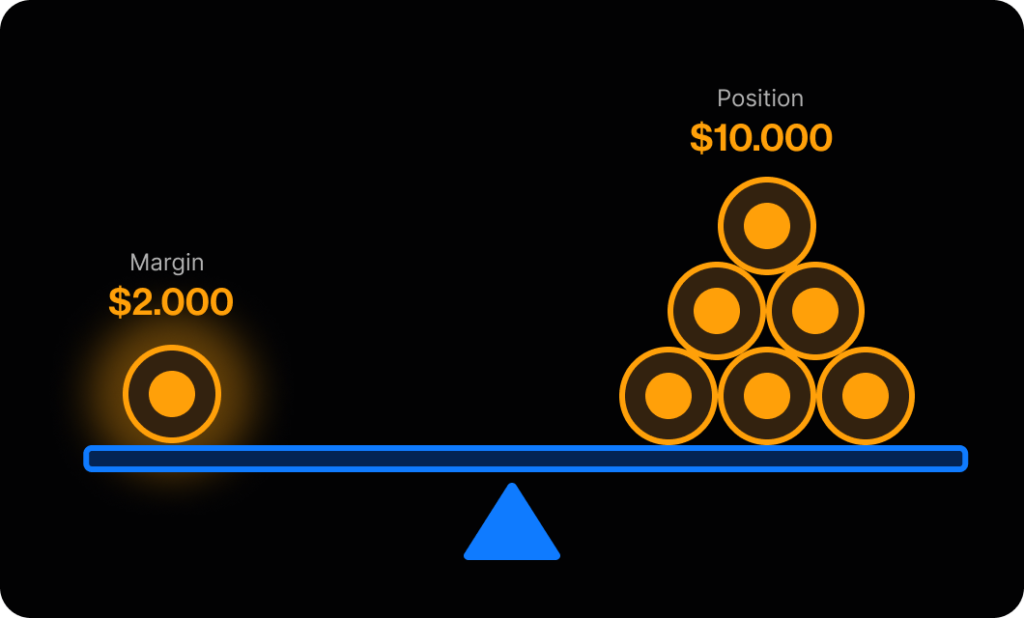

- Leverage: Leverage is a feature that lets you borrow assets from a crypto exchange to amplify your potential profit. A 10x leverage of $100 lets you open a $1,000 trade, which means you borrow $900 from the exchange.

- Margin: Margin in futures trading is the cost you need to open and keep your positions. Maintenance margin is the threshold you must maintain to keep your position open. If your margin usage reaches a critical point, you will get a margin call to close or top up your asset. If you can’t restore your margin above the maintenance margin, the exchange will liquidate (close) your position, where you’ll lose 100% of your asset.

- Funding Rate: Keeps futures price in par with spot. When the funding is positive, long traders need to pay short traders and vice versa. You need to pay the funding rates every 8 hours.

More on leverage: Tutorial For Using Leverage – Pintu Academy.

Types of Trade in Crypto Futures

- Long: You buy a futures contract if you believe the price will rise.

- Short: You sell a futures contract if you believe the price will fall. In this way, you will still profit when the price keeps falling.

Key Differences of Crypto Futures vs Spot Trading

| Faktor | Futures Trading | Spot Trading |

|---|---|---|

| Asset Ownership | No ownership | Direct ownership of asset |

| Advantages | You can only profit when the price rises | You can only profit when the price rises |

| Risks | Higher risk due to leverage | No added risk |

| Initial Cost | Flexible depending on your initial margin | You need the full cost when buying an asset |

What are the Advantages of Crypto Futures?

Many experienced traders choose crypto futures instead of just spot trading. Although leverage is a huge risk, in the hands of a skilled trader, it becomes an amazing tool that will amplify profits tenfold or even more.

Below are several advantages of crypto Futures:

- Speculation: Traders speculate on the future direction of cryptocurrency prices by opening future positions. This allows them to potentially profit from the high volatility environment, such as token unlocks, regulatory developments, or macroeconomic conditions. Speculating is an extremely high-risk,high-return trading that should be treated carefully.

- Leverage: Leverage is both a blessing and a curse for future traders. If used correctly, it can increase profits exponentially even though the price has only moved slightly.

Risks of Crypto Futures

- Liquidation: Liquidation happens when the price moves too far against your trade, and your maintenance margin hits the limit. If you’re not careful, the worst-case scenario is that you can lose all the funds in your account (using cross margin).

- Higher risk than spot trading: Perpetual futures trading carries significantly higher risk compared to spot trading, especially if high leverage is involved. A 5% move against your trade can result in a 50% loss.

- Volatility: One of the biggest downsides of trading futures is the so-called “scam wick” when volatility is at its highest. This is when the price suddenly wicks lower only to recover minutes later. BTC has experienced this type of movement several times, including the COVID crash and the start of the Ukraine-Russia conflict.

In crypto futures trading, you should watch the mark price instead of the traded price, as this is the reference price used to calculate profit, loss, and liquidation.

Tips for Crypto Futures Trading

1. Start Slowly

Position sizing is one of the most important aspects of crypto futures trading. Inexperienced traders or users who are just starting out should limit their position to small amounts. Most spot traders will likely need to adjust to futures trading. So, these smaller positions are designed to help learn the nature of futures trading.

Read more: Crypto futures trading tips.

2. Never Go All-In

New traders are usually very ambitious when they take a position, often going all-in to chase big profits. However, as the saying goes, “manage your risk or the market will manage it for you”, these “all-in” type of traders often get punished by the market. If you go all-in on a 25x leverage trade, a 3% move against your trade can liquidate your position. As we’ve learnt over the past 2 years, the market is becoming highly unpredictable.

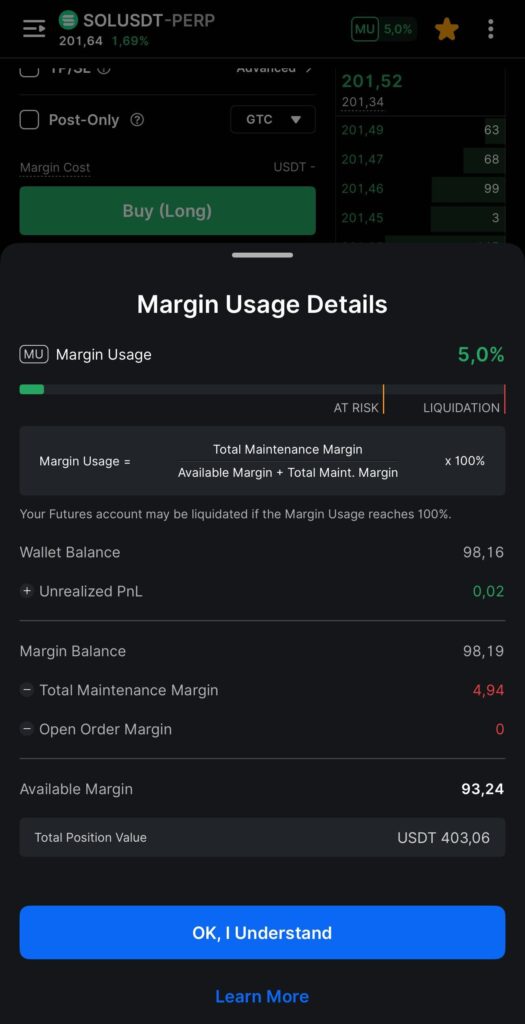

3. Watch Your Margin Usage and Liquidation Price

Available margin is the buffer between you and liquidation. When the available margin hits zero, it means you will be liquidated. Traders should always monitor their Margin Usage Ratio and make sure the number is way below 100%. The exchange will warn you with a margin call before the number hits 100%. Ensure that you have a healthy margin usage ratio before opening a trade (around 50% is safe). Alternatively, the easy way is to look at your liquidation price.

Read more: How to avoid liquidation.

4. Always Use Stop Loss

Stop loss is the magic ingredient for not getting liquidated in your futures trade. Stop loss should always be set above your liquidation price and according to your risk tolerance. If you can only tolerate a 20% loss in your trade, set the stop loss above that level. Additionally, avoid round numbers for stop loss as they are usually very crowded and reduce the chance of your stop loss getting triggered.

Tutorial on how to use Stop Loss: Strategy for Determining Take Profit and Stop Loss – Pintu Academy.

How to Use Pintu Futures in Web

You can trade cryptocurrencies such as BTC, SOL, and many others directly through Pintu Futures on your browser.

How to trade Crypto Futures in Pintu Web:

- Open https://pintu.co.id/en.

- Click the button Futures in the upper center.

- Click Trade Futures on Desktop.

- Then, click register or login if you already have an account.

- Trade BTC and other cryptocurrencies.

How to Start Trading Crypto Futures on the Pintu App

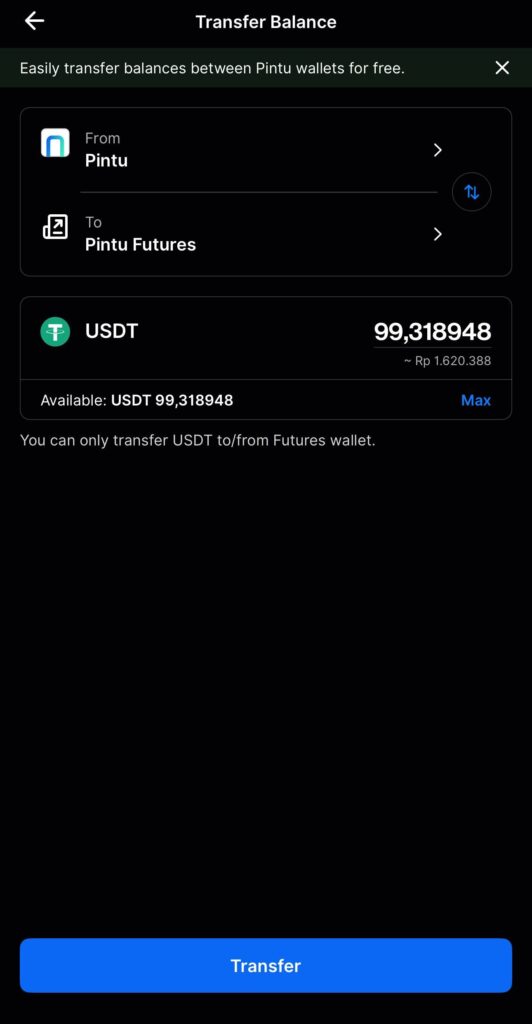

Step 1: Depositing USDT to Your Pintu Futures Account

Getting USDT

To trade perpetual futures, you need to fund your futures account with USDT margin.

If you do not have any USDT balance, then you will need to buy USDT on Pintu or Pintu Pro or you can deposit USDT from external wallets by using the “Receive” function.

Transferring USDT to Futures

Once you’ve got your USDT balance, you can transfer the USDT balance from Pintu or Pintu Pro to Pintu Futures margin account directly.

Pintu will soon support direct convert and transfer of IDR balance into your futures account as USDT to streamline & simplify the futures deposit process. Stay tuned.

Step 2: Opening a Position

Selecting a Contract to Trade

To start trading, first pick a contract you want to trade – for example, SOLUSDT-PERP. Then click on any SOLUSDT-PERP you see on the Homepage or on Markets, or go directly to the Futures tab and find SOLUSDT-PERP from the top left trade drawer, which will lead you to the Pintu futures trading page.

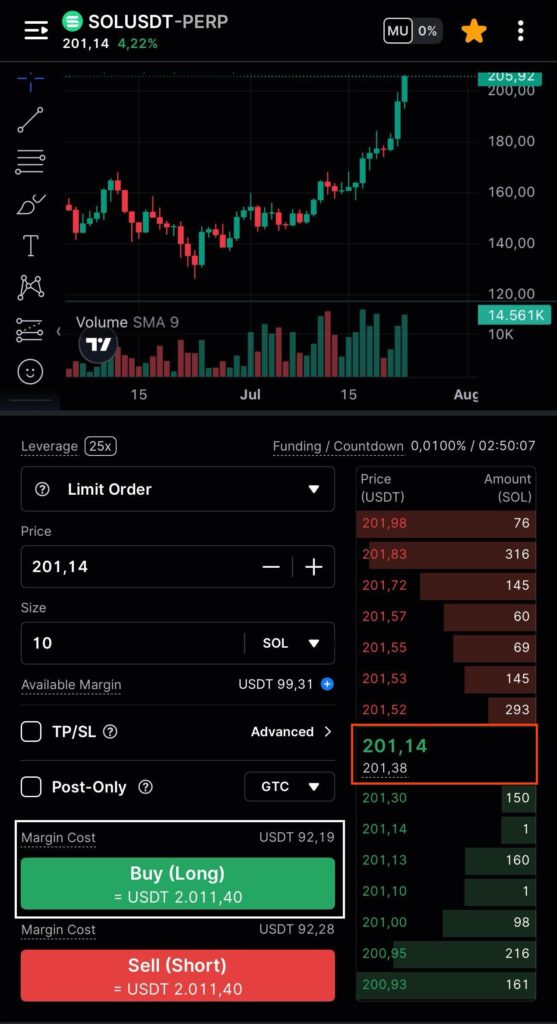

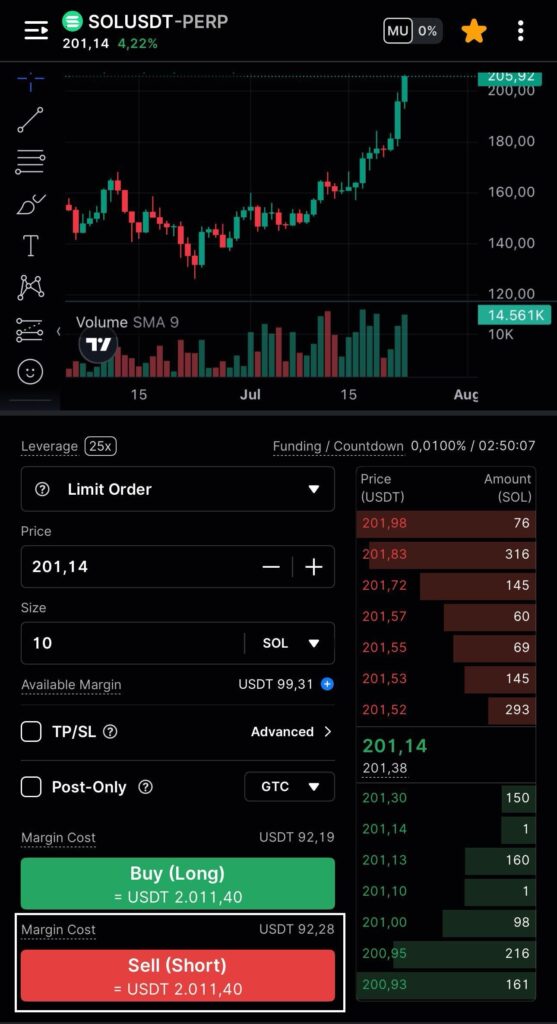

Submitting Your Order

Once on the futures trading page, make sure the contract is the one you want to trade and then fill out the order form.

Make sure you fill out the key fields correctly to avoid errors and order rejection. Below are some key fields and definitions.

| Field | Description |

|---|---|

| Order Type | Select the order type you want to use – Limit vs Market to open a new order |

| Price | The price you want to enter at, applicable if you are sending a Limit Order |

| Size | The quantity you want to trade, this can be in USDT or the base asset |

| Margin Cost | The amount of USDT margin you need to submit this order |

| TP/SL | Take Profit / Stop Loss is a more advanced form of order that automatically closes your position when in profit or loss |

| Post-Only | Makes sure your order will not immediately execute and will be placed into the order book |

What is Margin? Margin is the required collateral a trader must provide to open and keep a leveraged futures position. Users need to have a margin value equal to 2–10 percent of a position’s value. In Pintu futures, you need an initial margin requirement of 4%. So, users need to provide 4% of their position value as the initial margin. For example, a user opening $5k 25x leverage long position on ETH needs $200 (4%) as initial margin. If the user has $500, their maintenance margin is $50 and available margin is $450. So, this user’s position will get liquidated once the loss reaches $450 or 9%.

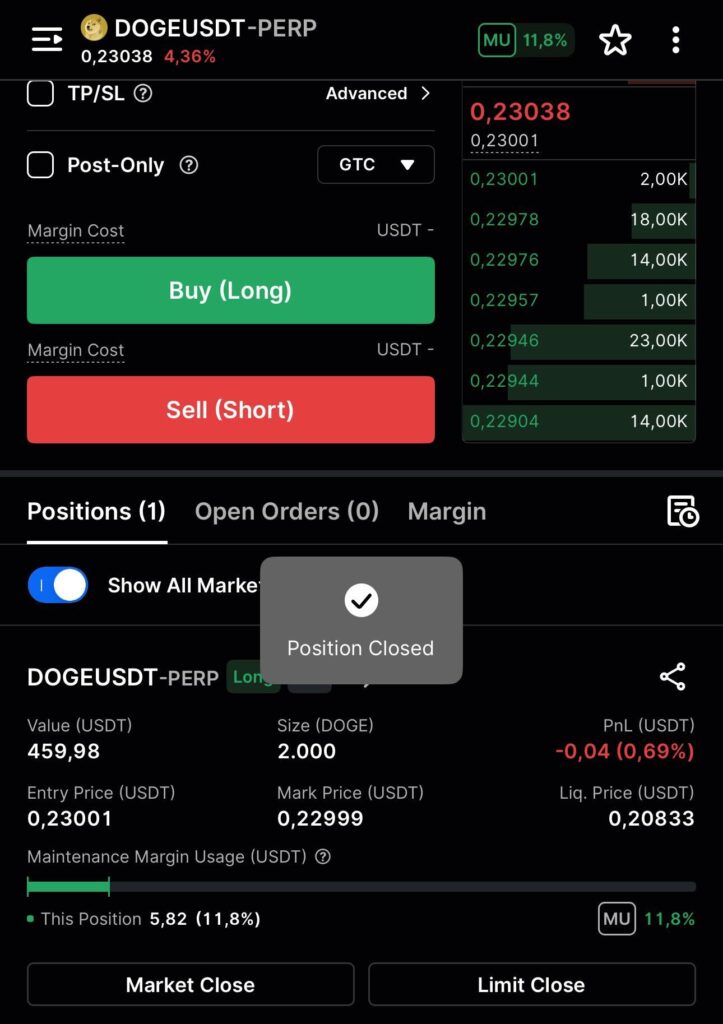

Once you’ve completed the Order Form and made sure you have sufficient USDT margin balance to cover the Margin Cost, you can click Buy (if you want to open a Long position) or Sell (if you want to open a Short position).

If you’ve submitted a Market Order, then congratulations, you’ve opened a futures position. If you submitted a Limit Order, as soon as your order is filled, your futures position will be opened.

Pro Tip: perpetual futures always trade on leverage, a useful proxy to see how much you can trade is simply to multiply your capital by the number of leverage offered on the contract. So, for example, if you have USDT 100, and you want to trade a 25x contract, you can trade “up to” USDT 2500; but we generally encourage users to trade below this since your account will be at a high risk of liquidation if you trade 25x. Trading at less than 10x (i.e. USDT 1000) will be much safer. Read more about Leverage in Pintu Academy: Managing Risk in Futures Trading With 25x Leverage.

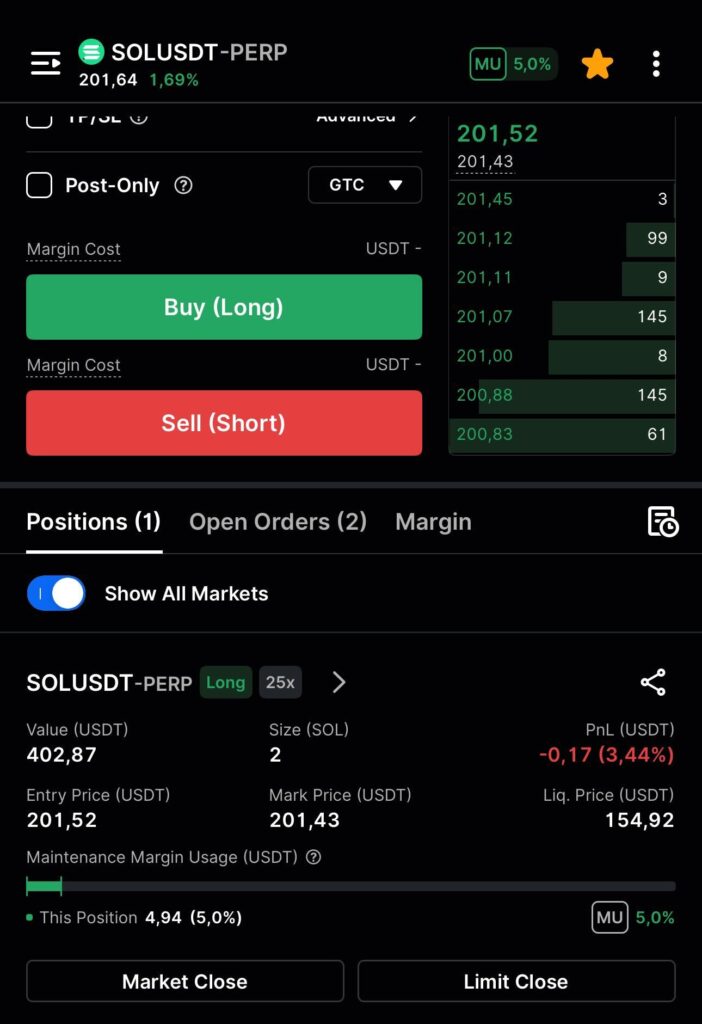

Step 3: Managing Your Position & Risks

Trading futures can bring huge potential for returns, but it also comes with a lot of risk. You must always monitor your positions and risks closely to avoid liquidations and excessive losses.

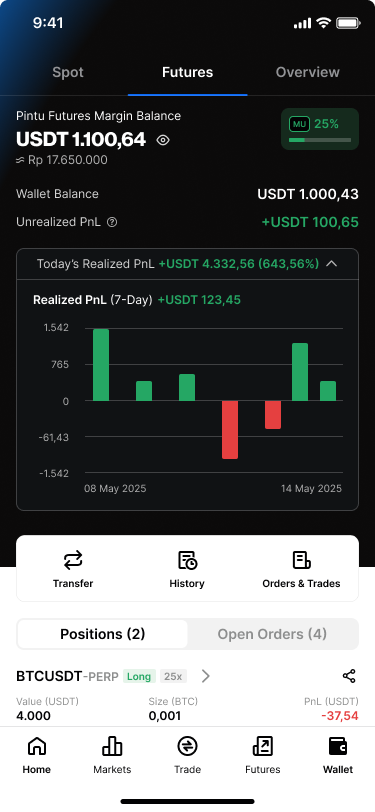

The 3 key things to monitor are your Margin Usage Ratio (”MU”), your maintenance margin and your positions’ Liquidation Price & Unrealized PnL.

Margin Usage Ratio

MU% is a quick and easy way to understand your account’s liquidation risk. If MU reaches 100%, then CFX will cancel any open orders you have, and if you have no open orders, liquidate your account. MU% is viewable from the Futures Trade Page, Futures Wallet Page and the Home Page.

Maintenance Margin

Maintenance margin is the minimum amount of capital you need to maintain your position. If your margin balance falls to this level (due to P&L losses or other factors), then you will trigger a liquidation.

Liquidation Price & Unrealized P&L

Pay attention to the liquidation price of your position. If the Mark Price touches this price, then your account may be liquidated. Liquidation price will always be below the mark price for long positions and above the mark price for short positions.

You may also want to monitor your unrealized P&L so that you take appropriate measures to stop losses or take profits.

Pro Tip 1: Mark price is different than spot price and entry price. The mark price is calculated as a weighted average from the largest international crypto exchanges. This ensures that the Mark Price is the most reliable price source that is less prone to manipulation. Pro Tip 2: While your unrealized P&L is calculated using the mark price against your entry price, the final and actual realized P&L you will receive will be based on the final traded price when you close the position. If Mark Price and the Order Book price have a large deviation, then pay extra attention as it may indicate high volatility and you may not be able to fully realize your P&L potential.

Step 4: Closing Your Position

If you want to close your position, there are a few ways to do it. Within the positions tab, you can use the Market Close and Limit Close functions to help you close out your position. Both options will also provide you with a view of the estimated P&L if you were to close the position.

- Market Close allows you to instantly close your position at the best available market price. This is useful if you want to exit quickly, especially in fast-moving markets.

- Limit Close lets you set a specific price at which you’d like to close your position. Your order will only be filled if the market reaches that price, giving you more control over the execution.

Alternatively, you can also simply submit a new order in the opposite direction. For example, if you are long 1 BTC, then you can close your position by submitting a 1 BTC short order.

Pro Tip 1: You only need the margin cost to open a new position. When you are submitting an order to close an open position, the margin cost of that order will be zero.

Step 5: Check Your Realized P&L

Pintu provides users an easy way to see their trading realized P&L over a 7-day rolling period. You can access this by going to the Futures wallet and opening the realized P&L chart. You can also click on the bar to know your P&L on each trade.

Pintu Pro allows you to trade both Futures and Spot in one place, making it practical and efficient.

Click the following link to access Pintu Pro via desktop or app.

The Pintu app is also compatible with popular digital wallets such as MetaMask, making your transactions even more convenient. Go ahead and download the Pintu app on the Play Store or App Store today! Your security is guaranteed, as Pintu is regulated and supervised by OJK and CFX.

In addition to trading, Pintu also allows you to learn more about crypto through a wide range of articles on Pintu Academy, updated weekly!

All articles from Pintu Academy are intended for educational purposes only and do not constitute financial advice.

Conclusion

Crypto perpetual futures are powerful tools for hedging and speculation, offering flexible long/short positions, deep liquidity, and fee advantages over spot markets. However, the leverage and margin system introduces substantial risks, including sudden liquidations and outsized losses if trades aren’t sized and managed carefully. By understanding how leverage, margin, and funding rates work, setting prudent stop-loss levels, and maintaining healthy margin buffers, traders can harness the profit potential of futures while minimizing the danger of catastrophic account wipeouts.

References

- Kraken Learn, “What are Crypto Futures Contracts?”, Kraken, accessed on May 6, 2025.

- Robinhood Learn, “What are Bitcoin, Ether, and Solana crypto futures?”, Robinhood, accessed on May 6, 2025.

- Hikma Dirgantara, “What is Perpetual Futures Trading?”, Pintu Academy, accessed on May 7, 2025.

- Prableen Bajpai, “Cryptocurrency Futures: Definition and How They Work on Exchanges”, Investopedia, accessed on May 7, 2025.

- “What is Crypto Futures trading? A beginner’s guide to how it works”, PrimeXBT, accessed on May 8, 2025.

Share

Table of contents