Nasdaq Warns Bitcoin Treasury Company KindlyMD, Shares Remain Below $1

Jakarta, Pintu News – Nasdaq, a major US stock exchange, has issued a warning to Bitcoin treasury company KindlyMD, after its share price continued to trade below the $1 minimum threshold for more than 30 consecutive business days.

This warning puts KindlyMD at risk of delisting – or being expelled from Nasdaq – if it is unable to meet the share price requirements within the set timeframe. This development caught the market’s attention as it involves a company that is one of the large public Bitcoin holders and combines digital treasury and healthcare strategies.

KindlyMD Shares Below Nasdaq Minimums

KindlyMD, which trades on Nasdaq under the code NAKA, has received a formal notice for its shares trading below $1 for 30 consecutive business days. As per Nasdaq’s listing rules, a company must have a closing share price above $1 for at least 10 consecutive trading days to remain eligible for listing. If it does not meet these requirements, the exchange may initiate delisting proceedings.

Nasdaq has given KindlyMD 180 days, or until June 8, 2026, to lift its share price above this limit consistently for a period of 10 consecutive days. If it fails to achieve this target, the company may seek an extension or move its listing to the Nasdaq Capital Market, subject to meeting other applicable requirements.

Also Read: Bitcoin, Ether, and XRP Decline Increases Toward the End of 2026, Why?

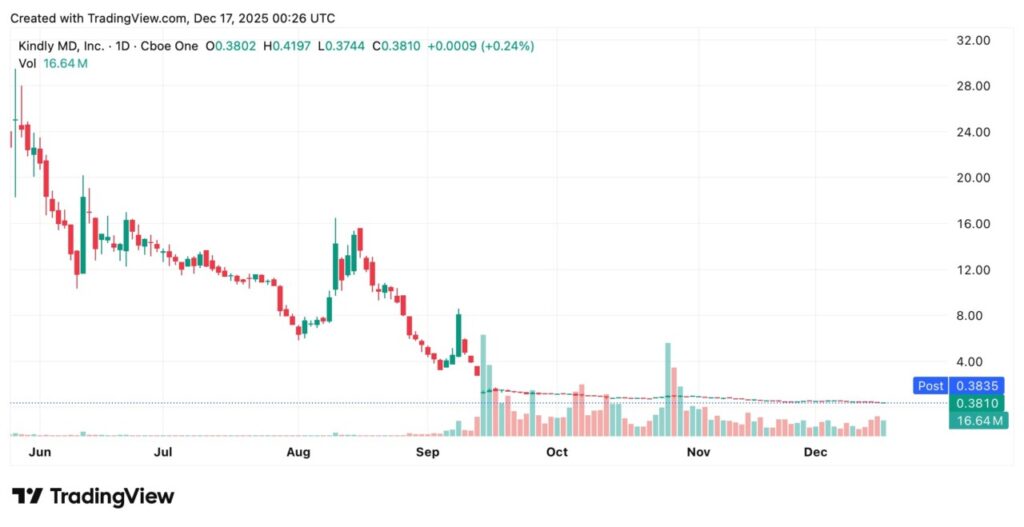

Sharp Share Price Decline

NAKA shares fell dramatically after reaching an annual peak of around $34.77 post the merger with Nakamoto Holdings in 2025, then plummeted almost 99% to trade at around $0.38 per share when the notice was published. The decline is attributed to heavy selling pressure after a number of previously restricted shares became available for free trading, increasing supply and weakening prices.

Despite this, KindlyMD is still listed as one of the large public Bitcoin holders with over 5,398 BTC in its reserves. However, the amount of BTC held does not guarantee that the share price will recover, as equity market dynamics and investor expectations of the Bitcoin treasury business model also affect valuations.

Delisting Risk and Recovery Strategy

According to the Nasdaq notice, KindlyMD’s shares remain tradable on the exchange during the recovery period. The company has several options to try to remedy the situation, including conducting a reverse stock split or taking other steps to increase demand for its shares. However, there is no guarantee that these strategies will work, and failure could lead to NAKA shares being delisted.

If the stock listing switches to the Nasdaq Capital Market, the company will still have to comply with different pricing and shareholder count requirements, making the recovery process more complex. Failure to meet these rules could mean loss of access to retail and institutional investors who can only trade on large exchanges such as the Nasdaq Global Market.

Implications for the Crypto Industry and Bitcoin Treasuries

The KindlyMD case reflects the challenges facing public companies that combine traditional corporate strategies with extensive exposure to cryptocurrencies such as Bitcoin. The extreme share price decline shows that crypto volatility not only affects the digital asset market, but can also have serious consequences for companies that take a Bitcoin-based treasury approach.

This incident may serve as a reference for other investors and companies considering the Bitcoin treasury model, highlighting the need for a well-thought-out capital markets strategy and a strong understanding of exchange rules if it is to maintain listing status on a major exchange.

Also Read: 7 Bitcoin (BTC) Facts Drop to Around $85,000, New Losses in the Global Crypto Spotlight

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

What caused Nasdaq to issue a warning to KindlyMD?

Nasdaq issued a warning as KindlyMD (NAKA) shares traded below $1 for 30 consecutive business days, violating the exchange’s minimum listing price rule.

What risks does KindlyMD face as a result of this warning?

If the stock does not return above $1 for 10 consecutive days in the period until June 8, 2026, Nasdaq may initiate delisting proceedings.

What is NAKA’s current share price?

When the notice was issued, NAKA shares were trading at around $0.38, down almost 99% from their peak in 2025.

Does KindlyMD still hold Bitcoin?

Yes, the company is still recorded as having more than 5,398 Bitcoin (BTC) in its reserves, making it one of the public companies with significant BTC holdings.

What options does KindlyMD have to maintain the listing?

Companies can try strategies such as a reverse stock split or moving the listing to the Nasdaq Capital Market, but must still meet pricing requirements and other applicable rules.

What are the implications of this case for the Bitcoin treasury sector?

This case shows that Bitcoin treasury strategies face significant risks from market volatility and traditional exchange rules, and this should be considered by investors and other companies following a similar model.

Reference

- Bitcoin.com News. Nasdaq Warns Bitcoin Treasury Firm KindlyMD as Shares Linger Under $1. Accessed December 17, 2025.