How to Avoid Getting Liquidated in High-Leverage Crypto Trading

Liquidation is one of the primary risks when engaging in futures trading using leverage. Imagine you’re in a promising trading position, but suddenly the market reverses, potentially draining your entire futures account balance. In this article, we’ll cover practical strategies for reducing your chances of getting liquidated, especially when trading with leverage in volatile cryptocurrencies.

Article Summary

- 💸 Liquidation is the process where a trader’s open position is automatically closed when the margin usage reaches 100%.

- 🚨 Leverage can amplify potential profits but also increases risk. Liquidation occurs when the market price moves against the position and the account balance is insufficient.

- 💡 Strategies to avoid liquidation include understanding position sizing and practicing good risk management.

Understanding Leverage and Liquidation in Crypto Trading

Liquidation is the process where a trader’s open position is automatically closed when the margin usage reaches 100%. In futures trading, when a trader takes a leveraged position and the market moves against their position, they risk having their position liquidated by the exchange. This results in the trader losing funds.

Many traders use leverage to amplify their potential profits. However, due to the highly volatile nature of the crypto market, using leverage also increases the risk of liquidation.

The liquidation process can happen quickly or slowly, depending on the amount of leverage used in the trade. For instance, with a lower amount of leverage, liquidation won’t occur immediately after a small market correction. Conversely, a higher amount of leverage can quickly deplete a trader’s initial investment.

Essentially, liquidation happens when the market moves against the established position, causing the account balance to be insufficient to cover the required margin, forcing the exchange to forcibly close the trader’s position.

Learn more about perpetual futures trading through the following article.

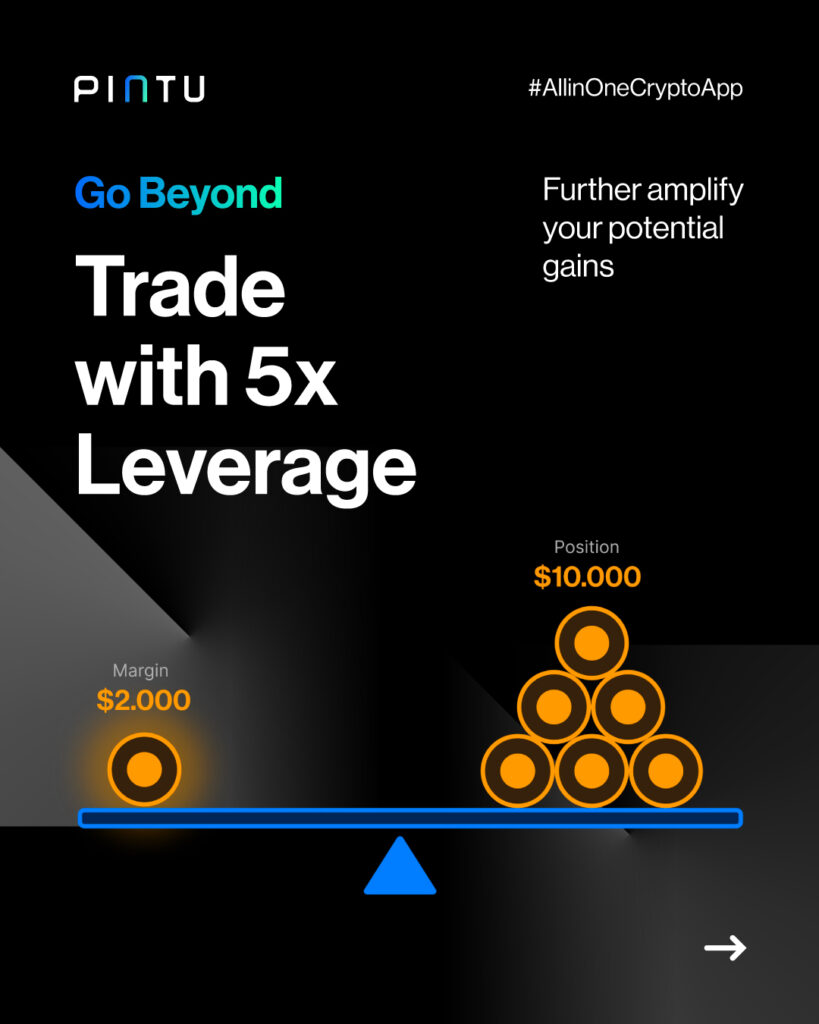

Example of Leverage on Pintu Pro Futures

Suppose you open a long position with 5x leverage. If the market moves 20% against your trade, you’re likely to be liquidated because the leveraged position amplifies losses. The same position with 100x leverage means even a 1% adverse move could wipe you out. The higher the leverage, the closer the liquidation price is to your entry price.

Here’s a breakdown:

- 5x leverage means you’re controlling a position five times larger than your initial investment.

- To calculate the liquidation point, we divide 100% by the leverage: 100% / 5 = 20%.

So, if the market moves 20% against your position, your position will be liquidated. This is because your initial investment will no longer be sufficient to cover the losses incurred due to the leveraged position.

Remember: Higher leverage amplifies both gains and losses. While it can lead to significant profits, it also increases the risk of substantial losses. It's crucial to use leverage cautiously and understand the risks involved.

Strategies to Avoid Liquidation

- Use Lower Leverage: The easiest way to reduce liquidation risk is to lower your leverage. Lower leverage gives the market more room to move against you without hitting your liquidation price.

- Understand Position Sizing: Position size matters more than the leverage itself. For example, if you trade with 10x leverage and a $10 margin, your position size is $100. However, if you use 100x leverage with a $1 margin, the position size is the same, but the risk is significantly higher. With higher leverage, your liquidation price moves closer to your entry, making it more likely you’ll lose the position.

- Focus on Risk Management and Trading Psychology: Success in trading is not about finding a “perfect” strategy but about disciplined risk management. Even the best trading strategy is ineffective without proper risk management, which includes appropriate position sizing and a focus on controlling losses.

Final Thoughts

Trading with high leverage in the crypto market offers exciting profit opportunities but comes with heightened risks. Beginners, in particular, should prioritize risk management and avoid high leverage until they understand the mechanics of position sizing. With a disciplined approach, you can reduce your chances of liquidation and trade more confidently in the volatile crypto market.

How to Start Trading on Pintu Pro Futures

Interested in trying futures trading? Don’t worry, now you can do futures trading on Pintu Pro. However, make sure you have a balance in Pintu Pro Futures first. Here are the steps:

- First, you need to transfer USDT from your Pro Spot Wallet to your Pro Futures Wallet.

- Futures trading can only be done in USDT pairs. To do this, select the “Futures” tab from the main Pro Wallet page. Then, tap “transfer” and enter the amount you want.

- If you don’t have a balance in your Pro Spot Wallet, you can transfer USDT from Pintu to your Pro Spot Wallet first.

- Congratulations! Now you have a margin balance for trading on Pintu Pro Futures.

To learn how to place and manage positions on Pintu Pro Futures, you can follow the steps from the video below. Good luck!

Share