Crypto Market Analysis Today (10/15/25): Scenarios If BTC $110,000 Support Is Broken

Jakarta, Pintu News – The crypto market is once again plagued by uncertainty after the price of Bitcoin fell close to the crucial $110,000 (Rp1.82 billion) area on Tuesday, October 15, 2025. After recovering from the weekend fall, technical signals and onchain data now point to the potential for a deeper correction if this important support level fails to hold.

The 4.65% drop in the past 24 hours came as global stock markets slumped. This was triggered by the latest geopolitical tensions after China restricted the activities of five US companies with ties to a South Korean conglomerate.

If the pressure continues, analysts predict that Bitcoin price could correct to the range of $96,500-$100,000 (Rp1.6 billion-Rp1.66 billion). Here’s today’s crypto market analysis according to Cointelegraph!

“Broadening Wedge” pattern hints at potential drop to $100,000

According to analysis from a number of chartists, Bitcoin’s current price movement is still in a natural correction phase amid a larger long-term trend. Daily charts show that BTC is fluctuating within a “broadening wedge” pattern – a technical pattern that often signals major volatility before a new direction is formed.

A popular technical analyst, BitBull, highlighted that Bitcoin is currently moving between the upper and lower boundaries of the wedge. Whenever the price fails to break the upper boundary, the correction usually ends up around the lower boundary – which this time is in the $100,000-$103,000 (Rp1.65 billion-Rp1.70 billion) zone.

This zone also coincides with the 50-week Exponential Moving Average (EMA) and the Fibonacci retracement level of 1,618, which further strengthens the possibility that the area will be a major correction target before prices bounce back. History shows that this kind of retracement is often a healthy “cooling off” phase before the next rally begins.

Read also: The Market Starts Volatile, What is the Current Crypto Market Condition (10/15/25)?

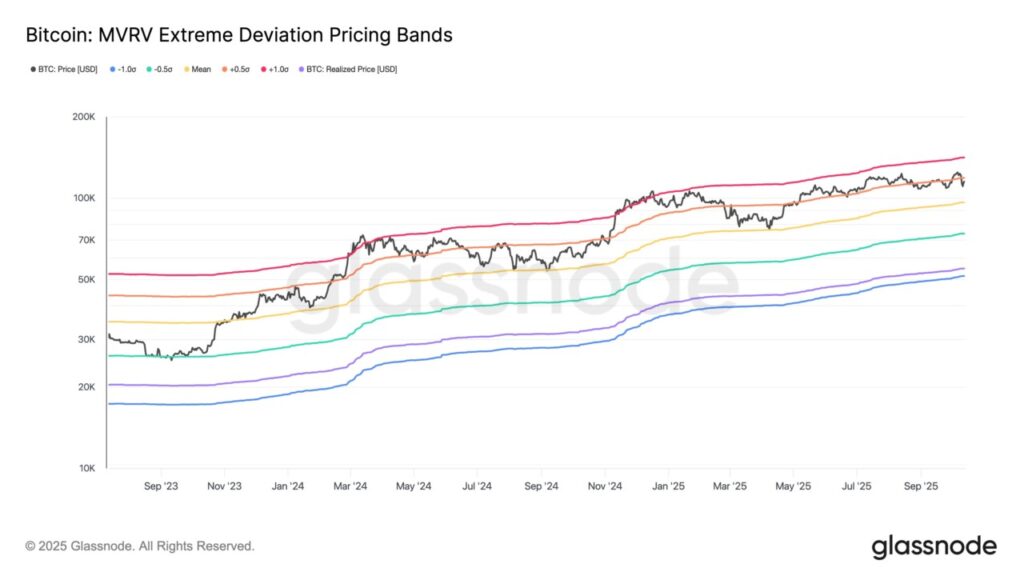

Glassnode Onchain Indicator Predicts Correction Target to $96.500

In addition to technical signals, Glassnode’s MVRV Extreme Deviation Pricing Bands onchain model also reinforces the potential for a Bitcoin price drop in the near future. This model measures the extent to which the market price deviates from “fair value” based on the average purchase price of BTC holders.

Currently, the price of Bitcoin has dropped below the +0.5σ band which stands at around $119,000 (Rp1.97 billion). Historically, whenever the price fails to stay above this level, Bitcoin tends to make a “mean reversion” or return to the mean band – which is now at around $96,500 (Rp1.6 billion).

This situation is similar to the December 2024 to April 2025 correction period, when BTC prices plummeted from $66,980 to $53,900 before finally recovering and setting a new record above $120,000.

As such, the current decline could be just part of the adjustment phase amidst the ongoing bull market cycle. However, if the price drops below the mean band line, the risk of a long-term bearish trend forming increases with an extreme target of around $74,000 ($1.23 billion).

Read also: Price of 1 Pi Network (PI) in Indonesia Today (10/15/25)

Healthy Correction or the Beginning of a New Bear Market?

Although the current price pressure is quite strong, some analysts still see it as a “mid-cycle reset”, not the end of Bitcoin’s uptrend. After a long rally since early 2024, the crypto market is indeed showing signs of being over-leveraged and overbought, which makes big corrections like this one natural.

However, the biggest challenge for investors right now is keeping their emotions in check amid extreme volatility. The $110,000 (Rp1.82 billion) level is now a psychological key – if this level holds, Bitcoin has a chance to continue its healthy consolidation towards recovery in the next quarter. Conversely, if this level is broken on high volume, the market could face a drop towards the $96,500-$100,000 (Rp1.6 billion-Rp1.66 billion) zone in the near future.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Cointelegraph. How Low Can Bitcoin Price Go if $110K BTC Support Fails?. Accessed October 15, 2025.

- Featured Image: Investing News Network