What is Sonic? The New Era of the Fantom Network

In the ever-evolving world of blockchain, innovation, and rebranding are crucial strategies for staying relevant and competitive. The transformation of Fantom into Sonic is the latest example of an effort to address market challenges while strategically positioning itself for broader adoption—especially amidst the rise of similar emerging projects. The question is, does this mark the beginning of a new era for the Fantom network as it evolves into Sonic? Find out all the details here.

Article Summary

- 🔥 The reasons behind Fantom’s transformation into Sonic and how this strategic move enhances its competitiveness in the blockchain industry.

- 💡 An explanation of Sonic as a Layer-1 platform with a Proof-of-Stake mechanism, along with innovations like SonicVM and SonicDB to improve transaction speed and efficiency.

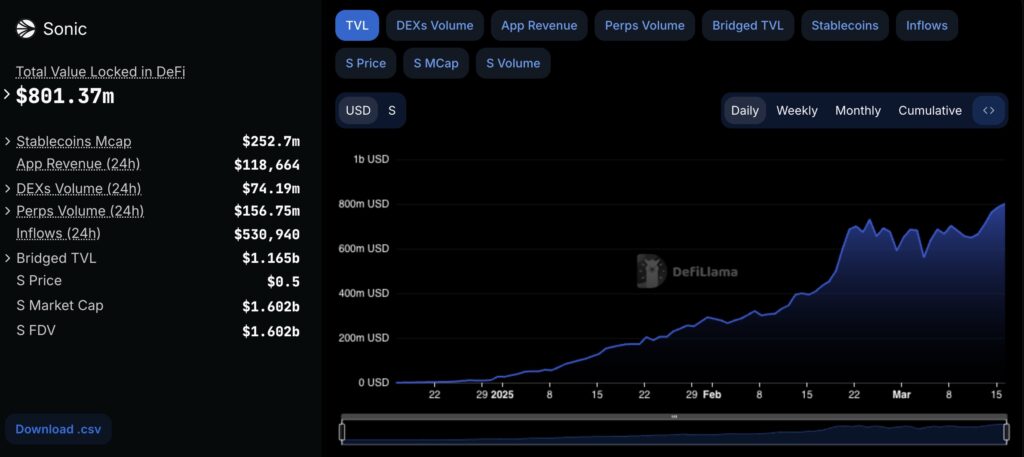

- 🚀 This year, Sonic has experienced a Total Value Locked (TVL) growth from $26.39 million to $801.37 million, a staggering 2,936% increase (30x).

The History of Fantom and the Reason for Rebranding

Fantom is a Layer-1 project launched in 2018, integrating Directed Acyclic Graph (DAG) technology and the Fantom Opera network as the foundation for its smart contracts. With robust smart contract capabilities, Fantom has become a go-to platform for developers to build diverse and innovative decentralized applications (dApps), thanks to its compatibility with the Ethereum Virtual Machine (EVM).

Additionally, innovations such as aBFT technology, DAG structure, and the Lachesis consensus mechanism enable Fantom to process transactions quickly, cost-effectively, and securely. Its native token, $FTM, plays a vital role in network security through staking, transaction fee payments, and participation in the broader ecosystem.

Despite its strengths, Fantom’s implementation has faced challenges in keeping up with the rapidly evolving market. To address these issues, the development team strategically rebranded Fantom into Sonic. The team focuses on high network performance, low transaction costs, improved liquidity inflows, a stronger ecosystem, and ambitions to become a world-class infrastructure for Decentralized Finance . This transition was officially announced via their X account on August 2, 2024, as part of a broader effort to position the platform for a more competitive future.

What is Sonic?

On December 18, 2018, through its official X account, Sonic Labs officially launched its mainnet. Sonic is a new Layer-1 platform utilizing a Proof-of-Stake consensus mechanism, claimed to handle up to 20,000 transactions per second—twice the capacity of Fantom, which previously supported only 10,000 transactions per second.

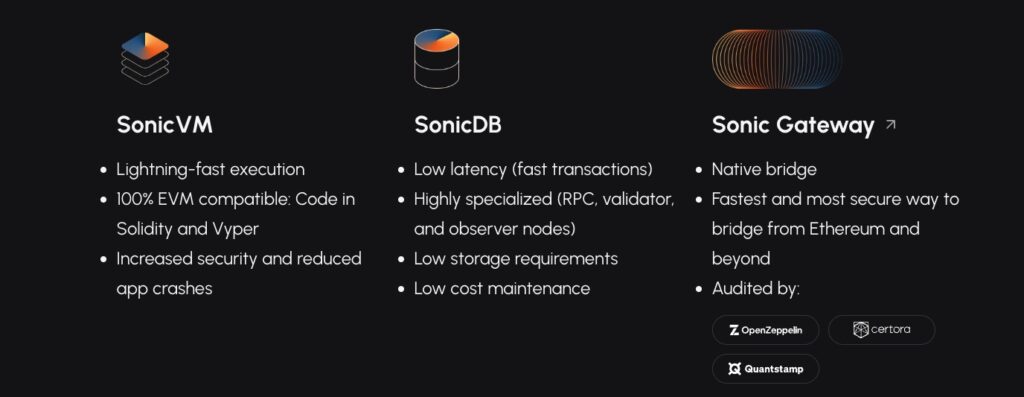

Two key components driving Sonic’s high-performance network and scalability are Sonic Virtual Machine (SonicVM) and SonicDB. Sonic offers an infrastructure that is developer- and user-friendly, enhancing network security while optimizing transaction processes to be faster, cheaper, and more efficient.

Furthermore, one of Sonic’s primary focuses is addressing liquidity challenges, which have historically been a significant hurdle. The evolution into Sonic represents a strategic move to simplify what was previously a complex ecosystem, thereby fostering broader blockchain adoption and ensuring greater responsiveness to market dynamics.

Key Points of the Rebranding

- A More User-Friendly Ecosystem

Sonic features an intuitive user interface, making it easier for users to navigate and access dApps within the ecosystem. This simplification aims to eliminate the complexities that previously hindered user adoption.

- The Impact of SonicVM, SonicDB, and Sonic Gateway on the Rebranding These three components play a crucial role in the transformation from Fantom to Sonic, collectively enhancing the performance of the Sonic ecosystem.

- Sonic Virtual Machine (SonicVM) is designed to optimize smart contract execution, enabling faster and more efficient transactions by replacing the outdated bytecode model of the Ethereum Virtual Machine (EVM) with a new format. This update significantly improves execution efficiency and allows for specialized instructions. However, Sonic remains EVM-compatible, ensuring a seamless migration process for existing dApps.

- SonicDB functions as a high-performance data system that supports large-scale data storage and management within the Sonic network, offering low maintenance costs and minimal latency.

- Sonic Gateway serves as a crucial integration bridge between networks, facilitating the seamless onboarding of users and dApps from other ecosystems into Sonic. This enhances liquidity inflows and ensures smooth interoperability between supported blockchain ecosystems.

Sonic’s Performance

As a platform aiming to become a world-class DeFi infrastructure, Sonic has demonstrated remarkable growth in Total Value Locked (TVL), surging by 2,936% (30x increase) from $26.39 million on January 1, 2025, to $801.37 million on March 19, 2025.

Below is a comparison of Sonic’s growth against other leading Layer-1 projects:

- Growth in Daily Active Addresses: Sonic recorded a 129.1% increase in the past month, surpassing other Layer-1 projects such as Solana, Sui, Tron, Aptos, TON, Avalanche, Near, and Ethereum.

- Surge in Daily Transactions: Sonic experienced a 39% increase in daily transactions over the past month, reflecting higher activity within its ecosystem.

- Relatively Small Market Capitalization: Despite its rapid on-chain activity growth, Sonic’s market cap remains significantly smaller than other Layer-1 projects, standing at approximately $1.5 billion.

- High Interest and Participation: This data indicates that despite being relatively new, Sonic has successfully attracted strong user interest.

- Incentive-Driven Growth: This surge is likely fueled by various incentive programs, including, airdrops, yield farming, and a point-based reward system that benefits active users within the Sonic network.

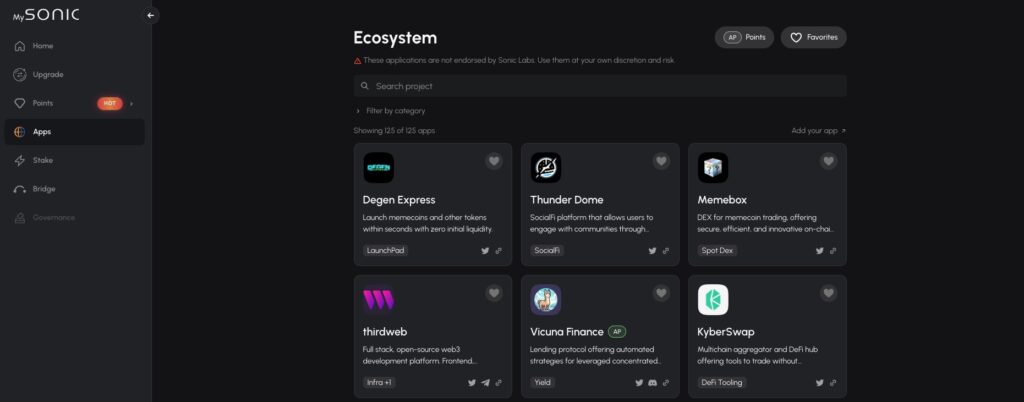

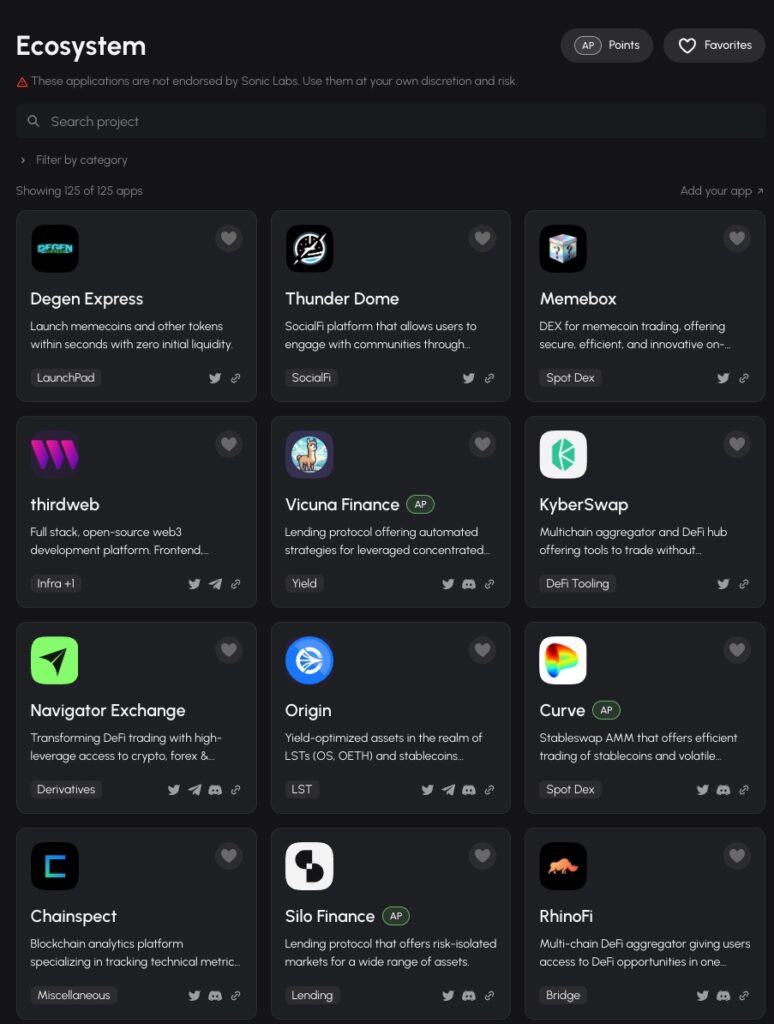

Sonic Ecosystem

The surge in TVL is primarily driven by the increasing number of dApps offering point-based incentive programs for users. Most of these dApps are within the DeFi sector, where users not only accumulate points but also earn variable interest through farming mechanisms. The combination of Sonic’s airdrop incentives and passive income opportunities has created a strong appeal, attracting more liquidity into the Sonic ecosystem.

As of March 19, 2025, Silo Finance holds the highest TVL within the Sonic ecosystem, with a total value of $193.99 million, making it one of the most dominant protocols on the network.

Leading DeFi projects such as Pendle and AAVE have also integrated with Sonic, bringing new liquidity growth into the ecosystem. This integration enables Sonic users to access decentralized financial services such as yield farming, lending, and borrowing with significantly lower transaction fees and faster transaction speeds compared to other networks.

Token Migration

$FTM token holders can seamlessly swap their tokens for $S, Sonic’s native token, at a 1:1 ratio via the official Sonic Labs website. This migration process ensures users can transition into the Sonic ecosystem without losing their assets.

Sonic Tokenomics and Utility

The $S token plays a crucial role within the Sonic ecosystem, serving multiple functions, including:

- Transaction Fees – Used to pay for network transactions.

- Validator Operations – Required for running a validator to secure the network (Minimum Requirement: 50,000 $S).

- Governance Participation – Enables holders to vote on network development and key decisions.

- Staking – Users can stake their $S tokens to earn rewards (Minimum Requirement: 1 $S).

- Ecosystem Participation – Used in dApp within the Sonic network.

The total supply of $S is 3.175 billion, which mirrors the total supply of $FTM tokens prior to the rebranding.

Sonic’s Potential

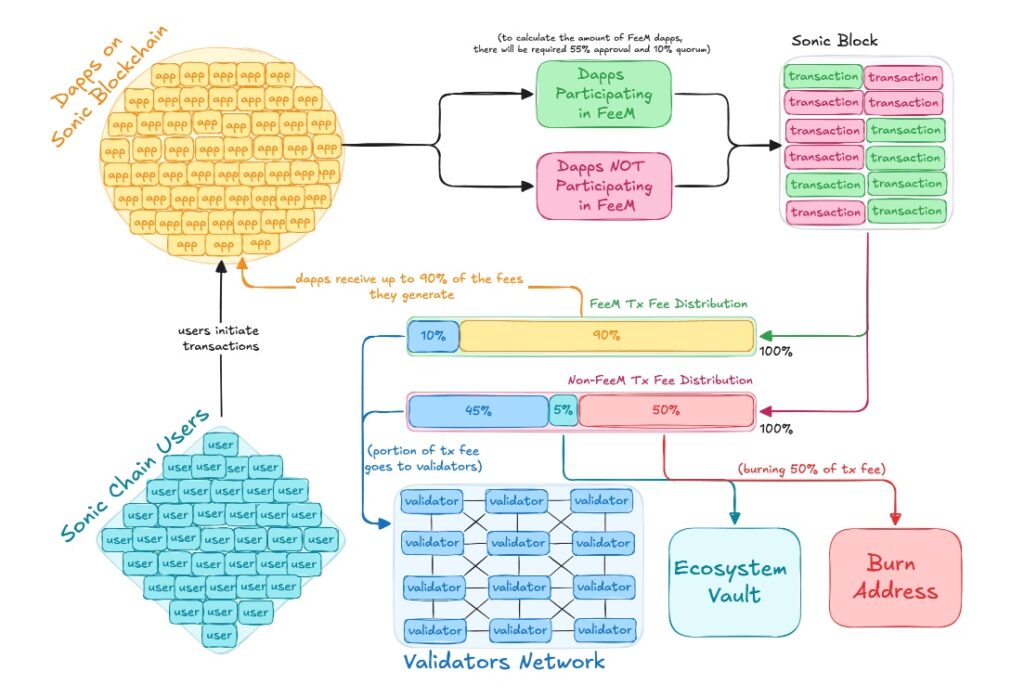

- Sonic’s New Fee Monetization (FeeM) Model

This scheme creates opportunities for developers building dApps on the Sonic network to earn rewards in the form of Sonic tokens—up to 90% of the total transaction fees generated by their dApps. This mechanism has the potential to be a game changer in the Layer-1 blockchain ecosystem, fostering greater innovation and adoption within the network.

This revenue-sharing model is similar to traditional business structures. Imagine if Apple distributed 90% of its revenue to retailers who successfully sold MacBooks or iPhones.

The FeeM mechanism is divided into two structures:

- Non-FeeM Apps In this model, transactions occur in dApps that do not participate in FeeM. The transaction fee distribution is as follows:

- 50% of the transaction fee is burned.

- 45% of the transaction fee is allocated to validators as a reward for their participation in the network.

- 5% of the transaction fee goes to the Ecosystem Vault, which is likely used to support the development of the Sonic ecosystem.

- FeeM Apps In this model, transactions occur in dApps that participate in FeeM. The transaction fee distribution is as follows:

- No transaction fees are burned.

- 10% of the transaction fee is allocated to validators as a reward.

- No transaction fees go to the Ecosystem Vault.

- 90% of the transaction fee is given to the dApp developers, creating a strong incentive for developers to build and contribute to the Sonic ecosystem.

- Innovator Fund Sonic Labs has introduced a funding program designed to support the development of the Sonic ecosystem. This initiative targets startups, developers, industries, and projects looking to build dApps and infrastructure within the Sonic network. The primary goal is to drive innovation across the ecosystem. Total funding allocated: 200,000,000 $S tokens

- Airdrop Program Sonic has also launched an airdrop program to reward active users and developers who meet specific criteria. This initiative aims to boost adoption and engagement within the Sonic ecosystem by distributing reward points across three categories:

- Passive Points: Users can accumulate points by holding assets that fall under the whitelist category.

- Activity Points: Users can participate by providing liquidity using whitelisted assets.

- App Points (Gems): This airdrop focuses on dApps within Sonic. Eligible dApps can convert the Gems they earn into $S tokens, which can then be distributed to users based on predefined criteria.

How to Buy Sonic on Pintu

After knowing what Sonic is, you can start investing in S by buying it on Pintu app. Here is how to buy crypto on Pintu application:

- Create a Pintu account and follow the process of verifying your identity to start trading.

- On the homepage, click the deposit button and top up the Pintu balance using your preferred payment method.

- Go to the market page and look for S.

- Click buy and fill in the amount you want.

- Now you have S!

In addition to Sonic, you can safely and conveniently purchase a wide range of cryptocurrencies such as BTC, ETH, SOL, and others safely and easily on Pintu. Pintu diligently evaluates all its crypto assets, highlighting the significance of being cautious.

Pintu is also compatible with popular wallets such as Metamask to facilitate your transactions. Download Pintu app on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

Conclusion

The rebranding from Fantom to Sonic marks a new era for this blockchain ecosystem, emphasizing speed, efficiency, and broader adoption. With innovations like SonicVM, SonicDB, and Sonic Gateway, Sonic significantly enhances transaction performance—reaching up to 20,000 TPS—while creating a more developer- and user-friendly environment.

Additionally, key strategies such as Fee Monetization, the Innovator Program, and Sonic Airdrops serve as major incentives driving participation in the ecosystem. The significant growth in Daily Active Addresses and Total Value Locked (TVL) suggests that Sonic is successfully gaining market attention, despite having a smaller market cap compared to competitors like Solana or Ethereum.

However, challenges remain, including the sustainability of growth beyond its initial incentives and intense competition in the Layer-1 sector. If Sonic can maintain its momentum and build a robust ecosystem, it has the potential to become a major player in the blockchain space.

*Disclaimer

This article is for educational and informational purposes only and should not be considered financial advice.

References

- Ash V. Khatibi, “From Fantom to Sonic — What You Need to Know”, Sonic Labs Blog, accessed on April 14, 2025.

- Lavina, “Everything You Need To Know About the Sonic Launch” blocmates, accessed on April 14, 2025

- OneSafe Content Team, “Fantom’s Sonic Shift: A Desperate Bid for Liquidity?” OneSafe Blog, accessed on April 13, 2025.

- “The Fantom Foundation’s Rebrand to Sonic: What Users Need to Know” Nansen, accessed on April 14, 2025.

- Sonic Labs: Litepaper

- Sonic Labs: Fee Monetization

- Sonic Labs: Points

- DefiLlama

- Artemis

Share

Related Article

See Assets in This Article

DEFI Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-