Which Altcoins Are Crypto Whales Buying and Selling Before the US CPI Release?

Jakarta, Pintu News – Crypto whales are positioning themselves cautiously ahead of the US CPI data release, and the movement is not one-sided.

Inflation is forecast at 3.1% year-on-year for November, with core CPI close to 3.0%, while labor market data continues to weaken. This combination leaves the market torn between hopes of a pending rate cut and hopes of renewed easing in 2026.

As a result, large holders are hedging with three very different strategies. One involves adding exposure as the market rallies, another trimming positions during a rally, and the last strategy suggests a clear internal conflict between two different groups of crypto whales.

Pippin (PIPPIN)

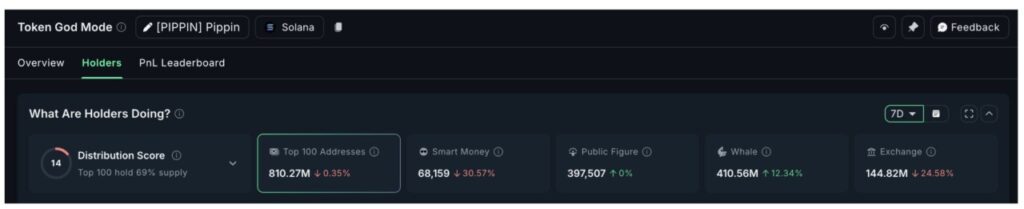

If you were monitoring what the crypto whales were buying ahead of the US CPI data release, Pippin (PIPPIN) became a clear case of accumulation. The whales have increased their holdings by 12.34%, lifting their total stash to 410.56 million PIPPIN. They added about 45 million PIPPIN during the period. At current prices, this accumulation is worth almost $19 million.

Read also: Which Crypto will Shine in 2026: Bitcoin, Ethereum, or XRP? Check out the answer!

Importantly, these purchases have not stopped. Whale balances have continued to increase even in the last 24 hours, albeit slowly. This behavior indicates a built-up position, not short-term trading.

The pricing structure helps explain this sense of confidence.

Pippin briefly touched an all-time high on December 16 and continues to trade slightly below that zone. The token remains inside a bullish flag pattern, a continuation pattern that often ends with higher price movements when broader market conditions are favorable.

The whales seem to be positioning themselves for the outcome, perhaps anticipating a neutral or slightly lower CPI release, which would keep rate cut expectations alive until 2026.

The key level above is at $0.52. A clean daily close above this level would confirm the breakout and push PIPPIN towards price discovery, opening up room for price movement higher from current levels.

Downside risks remain clearly defined. A loss below $0.22 would weaken the flag structure and weaken the bullish case. A deeper drop could pull the price towards $0.10, which serves as a full invalidation.

Overall, Pippin reflects risk selective behavior. Whales are adding exposure where structure supports upside potential, but only ahead of macro events that could benefit their positions.

Maple Finance (SYRUP)

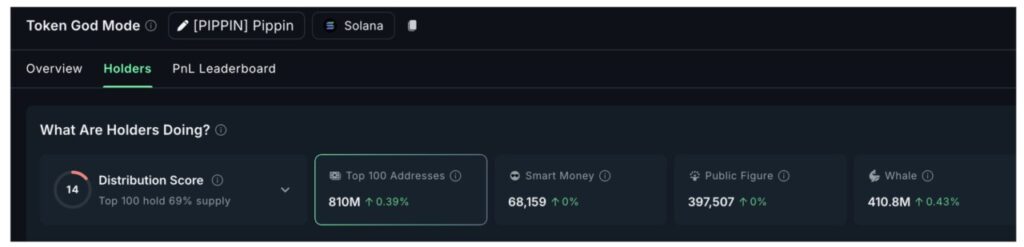

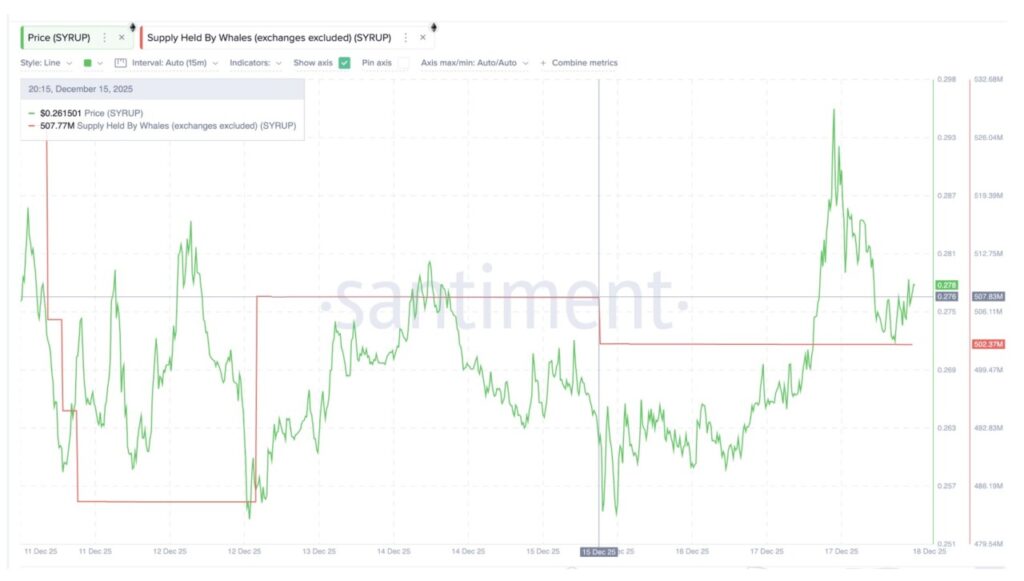

On the selling side, Maple Finance shows a very different picture. SYRUP is up almost 4% in 24 hours and around 5% in the last seven days, beating the broader market which is weak. Despite this strength, crypto whales are moving in the opposite direction.

Whale holdings peaked at 507.83 million SYRUP on December 15. Since then, their balance has dropped to 502.37 million, meaning whale has sold around 5.46 million SYRUP in just a few days. This equates to around $1.5 million in net distributions.

The divergence between rising prices and declining whale supply is crucial, especially ahead of major macro events such as the CPI release.

From a chart perspective, SYRUP had printed lower peaks between November 24 and December 18. Meanwhile, the RSI (Relative Strength Index), which measures momentum, printed higher peaks. This created a hidden bearish divergence. Momentum did increase, but the price did not follow. This combination often signals exhaustion, not strength.

The immediate downside level is at $0.25. If it breaks that level, the price could drop towards $0.23. On the upside, SYRUP must reclaim $0.31 with a clean daily close to invalidate the bearish setup. Without that confirmation, the rally remains vulnerable.

This selling behavior suggests that crypto whales are protecting themselves from macro risks. If CPI shows high numbers and expectations of interest rate cuts are delayed, DeFi exposure with higher betas becomes less attractive.

Read also: Stage 5 Aster Airdrop to Start December 22: What Can We Expect?

Fartcoin (FARTCOIN)

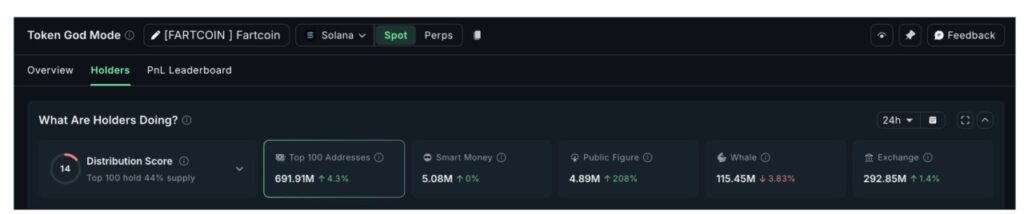

Fartcoin presents the most contradictory crypto whale setup ahead of the CPI release. The price action has been very weak. FARTCOIN is down almost 17% in the last 24 hours. Under normal conditions, a move like this would trigger widespread selling. That’s exactly what the small whales seem to have done in the last 24 hours.

The standard whale balance has dropped by 3.83%, reducing holdings to 115.45 million FARTCOIN. This represents a net reduction of about 4.6 million tokens. However, the mega whale tells a different story. The top 100 addresses have increased their holdings by 4.3%, lifting their total stash to 691.91 million FARTCOIN.

This creates a direct conflict between groups of whales.

On the 12-hour time frame, a bearish EMA crossover formation is forming. The exponential moving average (EMA) is giving more weight to the recent prices. The 20-period EMA is getting closer to a bearish crossover below the 50-period EMA, while prices continue to weaken.

This setup favors further declines. The most important level in the near term is around $0.26, which is in line with the 0.618 Fibonacci retracement and a structurally active demand zone. If it breaks that level, the door to $0.23 opens, and possibly down towards $0.17 if selling accelerates.

For the bullish case to regain credibility, FARTCOIN must reclaim $0.35. This level has capped any rebound attempts since December 14.

The small whales seem to be respecting the bearish structure, while the mega whales are positioning themselves early, likely betting on volatility around CPI and the tendency of Solana-based meme coin to see sharp bounces during macroeconomic-influenced moves.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Crypto Whales Buy, Sell Tokens Ahead of US CPI. Accessed on December 19, 2025