What is Dollar Cost Averaging (DCA)?

When the crypto market enters a bear market, traders often find that buying and selling assets is less profitable. However, long-term investors see this situation as a golden opportunity. They see the bear market momentum as a chance to regularly accumulate crypto without caring about price fluctuations. This strategy is known as Dollar Cost Averaging (DCA). In this article, we will delve deeper into the concept of DCA and explore how to implement it in crypto investing.

Article Summary

- 🕰️ Dollar Cost Averaging (DCA) is an investment method where investors regularly buy crypto with fixed funds at specified time intervals, such as monthly or weekly.

- 📈 DCA is suitable for beginners and long-term investors. It helps them maximize profit opportunities while ignoring price fluctuations.

- ⚖️ Before implementing DCA, you have to consider which assets to buy, the frequency, the amount to invest, and your emotional tolerance to deal with market volatility.

- DCA offers several advantages, such as risk reduction, discipline in investment, simplifying decision-making, and is suitable for long-term investment.

What is Dollar Cost Averaging (DCA)?

Dollar Cost Averaging (DCA) is an investment method in which investors buy crypto with fixed funds regularly at specified time intervals. In other words, investors invest the same amount at regular intervals, such as monthly or weekly.

Investing regularly through DCA can minimize the impact of crypto price volatility as you buy assets at different time intervals. Thus, you will invest at an average purchase price rather than buying once.

Investors can maximize their profit opportunities by implementing DCA in the long term. Through this strategy, investors will find it easier to deal with the emotional rollercoaster of drastic price volatility. This method is perfect for beginner and long-term investors.

Read also: Appropriate Implementing DCA Strategy.

How to Implement DCA in Crypto Assets?

You can first determine the total funds you want to commit and which assets to DCA. Then, instead of investing the money all at once, you can invest it in smaller installments and specific time frames.

Here’s an example of using Dollar Cost Averaging:

You have IDR 10 million, and you have allocated it to buy Bitcoin . The current price of BTC, for example, is around IDR 500 million. If you buy BTC at one time, then you will get:

IDR 10,000,000/ IDR 500,000,000 = 0,02 BTC

However, if you decide to buy BTC using the DCA method gradually over 10 weeks with a fund allocation of Rp1 million per week, then the Bitcoin you get will be as follows:

| Time | BTC Price (IDR) | IDR 1 million : BTC Price | One-time purchase at IDR 10 million |

|---|---|---|---|

| Week 1 | 500,000.000 | 0,002 BTC | 0.02 BTC |

| Week 2 | 510,000,000 | 0,00196 BTC | |

| Week 3 | 470,000,000 | 0,00212 BTC | |

| Week 4 | 460,000,000 | 0,00217 BTC | |

| Week 5 | 475,000,000 | 0,00210 BTC | |

| Week 6 | 400,000,000 | 0,0025 BTC | |

| Week 7 | 500,000,000 | 0,002 BTC | |

| Week 8 | 490,000,000 | 0,00204 BTC | |

| Week 9 | 510,000,000 | 0,00196 BTC | |

| Week 10 | 450,000,000 | 0,002 BTC | |

| 0,021 BTC | 0,02 BTC |

If by Week 11, the Bitcoin price has risen to IDR 525 million, then buying gradually, you can have more profit.

Dollar Cost Averaging is best practiced during a bear market or when the market is in a downtrend because investors can get assets at a lower price over time.

This method is also suitable for long-term investors who want to invest either daily, weekly, or monthly.

If you want to know more about why Bitcoin is one of the investment instruments many people choose, you can read the following article: Why Do People Invest in Bitcoin?

Things to Consider Before Implementing the Dollar Cost Averaging (DCA) Strategy

1. What assets are you going to buy?

It would help if you consider first what crypto assets to buy with the DCA method. Fundamental analysis is very important to see the potential and risks. Blue chip crypto assets like BTC and ETH are popular for Dollar Cost Averaging.

2. How often will you invest?

Choose an investment frequency that suits you: daily, weekly, or monthly. This frequency should fit your financial schedule so that you can consistently implement DCA.

3. How much will you invest?

Decide how much you will invest regularly. It can be a fixed amount, such as IDR 3 million per month, IDR 1 million per week, or according to your financial budget. Make sure this amount is suitable for your financial capabilities.

4. Emotional Resilience

DCA is a long-term strategy, and the crypto market experiences high volatility. It would help if you had the emotional resilience to stay calm when seeing fluctuations in the price of your assets. Avoid making investment decisions based on emotions.

Advantages of Dollar Cost Averaging (DCA)

- Risk Reduction: DCA helps protect you from significant price fluctuations. It reduces the risk of entering the market at the wrong time.

- Convenience and Discipline: DCA allows you to invest the same amount at specified intervals automatically. It helps maintain the discipline of your investments.

- Decision Simplification: With DCA, you don’t need to constantly monitor the market or make decisions based on the daily asset movements. It makes investing more manageable and less stressful.

- Long-term investment: DCA is perfect for those of you who want to invest in crypto in the long term.

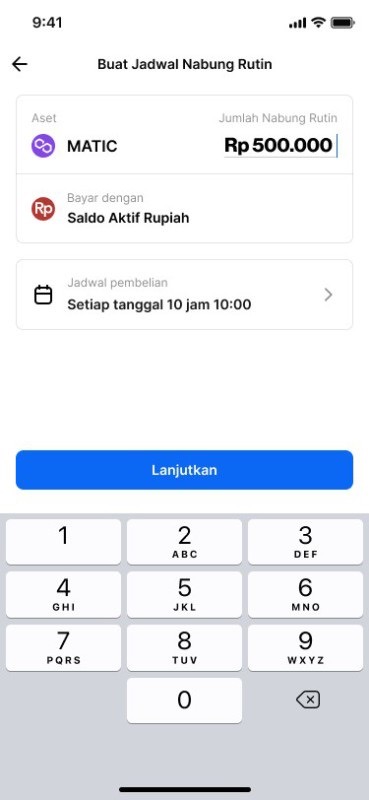

How to Use the Dollar Cost Averaging (DCA) Feature on Pintu

The Pintu app has an Auto DCA or Nabung Rutin feature that you can use to automatically buy crypto. The app will automatically deduct your IDRT fund so make sure you have the money before the auto DCA due date.

You can set a regular investment schedule with daily, weekly, or monthly interval options. Thus, you will automatically get crypto assets on the date and time you have set.

Here’s how to use the Auto DCA feature:

- Open the Pintu app and click ‘Auto DCA’ or ‘Nabung Rutin’.

- Choose the token that you will invest for regular savings.

- Input the amount of rupiah for your regular savings (maximum IDR 10 million).

- Set the purchase schedule (date and time).

- Click ‘Confirm’.

Pintu’s Auto DCA feature also comes with DCA Simulation to see how DCA works in specific scenarios without making actual investments. This feature allows you to test your DCA strategy and see its potential results before investing real funds.

With Pintu, your crypto investments are better planned, automated, and aligned with your preferences.

Conclusion

Dollar Cost Averaging (DCA) is an investment method where investors regularly buy crypto assets with a fixed fund amount at specified time intervals to avoid price fluctuations.

DCA is suitable for long-term investments as it helps reduce risk, increase discipline, and make investment decisions easier.

To implement a DCA strategy, you can use Pintu as a platform that offers DCA features to invest in crypto automatically and in a planned manner.

References

- Christian Vos, What is dollar-cost averaging (DCA) and how does it work? Cointelegraph, accessed 11 October 2023.

- Cryptopedia Staff, Dollar-Cost Averaging: Building Wealth Over Time, Cryptopedia, accessed 11 October 2023.

- Adam Hayes, Dollar-Cost Averaging (DCA) Explained With Examples and Considerations, Investopedia, accessed 12 October 2023.

Share

Table of contents

Related Article

See Assets in This Article

BTC Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-