Introduction to Optimism Ecosystem

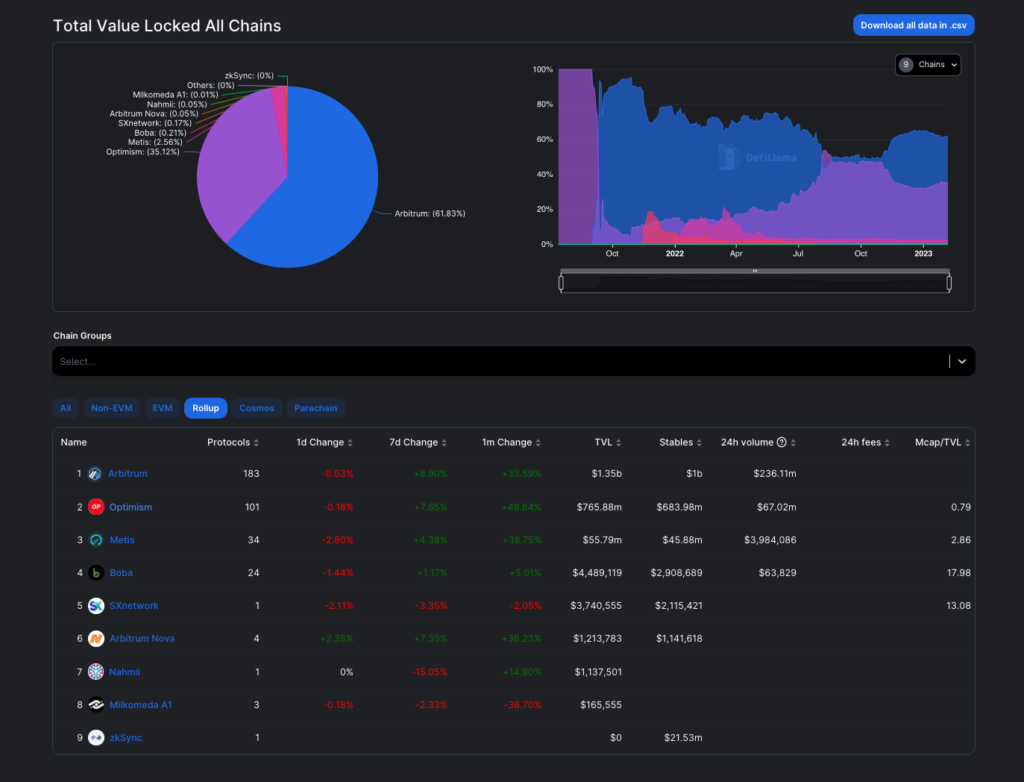

Adopting layer-2 technology to solve Ethereum’s scalability problem has become very common lately. This condition favors Optimism, one of Ethereum’s layer-2 protocols with the second biggest TVL. Many switch to the Optimism ecosystem as it offers faster and lower fee transactions than Ethereum.

The Optimism ecosystem is hence becoming more well-known and popular. Then, how is the Optimism ecosystem developing right now? What protocols are currently available in the Optimism ecosystem? Find out the answer through the article below.

block-heading joli-heading" id="ringkasan-artikel">Ringkasan Artikel

- 🔗 Optimism is a layer-2 blockchain built on top of Ethereum. Optimism uses optimistic rollups as scaling technology to reduce the Ethereum gas fee while making transactions faster.

- 🌐 Optimism is the second largest Ethereum layer-2 with TVL reaching US$ 769.73 million. Currently, there are 101 protocols in the Optimism ecosystem, with decentralized finance applications dominating the most.

- 📊 Velodrome, Synthetix, Curve, AAVE V3, and Uniswap V3 are the five biggest protocols in Optimism.

- 🌟 The adoption of layer-2, faster and lower fee transactions than Ethereum, the security aspect of Ethereum, and the potential for Bedrock updates are the driving factors for the high interest in Optimism.

Optimism Ecosystem Development

Optimism is a layer-2 blockchain built on top of Ethereum. Optimism using optimistic rollups as scaling technology to reduce the Ethereum gas fee by 90% while making the transactions faster. Optimistic rollups combine various transactions from the main chain, then rolled them up into one transaction. All the data processing is done on Optimism’s blockchain. But, the results are sent back to the Ethereum blockchain as a new block to be validated.

You can learn more about Optimism and its technology in the following article.

Currently, Optimism has a Total Value Locked (TVL) of US$ 765.88 million. The TVL figure experienced positive growth throughout January 2023. It is considering that at the end of 2022, the value was only around US$ 500 million. However, this figure is still below its highest level, US$ 1.1 billion, in August 2022.

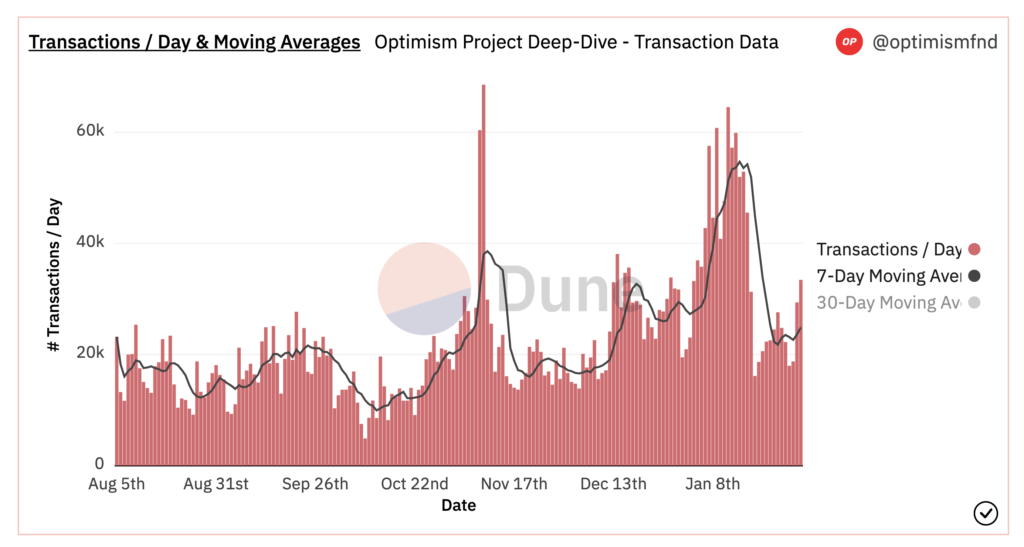

Optimism launched Optimism Quest to increase transactions and attract the crypto community’s attention. The initiatives offers rewards in OP tokens and NFTs for users who complete various tasks, starting with learning about tutorials on using Optimism applications, to bridging assets to Optimism using Stargate and becoming a liquidity provider at Velodrome. The program lasted for four months and ended on January 17, 2023.

Optimism Quest apparently provides positive returns for the Optimism ecosystem. During the program, weekly transactions on Optimism increased from 132,000 to 694,000, an increase of 426%.

However, once the program ended, it affected the Optimism ecosystem negatively. After recording 603,000 transactions in the last 7 days of Optimism Quest, the following week saw a 60% decrease to 240,000 transactions. This decrease in transactions resulted in a drop in network profits, causing the Price-to-Earning (P/E) ratio to spike from 1,000 to 3,950.

In the future, Optimism will likely have other incentive programs to encourage the adoption of its network. In addition, Optimism also plans to launch the Bedrock update on March 2023, which will make Optimism as a layer-2 with the lowest transaction fees.

Optimism also mentioned that bedrock became the foundation for the next update, Cannon, a more up-to-date interactive fraud-proof system. If Bedrock is successfully implemented, it will provide a huge advantage for optimism to become the dominant L2 in Ethereum.

Besides Optimism, there is another popular protocol in the layer-2. Read more here.

Protocol on Optimism Ecosystem

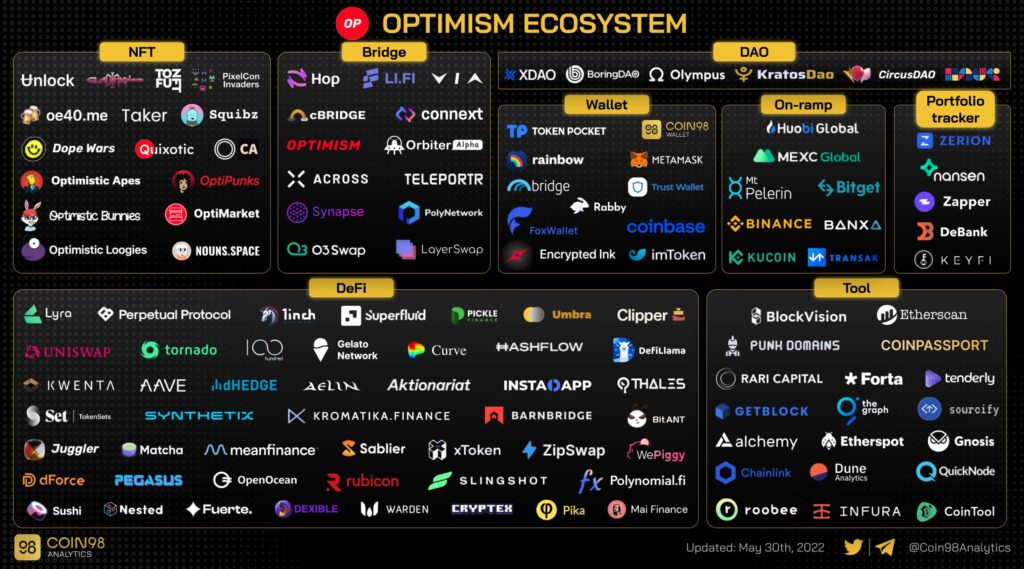

Currently, the Optimism ecosystem is largely dominated with Decentralized Finance (DeFi) projects. However, it also encompasses a variety of other projects, such as bridges, wallets, tools, DAOs, and NFTs. The following are some of the biggest projects in the Optimism ecosystem:

Velodrome

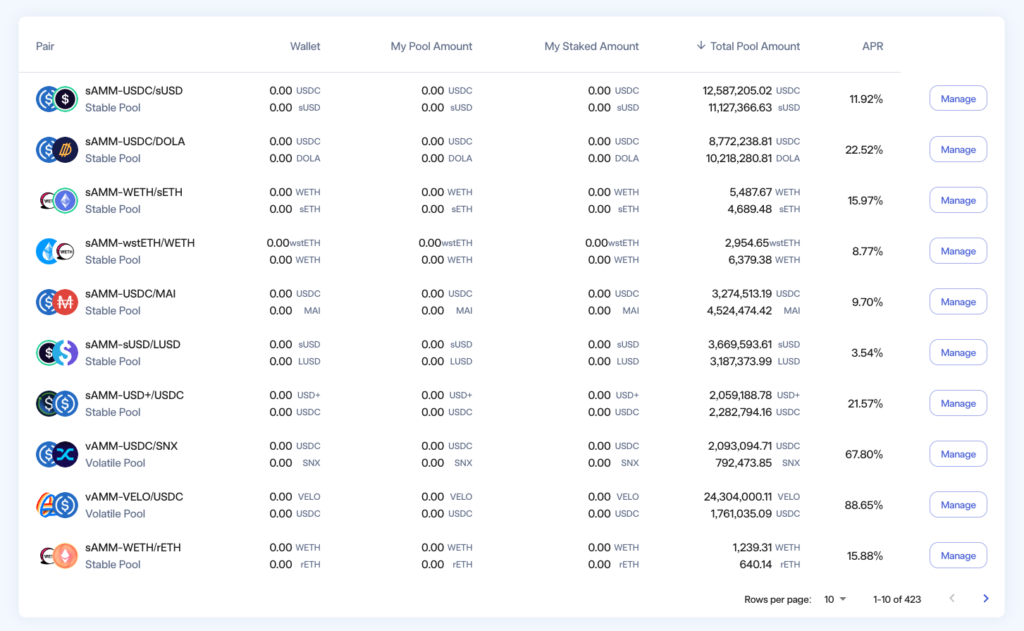

Velodrome is an Auto Market Maker (AMM) designed as a hub for marketplace trading and liquidity on the Optimism network. Velodrome is a native protocol on the Optimism network. Meanwhile, Velodrome is a fork from Solidly designed to provide greater liquidity and lower slippage costs. Currently, Velodrome has a TVL of US$ 156.65 million, making it the protocol with the highest TVL in Optimism.

One of the other unique things that Velodrome offers is the existence of “stable pools,” which contain stablecoin pairs such as USDC/sUSD. This is because stable pools offer one of the largest yields among stables in DeFi today. The developer team behind Velodrome is currently preparing the Velodrome 2.0 update. There will be a new UI/UX called Velodrome Night Ride, Velodrome Relay, and various features and technical updates in Velodrome 2.0.

Some of activities that you can do in Velodrome are as follows:

- Liquidity provider. You can earn VELO as a reward by becoming a liquidity provider (depositing pairs of crypto assets of equal value). You can see a list of the pools alongside their crypto asset pairs and the profit percentages on the pools page.

- Exchange/swap tokens. This feature allows you to exchange various kinds of tokens at a low cost. Currently, the fee for exchanging tokens in Velodrome’s liquidity pools is 0.02-0.05%.

- Vest. This feature is a token-locking mechanism. But the locked token is not VELO, but veVELO, a Velodrome governance token in the form of an NFT. The longer the token locking period, the greater the power in voting. So, the more significant the rewards that can be obtained. The duration of lockdown lasts from one to four years.

- Vote. Owning the veVELO token will allow you to participate in the governance of Velodrome. You will get VELO tokens as a reward if you take part in voting about Velodrome development.

You can read a complete explanation of automated market makers and how its work here.

Synthetix

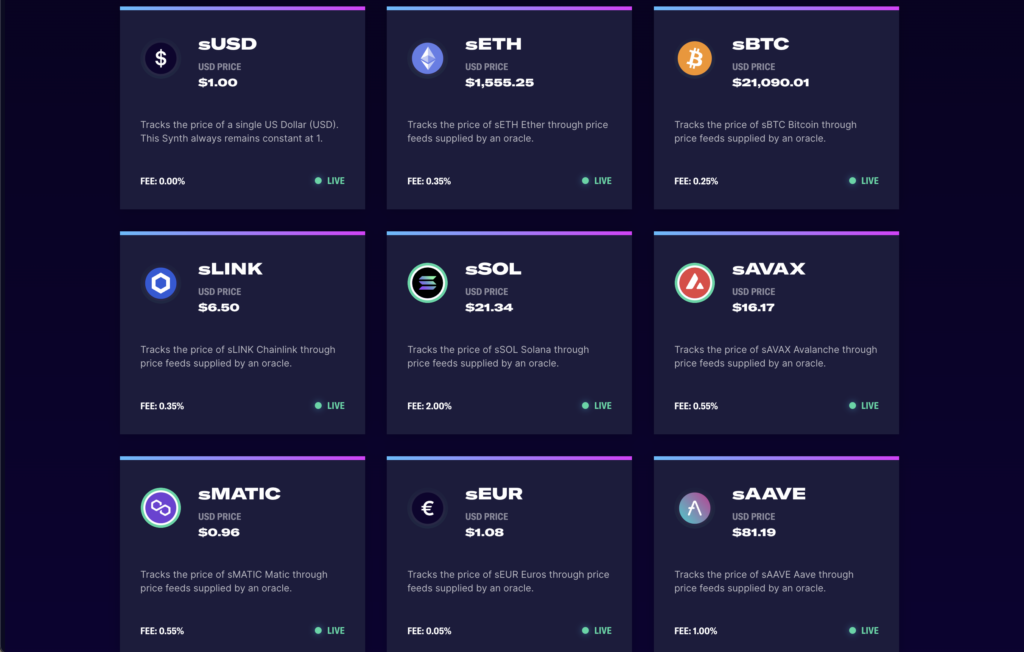

Synthetix is an Ethereum-based DeFi that provides on-chain exposure to crypto and non-crypto assets. Through Synthetix, users can create and trade synthetic assets in ERC-20 tokens called “Synth.” Traders can trade various Synths in the form of commodities, fiat currencies, stocks, and crypto assets without being subject to ‘slippage’ price.

According to DeFi Llama, Synthetix has the second largest TVL value on Optimism, which was US$ 133.24 million when this article was written. Synthetix’s crypto token is SNX. Synthetix decided to migrate to Optimism’s mainnet because they want to reduce gas fees and lower oracle latency.

Some of activities that you can do in Synthetix are as follows:

- Synthesis Trading. With Synthetix, users can trade and gain exposure to an off-chain asset without actually owning it. As shown above, the various synthetic assets available on Synthetix include ETH, BTC, USD, EUR, JPY, and so on. These assets can be traded using the pooled collateral mode of the Synthetix protocol

- Staking. Staking on Synthetix is quite different when compared to other DeFi protocols. Rewards are earned by contributing collateral (SNX) to the Synthetix protocol. Users will get rewarded in two ways. First, the reward comes from trading fees in the form of sUSD. Second, the reward from the inflationary rate is in the form of an SNX, which is locked for 12 months in advance. The SNX also can be staked to increase the rewards during the locking process.

- Decentralized Perpetual Futures. Apart from spot trading, you can also trade perpetual future at Synthetix. Using simulated liquidity, Synthetix can offer very low to free slippage costs and up to 10X leverage. Currently, two DEXs can be used to trade Synthetix’s perpetual futures, Kwenta and Decentrex.

Find out various tips and how to use DeFi apps in the following article.

Stargate

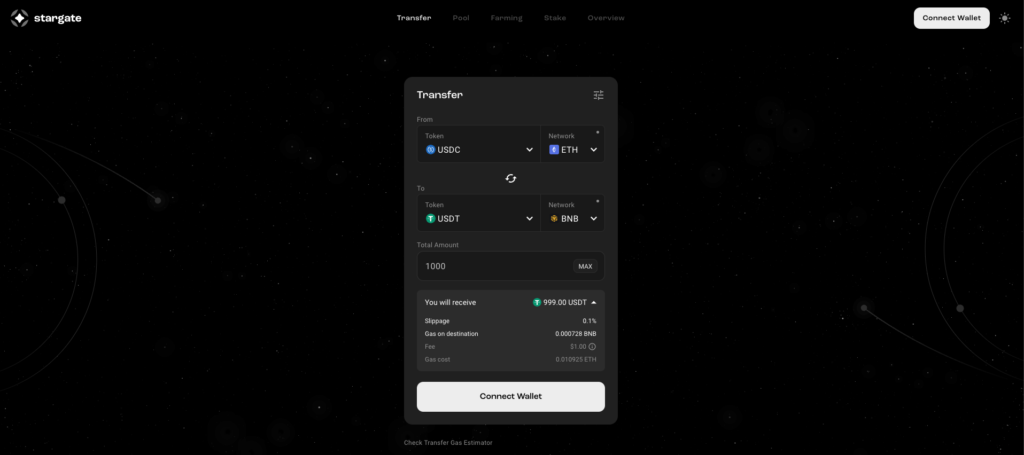

Stargate is a cross-chain-based bridge protocol allowing users to transfer assets between blockchains in a single transaction easily. The factors differentiating Stargate from other bridge protocols are the guaranteed success of transactions, the users can swap native assets on various blockchain networks, and a single liquidity pool spread across multiple chains to create deeper liquidity. These three factors are also Stargate’s efforts to overcome the bridging trilemma.

So far, Stargate has focused more on stablecoin tokens to reduce the risk for its users. It is because the price is pegged to stable assets. Stargate is also an easy protocol to use. This is supported by the easy-to-understand UI and all activities that can be accessed on the main page. If you want to use Stargate, users only need to connect their wallet to Stargate.

Some of activities that you can do in Stargate are as follows:

- Asset transfers. Through Stargate, you can transfer native assets from one blockchain to another easily. Through this bridging, you will swap with a ratio of 1:1 for native assets with different networks. For example, you want to send 100 USDC from Ethereum to 100 USDT on Binance Smart Chain. Users can also set gas cost limits and slippage fees.

- Liquidity Provider. By becoming a liquidity provider on the Stargate omnichain protocol, you will earn stablecoin tokens in exchange for every Stargate transaction. On the following page, you can see what tokens can be chosen to supply liquidity.

- Farming. Becoming a liquidity provider at Stargate also allows you to farm these liquidity tokens. Later, you will get STG tokens in return. The following page shows the amount of APY offered from farming.

- Staking. After getting the STG token, you can also stake the STG and get veSTG in return. By owning a veSTG, users can participate in the governance of Stargate.

If you are interested in staking, learn how to do it in the following article.

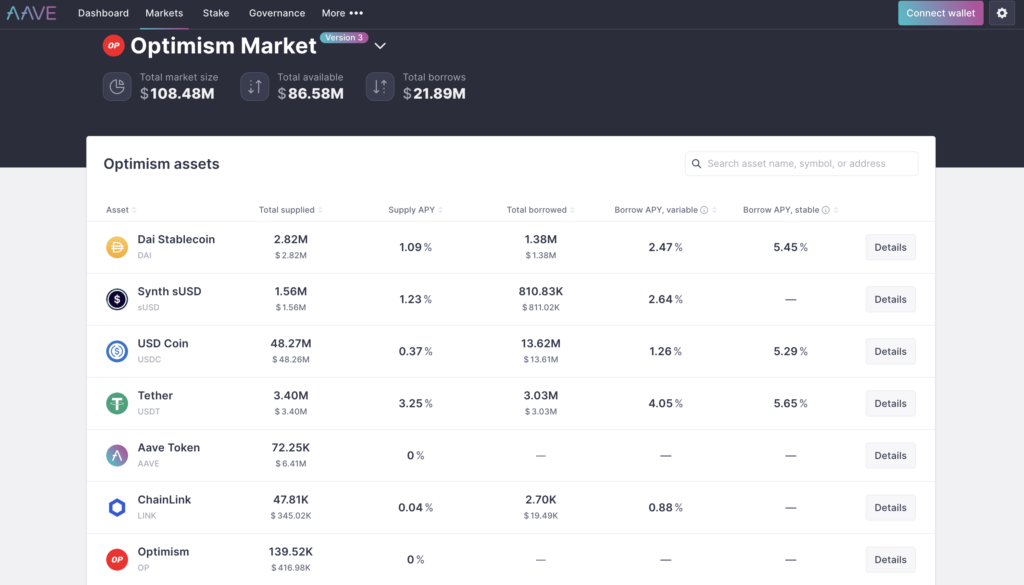

AAVE V3

AAVE protocol is a decentralized non-custodial liquidity protocol where users can participate as lenders or borrowers. Currently, AAVE V3 is Optimism’s largest loan protocol with a TVL of US$ 86.52 million.

AAVE V3 introduces higher efficiency, improved security, and cross-chain functionality while facilitating cross-protocol decentralization. The update includes new features, such as efficiency mode (eMode) and isolation mode, in this V3 protocol. In addition, AAVE V3 also promises lower gas fees, with a reduction of 20-25%.

Some of activities that you can do in AAVE V3 are as follows:

- Borrowing crypto assets. AAVE provides much bigger incentives for users who borrow crypto assets. However, the user must first save their crypto asset as collateral to make a loan. The guarantee amount will affect how much nominal that can be borrowed.

- Become a lender. Liquidity providers at AAVE actually earn relatively much smaller interest. This shows that AAVE encourages its users to make loans more.

- Staking. Users can also stake their AAVE tokens on the safety module for an added level of security as well as additional profit. Currently, AAVE’s APR staking rate is 6.12%.

Apart from AAVE V3, there are several other Ethereum DeFi applications, such as Curve and Uniswap. Both DEX-based protocols have a lot in common with how Velodrome works. Users can exchange tokens, become liquidity providers, and staking.

You can read a more complete explanation of AAVE and its technology in the following article.

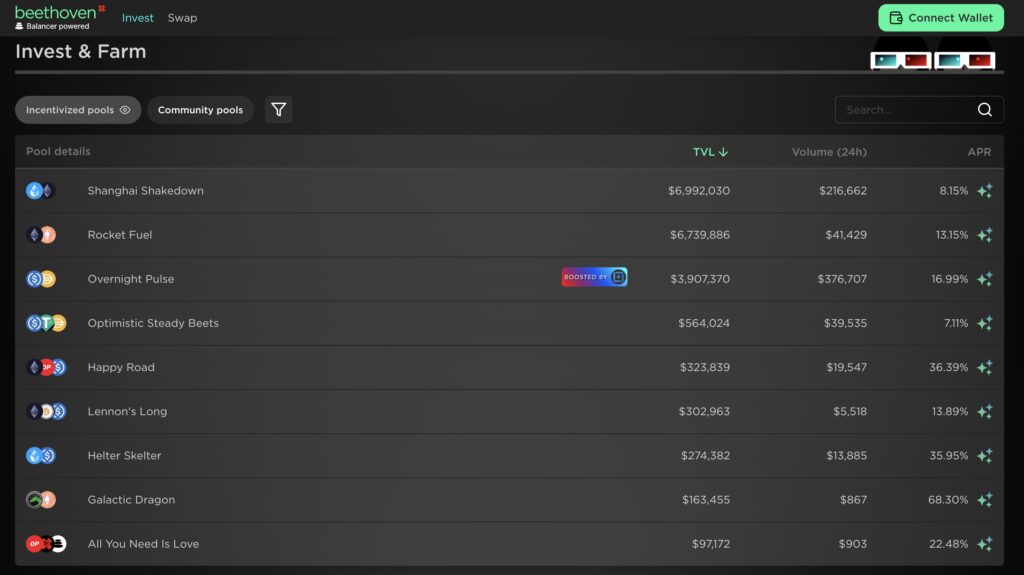

Beethoven X

Beethoven X is a DEX-based DeFi protocol offering decentralized investment strategy features. So, apart from exchanging crypto assets, users can also invest in Beethoven X. Users only need to deposit their money, like being a liquidity provider in general. As the name implies, Beethoven X has a Beethoven-based theme. This can be seen from the Beethoven X liquidity pool, which is named a parody based on Beethoven’s music melody and music title.

As a DEX, Beethoven X also provides various liquidity pools, such as stablecoin pairs, similar to Curve. Meanwhile, the investment scheme offered by Beethoven X is an index fund or a decentralized mutual fund. The liquidity pool contains 4-8 crypto assets and offers substantial returns. Beethoven X removed the portfolio manager role and replaced it with the Balancer V2, which played a similar role.

Some of activities that you can do in Beethoven X are as follows:

- Exchange tokens. You can exchange various tokens on Beethoven X to maximize your revenue strategy. For example, you are converting your BPT interest tokens into BEETS and depositing them into the BEETS-FTM fund pool to earn higher interest.

- Invest in various liquidity pools. You can invest across multiple liquidity pools with a fairly large APR. Remember to invest in large volumes of liquidity pools to reduce risk.

Why are people attracted to Optimism applications?

- ⚡ The adoption of layer-2 technology.The adoption of layer-2 technology has been and continues to be a significant theme in the cryptocurrency industry in 2022 and 2023, particularly with regards to Ethereum’s scalability issues. Optimism is seen as a solution to these problems.

- 💨 Fast transactions with lower fees. Optimism’s optimistic rollup technology reduces transaction fees by 10 times compared to Ethereum and provides a much faster transaction process.This is because the rollup process happens off-chain, so it is not affected by Ethereum network congestion.

- 🛡️ Security level. As a layer-2 built on top of the Ethereum blockchain, Optimism can take advantage of Ethereum’s state-of-the-art security level.

- 🚧 Potential Bedrock update. The Optimism team is currently working on a Bedrock update and a more advanced fraud-proof system, Cannon. This update could be a game changer because it can make Optimism as a layer-2 with the lowest transaction fees.

Read the following article’s predictions of crypto market trends and conditions in 2023.

How to Buy Optimism on Pintu

You can start investing in OP tokens by buying it in the Pintu App. Here is how to buy crypto on the Pintu application:

- Create a Pintu account and follow the process of verifying your identity to start trading.

- On the homepage, click the deposit button and top up the Pintu balance using your preferred payment method.

- Go to the market page and look for OP token.

- Click buy and fill in the amount you want.

- Now you have OP token as an asset!

Besiden OP token, you can also invest in various crypto assets such as, BTC, BNB, ETH, and others safely and easily through Pintu.

Pintu is also compatible with popular wallets such as Metamask to facilitate your ttransactions. Download Pintu app on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

In addition to executing transactions, in the Pintu Apps, you can also learn more about crypto through various Pintu Academy articles which are updated every week! All Pintu Academy articles are made for knowledge and educational purposes, not as a financial advice.

Reference

Kunal Goel, Optimism: A Glass Half Full, Messari, accessed on February 3, 2023.

Ivan Cryptoslav, What Is Optimism? The Ultimate Guide to the Optimism Ecosystem, CoinMarketCap, accessed on February 3, 2023.

Jerry Sun, Optimism Falls After its Quests End, Messari, accessed on February 4, 2023.

ConsenSys, 2023 CMC Crypto Playbook: The Present and Future of Layer 2 Roll-ups, CoinMarketCap, accessed on February 3, 2023.

Jocelyn Yang, Optimism’s OP Token Hits All-Time High as Layer 2 Adoption Interests Grow, CoinDesk, accessed on February 3, 2023.

Rahul Nambiampurath, What Is Synthetix? The Defiant, accessed on February 3, 2023.

The Velodrome, Velodrome: The Road Ahead, Velodrome Medium, accessed on February 4, 2023.

Oliver Knight, DeFi Lender Aave Deploys Version 3 on Ethereum Network, CoinDesk, accessed on February 3, 2023.

Stargate Protocol, Stargate, accessed on February 4, 2023.

Beethoven Introduction, Beethoven X, accessed on February 4, 2023.

Share

Related Article

See Assets in This Article

DEFI Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-