4 US Economic Events that Affect Crypto Markets This Week

Jakarta, Pintu News – Global financial markets, including cryptocurrencies, will face several important economic events from the United States this week. Interest rate decisions, press conferences, and other economic data will provide important clues about the future direction of the markets. Here’s the full news!

FOMC Interest Rate Decision

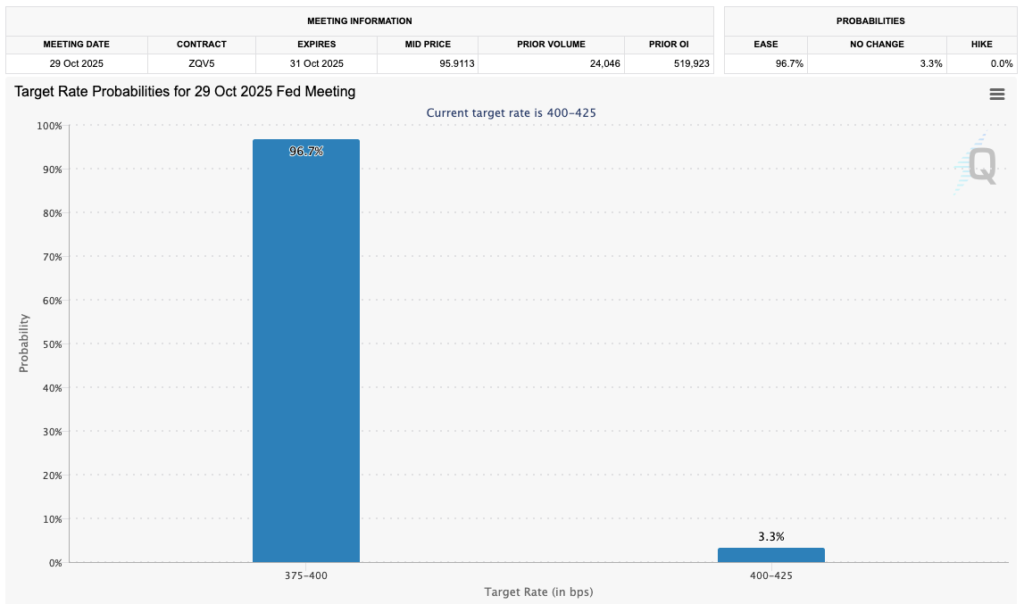

The Federal Open Market Committee (FOMC) will announce its interest rate decision on Wednesday, five days after the release of the September Consumer Price Index (CPI). According to CME’s FedWatch tool, market participants estimate there is a 96.7% probability that the FOMC will cut interest rates by 25 basis points to 4.00%. This decision is crucial as it can affect liquidity and trading behavior in all markets, including cryptocurrencies.

This decision is closely anticipated as it will signal the future of US monetary policy. Markets will be watching closely to see if the Fed will keep interest rates on hold or signal for future rate cuts. This decision not only affects the stock and bond markets, but also has a significant impact on cryptocurrencies such as Bitcoin and Ethereum .

Jerome Powell Press Conference

Half an hour after the FOMC decision announcement, Fed Chair Jerome Powell will hold a press conference. Markets will be watching Powell’s every word for clues on the Fed’s view of the economy and monetary policy going forward. A dovish or hawkish sentiment from Powell is expected to affect investor sentiment significantly.

Powell’s tone and comments will greatly influence market expectations of the Fed’s next move. If Powell signals that the Fed may continue to ease monetary policy, this could be positive for crypto markets. Conversely, hawkish comments could depress crypto asset prices.

Also read: 5 Important Facts About BTC Price Movement Ahead of November 2025

Initial Jobless Claims

Initial jobless claims data due on Thursday is also important to watch. This data shows the number of US citizens who filed unemployment insurance claims for the first time last week. This information provides a snapshot of the strength of the US labor market, which is an important indicator for the overall economy.

A strong labor market usually indicates a healthy economy, which can influence the Fed’s monetary policy. Strength or weakness in the labor market can affect Bitcoin (BTC) and other cryptocurrencies, as investors often seek safer or speculative assets based on economic conditions.

Also read: Strategy adds 390 BTC, bringing total holdings to 640,808 BTC!

Personal Consumption Expenditure (PCE)

Personal Consumption Expenditure (PCE) for September will also be in focus. In August, US PCE inflation rose at an annualized rate of 2.7%, faster than July and in line with expectations.

This data is important as it is an inflation indicator monitored by the Fed to determine interest rate policy. Traditional asset markets and cryptocurrencies react quickly to changes in US monetary policy. Therefore, PCE data that is higher or lower than expected can significantly affect cryptocurrency prices.

Conclusion

This week, financial markets, including crypto markets, will be heavily influenced by some key economic data from the US. The FOMC interest rate decision, Jerome Powell’s press conference, jobless claims data, and the PCE report are some of the events that investors will be waiting for. The outcome of these events will provide important clues about the future direction of the market.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. US Economic Events & Crypto Implications for October. Accessed on October 28, 2025

- Featured Image: Generated by Ai