Make Trading Easier With These Four Crypto Screener Apps

Crypto screener has become a tool widely used by both beginner and professional crypto investors. Not only does it facilitate the process of analyzing various cryptocurrencies, but it also makes investment decision-making easier. So, what is a crypto screener? How do you use it? What are the recommended platforms to use? Find out the answers through the following article.

Article Summary

- 🔍 A crypto screener is a tool that facilitates investors and traders to sort, monitor, and analyze crypto assets based on specific criteria. Usually, the criteria are price, trading volume, and market capitalization.

- ⚡ Using a crypto screener can save time and effort in researching. It also helps investors make data-driven decisions.

- ⚙️ In using a crypto screener, users must choose a platform that suits their needs, set the criteria, and then analyze the results.

What is Crypto Screener?

A crypto screener is a tool that allows investors and traders to filter, monitor, or analyze crypto assets based on specific criteria. With a crypto screener, you can sort hundreds or even thousands of crypto assets according to selected criteria. The criteria can be price, trading volume, market capitalization, technical indicators, on-chain, etc.

It is a helpful tool for beginner and experienced investors as it can save time and effort in research. Users can get an overview of the market or some crypto assets through the crypto screener. In addition, its notification feature can alert users when the price of crypto assets reaches a certain level.

Ultimately, a crypto screener makes the technical and fundamental analysis more efficient and effective. Moreover, the data displayed is also updated in real time.

How to Use Crypto Screener

Crypto screener platforms are quite diverse. Some are for crypto assets, some are specialized for DEX, and some are specialized for on-chain. But all functions remain the same, making searching and displaying data in real-time more accessible.

Using a crypto screener is quite simple and intuitive. The following are the basic steps in using a crypto screener:

1. Select a platform according to your requirements: If you are looking for a free crypto screener with straightforward search criteria, platforms like CoinMarketCap and TradingView would be excellent options. If you’re interested in DEX (Decentralized Exchange) platforms, DEX Screener and DEX Tools would be more suitable. For on-chain data analysis, you can choose platforms like Bubble Maps.

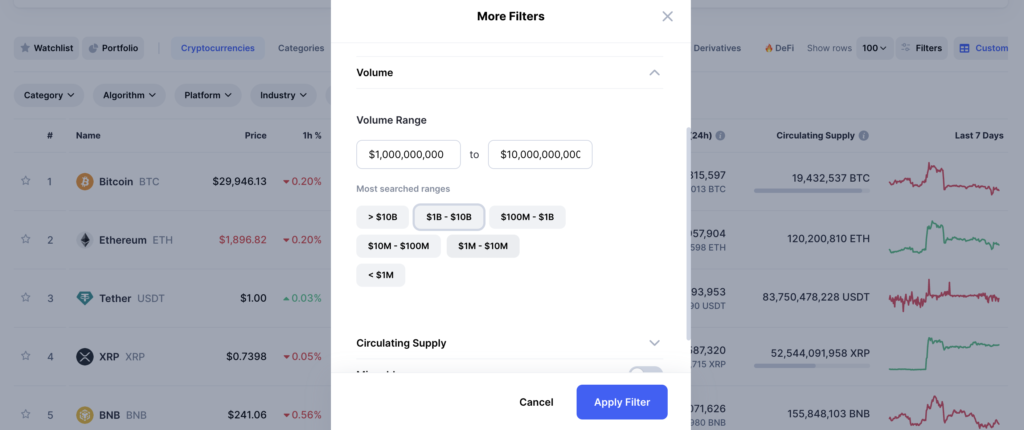

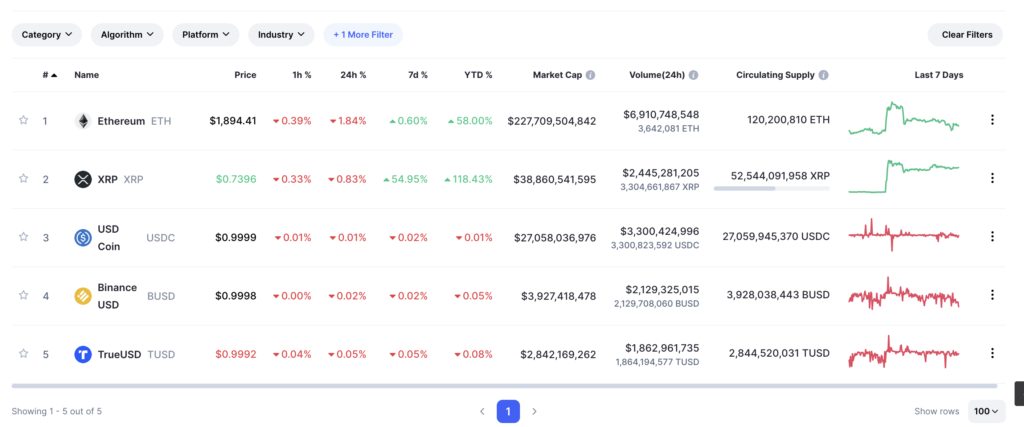

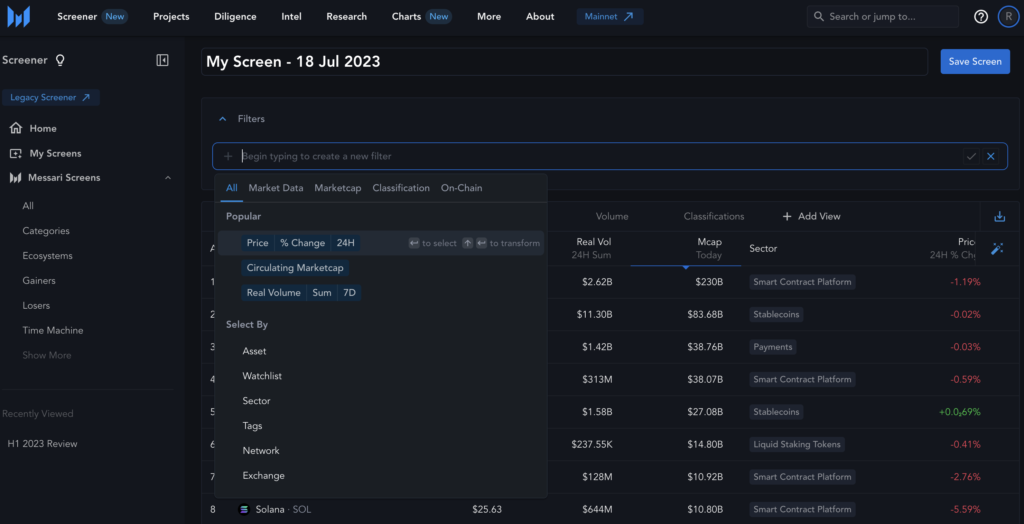

2. Define your search criteria: Once you access the crypto screener page, specify your search criteria. For instance, you can search based on minimum and maximum trading volume, price movements, trading signals, timeframe, and other relevant factors. Customizing these criteria allows you to narrow down the search results and find cryptocurrencies that align with your investment preferences.

3. Analyze the results. Once the search results are out, the crypto screener will display a list of cryptocurrencies according to the specified criteria. Afterward, analyze the results to make an informed investment decision.

The Advantages of Using a Crypto Screener

- ⏱️ Saving time. Users do not need to sort hundreds of crypto assets manually. With a crypto screener, you only need to enter specific numbers and criteria. Voila, a list of crypto assets appears according to the numbers and standards selected.

- ⚡ Real-time data update. Every data displayed by the crypto screener will be updated at any time. You can also sort each data based on a specific time range or minimum and maximum price range.

- 📊 Data driven. In a volatile and emotionally charged crypto market, using data can help you make more objective decisions. Starting from observing historical data on-chain and comparing it with other cryptos.

- 🔔 Notifications and alerts. Crypto screener generally has a notification feature when crypto assets are at a price level or have specific movements. Thus, users will not miss the momentum.

Four Crypto Screener Apps

The following are popular crypto screener apps that investors often use:

1. Basic Crypto Screener

The basic crypto screener platform is a must-use tool for both novice and professional investors. Not only free, but it is also easy to use and already offers a variety of filter criteria. Users can filter crypto assets based on price movement, trading volume range, market capitalization, or other specific criteria.

Using a basic crypto screener saves users time and effort in finding crypto assets based on their preferred search. Some popular platforms used are CoinMarketCap, CoinGecko, Messari, and Santiment. There are also basic crypto screeners for decentralized apps (DApps) and NFTs, such as DappRadar. Some platforms also have paid plans that offer various search criteria and custom dashboards.

2. Chart Pattern Screener

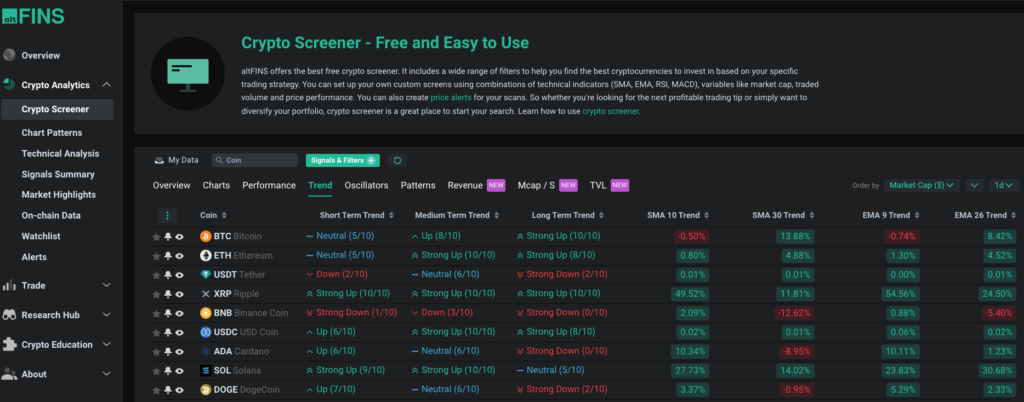

Next up is a chart pattern-based crypto screener, altFins. It has basic features such as crypto asset performance, trading volume, and market capitalization. In addition, altFins can also search for crypto assets based on technical indicators. So, users can sort crypto assets based on SMA, EMA, and MACD movements and oscillators such as RSI and stochastic.

altFins also offers other features, such as sorting crypto assets based on specific chart patterns. Currently, 26 chart patterns can be searched using altFins. From ascending/descending triangle charts, head, and shoulders, falling/rising wedge, etc. Not only that, but altFins also has a sorting feature based on on-chain data. With these various features, investors can cut their time and energy searching for crypto assets.

Some of the features offered by altFins can be accessed for free, and you only need to register. However, more complex features, such as chart patterns, can only be accessed by those who subscribe to a paid package.

3. Screener DEX

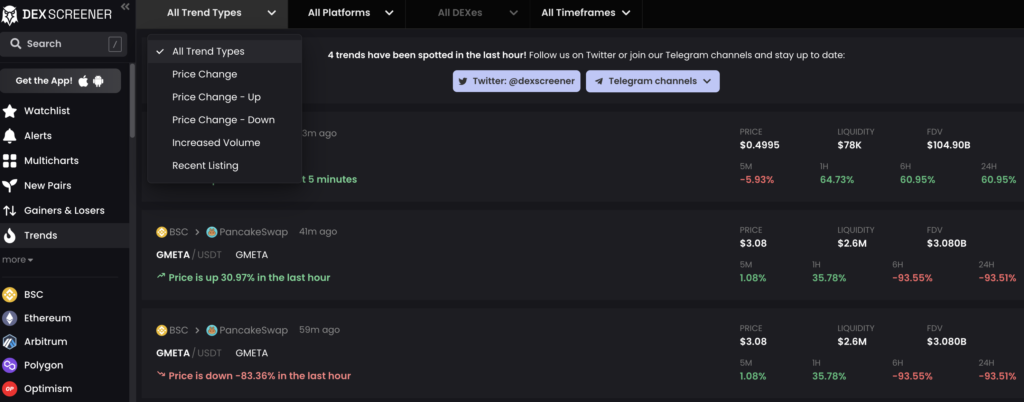

The following crypto screener platform is specialized for searching and filtering various decentralized exchange (DEX) data. There are two platforms that investors often choose, namely Dexscreener and Dextools.

Both allow users to sort crypto asset pairs on DEXs based on price changes, volume increases, and the latest pairing listing. In addition, users can also filter assets based on gainers & losers and create multi-charts containing movement charts of various selected assets.

Another difference from the DEX screener is that it features on-chain data on each token. The data displayed includes the number of transactions made, smart contract security, trading volume, and total liquidity. In Dextools, there is even a score that indicates basic security parameters. If the score is low, it means poor security quality.

4. On-Chain Screener

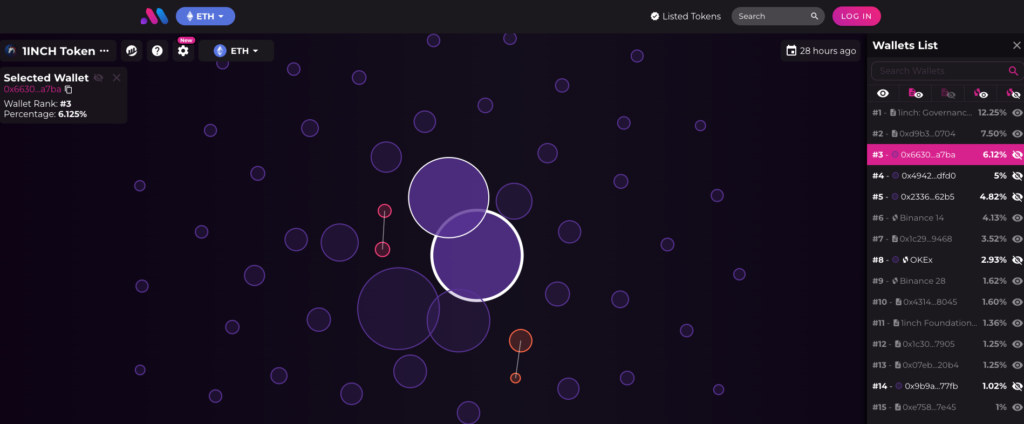

Unlike another crypto screener, the following platform is a screener that visualizes the on-chain data of various crypto assets. Bubble Maps and Arkham Intel are usually the platforms that investors often use. As both are multi-chain, they support a variety of crypto assets from the Ethereum, BSC, Fantom, Arbitrum, Chronos, Avalanche, and Polygon blockchains.

In Bubble Maps, users can see a list of active addresses that hold crypto assets on a particular blockchain. It also shows the transaction history between two addresses that hold large amounts of tokens. As the name implies, the data is visualized as bubbles. Meanwhile, in Arkham Intel, users can see analytical data related to the flow of funds in and out of a crypto asset, recent transactions, historical data, and active addresses of top crypto holders.

The on-chain screener was created to make it easier for users to view and observe on-chain data. The results of these observations can then be used to make investment decisions, predict trends, and manage risk without going through a complicated process.

Conclusion

A crypto screener is an analytical tool that allows investors and traders to filter, monitor, and analyze crypto assets based on specific criteria. It is an essential tool for anyone involved in trading or investing in crypto assets. By utilizing a crypto screener, users can save significant time and effort while gaining a comprehensive overview of the current market situation.

The real-time and data-based nature of the displayed information allows crypto screeners to assist investors in making more objective and efficient investment decisions. This ensures that investors can stay up-to-date with the rapidly changing market conditions and make well-informed choices regarding their crypto asset portfolio.

Buy Crypto Assets in Pintu

Looking to invest in crypto assets? No worries, you can safely and conveniently purchase a wide range of cryptocurrencies such as BTC, ETH, SOL, and others safely and easily at Pintu. Pintu diligently evaluates all its crypto assets, highlighting the significance of being cautious.

Pintu is also compatible with popular wallets such as Metamask to facilitate your transactions. Download Pintu app on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

Aside from buying and trading crypto assets, you can expand your knowledge about cryptocurrencies through various Pintu Academy articles. Updated weekly, all Pintu Academy articles are made for knowledge and educational purposes, not as financial advice.

Reference

- Mike Antolin, What Are Crypto Screeners? Coin Desk, accessed on 18 July 2023.

- Jeffrey Craig, What Is DEX Screener? Phemex, accessed on 18 July 2023.

- Stacy Muur, 50 Web3 Research Tools, Twitter, accessed on 19 July 2023

Share