XRP Price Outlook for December 2025: Historical Trends, Key Levels, and What to Expect

Jakarta, Pintu News – The XRP price entered December after experiencing a weak performance in November, with a decline of almost 13% during the month. While December has historically been strong due to the big spike in 2017, in recent years the results have been much more moderate.

With fund flows into ETFs increasing, long-term holders starting to sell, and XRP trading near important resistance zones, traders are keen to see if December could provide a clearer opportunity.

This analysis will review XRP’s seasonal history, on-chain behavior, and the most crucial price levels.

December History and ETF Momentum for XRP: A Mix of Positive and Negative Signals?

At first glance, December looks like a strong period for XRP, with an average gain of around 69.6%. However, when looking at its median return, it actually registered a decline of -3.16%, which suggests that the huge +818% surge in 2017 has disproportionately lifted the long-term average.

Read also: Why the Crypto Market Is Crashing Today – Here’s What’s Causing the Drop

A more realistic comparison comes from recent years, with a rise of 6.94% in 2024 and 1.62% in 2023.

November 2025 itself showed a weak performance. XRP fell by almost 13%, making traders doubt whether December’s positive seasonal pattern is still relevant.

Ray Youssef, CEO of NoOnes, believes that December this year could be different as institutional demand is now active through ETFs. In his interview with BeInCrypto, he said:

“December is likely to look very different for XRP this year, especially as institutional demand has now arrived… XRP enters the month with momentum coming from the ETF hype, which has attracted large amounts of institutional interest and capital since its inception,” he said.

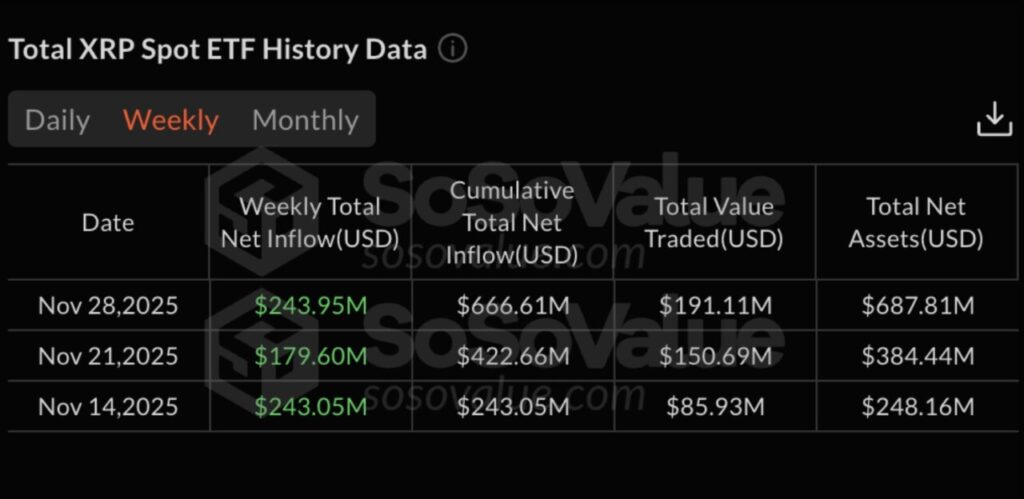

Youssef also noted that XRP has recorded ETF inflows for several consecutive days, totaling over $640 million. He adds:

“The continuation of ETF inflows is likely to be a key driver for XRP price movements in December,” he said.

However, Youssef remains cautious. He gave a warning:

“If general market conditions weaken further and ETF flows reverse, then XRP is likely to follow the movements of BTC and ETH, and could test the $2 level again,” he added.

Overall, the combination of December’s inconsistent history and the renewed momentum from ETFs suggests that XRP’s performance in December depends largely on whether or not institutional demand will continue.

On-Chain Signals Do Not Fully Support the Bullish Trend

The current on-chain picture for XRP is not yet fully supportive of a potential December rally. Long-term holders – especially the group with 1-3 years of holding duration – are still seen reducing their balances.

This data is taken from HODL Waves, which shows how XRP supply is spread based on the length of time the tokens have been held. In the past month, the 1-2 year holding group decreased from 9.72% to 8.516%, while the 2-3 year group decreased from 14.80% to 14.251%.

While these declines may seem small, their impact is significant as both groups hold a large share of the outstanding supply. Their selloffs could undermine any attempts at price increases.

Ray Youssef also gave a warning in this regard. He stated:

“Long-term holders still control most of the circulating supply… XRP can only post significant gains in December if institutional demand is strong enough to withstand selling pressure from this group,” he said.

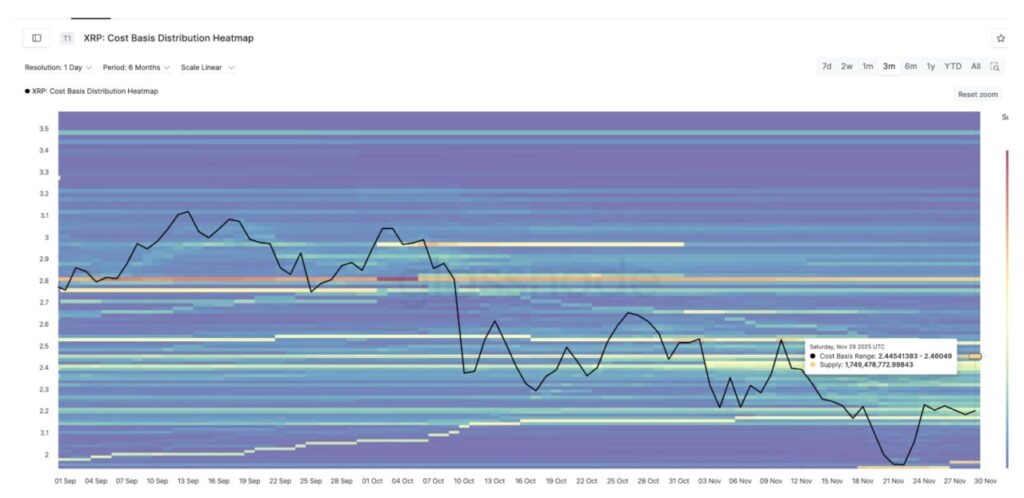

The cost basis heatmap also confirms this risk. It can be seen that the largest supply cluster is in the price range of $2,445 to $2,460, where approximately 1.749 billion XRP resides.

This area has been a proven resistance zone in the past. So, while ETF inflows remain strong, XRP prices still need to break through this “wall” for a clean bullish trend to form.

Read also: 4 Catalysts that Could Push Solana Prices Up to 80%

Overall, the distribution of long-term holders and the concentration of purchase costs in the resistance area make it clear that the XRP price in December likely needs a big push to really gain momentum.

XRP Price in December: Key Levels and Most Realistic Scenarios

XRP price is currently trading around $2,196, slightly above the second bounce point from the $1,772 level. This pattern forms a clear double bottom structure – with one bounce occurring in October and another in late November.

This technical pattern supports a potential short-term recovery, but XRP needs to break the $2,307 level first, and then the key breakout level at $2,459. This $2,459 level coincides with the cluster area in the cost basis heatmap.

A clean daily close above $2,459 would open the way to the next zone around $2,612. This level aligns with the 0.618 Fibonacci level, the buying cost cluster, and also Ray Youssef’s outlook. As he says:

“A more realistic target for December is $2.60. A clear breakout above $2.60 would be the first indication of a strong bullish shift,” he said.

Both technically and fundamentally, the primary target is in the range of $2.60-$2.61.

However, if ETF inflows weaken and Bitcoin and Ethereum prices decline, XRP will likely follow the general market direction. Youssef also noted:

“If BTC and ETH drop again in December, XRP will most likely follow suit,” he said.

If this scenario plays out, the important zone to watch is $2,119. A close below this level could reopen the way to support at $1,772.

Currently, the XRP price in December is between two paths. If ETF demand remains strong, XRP could break $2,459 and proceed to $2,60-$2,61. Without such support, the price will most likely continue to follow Bitcoin’s direction and return to the lower price range.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. What To Expect From XRP Price In December 2025. Accessed on December 1, 2025