4 Bitcoin Facts of the Day: Market Reset, Whale Sells, and Leverage Drops 30%

Jakarta, Pintu News – The cryptocurrency market is again entering an adjustment phase after high volatility in recent weeks. Bitcoin as the largest crypto asset is showing cooling signals characterized by whale selling and clearing excess leverage. This condition is important for both novice and experienced investors to understand in order to read the market direction more rationally.

1. Bitcoin enters reset phase after high volatility

Bitcoin (BTC) price movements have recently shown a phase that is often referred to as a market reset. This phase usually occurs after a sharp price spike followed by a healthy correction to balance the market. In the context of cryptocurrencies, the reset is considered a natural mechanism to reduce the risk of price bubbles.

Market resets also help restore a more stable market structure. Short-term speculative activity tends to decrease, while market participants begin to focus on fundamentals. For long-term crypto investors, this phase is often seen as a period of strategy evaluation, rather than a signal of panic.

Read More: 7 Impacts of Japan’s Political Victory on BTC & Gold Prices

2. Bitcoin Whales Begin to Release Holdings

On-chain data shows that Bitcoin whales, i.e. owners of large amounts of BTC, have started selling. This movement is often interpreted as profit realization after a previous price rally. In the cryptocurrency world, whale activity often significantly affects market sentiment.

While it may seem negative, whale selling does not necessarily mean a prolonged bearish trend. In many cases, the distribution of assets to the market actually increases liquidity. Novice investors need to understand that whale movements are a normal part of the crypto cycle and don’t always have a long-term impact.

3. Leverage Flushed to Tens of Percent

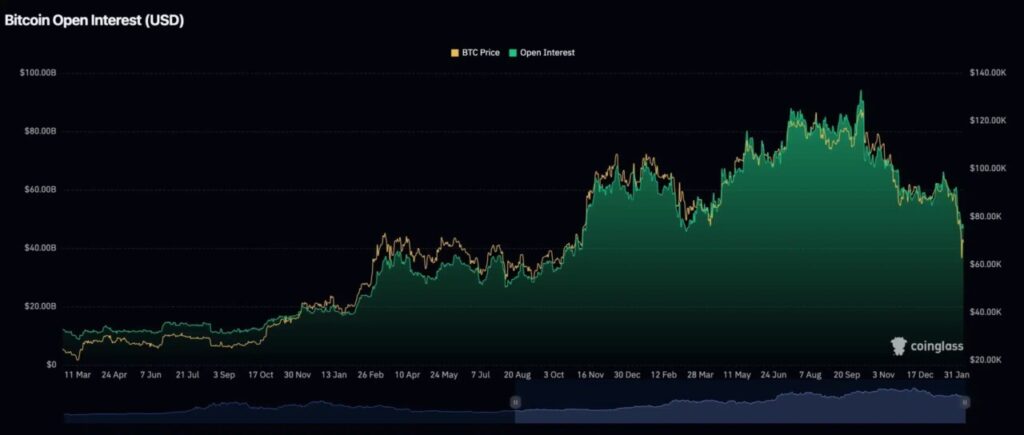

One of the main features of the reset phase is the decrease of leverage in the derivatives market. Highly leveraged positions that are too risky are usually liquidated when prices move against them. This makes the cryptocurrency market healthier as systemic risk is reduced.

The decrease in leverage also signals a reduction in extreme speculation. Traders are starting to be more cautious about opening new positions, especially on Bitcoin (BTC). For long-term investors, clearing leverage is often seen as a stronger foundation for further price movements.

4. Impact on Beginner Investors and the Crypto Market

For novice investors, Bitcoin’s reset phase can feel confusing. A flat or corrected price is often misinterpreted as the start of a downtrend. In fact, in the cryptocurrency cycle, this is often a period of consolidation before a new direction is established.

Crypto investors are advised to focus on risk management and investment objectives. Understanding market cycles, including whale action and leverage dynamics, helps with more objective decision-making. With a rational approach, the reset phase can be seen as a normal part of the cryptocurrency market journey.

5. What to Watch Out For Next

Going forward, market participants will be watching to see if the selling pressure from whales begins to subside. The stability of leverage and trading volume is also an important indicator of Bitcoin’s (BTC) direction. If market conditions remain under control, the opportunity for price recovery remains open.

For investors, it’s important to not just focus on short-term price movements. Understanding the macro context and on-chain data helps to read the crypto landscape more fully. Thus, investment decisions can be made based on analysis, not just market emotions.

Also Read: 5 Facts Robert Kiyosaki is Ready to Buy Bitcoin if it Falls to the Level of IDR101 Million

Follow us on Google News to stay up to date with the latest crypto and blockchain technology. Check Bitcoin price, USDT to IDR and Nvidia stock price tokenized via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMBCrypto. Bitcoin Enters a Reset Phase: Whales Sell as BTC Leverage Gets Flushed. Accessed February 10, 2026.