5 Reasons Fartcoin (FARTCOIN) Is Up 13% But Rally Is Limited

Jakarta, Pintu News – Fartcoin , one of the memecoins traded in the cryptocurrency market, recorded a price increase of about 13.46 percent in the past 24 hours to a level of about US$0.2183, with the market capitalization reaching about US$218.36 million after buying interest increased sharply.

This surge was accompanied by a nearly 49 percent expansion in trading volume, suggesting an influx of new capital rather than just the usual volatile movements in the memecoin market. However, despite this attention-grabbing rally, the technical structure still shows limitations that restrain further upside potential.

1. Increased Volume Indicates Market Participation

Fartcoin’s price movement since the weekend was accompanied by an increase in trading volume of about 48.77 percent, with total volume reaching about US$48.48 million. This surge in volume indicates that the rally is supported by an influx of new capital from active market participants, rather than mere fluctuations. This is often an early signal that market forces are changing from an accumulation phase to an expansion phase.

This trend of increased volume generally reflects strong speculative interest in high-profile assets, especially memecoins that often experience price spikes in a short period of time. However, the fact that volume alone does not guarantee trend continuation should still be noted by investors.

Also Read: 7 Crypto in the Spotlight Ahead of Chinese New Year 2026, Seasonal Momentum or Just a Trend?

2. Downward Channel Structure Still Dominant

Although Fartcoin managed to hold the support level around US$0.20-US$0.21 and triggered a technical bounce, the price is still locked in a descending channel that has formed a downward trend structure over the past few months. The upper trendline of this channel continues to be a major resistance that limits further movement above current levels.

As a result, the upswing that has occurred has not signaled a change in the direction of the long-term trend, but rather a reaction to strong technical support. As long as the price has not broken the upper limit of the channel with sufficient volume, the overall trend is still considered bearish.

3. Resistance and Technical Levels that Hold

Two key technical resistance levels worth noting are around US$0.32 as a medium-term resistance limit and around US$0.47 as a broader supply ceiling. Both are theoretical target areas for bulls, but under current market conditions, prices are likely to be stymied before reaching these levels.

Technical indicators such as the Relative Strength Index (RSI) are still below the midpoint of 50, indicating that buyers’ control is not yet fully dominant. Prices are also having difficulty maintaining acceptance above US$0.22, signaling selling pressure is still present.

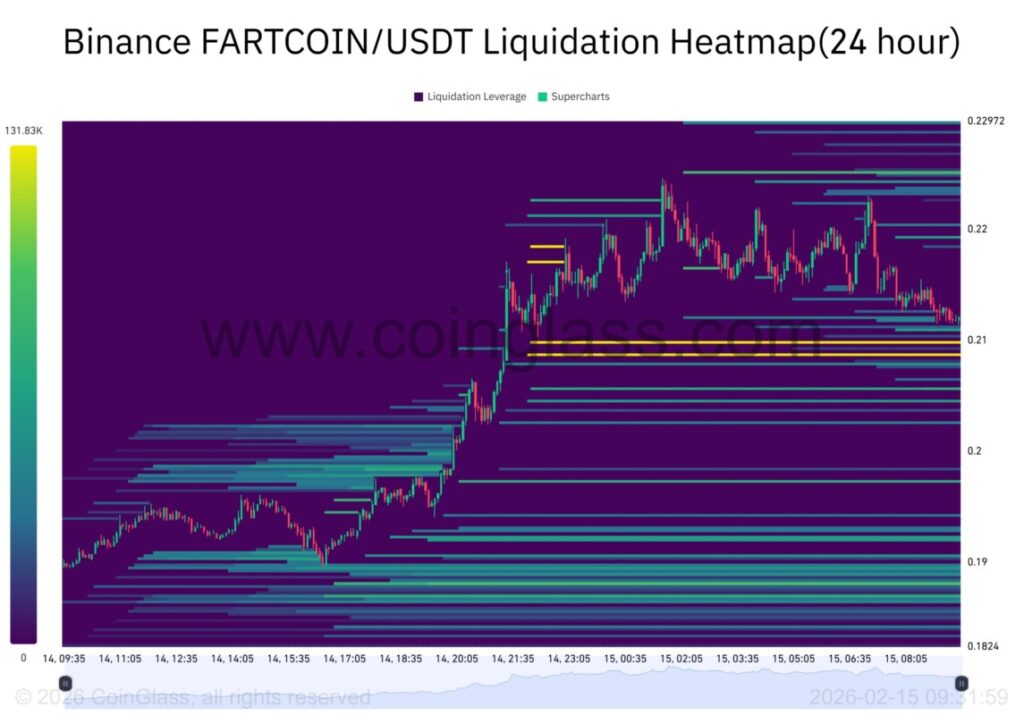

4. Liquidation and Position Risk

The data for the rally period shows a liquidation of long positions in excess of shorts, reflecting that some traders may have chased the rally and then experienced a forced exit when the price failed to continue its uptrend. This situation is common in crypto markets that utilize high leverage, especially in the highly speculative memecoin segment.

This kind of liquidation can lead to a short-term drop in volatility as overly aggressive positions are cleared from the market. This could create a stabilization or correction phase before a more valid potential breakout occurs.

5. Implications for Crypto Investors

For cryptocurrency investors, Fartcoin’s latest rally shows that the memecoin continues to attract market interest especially when momentum is speculative. However, as it is still within a descending channel structure with strong resistance, long-term breakout opportunities remain unconfirmed.

Investors are advised to monitor for technical confirmation such as a break of resistance above a descending channel with high volume before assuming momentum as a new trend. Risk management and diversification remain critical components in dealing with speculative-profile cryptocurrencies like these memecoins.

Follow us on Google News to stay up to date with the latest crypto and blockchain technology. Check Bitcoin price, USDT to IDR and Nvidia stock price tokenized via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMBCrypto. FARTCOIN surges 13% but THIS caps upside – What comes next? Accessed February 16, 2026.