What is Tether (USDT) used for?

One of the most significant advantages of using cryptocurrencies is its capacity to transfer assets more quickly, cheaply, and securely from one location to another. The volatility of crypto assets, on the other hand, was one of the factors that made it currently unsuitable as a medium of trade.

The solution to this problem is stablecoin, a cryptocurrency designed to have the same value as a fiat currency or other assets with a more stable value. Tether , a USD-backed stablecoin is currently the most valuable stablecoin by market capitalization.

What exactly is USDT and how does it function? In this article, we’ll learn more about the stablecoin.

What is USDT?

As explained briefly above, USDT is a token that has the same value as USD, built on Ethereum blockchain. It is based on the ERC-20 standard, which is the Ethereum blockchain’s basic token.

The value of USDT is guaranteed by its issuer, Tether, to remain tied to the US dollar. Tether allocates the same amount of USD to its reserves whenever it distributes new USDT tokens, ensuring that USDT is fully backed by cash and cash equivalents.

Read also: What is Stablecoin?

What is stablecoin like USDT used for?

Because of the crypto markets’ notoriously high volatility, cryptocurrencies can rise or fall by more than 10% in a single day, making them unreliable as a store of value. The USDT, on the other hand, is immune to these swings.

This attribute provides USDT a safe haven for crypto traders: they can park their assets in Tether without having to totally cash out in USD during moments of excessive volatility. Below are few examples of how USDT is used.

1. Trading

Crypto market opens 24 hours a day. By converting value to USDT, a trader may reduce their risk of being exposed to a rapid decline in the price of cryptocurrencies. Transferring BTC into Tether rather than the US currency is considerably faster and less expensive.

Tether tokens provide consistent liquidity that can be transferred at the same pace and with the same degree of flexibility as the rest of the cryptocurrency market. Below is the use case.

💡 Example: An investor wanted to secure her earnings from bitcoin trading. If he converts BTC to US dollars or another fiat money, the conversion may take more than a day to complete.

In the meantime, he spotted an opportunity to acquire another crypto asset, given the nature of cryptocurrency, which sees price changes in minutes. He couldn’t get to the fund since it was still being converted into fiat currency.

This is why traders will find stablecoins such as USDT to be a more convenient means of storing value.

2. International payments

USDT enables a simple means to transact a US dollar equivalent between regions, countries, and even continents via blockchain – without the need for a slow and expensive intermediary like as a bank or financial services provider.

3. Holding dollar value

People who live in nations where fiat currencies are weak or volatile prefer to deviate their money in US dollars. This is difficult to achieve since they must save in cash or rely on local institutions, which are not always able to meet their needs.

One option is to hold their assets in stablecoins like USDT, which are simple to trade and have a consistent value.

4. DeFi Infrastructure

De-Fi is a rapidly gaining popularity notion that stems from the capacity of decentralized networks to provide financial infrastructure. Many De-Fi products use collateralization, borrowing, and yield generating in some way.

These applications have been shown to be effective at facilitating lending and borrowing at increasing scales. However, because De-Fi can only interact with on-chain assets right now, it has to deal with the natural volatility of today’s crypto assets.

Excess volatility might put those who use De-Fi products at greater financial risk, as a spike in volatility can lead to liquidations or losses.

Tether offers a solution in the form of on-chain collateral that keeps the value steady. Tether Tokens can be used as collateral to participate in De-Fi networks without having to worry about volatility.

Read also: What is Defi?

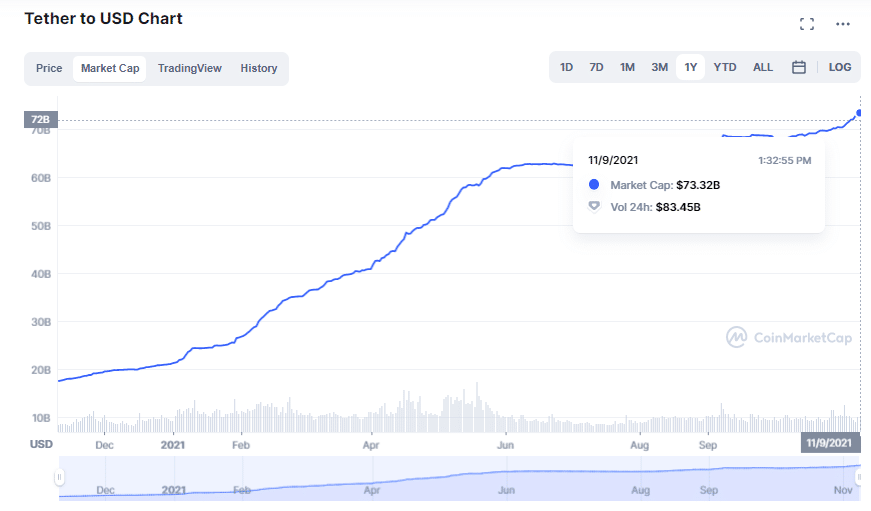

How many USDT is on the market?

As of November 2021, USDT tokens already circulating in the market reached more than 70.2 billion USDT coins guaranteed in USD of the same value. The USDT trading volume reached 91.1 billion in 24 hours as of 1 November 2021.

Who developed USDT?

Brock Pierce, Reeve Collins, and Craig Sellars founded USDT — or Realcoin as it was known at the time — in 2014.

Brock Pierce is a well-known businessman who has co-founded a number of high-profile crypto and entertainment companies. In 2013, he co-founded Blockchain Capital, a venture capital firm that has garnered over $80 million in funding by 2017.

Pierce became the director of the Bitcoin Foundation in 2014, a non-profit dedicated to improving and promoting Bitcoin. Pierce is also a co-founder of Block.one, the firm behind EOS, one of the most popular cryptocurrencies.

How to get USDT?

Download Pintu, a cryptocurrency exchange application that has been registered with BAPPEBTI, if you want to acquire USDT and trade other crypto assets. With Pintu, you can start to invest in crypto from as little as IDR 11,000.

Reference:

https://tether.to/wp-content/uploads/2016/06/TetherWhitePaper.pdf

https://coinmarketcap.com/currencies/tether/

https://www.theverge.com/22620464/tether-backing-cryptocurrency-stablecoin

“How to DeFi?”, CoinGecko (2020)

Share

Related Article

See Assets in This Article

BTC Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-