What is Rocket Pool (RPL)?

Staking has become a popular option for crypto holders to earn passive income. However, one problem in staking is the loss of economic activity. Assets locked in staking are unusable for a certain period of time. The emergence of liquid staking platforms allows users to continue enjoying the yield from staking while using it in DeFi applications.

Rocket Pool is a liquid staking platform on the rise lately. In addition to utilizing staking features, users can participate in Rocket Pool as validators with only 16 ETH, instead of the usual 32 ETH. As for staking, users only need to stake a minimum of 0.01 ETH. Want to know more about Rocket Pool and how it works? Check out the full article below.

Article Summary

- 🚀 Rocket Pool is a decentralized liquid staking protocol that allows its users to stake ether and also become validators (smart node operators).

- 🌐 What sets Rocket Pool apart from other liquid staking platforms is that to become a validator, users only need to stake 16 ETH, instead of the 32 ETH required by the Ethereum Beacon Chain.

- 🪙 For stakers, Rocket Pool gives them rETH tokens whose value equals to the users’ staked asset in Rocket Pool. For example, you will get 3 rETH when you stake 3 ETH in the Rocket Pool.

- 🌟 Based on its price chart, the RPL token has experienced a positive rally throughout 2023. The completion of The Merge and Shangai Upgrade plan are some of the driving factors. Liquid staking protocol giant Lido DAO is still Rocket Pool’s main competitor.

What is Rocket Pool?

Rocket Pool is a decentralized Liquid Staking Derivatives (LSD) protocol that was created to meet two user needs: those who want to participate in tokenised staking using rETH and those who want to stake ETH and run a node as Smart Node Operator (SNO)

Unlike traditional staking protocols, with Rocket Pool, stakers will get Rocket Pool ETH (rETH), equivalent to the ETH they put in. The rETH token can be used on various decentralized finance platforms to maximize profits.

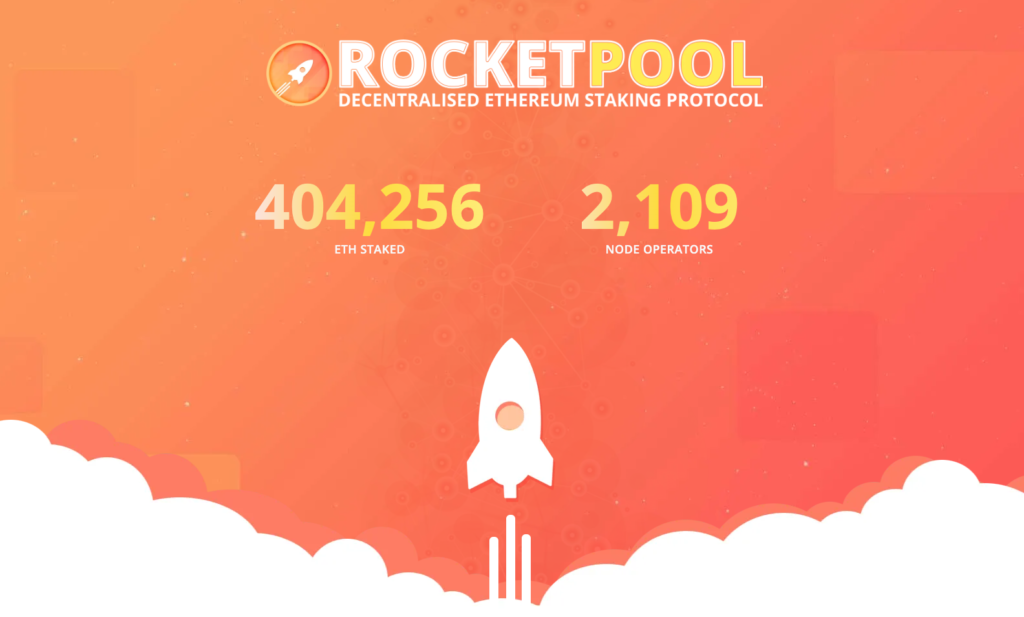

Rocket Pool also simplifies the ETH staking process, making it accessible to more users. To become a validator, users only need to stake 16 ETH instead of 32 ETH, as the Ethereum Beacon Chain requires. As a result of this convenience, Rocket Pool is the liquid staking protocol with the largest number of validators. Per February 2023, Rocket Pool has 2,109 operator nodes.

Currently, Rocket Pool has a Total Value Locked (TVL) of US$ 1.05 billion based on data from DeFiLlama. This amount has increased by 85.84% compared to the end of 2022, which was still worth US$ 565 million. When this article was written (February 2023), Rocket Pool had a market capitalization of US$ 887 million. Meanwhile, the amount of ETH staked in Rocket Pool reached 404,256 ETH with 2,109 SNO operators.

Curious about what staking is and how it works? Read more in the following article

What does Rocket Pool Offer?

Smart Node Operators (SNO)

Rocket Pool provides an opportunity for its users to become a validator or SNO with lower capital requirements. To become an SNO in Rocket Pool, users only need to stake 16 ETH, instead of 32 ETH required on the Ethereum Beacon Chain.

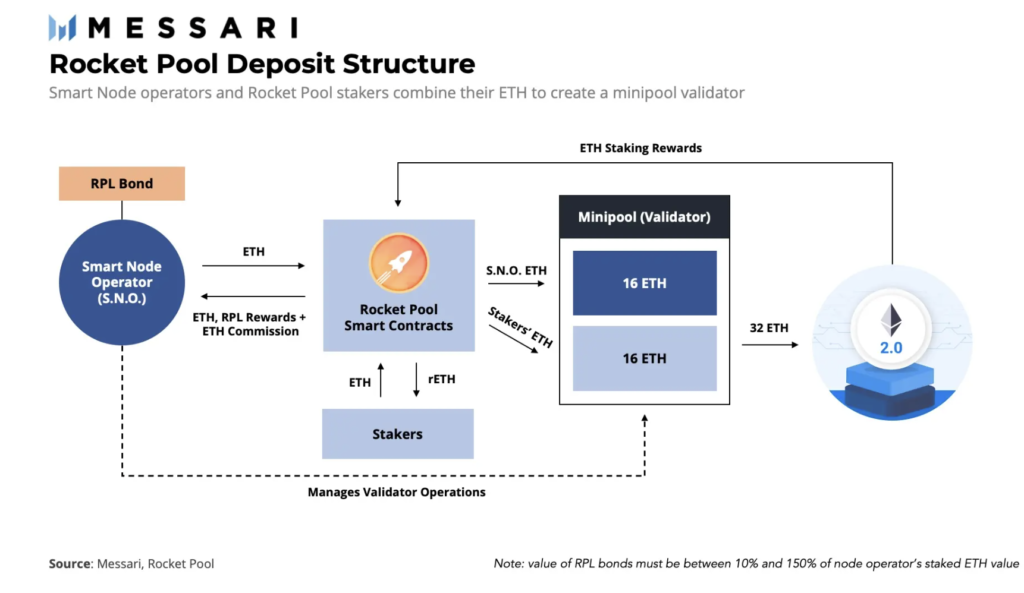

Rocket Pool provides a unique solution by connecting SNOs with prospective ETH stakers. This relationship enables SNOs and stakers to collaborate to reach the 32 ETH threshold.

Currently, Rocket Pool offers an APR reward of 7.25% for SNOs. Additionally, SNOs receive rewards in the form of Rocket Pool Protocol (RPL) tokens, which depend on how many tokens are used as collateral.

RPL tokens also serve as insurance on Rocket Pool nodes. When SNO stakes 16 ETH to create minipools, at least 10% of that ETH’s value must also be staked in RPL. This insurance is used as collateral. So, when a node operator is penalized or slashed, the RPL used as collateral will be auctioned off to compensate for the lost ETH value.

Apart from as insurance, RPL tokens can also be staked to increase the rewards earned by SNO. Currently, the RPL rewards that node operators can get are around 5-20%. On the other hand, RPL tokens also serve as governance tokens in the Rocket Pool protocol.

Staking Feature

Rocket Pool also allows users to stake ETH individually. The amount of rETH tokens that users earn will be the same as the value of the ETH they stake. Rocket Pool currently offers an APR of 4.52%, calculated based on the average of the last seven days. Meanwhile, the minimum amount of ETH staking in Rocket Pool is 0.01 ETH.

Apart from trading back to Rocket Pool, you can use rETH tokens in various Decentralized Finance (DeFi) applications. Some DeFi apps that accept rETH are 1Inch, Curve, and AAVE. As an ERC20 standard token, rETH tokens can be traded, lent, or used in a liquidity pool like any other ERC20 token.

Still confused about how to use DeFi apps? Check out the tips and tricks in the following article.

How Rocket Pool Works

The way Rocket Pool works are pretty simple, as illustrated above. First, users will stake ETH, and the assets will be stored in the Rocket Pool smart contract. The smart contract will tokenize and return the token to the user as rETH.

The rETH token has the same principle as stablecoins, which pegs its value to other assets. In this case, the value of rETH will equal to the value of ETH itself. However, the value of rETH tokens may be below or above the price of ETH due to unstable supply and demand in the secondary market.

For example, Nadia stakes 10 ETH and gets 10 rETH in return. Let's say the price of ETH rises, so the original 10 ETH is now equivalent to 10.5 ETH. Now, Nadia can redeem her 10 rETH and receive 10.5 ETH. Thus, as long as Nadia holds rETH, basically, she is also staking ETH with Rocket Pool.

Not only from single users, but the Rocket Pool also received 16 ETH from SNO. Then, every 32 ETH collected will be stored in the Rocket Pool’s minipools to be staked on Ethereum’s beacon chain. The SNOs then carry out their duties as validators on the Ethereum network. Later, SNOs will be rewarded with ETH staking, and RPL will be used as collateral.

Keep in mind, to swap rETH to ETH directly via Rocket Pool, the staking pool must have a sufficient supply of ETH. Meanwhile, the ETH in the staking pool comes from two sources. First, from ETH staked by other users and has not been used by node operators. Second, ETH from node operators when they exit as validators and get rewards from the beacon chain (This can only happen after the Shanghai update).

Pintu Academy has written an article about the Shanghai upgrade and how it will affect the Ethereum ecosystem.

The Pros of Rocket Pool

- 🌐Permissionless. Rocket Pool allows anyone to become a node operator. Not only that, but the requirements are also cheaper, as users only need to stake 16 ETH instead of the usual 32 ETH. This is because Rocket Pool subsidizes another 16 ETH from their minipools.

- 🌟 Decentralized. Through SNO, Rocket Pool managed to become the most decentralized LSD protocol. Lido DAO, which dominates validators on the Ethereum network by 29.95%, its entire validator set is run by just 30 node operators. In contrast, Rocket Pool’s validator share is only 10% of what Lido has, it has 2,110 individual SNOs operating its validator share.

- ⚡ Liquid. In other LSD protocols, users can only unstake their ETH after EIP 4863 or the Shanghai update. Meanwhile, in Rocket Pool, users can unstake their ETH at any time, thanks to the minipools system.

- 🔒 Bullish on Ethereum. The development of the Rocket Pool platform is closely related to Ethereum. This can be an advantage or weakness, depending on your view of Ethereum. If you are bullish on the future of Ethereum, Rocket Pool becomes the right platform to invest in Ethereum’s ecosystem.

If you found the content provided by Pintu Academy helpful, make sure to learn crypto through other Pintu Academy articles.

Rocket Pool Tokenomics

The Rocket Pool ecosystem consists of two tokens: rETH and RPL. rETH is a liquid staking token, whereas RPL is the native token for the Rocket Pool protocol mechanism. As a native token, RPL has three main functions. First, it serves as a governance token. Second, it serves as a reward token for validators who perform their duties well. Third, it serves as collateral for validators if they perform poorly or get slashed and lose their deposit. These three uses are positive signs because RPL is integrated with the Rocket Pool platform and has a clear use-case value.

Slashing is a form of penalty on the PoS network in the form that invalidates their id and makes them pay fines. The impact of slashing is that the value of ETH decreases over time. Slashing is implemented to enforce good behavior and accountability to stakers.

Currently, RPL has an annual inflation rate of 5%. The inflation rate in RPL is inseparable from RPL as a reward for staking itself. Then, as an inflationary token, the supply of RPL will always grow periodically.

When first launched, the supply of RPL reached 18 million. As for now, the total supply is 19.1 million. Regarding distribution, 70% of RPL is distributed to node operators, and 15% each is distributed to oDAO and pDAO members.

Rocket Pool as Investment

The RPL token has recently received attention from the crypto community, especially after the completion of The Merge. This is reflected in the price movement of the RPL token, which is in a positive trend. In fact, on a year-to-date basis, this token has skyrocketed up to 150%. At the time of writing, the RPL token is at US$ 49.72 (February 21, 2023).

The main factor is the rise of liquid staking popularity has made many investors more interested in staking their ETH. Moreover, the Shanghai Ethereum update scheduled for April or March allows staking users to withdraw their ETH.

This trend can be seen from Rocket Pool’s success in recording the highest growth among other LSD protocols after The Merge. Noted, Rocket Pool managed to experience growth in the number of ETH staked up to 18%. Rocket Pool outperformed its competitors, such as Lido DAO and Coinbase, which grew 3% and 16%, respectively. This strengthens Rocket Pool’s position in the LSD sector.

Rocket Pool has recently completed the Redstone update. With the update, Rocket Pool will focus on ensuring rETH liquidity by establishing various strategic partnerships, executing scalability improvements, and increasing DeFi adoption. This also increases Rocket Pool’s value in the eyes of investors.

Another influential factor is the Rocket Pool development team’s plan to bring the Low Ether Balance (LEB) minipool in the next update, the Atlas Upgrade. With the LEB minipool, users who want to become node operators only need to stake 8 ETH. Then, the protocol will subsidize the remaining 24 ETH. This update encourages the growth of rETH as more staking space is available in each minipool.

Are you curious about liquid staking in the Lido DAO? Read the full explanation in the following article.

Risks of Investing in Rocket Pool

The main risk of Rocket Pool is the intense competition with other LSD platforms. Currently, Lido DAO is still the main competitor for Rocket Pool. Lido DAO has the lowest fees among other LSD platforms. Lido DAO can reduce its fee further by utilizing its treasury.

In addition, Lido DAO also has a larger selection of LSD tokens, such as stETH, stMATIC, stKSM, stDOT, and stSOL. Meanwhile, Rocket Pool only has the rETH token.

On the other hand, centralized exchanges like Coinbase, which has the cbETH LSD token, also threaten Rocket Pool. Its because Coinbase has a real-world presence and the fiat ramp that institutions prefer.

The risk of failure of the smart contracts used by Rocket Pool could also be a risk factor. Rocket Pool’s development team is aware of this risk. As a mitigation effort, they use ConsenSys Diligence and Sigma Prime to audit the security of their smart contracts. Even so, users should still understand that there is still a risk of failure of the smart contract.

Therefore, as an investor, you have a choice: do you prefer Rocket Pool or other protocols such as Lido Dao or Frax? It would be best to weigh the potential and risks of investing in Rocket Pool before choosing.

Don’t forget to read the following article if you want to know more about how to choose crypto assets.

How to Buy RPL in Pintu

You can start investing in RPL tokens by buying them in the Pintu app. Here’s how to buy RPL on the Pintu app:

- Create a Pintu account and follow the process of verifying your identity to start trading.

- On the homepage, click the deposit button and top up the Pintu balance using your preferred payment method.

- Go to the market page and look for the RPL token.

- Click buy and fill in the amount you want.

- Now you have RPL tokens!

Pintu is also compatible with popular wallets such as Metamask to facilitate your transactions. Download Pintu app on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

In addition to executing transactions, in the Pintu Apps, you can also learn more about crypto through various Pintu Academy articles which are updated every week! All Pintu Academy articles are made for knowledge and educational purposes, not as financial advice.

Reference

David Rugendyke, Rocket Pool — Staking Protocol Part 1, Rocket Pool Medium, accessed on 15 Februari 2023.

David Rugendyke, Rocket Pool — Staking Protocol Part 2, Rocket Pool Medium, accessed on 15 Februari 2023.

Rocket Pool | Rocket Pool Docs, accessed on 15 Februari 2023.

Kunal Goel, New Highs for Liquid Staking Derivatives, Messari, accessed on 16 Februari 2023.

Trevor Normandi, Rocket Pool: Liquid Staking Lifts Off, Messari, accessed on 16 Februari 2023.

Bybit Learn, Rocket Pool (RPL): An Ethereum 2.0 Proof of Stake Protocol, Bybit, accessed on 17 Februari 2023.

Alexandria, Slashing, Coin Market Cap, accessed on 21 Februari 2023.

Share

Related Article

See Assets in This Article

ETH Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-