Whales Are Making Waves: Big Investors Scoop Up These 4 Altcoins Worth Millions

Jakarta, Pintu News – The crypto market has seen another interesting move at the end of the year, this time coming from whale activity – a term for large investors who are able to shake up the market with one big move.

In recent days, on-chain data has revealed that whales have been buying up four major altcoins with accumulated values reaching millions of dollars, even amidst sluggish market conditions.

1. AAVE

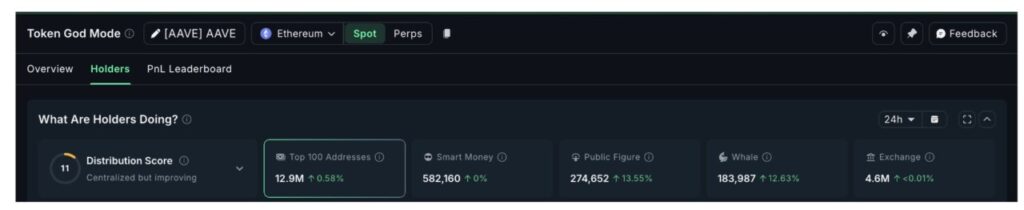

Reporting from BeInCrypto, although the balance on the exchange increased, the large holders of AAVE actually moved in the opposite direction. On December 23, whale Aave increased their holdings by 12.63%, bringing their total assets to 183,987 AAVE.

Read also: Bitcoin Whale Doubles Short Investments in BTC, ETH, and SOL Worth $243 Million!

This means that there is a new accumulation of about 20,600 tokens, worth approximately $3.1 million based on the current price.

At the same time, wallets belonging to public figures – which include verified funds and well-supervised entities – also increased their holdings by 13.55%, bringing the total to 274,652 AAVE. This increase is equivalent to about 32,700 tokens, or roughly $5 million.

Combined, these two groups added over 53,000 AAVE in just one day. At current prices, that’s over $8 million worth of accumulation amid weak market conditions.

This difference in direction is important. When supply on the exchange increases but whales increase their holdings, it often signals that short-term fears are being absorbed by long-term conviction. Instead of reacting to governance issues or momentary news, large holders seem to be realigning their positions based on market structure, not headlines.

2. Cardano

Wallets holding between 100 million to 1 billion ADA – the second-largest whale group on the Cardano network – have increased their holdings since December 20.

Their balance rose from 3.74 billion ADA to 3.84 billion ADA, an increase of about 100 million ADA. At current prices, the addition is worth about $36 million, which comes amid weak price movements.

This buying action aligns with changes to the Spent Coins Age Band metric, a measure that tracks the number of coins that change hands – often reflecting selling activity.

On December 16, the number of spent coins reached its peak, signaling that whales were distributing supply. However, when the amount of spent coins decreased, whale accumulation resumed.

This pattern looks consistent:

- As coin activity increases (which likely means selling pressure rises), the whales hold back.

- When selling activity weakens, they go back to buying.

This behavior suggests that the big holders are reacting to the easing of selling pressure, rather than chasing price increases. This also reinforces the bullish RSI divergence signal, signaling that the weakening selling pressure is now receiving support from the big whales’ buying.

3. Midnight

NIGHT’s balance on the exchange increased sharply on December 23. Holdings on the exchange rose by 17.97%, bringing the total balance to approximately 166.14 million NIGHT tokens. This spike clearly indicates an increase in selling activity.

Read also: Midnight (NIGHT) Token Price Plummets, But Big Investors Keep Hunting!

Looking at the context of the recent Midnight airdrop as well as the tranche-based distribution, it is likely that most of those inflows came from early recipients who moved tokens to exchanges to realize profits.

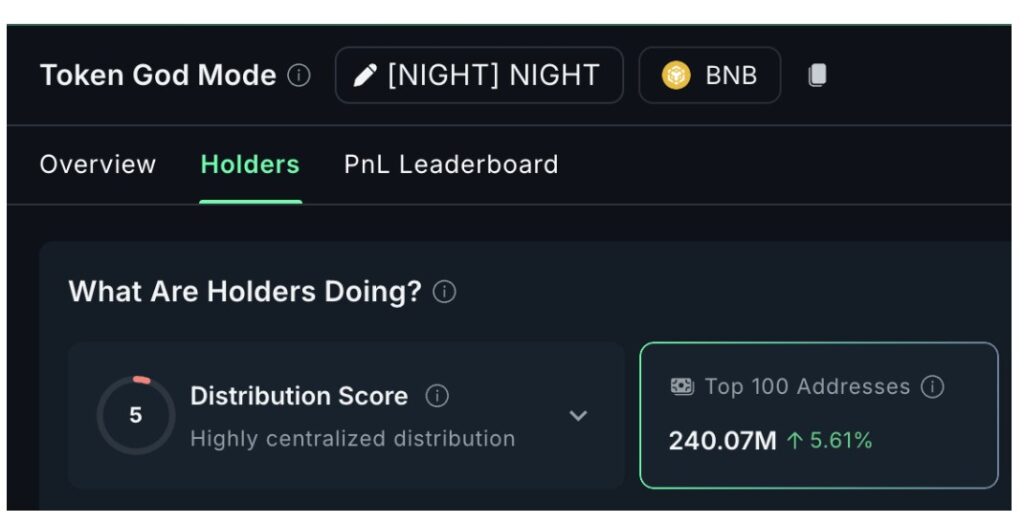

However, at the same time, mega whales are doing exactly the opposite. The top 100 addresses increased their holdings by 1.52% in the last 24 hours, despite the price drop. This means they added around 3.6 million NIGHT tokens on that red day.

Over the past seven days, the mega whale group has added more than 5.6% to their holdings, continuing to buy both on the downside and upside, while prices have surged nearly 70%.

This difference in direction is important. Inflows into the bourse reflect short-term selling pressure, which is usually driven by retail investors. Accumulation by mega whales, on the other hand, indicates long-term positioning.

By January 2026, the balance between these two forces – selling pressure from retail and accumulation from the big whales – will have more influence on the direction of the market than momentary price movements.

4. Chainlink

Despite Chainlink’s relatively flat performance, whale activity remains very high. Based on data from CryptoQuant, the Spot Average Order Size metric shows the presence of large orders from whales for seven consecutive days.

As noted by some on-chain observers, those large orders are mostly on the buy side, especially when the market starts to cool down.

According to Onchain Lens data, there was one whale that bought Chainlink for two consecutive days. On December 22, the whale bought 360,551 LINKs worth about $4.53 million from Binance.

Following the purchase, the whale’s wallet now holds 806,327 LINKs, worth approximately $10.17 million. In addition, Lookonchain also observed a series of other whales accumulating in the last three days.

Interestingly, there were 11 new wallets that bought a total of 1.567 million LINKs worth about $19.8 million each, also from Binance.

Typically, accumulation by whales when prices are flat signals a calm confidence in the market, with the expectation of further upside.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Ambcrypto. Chainlink: Can 19 Mln in Whale Buys Help LINK Break Out?. Accessed on December 24, 2025

- Ananda Banerjee. Aave Price: Whales Bullish Trigger. Accessed on December 24, 2025

- BeInCrypto. Cardano Price: Whales 36 Million. Accessed on December 24, 2025