5 reasons why November could be the most bullish month for XRP (XRP) according to analysts

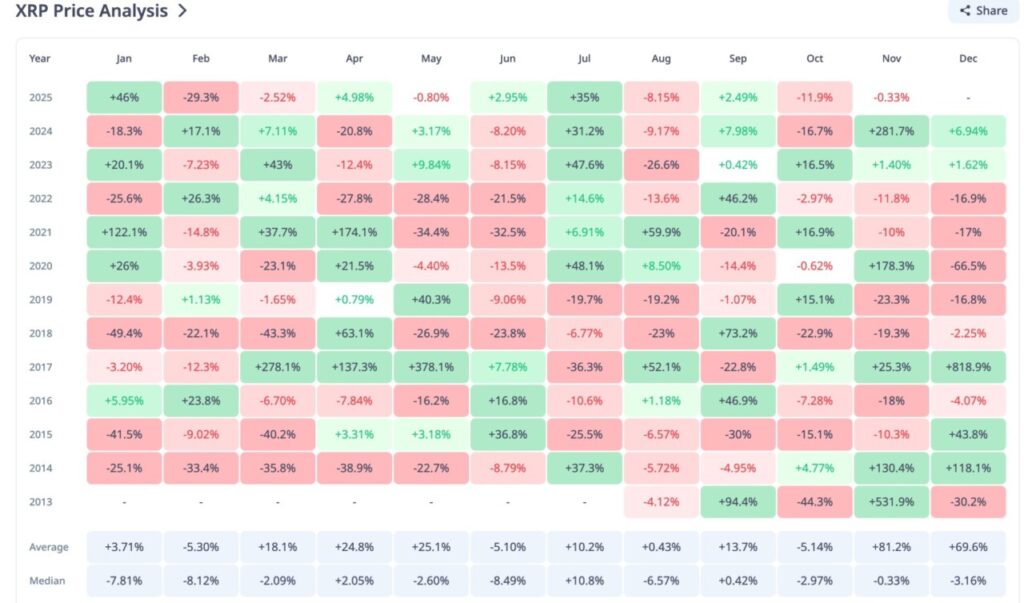

Jakarta, Pintu News – Although October 2025 closed on a red note, history suggests that November could be an important turning point for XRP prices. Based on historical data, November has been the month with the highest average gains throughout the year for XRP. With many investors monitoring this opportunity, let’s discuss 5 reasons why:

1. Average XRP Monthly Performance Highest in November: 81,2%

According to data from CryptoRank, XRP’s average monthly return in November reached 81.2%, the highest compared to other months.

In comparison, December only recorded an average of 69.6%. This fact makes November the most hunted month for XRP investors in the last 12 years.

Although not always green, November recorded the highest number of triple-digit gains than any other month in XRP’s history.

Also Read: 5 Shocking Ethereum (ETH) Predictions from Robert Kiyosaki that Made Crypto Hunted by Whales

2. November 2024: 281.7% Increase After Red October

Last year, XRP recorded a 16.7% drop in October 2024. However, the following month saw a 281.7% surge, which triggered a 600% price rally in total.

This shows that a red close in October does not necessarily hamper bullish performance in November.

With similar conditions in 2025, many analysts predict it is likely that this historical pattern will repeat itself and attract whale attention.

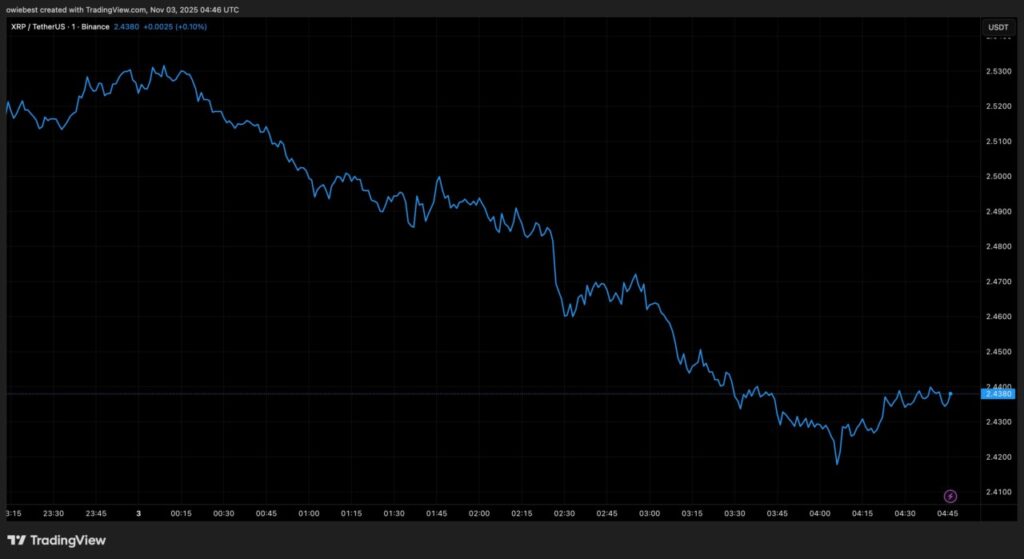

3. Initial surge may be curbed, but rally potential remains

Currently, XRP is in a consolidation phase after experiencing selling pressure. However, previous patterns suggest that momentum could reverse mid-month.

If XRP manages to break the resistance, the potential surge could push it towards significant gains, even becoming one of the resilient altcoins this month.

Technically, investors only need to wait for a confirmed breakout in anticipation of a big move.

4. Low XRP Open Interest: Early Signal for a Hike?

Data from Coinglass shows that XRP open interest plummeted by more than 50%, from over $10 billion to under $5 billion currently.

A similar phenomenon occurred in early November 2024, before XRP began its massive rally.

Low open interest usually reflects market calm, which can be the initial fuel for significant price movements.

5. Combination of Positive Fundamentals Could Trigger a Spike

In addition to historical and technical factors, there are a number of fundamental elements that could support XRP’s rally this November:

- Institutional adoption of XRP-based products slowly increases

- Volume of stablecoins on the network reaches record high

- Potential passage of crypto regulation bill in the US (CLARITY Act)

- General market sentiment begins to improve as Fed cuts interest rates

If all these factors converge, then XRP could very well surge and print a new ATH, or at least return to the highest price range of the year.

Conclusion

Although the crypto market is uncertain, historical data shows that November is the best month for XRP (XRP). Investors and traders are paying attention to important metrics such as open interest, short-term resistance, and macro sentiment. If the pattern repeats, XRP could be one of the top cryptos to surge this month.

Also Read: Can You Live Only on Crypto? Here are 3 Sources of Income & Challenges You Need to Know About

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Scott Matherson/NewsBTC. XRP Price Performance In November: History Says It’s The Most Bullish Month In History. Accessed on November 4, 2025