7 Facts XRP & Solana (SOL) Enter the “Big Leagues” with New Futures from CME Group

Jakarta, Pintu News – The latest development in the cryptocurrency market represents a major step towards integration between digital assets and traditional financial markets with the launch of spot-quoted futures for Ripple and Solana by CME Group, one of the world’s largest derivatives exchanges.

The move reflects the growing demand for crypto products that are closely monitored and traded within a regulatory framework, and are in the spotlight for institutional and professional investors around the world.

Addition of Spot-Quoted Futures XRP and Solana

CME Group officially launched spot-quoted futures for XRP and SOL on December 15, 2025, expanding its crypto product line that previously included spot-quoted futures for Bitcoin and Ether . The new contracts are designed to reflect spot market prices more accurately.

Spot-quoted futures contracts are designed to track spot market prices without the need for financing adjustments orrollovers that often occur with traditional futures. This gives traders additional flexibility to adjust positions according to their long or short-term view of the digital asset.

Also Read: Bitcoin, Ether, and XRP Decline Increases Toward the End of 2026, Why?

Wider and more organized market access

XRP and SOL futures are now available under the rules of regulated exchanges, providing broader access for investors seeking exposure to crypto assets through standardized capital market instruments. The products can also be traded alongside major indices in the US stock market such as the S&P 500 and Nasdaq-100, extending the relevance of the contracts beyond the pure crypto market.

The launch of such regulated futures is considered a way to bridge the gap between traditional markets and digital assets, allowing market participants to manage risk or take positions without having to hold crypto assets directly.

Impact for XRP and Solana on the Derivatives Market

This move puts XRP and SOL on par with Bitcoin (BTC) and Ether (ETH) in terms of access to spot-quoted derivatives products offered by international exchanges. This means that both assets now have a more mature market structure, with more stable liquidity than in the early days of crypto futures.

This contract comes with a smaller contract size than previous products on the CME, encouraging wider trader participation, including active day traders and long-term investors looking to capitalize directly on market prices.

Relevance for Institutional and Retail Markets

The launch is not just a technical move, but also a signal that demand for regulated crypto products continues to rise from both market segments – institutional and retail. The demand for tools that enable more sophisticated risk management such as futures is part of a broad trend where digital assets are increasingly seen as an asset class worthy of inclusion in professional portfolio frameworks.

Regulated futures provide a higher compliance and transparency structure than contracts on offshore crypto exchanges, which often have different levels of risk. This is relevant for institutions that need to comply with local regulatory reporting and risk standards.

The Context of XRP and SOL Adoption in Derivatives

Previously, XRP and Solana have shown growing interest in the derivatives market, including achieving significant open interest in futures prior to the spot-quoted launch. The data suggests that institutions are increasingly comfortable using futures tohedge their crypto exposure.

In addition, the market has also seen the development of XRP and SOL-based options products on CME before, further expanding derivative instruments beyond conventional futures.

Implications for Crypto Market Direction

The inclusion of XRP and SOL in CME’s spot-quoted futures lineup shows that altcoins that are not just Bitcoin or Ether now have serious derivatives market infrastructure on global exchanges. This may strengthen the perception of both assets as part of a more mature digital asset ecosystem.

Going forward, the possibility of adjusting trading hours to 24/7 is also being considered to bridge the typical crypto trading time compared to traditional market hours, although it is still pending regulatory approval.

Conclusion

CME Group ‘s launch of spot-quoted futures for XRP and Solana (SOL) is an important milestone in the evolution of the global crypto market. By adding these two contracts to its roster of regulated contracts, CME is expanding market access for traditional investors and increasing the depth of the crypto derivatives market. Looking ahead, such products are being monitored as further indicators of the integration of digital assets into the broader global financial system.

Also Read: 7 Bitcoin (BTC) Facts Drop to Around $85,000, New Losses in the Global Crypto Spotlight

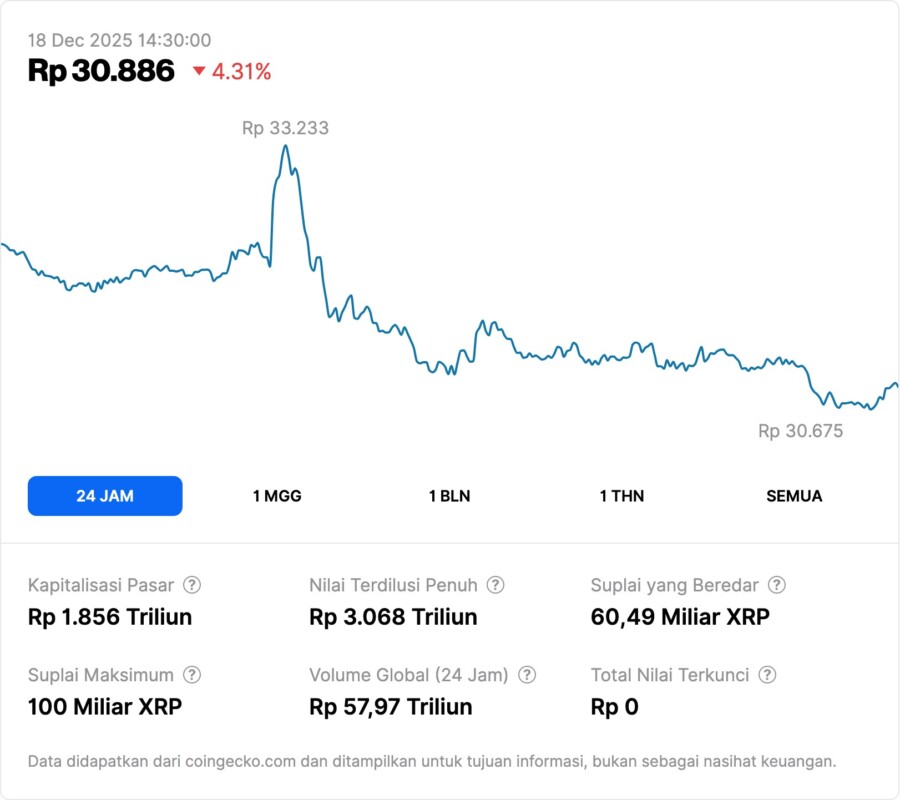

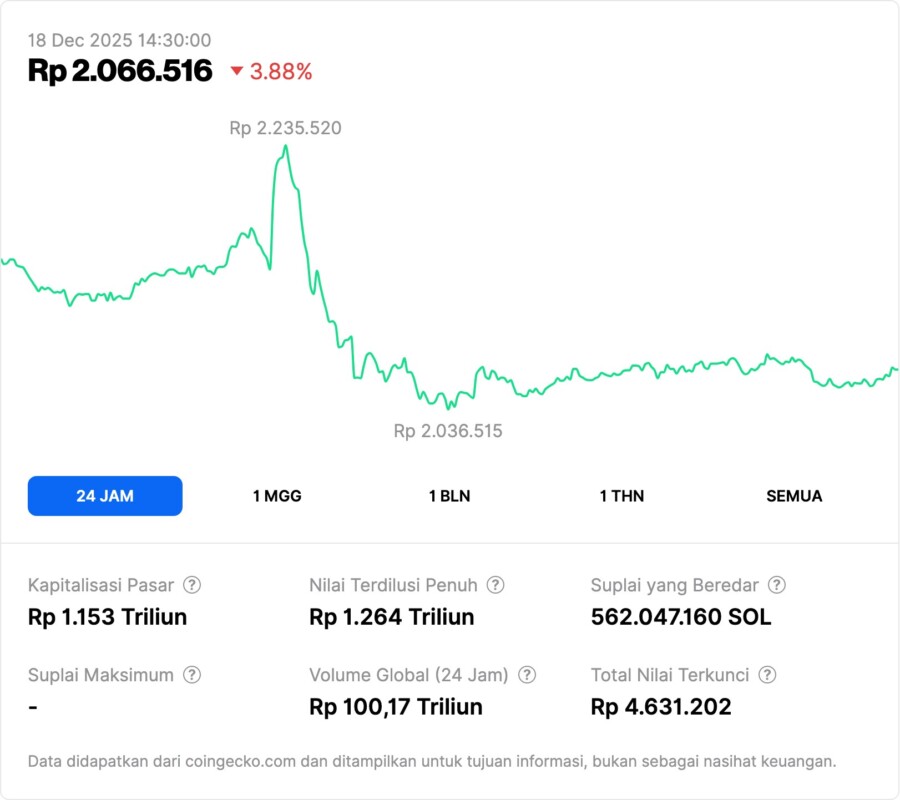

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

What do spot-quoted futures mean for XRP and SOL?

Spot-quoted futures are futures contracts designed to reflect spot market prices directly, allowing traders to manage positions without frequent contractrollovers.

How are these futures different from traditional futures?

Spot-quoted contracts follow the spot market price and provide greater flexibility in position management as there is no need for periodic financing or rollover adjustments.

What impact will this launch have on the adoption of XRP and SOL?

The launch supports institutional adoption as it provides a regulated and transparent market structure for investors, including large institutions.

Who can utilize these futures?

Retail and institutional traders can use these contracts forhedging strategies or exposure to price movements of XRP and SOL without holding the digital assets directly.

Does this impact the spot price of XRP and SOL?

While futures do not guarantee spot price movements, increased access to derivatives can expand liquidity and market participation.

Reference

- Bitcoin.com News. XRP and SOL Enter the Big Leagues With CME Group’s Latest Futures Launch. Accessed December 19, 2025