Bitcoin (BTC) Braces for a Key Decision from the Fed, What Will Happen?

Jakarta, Pintu News – Markets are eagerly awaiting a key decision from the US Federal Reserve to be announced, with Bitcoin currently trading above the $115,000 mark. This week is considered critical as the outcome of the meeting will provide a clearer picture of macroeconomic conditions, which will shape the outlook for risk assets, including cryptocurrencies.

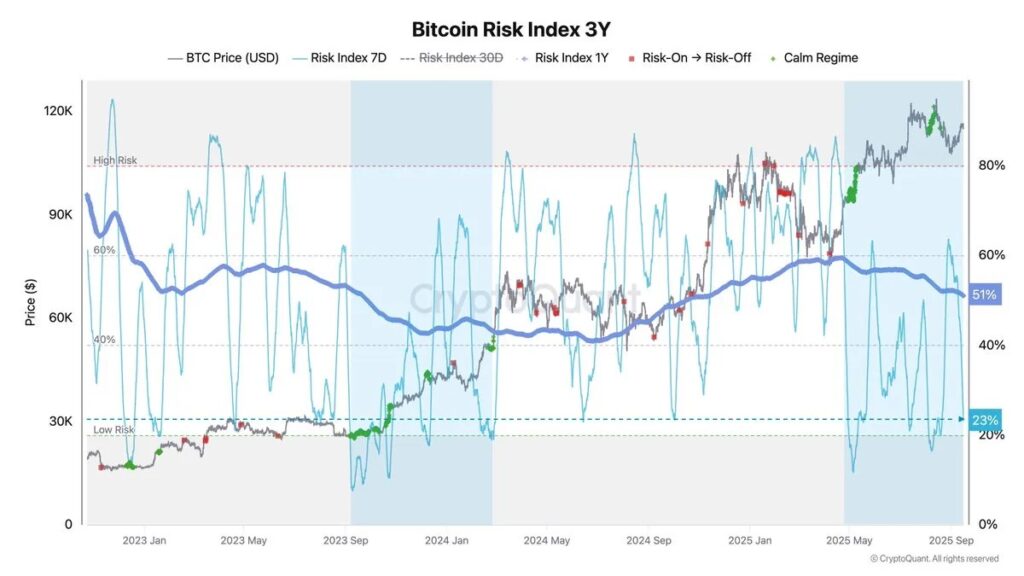

Bitcoin Risk Index Shows Stability

According to Axel Adler, the Bitcoin Risk Index provides a clear picture of the current market stability. A higher index indicates a more dangerous configuration compared to the last three years, as it signals the possibility of a rapid withdrawal of funds or liquidation.

Currently, the index is at 23%, a relatively low level that suggests that current market conditions are calm and the likelihood of a sharp decline remains minimal. Adler points out that a similar situation occurs between September and December 2023, when the index remains low, allowing Bitcoin (BTC) to gradually build strength.

During that period, volatility was limited, and those calm conditions became the basis for the continuation of the bullish trend. These historical parallels reinforce the idea that the current environment may be favorable for sustained growth if external shocks can be avoided.

Also Read: 5 Reasons Bitcoin Allocation on Wall Street Will Explode by the End of 2025

Macroeconomic Uncertainty as a Key Risk

Adler emphasized that the immediate risk lies in macroeconomic uncertainty. With Jerome Powell and the Federal Reserve set to announce their latest decision, investors remain wary. Adler even hopes for no surprises from Powell, as an unexpected move could quickly disrupt the calm backdrop.

As markets brace for volatility, many analysts believe that Bitcoin (BTC) could surge in the coming weeks. With low risk indicators, tightening exchange supply, and resilient institutional demand, conditions appear favorable for further gains once clarity from the Fed emerges.

Price Action Details: Keeping Demand Key

Bitcoin (BTC) is trading at $115,739 after a steady recovery from early September lows, showing resilience as it approaches a critical range. The chart shows that BTC is holding above its 50-day (blue) and 200-day (red) moving averages, while pressuring the 100-day SMA (green), which is near the current level of $114,417.

This area proved to be a crucial battleground for both bulls and bears. Despite intraday volatility, BTC managed to stay above the critical $114,500-$115,000 support zone, indicating demand from buyers whenever the price drops. The next significant resistance lies near $123,217, the previous peak and a key psychological barrier that the bulls will have to reclaim to confirm a breakthrough towards $125,000 and higher.

Conclusion

With the Federal Reserve’s decision to be announced soon, the cryptocurrency market, particularly Bitcoin (BTC), is at an important juncture. The stability shown by the Bitcoin Risk Index and strong support at key price levels offer hope for investors. However, all eyes are on the possible surprises that the Fed might announce, which could change the market dynamics significantly.

Also Read: Maartunn Analyst Says December 2024 Crypto Market Pattern Repeats, What Does It Mean?

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Bitcoin Risk Index Signals Stability, All Eyes on Fed Decision. Accessed on September 17, 2025