What Is A Limit Order?

In the world of cryptocurrency trading, mastering effective strategies is essential for success. One such strategy is the use of limit orders, which provide traders with precision and control in volatile markets. In this article we will discuss the definition, how to use limit orders, and how does limit orders work. Read more about it below.

Article Summary

- 💵 A limit order is a feature in stock or cryptocurrency trading that allows investors or traders to buy or sell an asset at a specific price.

- 🦾 Types of limit orders include buy limit orders and sell limit orders, which can be automatically executed when the market price reaches the specified price.

- 🎮 The benefits of using limit orders include greater control over transactions, protection from price fluctuations, and automation of order instructions.

- ✍🏻 Limit orders can be a good strategy in volatile markets or for traders who are sensitive to price changes and make large trades. However, the decision to use limit orders should be based on a careful understanding of trading objectives and market conditions.

What Is A Limit Order?

A limit order is a feature used in buying, selling and investing in stocks or cryptocurrencies where an investor or trader can buy or sell a certain amount of an asset at a predetermined limit price. Once the order is placed, it is recorded in the order book system and the order process can continue if there is a match at the specified price or even a better price.

Limit orders can be used to buy assets at a low price and then sell at a higher price. In addition, limit orders provide investors or traders with greater control over the price of the asset they wish to trade.

💡 Example of a Limit Order: Fajar, an investor, has analyzed the crypto asset Ether , which is currently priced at $1,500. According to his analysis, the price of ETH could drop to US$1,000 in the coming days. Fajar then places a limit order at $1,000, meaning that the crypto asset will only be bought at a price equal to or less than $1,000. Once this order is executed, Fajar conducts another analysis and believes that the price of ETH will rise again. He then sets the sell price of ETH at $1,200.

Types of Limit Orders

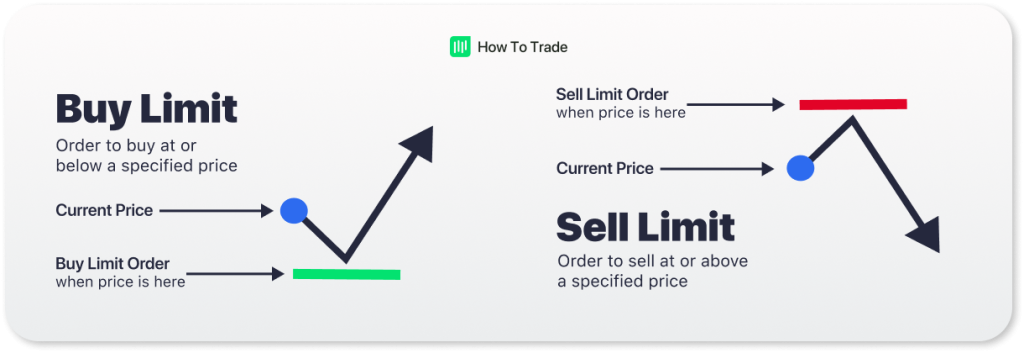

There are two types of limit orders feature:

- Buy Limit Order: An investor or trader can instruct the system to buy a specific cryptocurrency if its price falls to a predetermined level or lower. In other words, the purchase price and order will be executed automatically when the market price reaches that level.

- Sell Limit Order: This is an instruction to the system to sell a specific cryptocurrency if its price rises or falls to a predetermined level. This allows investors or traders to set their own sell price and the order will be automatically executed when the market price reaches that level.

Both Buy Limit Orders and Sell Limit Orders can be used as strategies to protect investors or traders in less favorable market conditions. Conversely, these two features have the potential to maximize profits.

The Advantages of Limit Order

The use of limit orders can provide many benefits in the implementation of investment strategies, including:

- Control over transactions

- Control the purchase price of assets to protect investors or traders from price fluctuations in uncertain market conditions, thereby minimizing losses.

- Take advantage of profit momentum by setting a selling price at a certain point in time to buy assets at a low price or sell assets at a high price.

- Obtaining the price according to the order or even better.

- Automation of instructions for orders determined according to the analysis performed, eliminating the need to monitor the market 24/7.

The Weakness of Limit Order

Although limit orders can provide control over asset purchases, there are some drawbacks, including:

- There is no guarantee that a limit order will be filled immediately.

- Transactions will not occur until the price falls below the predetermined limit price.

- Waiting to purchase an asset at the desired price may take longer.

- There may be additional fees, such as order cancellation fees, which may reduce profits.

These disadvantages may prevent investors or traders from taking advantage of investment opportunities at the right time.

Factors for Using Limit Orders

- Market Liquidity: Highly liquid markets are conducive to the use of limit orders because there are more buyers and sellers, increasing the chances that the order will be filled at the desired price.

- Market Volatility: Investors or traders need to be aware of the level of price movement in the market. If volatility is too high, it can render limit orders ineffective.

- Risk Profile and Investment Objectives: Determining risk profile and investment objectives is a factor that must be considered before using the limit order feature, which is useful for risk management.

Conclusion

Limit orders can be a feature of the strategy chosen by investors or traders who want to have more control over the price when buying or selling assets, especially in volatile markets where prices can change quickly and the limit order feature can be a great help. However, trading objectives and market conditions should be carefully considered before deciding to use limit orders. On the other hand, if an investor or trader is sensitive to price changes and engages in speculative trading that may be subject to large price fluctuations, or conducts large transactions where small price differences are critical, then the use of limit orders may be the right choice.

Read more: Understanding Different Types of Crypto Trading Order

Buy Crypto Assets in PINTU

For those of you interested in trading or investing in crypto assets such as BTC and ETH, you can use the PINTU application. There’s no need to worry because the PINTU application is officially registered and supervised by the Commodity Futures Trading Regulatory Agency (Bappebti). All crypto assets available in the PINTU application have undergone a rigorous assessment process, prioritizing cautionary principles.

Pintu is also compatible with popular wallets such as Metamask to facilitate your transactions. Download Pintu app on Play Store and App Store!

Aside from buying and trading crypto assets, you can expand your knowledge about cryptocurrencies through various Pintu Academy articles. Updated weekly, all Pintu Academy articles are made for knowledge and educational purposes, not as financial advice.

References

- Benjamin Curry, What Is A Limit Order? How Does It Work?, Forbes, accessed on 12 July 2023.

- What is a limit order?, Okcoin, accessed on 12 July 2023.

- Dheeraj Vaidya, CFA, FRM, Buy Limit Order, Wallstreetmojo, accessed on 12 July 2023.

- James Royal, Ph.D, Market Order vs. Limit Order: When to Use Which, Nerdwallet, accessed on 12 July 2023.

Share

Related Article

See Assets in This Article

ETH Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-