Lyn Alden: “Fed Starts Printing Money Slowly”, Time to Collect Rare Assets?

Jakarta, Pintu News – Economist and Bitcoin advocate Lyn Alden thinks the Federal Reserve (Fed) is entering a phase of “gradual print” or gradual balance sheet expansion, not a massive wave of money printing as anticipated by some in the crypto community.

According to him, this pattern still supports the rise in prices of risky assets and high-quality rare assets, but the effect will be moderate, not euphoric liquidity like the post-pandemic stimulus era.

Lyn Alden: The “Gradual Print” Mode and its Implications for Assets

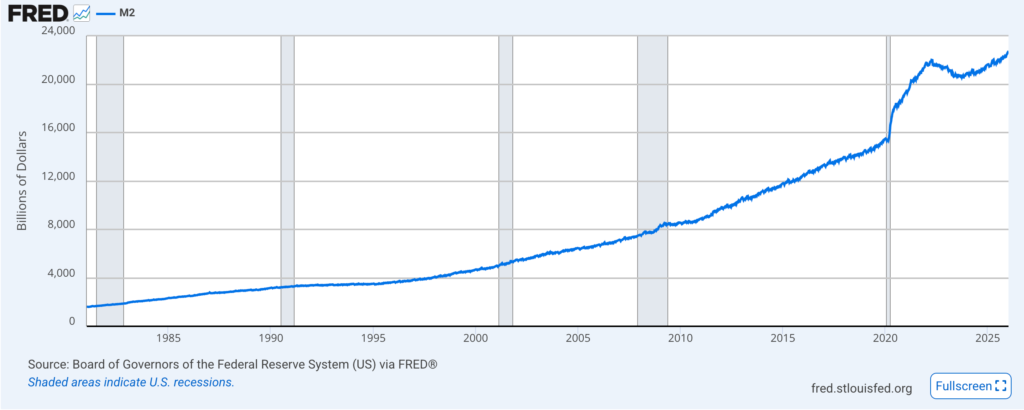

In its February 8 investment strategy report, Lyn Alden expects the Fed’s balance sheet to grow roughly in line with the growth in total banking assets or nominal gross domestic product (GDP). In other words, money supply (M2) continues to expand, but at a more restrained pace than during the period of aggressive quantitative easing. This still provides a tailwind for financial assets, just without the excessive speculative impulse.

Alden concludes that a rational strategy in this environment is to own “high-quality scarce assets” and rebalance from overly euphoric areas to under-owned segments. For both crypto and traditional market investors, this message implies a preference for assets with scarcity and strong fundamentals, rather than simply chasing short-term momentum.

Read also: ENS Canceled Namechain L2 Launch: Are you sure Ethereum L1 Scalability is Enough?

Warsh, Interest Rates, and Policy Uncertainty

Alden’s comments come amid political uproar after US President Donald Trump nominated Kevin Warsh as the Fed Chair nominee to replace Jerome Powell. Warsh is viewed by the market as more hawkish than other candidates, increasing uncertainty about the future path of interest rates. This perception is important as interest rate policy and liquidity heavily influence the performance of risk assets, including cryptocurrencies.

In theory, credit expansion and money supply growth are usually positive for asset prices, while tightening through high interest rates tends to depress growth and valuations. Powell himself has provided some “mixed” forward guidance: he acknowledges that inflation risks are still skewed to the upside, while risks to the labor market are skewed to the downside, so there is no “risk-free path” for policy.

His term will expire in May 2026, while Warsh is still awaiting Senate confirmation, adding another layer of policy uncertainty for the current year.

Also read: Bitcoin’s Sharpe Ratio Plunges into the Minus Zone: A Sign that the End of the Bear Market is Near?

Market Expectations: Rate Cut Chance Shrinks

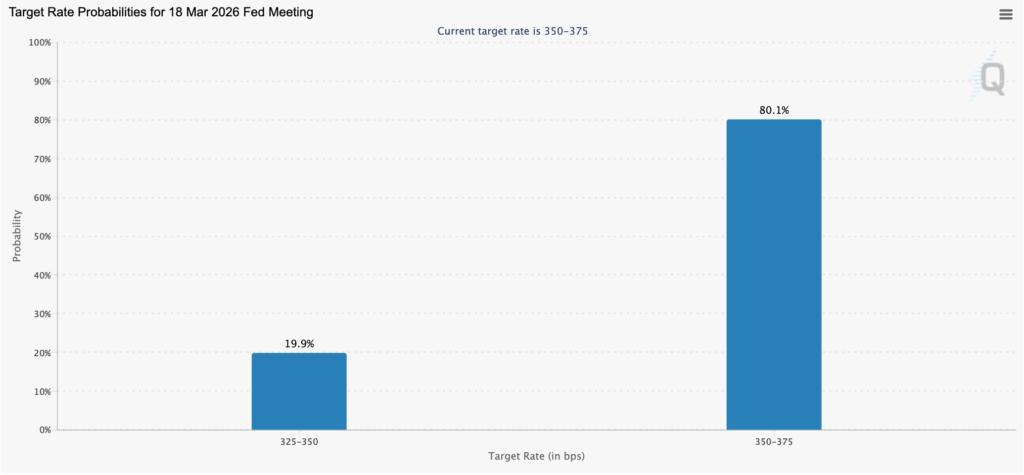

CME FedWatch data shows that only around 19.9% of market participants now expect a rate cut at the March FOMC meeting, down from around 23% a few days earlier. This decline in probability reflects the view that the Fed is not ready to reverse course aggressively, even though pressures on the growth and sentiment fronts are already being felt across various asset classes. Thus, the “gradual print” mode described by Alden is more like a long-term normalization than a short-term stimulus.

For crypto markets, this configuration means no major liquidity boost that could immediately lift prices, but also not an extreme tightening environment that forces rapid deleveraging. Setting more realistic expectations for the pace of interest rate cuts and balance sheet expansion is key in reading the outlook for Bitcoin and other risk assets throughout 2026.

Conclusion

Lyn Alden’s analysis suggests that the Federal Reserve will most likely go into “gradual print” mode: a moderate expansion of its balance sheet and money supply, in line with nominal economic growth, instead of massive liquidity injections.

Amid Kevin Warsh’s nomination and the reduced probability of a short-term rate cut, the market faces a combination of liquidity that is not very tight but also not very loose.

In this landscape, a preference for high-quality scarce assets and the discipline of rebalancing make sense, including for investors re-evaluating their exposure to Bitcoin and other crypto assets.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Cointelegraph. Federal Reserve enters ‘gradual print’ mode – Lyn Alden. Accessed February 10, 2026.

- Featured Image: