10 Ways to Learn Crypto from Zero: A Basic Guide to Start Investing Safely

Jakarta, Pintu News – Interest in cryptocurrencies continues to rise as blockchain technology develops and the adoption of digital assets in various sectors. Investopedia emphasizes that learning crypto from scratch requires a structured understanding as this market has high risks, extreme volatility, and technical challenges.

Therefore, beginners need to follow the basic steps in order to enter the crypto ecosystem in a more measured, safe, and relevant way to long-term financial goals.

1. Understand Risk: Invest Only What You’re Ready to Lose

Investopedia reminds us that crypto is still a highly volatile asset and its movements can change drastically in a short period of time. Therefore, beginners should understand that only funds that are ready to be lost should be allocated to digital assets. This principle maintains financial stability and helps reduce emotional stress in the investment process.

Also Read: 3 Stock Sectors Predicted to be Bought by Investors When the Technology Sector Weakens

2. Use Dollar-Cost Averaging (DCA) Method for Consistency

According to Investopedia, dollar-cost averaging is an effective strategy for beginners as it reduces the risk of mistiming the market. This method allows for the purchase of small amounts of assets at regular intervals so that emotions in decision-making are suppressed. This systematic approach helps build investment positions gradually and more steadily.

The Pintu app provides an Auto DCA feature that makes it easier for investors to implement this strategy. Investors can set up automatic Bitcoin purchases at specific time intervals, such as weekly or monthly. This allows investors to consistently accumulate Bitcoin without the need to constantly monitor the market.

3. Learn Crypto Fundamentals Before Entering the Market

Investopedia explains that fundamental research in crypto is different from stocks because the technology aspect is more dominant. The analysis includes an assessment of the token’s utility, developer capacity, adoption rate, and community strength. By understanding the fundamentals, beginners can avoid speculative projects that have no long-term value.

4. Start with the Top Crypto by Market Capitalization

According to Investopedia, large assets like Bitcoin and Ethereum have a strong track record and have weathered numerous market cycles. Big crypto tends to be more stable than low-cap altcoins, which have higher risks. Beginners are advised to focus on major assets before exploring other projects.

5. Use Secure Storage with a Trusted Wallet

Investopedia emphasizes the importance of storing crypto through non-custodial wallets or hardware wallets for long-term security. These storage methods provide protections such as encryption, PIN, multsignature, and cold storage. Recovery keys should be kept physically, not stored digitally without protection.

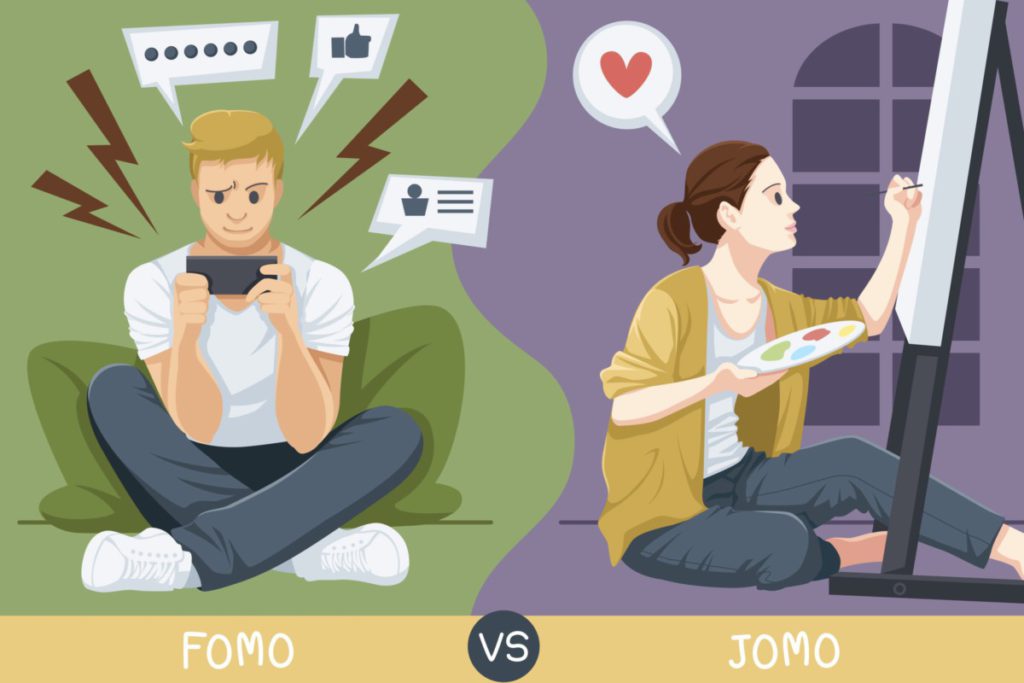

6. Be Objective and Avoid Hype

According to Investopedia, beginners should avoid decisions based on fear of missing out (FOMO) or the temptation of quick profits. Emotional decisions often lead to losses, especially on assets without strong fundamentals. Objectivity is necessary to filter information and avoid fraudulent schemes.

7. Learn Blockchain Technology and its Technical Components

Investopedia emphasizes that understanding technicalities such as consensus, hashing, and smart contracts is important for understanding the prospects of crypto projects. By understanding the underlying technology, beginners can evaluate the long-term value of an asset. Also, following industry publications helps beginners stay updated with the latest innovations.

8. Keep Up to Date with Regulations and Global News

Investopedia explains that changes in government policies and regulations can significantly affect crypto prices. Therefore, keeping up with news, court decisions, and regulatory actions is an important part of crypto learning. Regulatory analysis helps beginners understand market risks more clearly.

9. Use Crypto Indicators to Make Decisions

Investopedia suggests using indicators such as moving averages, relative strength index, and on-chain data for analysis. These indicators help beginners understand momentum and potential changes in market trends. However, indicators should be used as supporting tools, not the primary decision-makers.

10. Stay Disciplined and Use a Consistent Framework

According to Investopedia, discipline is a key foundation in learning and investing in crypto. Beginners should have a clear strategy, allocation plan, and risk limits before entering the market. Regular evaluation helps to refine investment decisions and build a better understanding of the digital market.

Also Read: 4 Key Risks of Cardano (ADA) in December 2025 that Crypto Investors Should Monitor

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

What are the first steps to learning crypto from scratch?

The first step is to understand the risks and learn the basics of blockchain before starting to buy digital assets.

Should beginners buy Bitcoin right away?

According to Investopedia, Bitcoin and Ethereum are the more stable large assets, but the selection still depends on personal research.

What is the minimum capital to start learning crypto?

Investopedia explains that beginners can start small, provided they are prepared for market volatility.

Does learning crypto require an understanding of technology?

Yes. A basic understanding of blockchain helps beginners assess the quality and prospects of crypto projects more accurately.

Is following the news important in learning crypto?

Investopedia emphasizes that regulation and global news have a significant influence on crypto price movements.

Reference

- Rahul Nambiampurath / Investopedia. 10 Rules of Investing in Crypto. Accessed on December 2, 2025.