A Practical Guide: 4 Optimal Strategies for Using Jupiter in DeFi

In the fast-evolving world of crypto, speed and efficiency are key to successful trading. Jupiter is one of the platforms offering a complete solution for traders within the Solana ecosystem.

With powerful features like token swaps at the best rates, limit orders, and perpetual trading, Jupiter opens up many opportunities to enhance your investment strategies. In this article, we will explore 4 optimal strategies for using Jupiter to help you trade smarter and more efficiently.

Article Summary

🔑 Jupiter is a decentralized exchange (DEX) aggregator built on Solana, serving as a liquidity hub to simplify and optimize trading activities in the DeFi space.

🏦 Jupiter provides features such as token swaps, limit orders, DCA, cross-chain bridging, perpetuals trading, and launchpads for new projects.

📈 By holding JLP tokens, you participate in providing liquidity for Jupiter Perpetuals, enabling traders to open leveraged positions using funds from the pool.

What is Jupiter?

Jupiter is a DEX aggregator built on the Solana network. It helps users find the best trade routes across various token pairs available on different decentralized exchanges. By combining liquidity from multiple DEXs, Jupiter functions similarly to protocols like 1inch on Ethereum, introduced back in 2019.

DEX aggregators like Jupiter address a major challenge in DeFi: fragmented liquidity across numerous exchanges and pools. This fragmentation often leads to inefficiency, increased price volatility, higher slippage, and susceptibility to price manipulation.

To solve this, Jupiter offers a single user-friendly interface that accesses liquidity across multiple platforms in one place, much like a decentralized broker finding the best trade for you.

How Does Jupiter Work?

Jupiter acts as a liquidity aggregator, sourcing data from different DEXs to find the most efficient trading routes. Here’s how it works:

- Trade Routing: Jupiter’s algorithm identifies the best paths for token swaps by tapping into multiple liquidity pools.

- Efficient Execution: To minimize slippage, Jupiter can split large trades into smaller ones across different pools, ensuring better pricing.

- Solana Integration: Leveraging Solana’s high-speed blockchain, trades are executed within seconds at a very low cost, typically less than $0.01.

What Can You Do on Jupiter?

Jupiter offers a comprehensive suite of tools for traders and investors:

- Token Swaps: Exchange a wide variety of Solana-based tokens at optimal rates.

- Limit Orders: Set specific prices for buying or selling tokens, similar to centralized exchanges.

- Dollar-Cost Averaging (DCA): Schedule recurring token purchases to minimize market volatility risk.

- Cross-Chain Bridging: Transfer assets between Solana and other blockchains via supported bridges like Wormhole.

- Perpetual Trading: Trade with up to 100x leverage through Jupiter’s decentralized perpetuals platform.

- Launchpad Access: Participate early in promising new Solana projects through the LFG Launchpad.

4 Strategies to Optimize Your Jupiter Experience

To fully leverage everything Jupiter offers, a smart strategy is essential. These four approaches can help you maximize your trading efficiency and boost your potential profits:

1. Buy and Stake JUP Tokens

The JUP token powers the Jupiter ecosystem, offering governance rights, community rewards, and access to exclusive features.

JUP holders can:

- Vote on platform governance decisions through the Jupiter DAO.

- Receive rewards via airdrops, trading incentives, and grants.

- Enjoy priority access to LFG Launchpad projects and potential fee discounts.

By staking your JUP tokens through Jupiter Voting, you actively participate in the ecosystem’s governance and earn staking rewards.

Keep in mind: unstaking JUP requires a 30-day cooldown, and while you can still vote during this period, your voting power will be reduced. Unlike passive staking, active JUP staking encourages active participation and rewards users who contribute to the platform’s growth.

2. Trade on Jupiter Perpetuals

Jupiter offers a decentralized perpetual platform where users can open long or short positions with up to 100x leverage. Liquidity providers lock their assets into the perpetual vault, which traders then borrow from to open leveraged trades. Supported assets include WBTC, USDT, USDC, SOL, and ETH.

The process is simple:

If a trader deposits $20 of collateral with 5x leverage, they can open a $100 position ($20 x 5).

Unlike centralized platforms, leverage funds in Jupiter come from liquidity providers, not the platform itself. Thanks to the use of LP liquidity pools and Pyth Network’s oracle pricing, Jupiter Perpetuals offer zero price impact, no slippage, and deep liquidity.

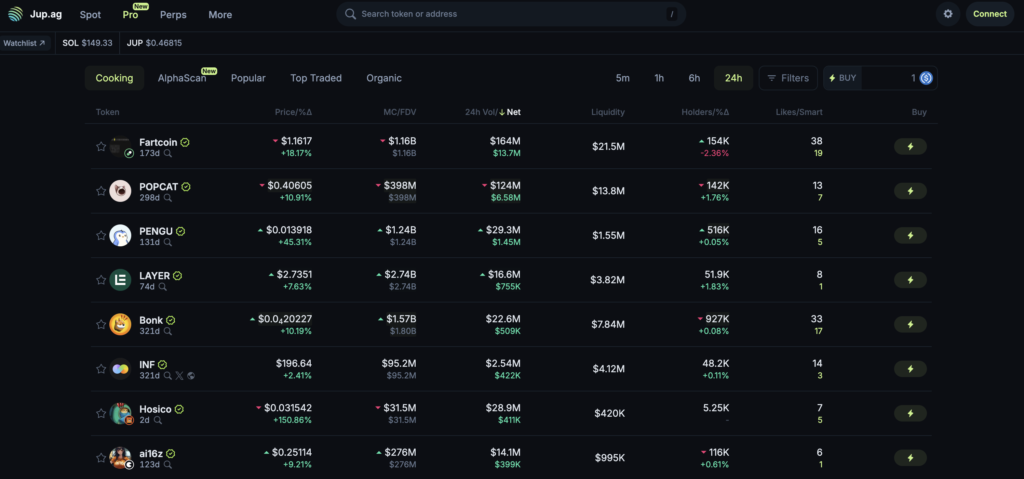

3. Discover Potential Meme Coins with Jupiter Pro

On April 14, 2025, Jupiter announced the launch of Jupiter Pro, a specialized product for investors looking for advanced features.

With Jupiter Pro, users can:

- Flexibly filter real-time market data,

- Build customized watchlists,

- Execute quick purchases with pre-set amounts.

Major upgrades include:

- Gas fees slashed by 10x, making transactions cheaper,

- A new token terminal offering deep analysis on Solana tokens,

- New momentum metrics like Net Buy Volume and Net Buyers,

- Community sentiment analysis to help guide investment decisions.

For those looking to hunt promising meme coins in the Solana ecosystem, Jupiter Pro provides advanced tools to spot opportunities faster and smarter.

4. Maximize JLP Token (Jupiter Liquidity Provider)

Unlike JUP, JLP is not meant for long-term holding like a traditional investment — it’s designed to generate yield through DeFi activity.

By holding JLP tokens, you supply liquidity to the Jupiter Perpetuals pool, earning fees from traders who borrow assets to open leveraged positions.

What is JLP?

The Jupiter Liquidity Provider (JLP) is a liquidity pool that acts as the counterparty for traders on the Jupiter Perpetuals platform. Traders borrow tokens from this pool to open leveraged positions on Jupiter Perpetuals.

Meanwhile, the JLP token is issued to users who provide liquidity to the JLP Pool.

The value of the JLP token is derived from several sources:

- An index fund composed of SOL, ETH, WBTC, USDC, and USDT,

- The profits and losses generated by traders,

- 75% of the fees are collected from opening and closing positions, price impact fees, borrowing fees, and trading fees within the pool.

How Does JLP Work?

The mechanism behind JLP is straightforward. Traders borrow tokens from the JLP Pool to open leveraged positions on the Jupiter Perpetuals exchange. In return, they pay hourly borrowing fees to the pool, proportional to the amount borrowed.

The value of the JLP token is directly influenced by the performance of the assets within the pool. Holding JLP allows users to benefit from the earnings generated by these underlying assets.

How to Become a Liquidity Provider (LP) on Jupiter

Anyone can become a Liquidity Provider by contributing assets or tokens to the Jupiter Liquidity Provider Pool.

- The JLP tokens you receive represent your proportional ownership of the pool.

- You can use any asset supported on Jupiter to acquire JLP tokens.

- Please note that buying into JLP involves certain fees, which you can learn more about here.

How to Get JLP Tokens

There are two simple methods to acquire JLP on Jupiter:

Method 1: Through Jupiter Swap

For a more detailed guide, visit How to Swap.

- Navigate to the USDC-JLP swap pair on Jupiter Swap.

- Ensure your crypto wallet is connected (check the status icon at the top right).

- In the “You’re Selling” section, select the token you want to swap for JLP.

- JLP should already be selected under the “You’re Buying” section.

- Enter the amount you wish to swap. An estimated amount of JLP you will receive will appear.

- Click the

Swapbutton at the bottom of the page. - Confirm the transaction when the notification pops up.

- A success message will appear once the transaction is complete.

Method 2: Through the JLP Page

- Visit the JLP Earn Page.

- On the right side of the page, select Buy from the options (Trade, Buy, Sell).

- An input box will appear with a token selector.

- Choose the token you wish to trade for JLP.

- Specify the amount you want to trade.

- A module will display the estimated amount of JLP you will receive along with applicable fees (learn more about these fees here).

- Confirm the transaction when prompted.

- A success notification will appear once the transaction is completed.

Maximizing JLP with Kamino’s Multiply Feature

Besides simply holding JLP for passive earnings from trading fees, you can optimize your yield by utilizing it on platforms like Kamino. One of Kamino’s standout features is Multiply, a leverage farming tool that allows you to borrow additional funds and reinvest them into the liquidity pool, including JLP pools.

💡 By using Multiply, you can increase your exposure and potential yield significantly. However, it also comes with a higher risk of liquidation, so careful management is essential.

Risks Associated with JLP

Before investing in JLP, it’s important to consider the following risks:

- Asset Price Decline: The value of JLP is tied to the assets in the pool. A drop in the prices of SOL, ETH, WBTC, USDC, or USDT can negatively impact the value of JLP.

- Smart Contract Risk: There is always the risk of vulnerabilities or failures in the smart contracts underlying the Jupiter Perpetuals platform.

- Trader Profit Risk: Since JLP acts as the counterparty, if many traders generate significant profits, it can reduce the pool’s value.

- Low Platform Activity: Low trading activity or liquidity utilization on Jupiter Perpetuals can decrease the fee revenue distributed to JLP holders.

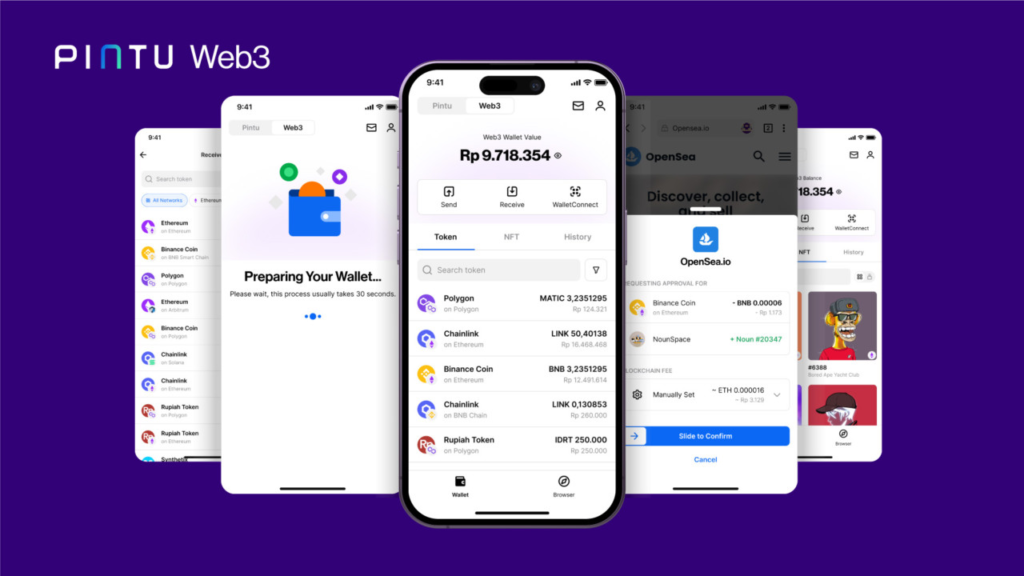

Accessing Jupiter Through Pintu Web3

Because Jupiter is built on Solana, you need a Solana-compatible wallet (like Phantom or Backpack).

Alternatively, you can easily access Jupiter through the Pintu Web3 feature within the Pintu app — no extensions needed!

How to Access Jupiter via Pintu Web3:

- Open the Pintu app and go to Pintu Web3.

- Search for Jupiter.

- Connect your Solana wallet.

- Start trading, staking, and exploring DeFi on Jupiter!

Conclusion

Jupiter offers a powerful suite of DeFi tools for swapping tokens, perpetual trading, DCA strategies, and early-stage project investing through Launchpad. To fully maximize the platform, users should stake JUP, trade on Jupiter Perps, hunt meme coin opportunities with Jupiter Pro, and farm yield with JLP tokens.

With easy access through Pintu Web3, Jupiter becomes even more accessible for users looking to grow their crypto portfolios — just remember to always manage your risks, especially when using leverage.

🚀 Download the Pintu App today on Play Store or App Store for a seamless, secure crypto trading experience — registered and regulated under Indonesia’s Financial Services Authority (OJK) and Commodity Futures Trading Regulatory Agency (CFX)!

Also, continue learning about crypto by reading updated articles on Pintu Academy!

All educational content is for learning purposes only and should not be considered financial advice.

References:

- Bitstamp. What is Jupiter? (JUP). Accessed on April 28, 2025.

- CoinGecko. What is Jupiter and How It’s Accelerating DeFi Adoption on Solana. Accessed on April 28, 2025.

- Jupiter. JLP Economics. Accessed on April 28, 2025.

- Keyring. What is the DEX ‘JUPITER’? An Overview of the JLP Token. Accessed on April 28, 2025.

Share

Table of contents