What is Maximal Extractable Value (MEV)?

As the adoption of smart contracts in the crypto industry continues to rise, it opens up new opportunities for exploiting loopholes and potentially gaining financial advantages. One such emerging practice is known as Maximal Extractable Value (MEV), which is often utilized by people with high technical expertise. So, what precisely is MEV, who can participate in it, and what are some real-life examples? This article provides in-depth insights to address these questions and shed light on the concept of MEV in the crypto world.

Article Summary

- ✨ MEV is the maximum value that a blockchain miner or validator can generate by including, excluding, or changing the order of transactions during the block production process.

- 🤑 The purpose of MEV is to create profit for block producers (miners or validators) and searchers by determining the order of transactions.

- 🦄 MEV can occur by arbitrage on DEXs, liquidation on crypto asset lending dApps, and frontrunning practices.

- 🚨 MEV can provide profit opportunities for some parties who can exploit it. On the other hand, MEV can also harm users by disrupting trust in blockchain transactions and can cause network congestion issues.

What is MEV (Maximal Extractable Value)?

MEV is initially referred to as Miner Extractable Value. However, along with developments in the blockchain ecosystem, the term was later expanded and more appropriately referred to as Maximal Extractable Value.

MEV is the maximum value that a blockchain miner or validator can generate by including, excluding, or changing the order of transactions during the block production process.

MEV aims to create an advantage for block producers (miners or validators) by determining the order of transactions.

Besides miners and validators, other participants (searchers) can also play a role in MEV to gain an advantage. Using bots, searchers can be liquidation managers, liquidators, and profit-seeking parties in the DeFi ecosystem.

Quoted from Ethereum, the increasingly competitive practice of MEV on Ethereum has led searchers to switch to other PoS blockchains, such as Binance Smart Chain. It offers similar opportunities to MEV on Ethereum but with less competition.

This article will explain the MEV mechanism in blockchains with a proof of stake consensus mechanism, such as Ethereum.

Read also: What is Ethereum and How Does it Work?

How Does MEV Work?

On blockchains like Bitcoin and Ethereum, miners (blockchain proof-of-work) and validators (blockchain proof-of-stake) execute network security and block production. They are known as ‘block producers.’

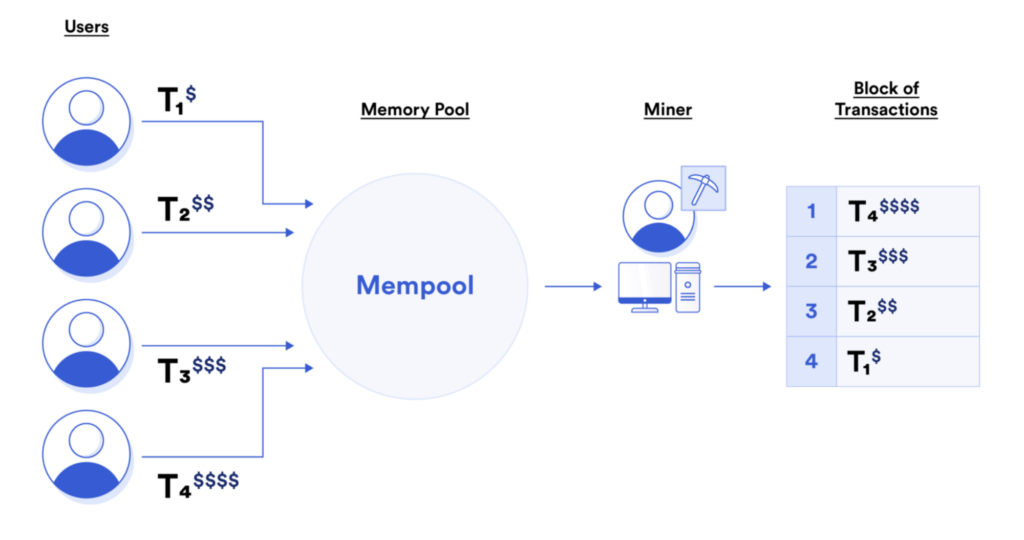

Block producers have full access and control over the transactions included in the block. They can select and order the pending transactions from the mempool to be included in the block. The mempool is the block producer’s location to store unconfirmed transactions off-chain.

The block producer will first prioritize transactions with the highest fees to maximize profits (potential MEV). It is why users pay higher gas fees, especially when the network is busy so that their transactions are processed faster by the block producer.

While the blockchain network ensures that all transactions are valid, there is no guarantee that transactions will be sorted according to the time submitted to the blockchain.

As such, block producers can extract additional value by taking advantage of their ability to reorder transactions arbitrarily. They can create what is known as the maximum extractable value (MEV).

In practice, however, most MEV is extracted by independent network participants referred to as ‘searchers.’ Searchers run complex algorithms on blockchain data to detect profitable opportunities and have bots to submit those profitable transactions to the network automatically.

Read also: What is Proof-of-stake (PoS)?

Examples of MEV Implementation

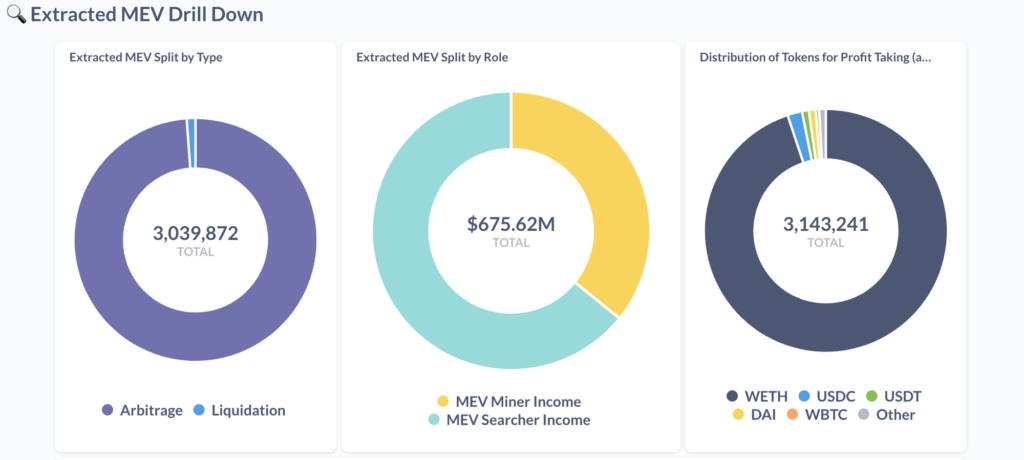

The image above shows that arbitration is the most common MEV practice opportunity. Besides arbitration, there are several types of MEV practices, as follows:

Arbitrage

Arbitrage refers to leveraging price differences or price gaps between different crypto exchanges.

Searchers look for arbitrage opportunities within blocks of transactions. They use bots or algorithms to monitor pending or processed transactions on the blockchain network. When they find a profitable arbitrage opportunity, they enter their own transaction quickly before the initial transaction is finalized.

Liquidation

Another frequent MEV practice is the liquidation process of lending protocols, such as Aave or Maker. Users must deposit collateral as another crypto asset to borrow a crypto asset.

For example, if a collateral has a liquidation threshold of 80%, it means that the position will be liquidated when the debt value is worth 80% of the collateral value. It usually happens due to high market fluctuations.

The protocol generally allows anyone (in this case, the liquidator) to liquidate the collateral, which quickly pays out to the lender. If liquidated, the borrower usually has to pay a huge liquidation fee, part of which goes to the liquidator.

Searchers or liquidators compete in identifying which borrowers they can potentially liquidate for profit.

Frontrunning

Frontrunning is one of the practices in MEV where searchers use bots to monitor large transactions and use this info to their advantage.

Searchers utilize information about upcoming transactions to enter their transactions at more favorable prices before the initial transaction occurs.

For example, when Ari sends a large token purchase order to the blockchain network for execution, bots can detect the transaction. It is because user transactions often use public mempools that bots can access.

Then searchers quickly enter their transactions at a slightly higher price to buy the tokens before Ari’s transaction occurs. As a result, the token price increases due to the sudden demand. It benefits the frontrunner who has purchased the tokens at a lower price. Afterward, he can sell those tokens at a higher price and profit from the price difference.

MEV NFTS

The practice of MEV does not only happen in the DeFi sector but can also occur in the NFT world. In general, the techniques used by searchers are relatively similar to those used in the DeFi sector, such as frontrunning.

For example, when a searcher wants to purchase a popular NFT, he will run a complex algorithm in such a way as to make his transaction the first to buy the NFT.

In another example, searcher bots can detect when a popular NFT owner makes a mistake by entering a low NFT price. It once happened to CryptoPunk’s NFT 3860, valued at 69,000 US dollars, sold for less than 1 US cent in August 2021. The buyer was willing to pay a gas fee of 22 ETH (57,000 US dollars at that time) to pay Ethereum miners (Ethereum was still using the PoS mechanism) to get the transaction processed immediately.

Read also: DeFi Red Flags and How to Stay Safe in DeFi.

Pros and Cons of MEV

The advantages of this practice include the opportunity for significant financial gains for those who can leverage the information and situation within the transaction block.

In addition, MEV liquidators on DeFi applications perform fast liquidation, ensuring that lenders are paid quickly when borrowers fall below the specified collateral ratio.

Furthermore, block producers and searchers can also correct errors in the system quickly and have the potential to improve market efficiency.

However, the practice of MEV also has drawbacks, such as unfairness arising from unfair access to information and potential instability and uncertainty in transactions and markets.

MEV also leads to increased additional transactions that must be processed by the network, causing congestion and transaction slippage issues.

In addition, the risk of attacks and market manipulation can also cause losses to other users.

Unfair MEV practices, such as frontrunning, can result in users losing value or financial opportunities. It is similar to a tax, where users indirectly pay a "tax" in the form of a loss or reduction in the value of their assets due to MEV practices.

Conclusion

Maximal Extractable Value (MEV) is a significant phenomenon in the blockchain ecosystem that involves extracting maximum economic value from transactions within a block.

While MEV can provide profit opportunities for some parties leveraging it, some consequences must be considered. MEV practices can harm users by utilizing information without their knowledge, disrupt trust in blockchain transactions, and cause network congestion.

References

- Ethereum Team, Maximal Extractable Value (MEV), Ethereum, accessed 13 Juli 2023.

- Chainlink Team, What Is Maximal Extractable Value (MEV)? Chainlink, accessed 13 Juli 2023.

- Cointelegraph Team, What is MEV: A beginner’s guide to Ethereum’s invisible tax, Cointelegraph, accessed 13 Juli 2023.

- Erick, Apa itu MEV (Maximal Extractable Value)? Coindesk, accessed 13 Juli 2023.

Share