Bitcoin (BTC) Attracts New Investors, Is a Price Rise Imminent?

Jakarta, Pintu News – The Bitcoin market which is currently in the low $110,000 range is showing a new wave of demand. The latest on-chain data shows that the net position of Bitcoin (BTC) holders who have recently entered the market has returned to positive territory, signaling the potential for strong price gains in the near future.

Increased Demand from New Holders

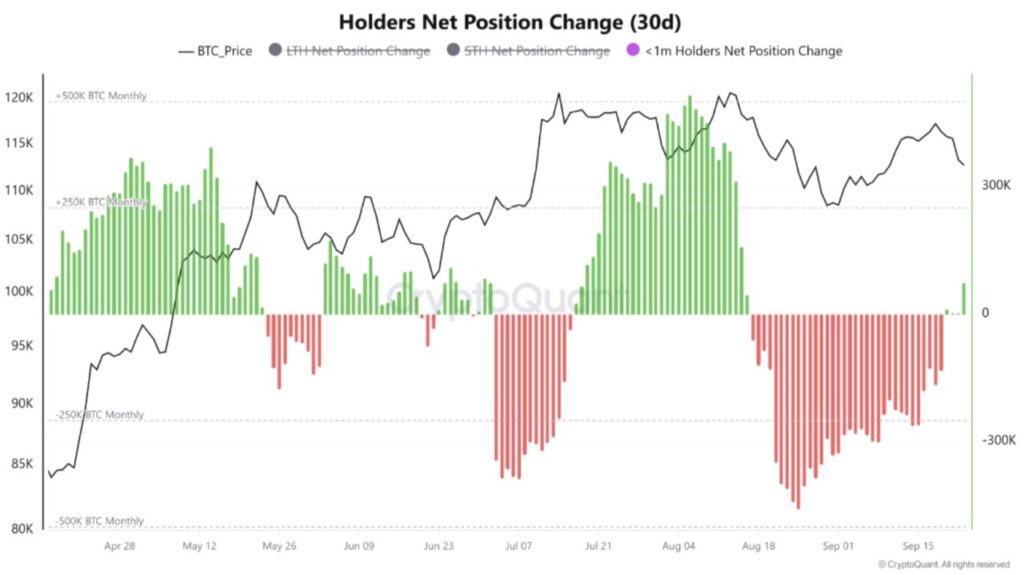

According to a CryptoQuant Quicktake post by Crazzyblockk, the net change in position (NPC) of new Bitcoin (BTC) holders who have owned the digital asset for less than one month has shifted significantly into positive territory. This suggests that there is a rapid flow of new demand coming into the market.

On September 23, an increase of +73,702 Bitcoin (BTC) was recorded on wallets that were less than one month old. The graph presented shows the spike after a previous negative period. This increase is significant because it helps absorb the supply sold by long-term holders (LTH), which are typically those who have held Bitcoin (BTC) for more than six months.

Also Read: 5 Key Points of Arthur Hayes’ Analysis: Bitcoin (BTC) Could Reach Rp56 Billion by 2028?

Strong Demand Structure Supports Price Increase

Currently, those long-term holders are selling their Bitcoin (BTC) at a rate of around -145,000 Bitcoin (BTC), a common indication of a bull market where early investors are realizing profits. Analysts add that this selling pressure is being offset by strong demand from new entrants, signaling a possible continuation of the rally.

In addition to the less-than-one-month-old cohort, short-term holders (STHs) – investors who hold Bitcoin (BTC) for less than six months – have also continued to accumulate. The NPC of STH has changed to +159,098 Bitcoin (BTC), reinforcing the strong demand for this top cryptocurrency from various investors based on their length of time in the market.

Lingering Concerns

Although demand from new cohorts is encouraging, there are still some concerns regarding Bitcoin’s (BTC) price action in the short term. For instance, Bitcoin’s (BTC) inflows to exchanges are still high, which raises concerns of greater selling pressure. In addition, the latest on-chain data shows that the current rally is majority led by retail investors.

Large Bitcoin (BTC) wallets – which hold significant amounts of Bitcoin (BTC) – seem to be absent from the current rally. However, the fundamentals of this digital asset continue to strengthen as the Bitcoin (BTC) network activity recently reached a new peak of 2025.

Conclusion: Exciting Outlook for Bitcoin (BTC)

With the current price at $112,804, Bitcoin (BTC) shows a slight decline of 0.2% in the last 24 hours. However, the strong demand structure and widespread market participation from new investors suggest that there is strong conviction among new investors. This supports the potential for price appreciation in the short to medium term.

Also Read: Deutsche Bank Predictions About Bitcoin (BTC) Becoming Central Bank Reserves in 2030!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Bitcoin Market: 73,000 BTC Wallets Emptied in 1-Month Rally. Accessed on September 25, 2025