Has the Era of Bitcoin Supercycle Arrived? Check out the Review!

Jakarta, Pintu News – Bitcoin has experienced a more than 30% drop in value since early October, drastically changing market psychology. What was previously considered a routine correction is now starting to be seen as the peak of a cycle by analysts. Initially optimistic market sentiment has now given way to fear and apathy, signaling a significant shift in Bitcoin’s market dynamics.

1. Bitcoin (BTC) Experienced a Drop of Over 30%

Since the beginning of October, Bitcoin (BTC) has experienced a decline of more than 30%, which drastically changed the psychology of the market. This significant drop has led analysts to start considering that the market may have reached the peak of its cycle. What was previously considered a routine correction is now starting to be viewed as the end of Bitcoin’s bull cycle, with the market entering a more fearful and apathetic phase.

Also Read: How Crypto is Remaking the Financial System, AI, and Privacy Until 2026 According to a16z Crypto

2. Bitcoin Supercycle: Institutional Adoption as a Key Factor

Based on CryptoQuant’s report, institutional adoption is becoming a key factor in the formation of Bitcoin’s supercycle thesis. The presence of a spot Bitcoin Exchange-Traded Fund (ETF), such as the one launched by BlackRock, provides stable and regular demand from the traditional financial sector.

This is in contrast to the speculative nature of retail fund flows, creating more consistent uptake rather than short-term hype. On-chain data shows that Bitcoin reserves on exchanges are declining, indicating that Bitcoin is being held more for the long term.

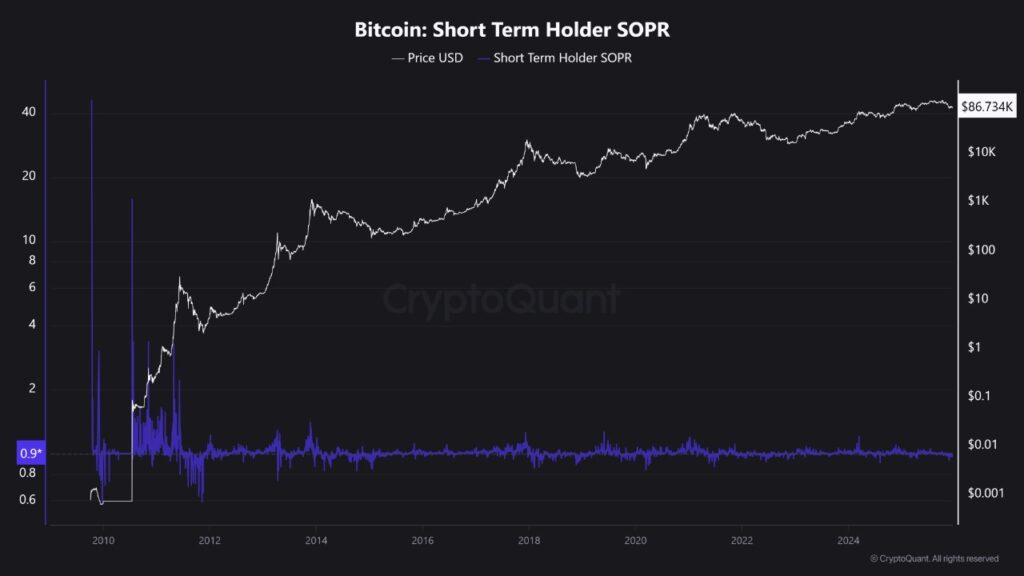

3. Balanced Spent Output Profit Ratio (SOPR)

Despite the decline in Bitcoin price, the Spent Output Profit Ratio (SOPR) shows a more rational movement. While there is profit-taking, there is no euphoric surge as often seen at the peak of previous market cycles. This suggests that the Bitcoin market is now more mature and disciplined, reflecting a more stable and controlled market structure, despite the price correction.

4. Rising Crypto Infrastructure Supports the Role of Bitcoin (BTC)

A maturing infrastructure is strengthening Bitcoin’s (BTC) position as the premier digital asset. With Ethereum’s Fusaka upgrade and the rapid expansion of the Layer-2 network, transactions in the crypto ecosystem are now faster and cheaper. This allows Bitcoin to be increasingly accepted as a settlement and reserve asset in the digital economy, which is increasingly integrated with the global financial system. These improvements make Bitcoin even more relevant and instrumental in the digital economy of the future.

5. Bitcoin Price Action Shows Weak Structure Near Key Supports

Bitcoin (BTC) price is still showing a weak structure, especially near the key support around $86,000-$87,000. Based on the 4-hour chart, Bitcoin continues to fail to overcome important resistance in the range of $92,000-$93,000. Moreover, the long-term moving averages show a downward trend, further reinforcing the bearish bias. Despite recovery attempts, the potential for continued decline is still huge, given the market uncertainty.

Also Read: 7 XRP Facts on Institutional Finance via VivoPower’s $900 Million Exposure Structure

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

What caused Bitcoin’s (BTC) price to drop more than 30% since October?

The decline in Bitcoin (BTC) price is due to a broader market correction and psychological uncertainty among investors. This was also driven by the price decline of other major assets such as Ethereum (ETH).

Is there a chance for Bitcoin (BTC) to recover?

Despite the decline, the chances of a Bitcoin (BTC) recovery remain if the price can hold above the $86,000 support level and overcome the existing resistance around $92,000.

What is the Bitcoin supercycle?

A Bitcoin supercycle refers to a phenomenon where greater institutional adoption, such as Bitcoin ETFs from large corporations, creates stable and sustained demand for Bitcoin, which can alter the previous cyclical pattern of the Bitcoin market.

How does crypto infrastructure play a role in the price of Bitcoin (BTC)?

Crypto infrastructure improvements, such as Ethereum’s (ETH) Fusaka upgrade and Layer-2 network expansion, enable faster and cheaper transactions, strengthening Bitcoin’s (BTC) position in the global digital economy.

Reference

- NewsBTC. From Cycles to Continuity: Why Bitcoin’s 4-Year Pattern May Be Breaking. Accessed on December 19, 2025