What is Crypto Scam and How Do You Avoid it?

In recent years, the crypto industry market is growing rapidly. Many crypto assets have increased by thousands of percent. The total market capitalization of the crypto industry even reached more than 3 trillion US dollars by the end of 2021. This drastic increase has attracted millions of new investors. However, at the same time, the level of fraud or scams against crypto users has also increased dramatically. So, what is crypto scam? How can millions of dollars be lost in crypto scams? This article will help you identify and avoid scams in crypto.

Article Summary

- ⚠️️ Crypto scam is a criminal attempt by a person or group to trick and deceive users into giving away their assets.

- 🔎 Some of the most common types of scams found in the crypto world are phishing, mining scams, giveaway scams, rug pulls, pump and dumps, and airdrops on MetaMask.

- ️🕵️ Each scam has different characteristics but you can see some common traits such as offering huge profits in a short time, suspicious links and sites, and usually requiring you to spend money.

- 🧠 There are many ways to avoid frauds and scams that often occur in the crypto world. In general, you need to add extra layers of security for your sensitive data such as private keys.

Scam in the Crypto World

Crypto transactions are basically scam-proof through the use of blockchain technology. However, that does not mean crypto users are completely safe from the risk of fraud. The scam usually happens directly to users.

A Crypto scam is a criminal attempt by a person or group to deceive and trick users into giving away their assets. These scams often target new users tempted by attractive offers from a message or some shiny new crypto assets.

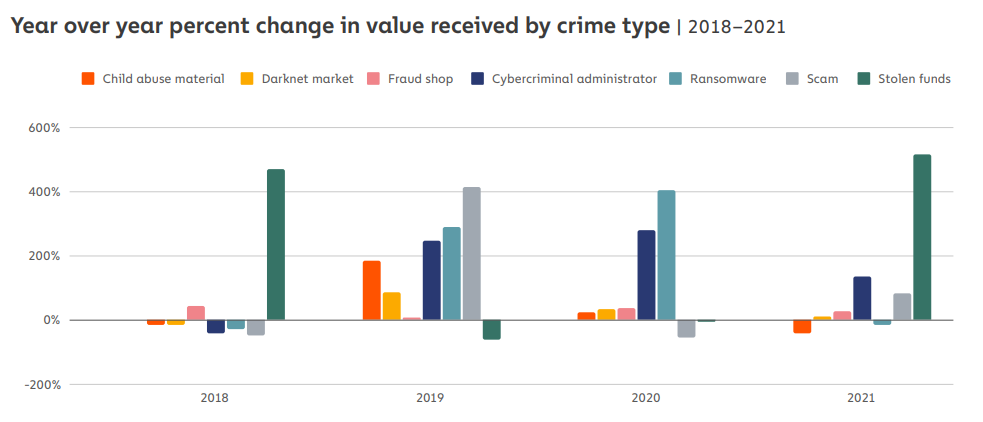

Chainalysis, a cryptocurrency security company, released a crypto crime report in 2021. The crime rate due to fraud reached $7.8 billion US dollars in 2021, an 82% increase from 2020. This increase in fraud rates coincides with last year’s bull market.

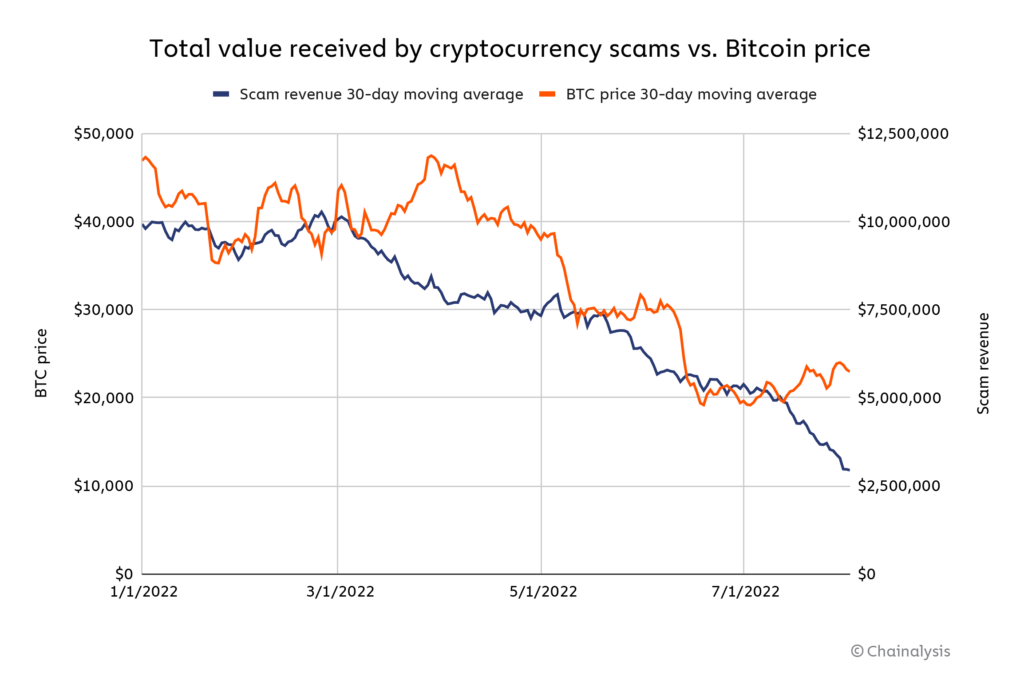

In 2022, the August Chainalysis report explained that there was a decrease in scams following the bear market. These scams usually target passive crypto investors or beginners, who usually enter when the price of crypto is high. These new users are fairly far in between in a bear market. In fact, Chainanlysis said the decline in fraudulent activity has a correlation to the price of Bitcoin.

Read also about Bull and Bear Market here.

The Chainalysis report above shows an interesting correlation between BTC prices and scams. Chainalysis suspected that the main victims of fraud are novice investors who FOMO crypto assets in a bull market. This indicates many beginners are investing without the knowledge of the risks. In a new industry like crypto, you need to understand the various modus operandi of various scams. Here are several types of crypto scams.

Types of Crypto Scams

1. Phishing

Phishing is a scam that “fish” or bait victims to provide sensitive data such as passwords or private keys. This type of scam is one of the most popular and common scams. These scammers use various mediums such as social media, private messages, and email. In addition, this is also one of the ways hackers steal Bitcoin from digital wallets.

Phishing scams usually come in the form of messages on behalf of an important organization or person. This message then invites the victim to follow instructions, such as entering the link sent or sending tokens to a specific address.

Perpetrators will hide ransomware or spyware behind these links to obtain important information from users. In a more advanced crypto phishing, the victim will immediately lose his crypto assets when using the link provided by the fraudster.

One of the crypto fraud events that has occurred due to phishing is the Ronin Bridge hack from Axie Infinity. The Block reports that the scammers offer a fictitious high-paying job to one of the senior developers of Axie Infinity. The employee downloads a pdf file from the scammers. After that, the hacker was able to access several validator nodes of Axie Infinity and managed to steal around $540 million US dollars.

💡 What can you do to avoid crypto scam like phishing?

Never click links from people you don’t know, especially on the internet. Always check the address and name of the sender of the message before following any written instructions.

2. Mining Scam

A mining scam is a type of scam in crypto that offers huge profits from mining activities related to crypto. This is the most popular type of scam in Indonesia with the majority of its victims being those who do not understand cryptocurrency. They are enticed by the promise of quick profits.

Quoted from Detik, one of the victims of this type of scam is deceived by Dogecoin mining offers promising 2% daily profits. It should be understood that mining equipment investment is never cheap and is difficult to do. Mining crypto assets usually doesn’t provide stable profits, especially in high amounts.

In addition, many fake mining applications circulating in the Android application store turn out to be dangerous for users.

3. Giveaway or Airdrop Scam

A giveaway scam is a type of scam that gives away free crypto assets which turns out to be a drain on their crypto assets. Users are usually required to connect their digital wallet to a specific smart contract or follow a link provided by a fraudster. This type of fraud is also common in NFT projects.

As in phishing, scammers usually use the name of a popular organization or someone’s account to get you to trust them. In crypto, you can verify your own digital address from a giveaway or airdrop. You can also learn how to verify smart contracts before connecting your digital wallet to an unknown address.

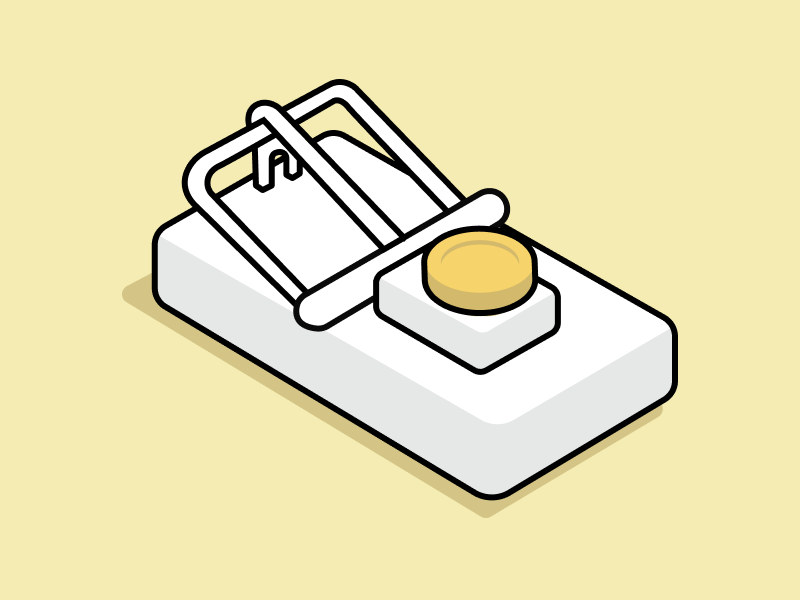

4. Rug Pull

Rug pull is a form of fraud in which developers abandon their crypto projects after raising funds from investors. The project development team did a rug pull by embedding a withdrawal mechanism into the smart contract code. After a large number of funds have been collected, the scammers will activate a code to drain all investors’ funds.

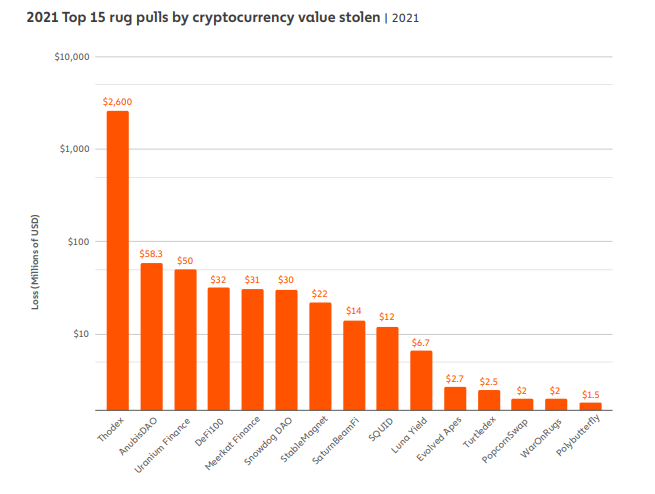

In Chainalysis’s report, the rug pull is a new type of scam proliferating since 2021. Thodex, a cryptocurrency exchange in Turkey, took about $2.6 billion of its users’ funds. The easiest way to avoid projects like this is to check their smart contracts on platforms like BSCscan and Etherscan.

💡 How to avoid rug pull?

Always verify the project, smart contract, and the team behind a crypto project! You can check the whitepaper, check out their social media, and look for information from trusted sites like CoinMarketCap.

You can check out Pintu Academy’s article which dives deeper into the rug pull scam.

5. Pump and Dump

Pump and Dump is a crypto scam by a group of people that tricks people into buying an asset to push its price so they can sell for a large profit. After successfully pushing the price, the scammers immediately sold in large quantities, trapping investors who had already bought them. A pump and dump are one of the trickiest to identify but it usually happens to a low liquidity asset.

One way to identify pump and dump is to see the social media activity of a crypto asset that suddenly skyrockets in a short period of time. If the contents are only promotions to buy by similar accounts, it is most likely a pump and dump effort. This is one of the reasons why investing in small altcoins is so risky.

Do not invest or trade in crypto assets with little liquidity that suddenly becomes popular for no apparent reason. If you are a beginner, it is better to start investing in obvious crypto assets such as Bitcoin or Ethereum.

6. Unkown Token Airdrop in MetaMask

One of the most common scams on MetaMask is that a large number of unknown crypto assets suddenly appear. This is a form of scam for you to interact with the asset to sell or trade it. But, when you try it, all the assets in your wallet can suddenly disappear because it is a scam to steal assets in MetaMask.

Like the picture above, you will suddenly have a lot of new tokens, like getting an airdrop. MetaMask recommends never interacting with crypto assets that you didn’t buy. Currently, MetaMask is developing a token detection feature that will automatically check whether you have fake assets or not.

An “airdrop” refers to a method of distributing digital assets to the public, usually to spread awareness of a new cryptocurrency. An airdrop is a marketing campaign for distributing free coins or tokens such as follow all social media, retweet a Tweet, send referral code, etc.

How to Identify scam in crypto

- 💰 Unreasonable profit: This is a common characteristic of scams in the crypto world where the profits are unreasonable. For example, you can’t possibly get thousands of dollars worth of crypto assets for free.

- ❗Suspicious sites and links: Sites created by fraudsters usually have different links even though they look the same as the sites they are imitating. This is a way for fraudsters to do spoofing, which is to disguise a site or link as closely as possible to the original. You can check the extension at the end of the site link.

- 🙅 Request Money In Advance: Many scams start by telling you to send money or certain assets before getting big prizes. Legitimate airdrops usually won’t ask for funds of any kind.

How to Avoid Crypto Scam

1. Using Cold Wallet

A cold wallet is a piece of hardware that stores all the data about your crypto assets such as wallet addresses and private keys. Cold wallets are also commonly called offline wallets or hardware wallets because they are physical and not connected to the internet. Having a cold wallet is considered essential for experienced crypto investors. This type of crypto wallet has a high-security system because it is separated from the internet network.

2. Keep Your Private Key Secret

This is the most important crypto security principle. Just like you can’t give out a PIN or password, a private key is also data that other people shouldn’t know. If you lose it or give it to someone else, your digital wallet can be accessed and all your assets can be drained. Most phishing aims to gain access to your private key.

Private key is numbers that allow users to access their funds, sign transactions and to generate receiving addresses. It is usually written as a long string of letters and numbers.

3. Using Additional Security Apps

The world of crypto is closely related to the internet network. Given that almost all the devices we use are connected to the internet, you need to pay attention to the security of personal data. Therefore, adding a layer of security is paramount. This additional layer of security is known as Two-Factor Authentication (2FA) or Multi-Factor Authentication (MFA).

With 2FA, you need to authenticate with another app or device before you can access your account. This is very useful when your password or private key is stolen. Fraudsters who steal cannot access your account without additional authentication from your smartphone, e-mail, or authenticator apps like Google Authenticator.

Therefore, adding 2FA becomes very important especially if you have a large number of crypto stored in your wallet.

4. Always DYOR Before Investing

The most important ammunition against fraud in the crypto world is knowledge. This is why the word “DYOR” or do your own research is very often said by many people. Every crypto investor should have an understanding of the asset he is buying. Therefore, always seek information before deciding to buy a crypto asset, especially if this asset is a small and unpopular project.

This reading before buying strategy can prevent you from rug pull and pump and dump scam projects. By knowing the person who created it, reading the whitepaper, and seeing the activity of the project, we can evaluate whether a crypto project is safe or not. This is also referred to as fundamental analysis.

You can learn more about doing fundamental analysis in this Pintu Academy article.

5. Ignoring Unrealistic Offers

The crypto world is often considered to be able to provide huge profits instantly. Many investors earn a lot of money by investing in projects whose prices have skyrocketed. However, the notion of ‘instant profit’ is often used by fraudsters to lure their victims. You need to understand that although the profit potential of crypto assets is huge, they are not instantaneous.

Therefore, avoid projects or businesses related to crypto assets that provide the lure of large profits in a short time. Especially if the project is still small.

Investing on Cryptocurrency in Pintu

Pintu gives you a platform for safely investing in cryptocurrencies. Through Pintu, you can buy cryptocurrencies such as BTC, ETH, BNB, and others in an all-in-one convenient application.

Pintu is also compatible with popular wallets such as Metamask to facilitate your transactions. Download the Pintu app on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

You can learn more about cryptocurrencies through the various Pintu Academy articles that we update every week! All Pintu Academy articles are made for educational purposes only, not financial advice.

References

- Crypto Crime Report 2022, Chainalysis, accessed on 12 September 2022.

- Eric Jardine, Mid-year Crypto Crime Update: Illicit Activity Falls With Rest of Market, With Some Notable Exceptions, Chainalysis, accessed on 12 September 2022.

- Christy Bieber, 6 Tips to Avoid Crypto Scams, The Fool, accessed on 13 September 2022.

- Casey Murphy, Bitcoin Scams: How to Spot Them, Report Them, and Avoid Them, Investopedia, accessed on 13 September 2022.

- Imogen Searra, How To Identify a Scam Crypto Project, Bein Crypto, accessed on 14 September 2022.

- How To Use MetaMask’s Token Detection Feature For A More Complete Picture Of Your Wallet, Consensys, accessed on 16 September 2022.

- Jacky Yap, What Should I Do When Random Coins Appear In My MetaMask Wallet?, Chain Debrief, accessed on 16 September 2022.

Share