What is Eigenlayer? A Primer on Ethereum’s Restaking Protocol

Ethereum’s Shapella update on April 12, 2023, created a new sector on Ethereum: the Liquid Staking Derivatives (LSD) and LSDFI protocols. Shapella signals the completion of the staking infrastructure on Ethereum. With this, stakers can add and withdraw their ETH in a timely manner. LSD platforms are also creating a new ecosystem where ETH stakers can get various additional benefits. Furthermore, there is an innovation that wants to add a new ecosystem on top of the staking infrastructure. This innovation is brought by Eigenlayer, a protocol that adds a new restaking feature. So, what is Eigenlayer? How does restaking work and what benefits does it bring? We will discuss it below.

Article Summary

- ⚙️ Eigenlayer is a middleware protocol that introduces restaking. Eigenlayer allows the reuse of ETH in staking to secure other protocols on Ethereum.

- 🧑💻 The technological pillars behind Eigenlayer are pooled security through restaking and an open marketplace mechanism. Ethereum validators can choose which protocols they want to secure through restaking, while protocols using Eigenlayer can set conditions for validators who want to participate.

- 💎 Eigenlayer has advantages such as high flexibility, providing alternative solutions for new networks, and providing profits to validators as well as users through the additional yield.

- ⚠️ While Eigenlayer has its benefits, there are some risks. Some of these risks are a systemic risk to Ethereum if large validators experience issues on Eigenlayer, a higher risk of slashing for validators securing multiple networks at once, and a potential yield race from AVS that could lead to centralization risk.

What is Eigenlayer?

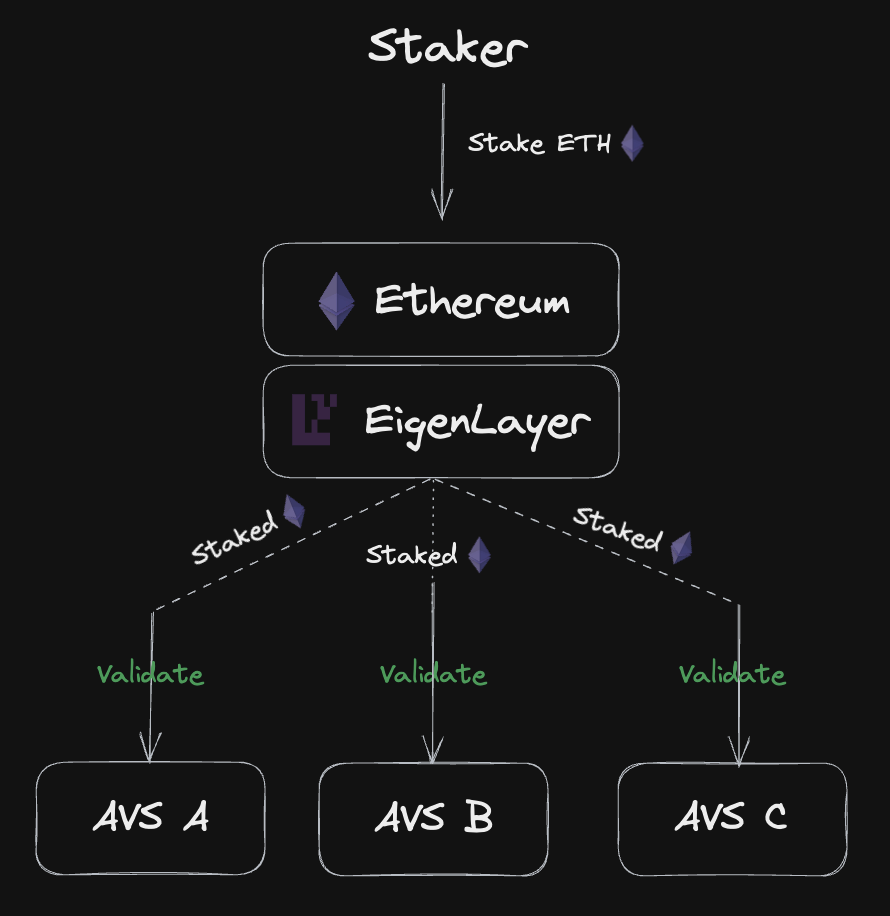

Eigenlayer is a middleware protocol that introduces a new cryptoeconomic security feature on Ethereum in the form of restaking. Users who stake ETH on native or liquid staking platforms can perform restaking on Eigenlayer. As the name suggests, restaking is reusing staked ETH to provide security for other protocols. It is an innovation to Ethereum’s security model as it allows ETH to simultaneously secure multiple networks at once.

Cryptoeconomic Security is a security model that utilizes economic incentives (in the form of tokens/coins) and cryptography to ensure network security. ETH is Ethereum's cryptoeconomic security instrument that plays an important role.

Eigenlayer essentially reuses ETH in staking to secure various other protocols on Ethereum. So, L2 networks like Arbitrum don’t have to spend a lot of money on recruiting new validators and instead can utilize the security from Eigenlayer. In this context, Eigenlayer is a security-as-a-service platform for various protocols on Ethereum.

Eigenlayer itself was founded by Sreeram Kannan in 2021. On March 28, 2023, Eigenlayer announced a $50 million dollar funding round led by Blockchain Capital. Eigenlayer had previously secured $14.5 million dollars in seed funding. Thus, Eigenlayer is currently valued at $64.5 million dollars.

Eigenlayer Dictionary of Terms

- Validator: A computer in charge of securing the network and processing all transactions on the blockchain. On Ethereum, validators stake 32 ETH and earn a profit for their services.

- Staking: A mechanism for locking up crypto assets as a condition for securing the network. Those who participate in staking will get rewards from the network.

- Restaking: A mechanism to reuse staked ETH to secure other networks that need them in Eigenlayer.

- Actively Validated Service (AVS): A term for platforms, blockchains, or protocols that require validator services from Eigenlayer.

What Problem Is Eigenlayer Trying to Solve?

One of the problems that development teams face is the high cost associated with building their own validator network. Developers looking to build new networks on top of Ethereum (L2, appchains, and middleware such as Oracle networks) will face issues such as determining incentives for validators (leads to tokenization with high emissions) and the issue of decentralizing validators. As shown in the figure above, Eigenlayer solves these problems by providing an alternative security solution for the network.

In addition, the proliferation of new networks on top of Ethereum creates another issue of fragmentation and compartmentalization of network security. This creates a security gap between protocols and causes hacking risks for protocols with small or centralized validator networks. Eigenlayer provides pooled security services so that every protocol can rely on Eigenlayer’s large decentralized validator network.

How does Eigenlayer work?

Eigenlayer gives Ethereum validators the option to opt in and secure various other networks on Ethereum through restaking. With this, they will get additional benefits from protocols that use Eigenlayer’s security services. Sounds simple, right? In practice, there are various barriers, potential risks, and additional parameters to ensure Eigenlayer security.

You can access the Eigenlayer whitepaper on the official Eigenlayer website.

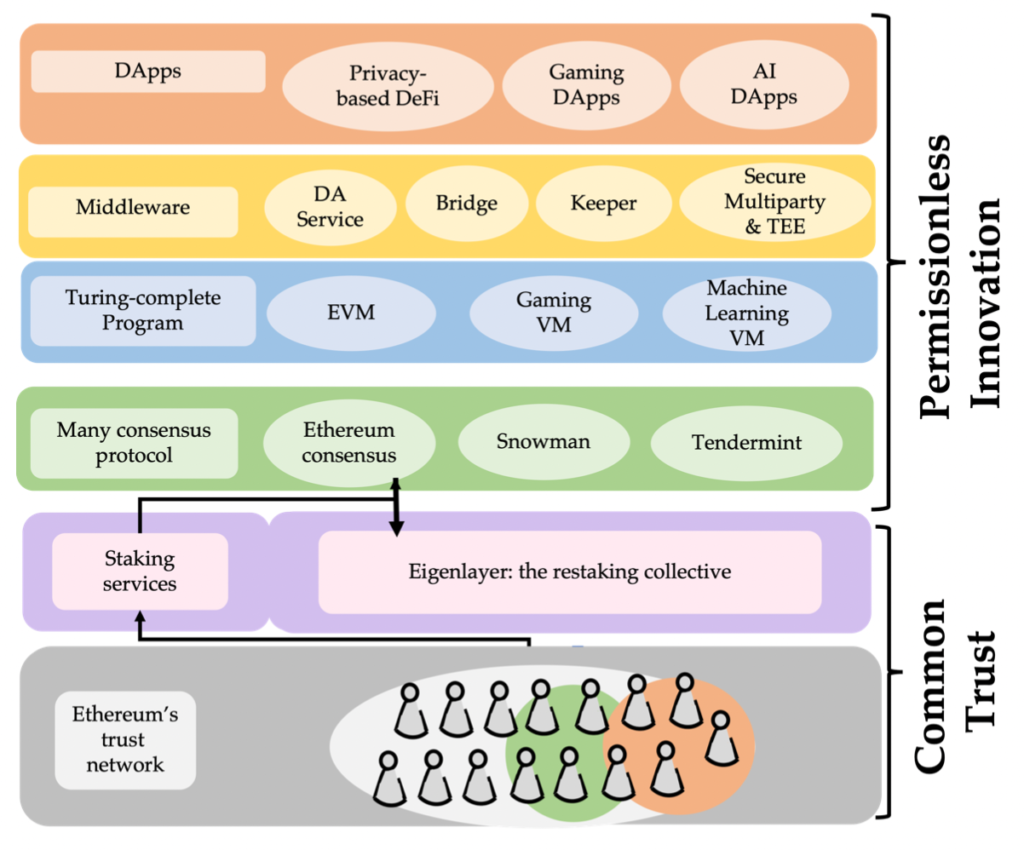

The two pillars of the technology behind Eigenlayer are pooled security through restaking and an open marketplace.

Pooled security refers to the Eigenlayer protocol pooling security from users and validators doing restaking. Ethereum validators can set their stake withdrawal address to Eigenlayer’s smart contract and choose which AVS (network using Eigenlayer) they want to validate. With this, validators will start providing security through Eigenlayer restaking.

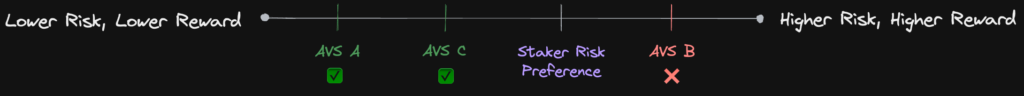

Validators will earn additional revenue from providing security services to their chosen AVS. However, if the validator does not perform their duties, the AVS can immediately slash additional ETH. So, there is a risk for both parties and this is governed by the second technology pillar, the open marketplace.

The open marketplace is a design that opens up a wide choice of how AVS and Validators want to utilize the collective security of the Eigenlayer. Validators can choose which AVS suits their risk-to-benefit ratio desires. This is important for validators as there is a risk of slashing additional ETH if they do not perform their duties.

On the AVS side, they can regulate what kind of ETH the validators have before participating in their network. For example, an AVS may only allow validators who are restaking with native ETH and not LST (stETH, rETH, etc.). Each AVS can also impose specific requirements for validators such as only validators who are familiar with DEX validation can enter the AVS. Finally, AVS can also integrate its native token into the transaction validation quorum process so that the security model can involve dual token staking (Mantle plans to do this).

Essentially, these two technology pillars open up innovation by providing pooled security for anyone to use and giving discretion to all participants through open market mechanisms.

About EigenDA: Eigenlayer’s Data Availability Scalability Solution

In addition to providing collective security usability through restaking, Eigenlayer also wants to build its own ecosystem. The first protocol in Eigenlayer’s ecosystem is EigenDA or Eigen Data Availability Layer. The DA layer has a vital role in every blockchain.

The data availability layer ensures that all nodes can download the latest network data quickly. If any data hasn’t been propagated, blocks become invalid and don’t process. Ethereum’s large network causes data availability issues because the network is congested and nodes race with each other to download the latest data to reach consensus.

EigenDA tries to solve the data availability problem in Ethereum by bringing a new model. Ethereum’s current data bandwidth (max capacity) is 80 KB per second, while EigenDA promises a capacity of 15 MB per second, a nearly 200x increase. Furthermore, EigenDA is targeting a speed of 1 GB per second.

EigenDA can achieve this using the Data Availability Sampling (DAS) method that Ethereum itself will implement through the Danksharding update. With DAS, nodes only need to download part of the transaction data but can still reconstruct the complete block data. Mantle Network is one of the L2 networks working with Eigenlayer to use EigenDA.

Advantages and Risks of Eigenlayer

Advantages/Benefits/advantages of Using Eigenlayer

- Eigenlayer positive feedback loop: The higher the value of protocols that use Eigenlayer, the higher the profit ETH restakers get. Furthermore, this increases the security value that ETH and each Eigenlayer project provide.

- Alternative solution for new protocols: As mentioned, creating your own validator network is costly. Eigenlayer provides a solution for developers who need Ethereum-level security.

- Additional yield for validators and users: Validators and users who perform restaking will benefit from yield securing other networks. This increases the capital efficiency of ETH in staking and LSD protocols.

- The high degree of flexibility: Eigenlayer provides a high degree of flexibility for validators and AVS. With the open marketplace design, validators can choose what network they want to secure and AVS can set requirements for validators who want to participate.

Eigenlayer Risks

- Systemic risk to Ethereum: Vitalik is concerned that Eigenlayer’s outsourcing of security could have a systemic impact. If a large group of validators secure the same network and are subject to slashing, attacks, or hacks, the impact could be systemic and have a domino effect even for Ethereum. Additional use of staked ETH beyond securing Ethereum runs a high risk of destabilizing Ethereum. Eigenlayer’s team is aware of this.

- Higher risk for validators: The requirements to be a validator for multiple networks may vary and this could compromise validator performance. Validators who secure multiple networks at once have a high risk of slashing which has the potential to jeopardize network security.

- Potential yield race from AVS: Eigenlayer’s open market design means that it lets AVS and validators choose. However, validators on EigenLayer may choose the protocol with the highest yield to maximize their profits. If this happens, it will lead to a race between protocols to offer higher yields to attract capital. This could pose a risk of centralization and increase the fees AVS must pay to use Eigenlayer.

How to Get Eigenlayer Token Airdrop?

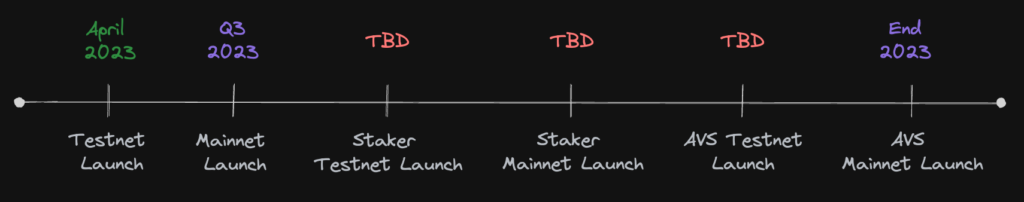

Eigenlayer explains that they will roll out the protocol in phases for performance and security optimization. The image above is a temporary Eigenlayer roadmap. Although Eigenlayer has yet to announce a token, with such a large investment many people assume Eigenlayer will have its own token. Many people are finding ways to potentially get the Eigenlayer token airdrop. Here are some thread from the crypto community that can help you get Eigenlayer airdrops:

- Stacy Muur on Twitter: “This week has the power to change your life. EigenLayer just launched their mainnet and is dropping a new FREE NFT every 24h. Collect all the NFTs + Become an early restaker 🧵 1/4 https://t.co/Tk7xTIebYM” / Twitter

- Leshka.eth ⛩ on Twitter: “🧵 Missed Arbitrum #airdrop? Missed Sui tokensale allocations? Don’t feel FOMO and take a look at the new testnet.🔽 Cost: $0. Potential gains: 1k+ per wallet. 1/9 https://t.co/lm5YrXzXqI” / Twitter

Always be mindful of potential airdrop scams! Pay attention to the links and always look for official sources from Eigenlayer!

Conclusion

Eigenlayer is a middleware protocol that features restaking. Restaking reuses staked ETH to secure other protocols on Ethereum. Eigenlayer also provides an alternative security solution for new networks at a lower cost. Eigenlayer offers benefits such as additional profits for validators and users, high flexibility, and solutions to security and data availability issues. However, it also has risks such as potential systemic impact for Ethereum, higher risk of slashing, and potential yield race from AVS.

Eigenlayer has secured $64.5 million in funding and continues to grow its ecosystem by launching EigenDA as a product for the data availability layer. Although there has been no official announcement about Eigenlayer tokens, the crypto community has shown great interest and is looking for ways to get Eigenlayer token airdrops.

References

- Intro to EigenLayer – EigenLayer Docs, accessed on 29 June 2023.

- Siddhart Shah dan Genesis Block, EigenLayer, Substack, accessed on 31 June 2023.

- Julia Ofoegbu, EIGENLAYR, Substack, accessed on 31 June 2023.

- David Shuttleworth, EigenLayer: A Restaking Primitive, ConsenSys, accessed on 3 July 2023.

- Ivan Cryptoslav, A Deep Dive Into EigenLayer: Restaking ETH, Coinmarketcap, accessed on 3 July 2023.

- The ReStakening, The Re-Stakening, Substack, accessed on 3 July 2023.

Share