What is Bull and Bear Market, and How to Tell the Difference?

In every asset market such as stocks and crypto, there is a pattern that determines the trend of rising and falling prices within the market. Investors and traders look for signs of this trend to make decisions. Stock and crypto investors refer to these two major trends as bear and bull markets. These two market trends usually signify rising and falling prices that will dominate the market within a certain period of time. So, what are a bull market and a bear market? Why are these two trends so important in the world of cryptocurrency? This article will explain these two market trends.

Article Summary

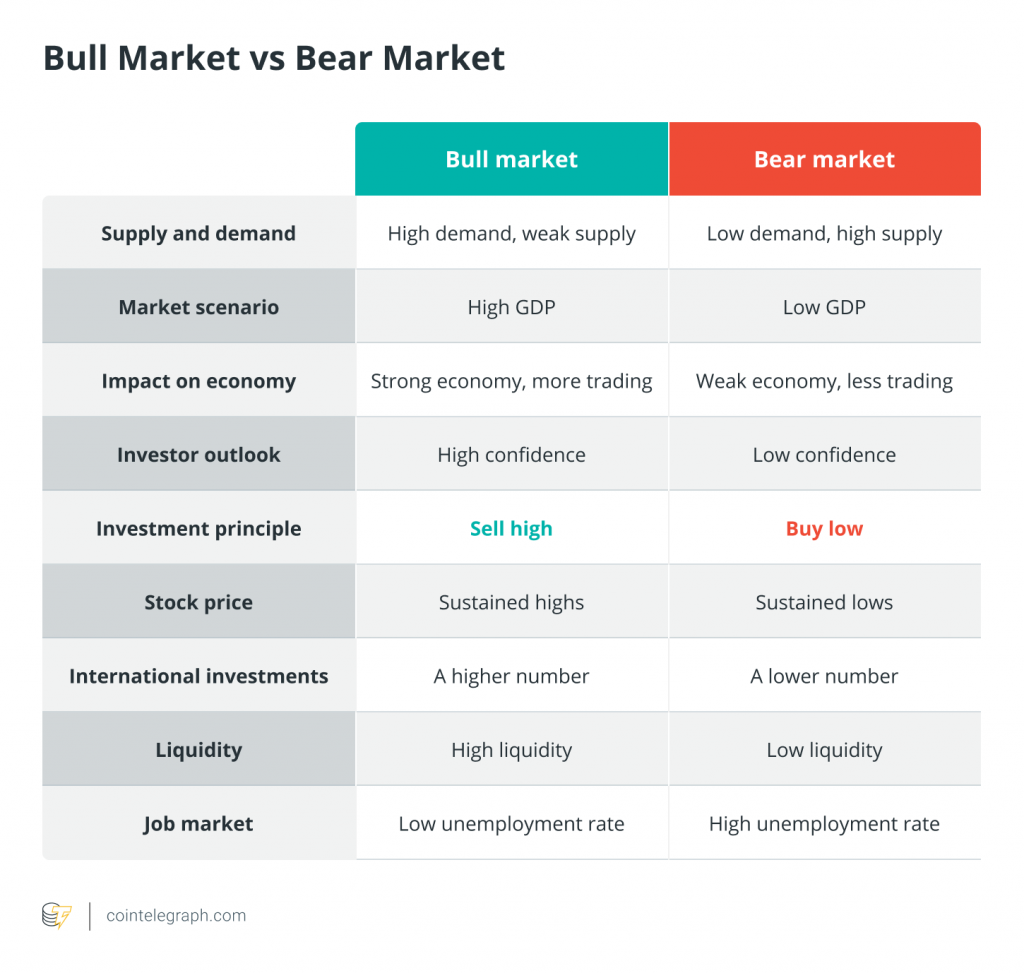

- 📉 A Bear market is a market condition where supply is higher than demand and prices are falling for a period of time.

- 📈 A bull market is a market condition where demand is higher than supply and prices are rising for a period of time.

- 🗒️ A trend change can be identified through several indicators and investors can take the necessary steps as a precaution and preparation for these changes.

What is Bear Market?

A Bear market is a market condition when there is more supply than demand and prices are falling. During this period, investor confidence is low and retail investors tend to sell their assets because they are afraid. Bear markets are usually marked by a steep decrease in most cryptocurrencies more than 20% from their all-time high . In this condition, if bitcoin experiences a price drop of more than 20%, most altcoins (ETH, BNB, etc.) will experience a more drastic price decline. Usually, it is very difficult to predict how long the bear market will last and at what price the bottoming (lowest price floor) will occur.

For amateur retail investors and traders, bear markets can be very dangerous. In a bear market, the wrong decision can cost you a lot of money, especially for assets with weak fundamentals. In the fear and greed index, the bear market is usually marked by a low number indicating extreme fear (10-30).

What is Bull Market?

A bull market is a market condition when demand is higher than supply and prices are rising. This causes the price of crypto assets to continue to increase because investors’ confidence is high which makes them confident and continue to buy (greed). During this time, Bitcoin’s price continues to increase and usually reaches a new all-time high. Just like in the bear market, predicting the duration and the highest number in the bull market is also difficult. In a bull market, the fear and greed index will show a high number indicating extreme greed (60-100).

Read this article to understand more about the fear and greed index “What is a Fear and Greed Index?“

The bull market provides opportunities for amateur investors and traders to learn at identifying cryptocurrencies with great fundamentals and potential. During a bull market period, altcoin usually experiences price increases alternately or even at the same time. DApps developers also announce their projects in the bull market because many investors have the confidence to buy new assets.

Why do bear and bull markets exist?

All markets experience cycles of ups and downs. It is a fundamental principle when investing and trading (what goes up will always go down), especially in the volatile crypto market. In the stock market, this cycle can last for years as investors and the market, are mature and stable. Cryptocurrency, on the other hand, is an asset market that is only about 8 years old. The market, developers, and investors are still in the early stages of maturity and development.

In addition, like other markets, the crypto market is closely related to economic conditions in the world. Usually, when a large stock hub like the S&P 500 goes down, the price of Bitcoin goes down as well. Furthermore, state policies related to Bitcoin also affect market trends such as when China decided to ban all Bitcoin transactions.

Other worldwide events such as The COVID-19 pandemic also affect Bitcoin just like any other asset. In fact, COVID-19 was the trigger for the Bear market in 2020 which lasted for about 5 months.

Therefore, with the market being so young, cycles of ups and downs occur very quickly. The cycles of the bear and bull market change so quickly between a period of a few months and a year. These two trends occur alternately following market psychology and are actually a healthy cycle normal for any asset market.

Sentiments and market cycles

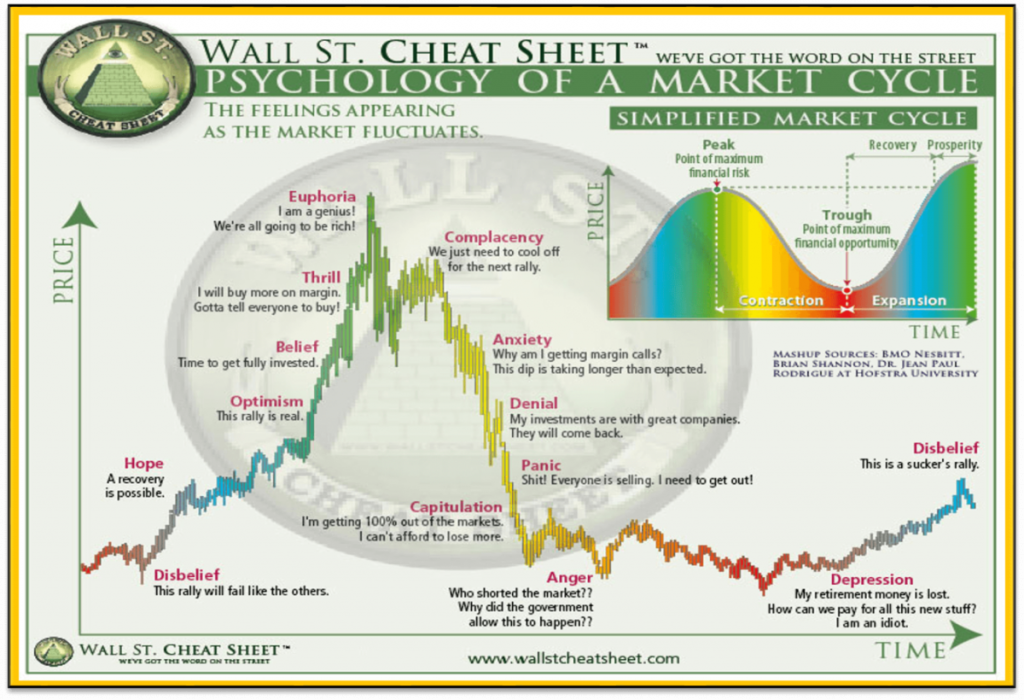

The Wall Street stock market is more than 100 years old. Hence, analysts can map and analyze market patterns that have been formed and tested for a long time. The picture above is the psychology behind the market cycle. In general, the bull market starts from hope until it reaches its peak at the euphoria stage. The bear market then starts at the next stage until depression and then disbelief usually keeps the price moving sideways or experiencing a further decline.

The thing to note from the picture above is the psychology of investors at each stage. This investor psychology is also commonly called market sentiment which describes the emotions of market participants in general.

A bull market is when retail investors have high self-confidence and a high purchase volume of retail investors. On the other hand, a bear market can be seen from the low self-confidence of investors and their reluctance to buy. Both market trends are normal because every investor will experience a period of buying or selling their assets for profit.

Criteria for a Bear and Bull Market

Bear and bull markets do not happen suddenly. Like other markets, cryptocurrencies have indicators that can give you information as to when the trend will change. However, several criteria must be fulfilled before we can say the market has entered a bear or bull market. These criteria can be seen through technical analysis, sentiments of the crypto community, and world events affecting the global market. Here are some indicators that we can analyze to determine a bull and bear market.

Liquidity

Liquidity is one of the easiest indicators to determine whether the market trend is likely to be bearish or bullish. Market trends with a bullish momentum will usually cause trading volume in exchanges to be high thus making the liquidity of most cryptocurrencies increase.

On the other hand, bear market conditions cause investors and traders to be reluctant to keep their money in crypto because they are afraid the price will decline. This prompted them to sell or convert their assets to stablecoins. This, in turn, causes the liquidity of most crypto to be low and seeding doubts in investors to open positions.

Community sentiment

Community sentiment is a general description of the emotional state of the crypto community in various forums and social media. In the bear market, you will see many people posting their decisions to sell crypto assets and see the panic of liquidated traders from leverage trading. Furthermore, there will be many people who start mentioning that the market has entered a bear market.

On the other hand, the bull market is filled with euphoria and high confidence felt by the crypto community. Usually, many investors will announce on social media that they have succeeded in choosing assets that have ‘pumped’. This period is also filled with sentiments to HODL or holding off selling before the price reaches its peak.

Community sentiment is not a definitive indicator of market trends but we can see the perspective of most retail investors.

Golden Cross and Death Cross

The golden cross and the death cross are several indicators that can help you identify the market. These two indicators are useful to see changes that signal a move from a bear to a bull market and vice versa.

Also read: What is the difference between fundamental, technical, and other analyses.

The chart above is an example of a golden cross that occurred in mid-2019. A golden cross is a condition where the 50-day moving average (MA) (which was previously below the 200-day MA) crosses at one point and moves above the 200-day MA. MA or moving average is the average moving average of an asset which is divided into short (50 days) and long (200 days) movements. Golden Cross is when the price suddenly moves rapidly upwards, signaling a shift from a bear to a bull market.

On the other hand, a death cross is a change in market momentum that signals a move from a bull market to a bear market. This occurs when the 50-day MA crosses the 200-day MA and falls below it. After that, the 50-day MA continues to be below the 200-day MA line which indicates that the price of the crypto asset will continue to decline for a period of time.

What can you do during a bear and bull market?

After you can identify and determine the current market trend, you need to make a quick investment decision. These two market trends require different actions so that you can avoid losses in a bear market and make gains in a bull market.

💡 One of the most popular sayings from Warren Buffet in the context of investing is “buy the fear and sell the greed”.

The point of this quote is to buy when the trend is down (fear) and sell when the price is up (greed). This looks very basic and easy to do but in reality, it is very difficult to do this without knowledge of the trend and patience. Therefore, here are some things you can do before entering and during the bear and bull markets:

- ⚠️ ️Moving assets before a bear market: One of the most important things you should do before or at the beginning of a bear market is to convert your crypto assets into stablecoins like USDT or sell them into fiat money to prevent losses.

- ️🛍️ Buying a dip during a bear market: While a bear market is often considered a bad time for investing, this is actually a good time to buy discounted crypto assets. Use the DCA method as risk mitigation in this period.

- 🤑 Take profits during a bull market: The bull market period is the right time to take profit from your assets that have been pumped. Take your profits in several periods in anticipation of the possibility of the price going up again.

- 💹 Trading in the bull market: Professional traders understand that the bull market is a great opportunity to choose assets that will likely provide large profits of up to hundreds of percent. Use a combination of technical and fundamental analysis to choose the right asset.

References:

- What is a bull or bear market?, Coin Base, accessed on 30 December 2021

- Bull vs. bear crypto market: What’s the difference and how to handle both, Coin Telegraph, accessed on 30 December 2021

- Rhys Thomas, What is a bull and bear market in crypto?, The Face, accessed on 30 December 2021

- How to Know Whether We’re in a Bull or Bear Crypto Market, AAX Academy, accessed on 31 December 2021

- Vamshy, Five ways to identify a Bitcoin Bull Run, Hacker Noon, accessed on 31 December 2021

Share

Related Article

See Assets in This Article

ATH Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-