What is Ethereum ‘Merge’? Ethereum’s Protocol Change Explained

2022 is the year that Ethereum will complete its biggest protocol change in history. Proof-of-work (PoW), the consensus mechanism currently used by Ethereum will be replaced by a proof-of-stake (PoS) consensus mechanism. This change will make ether a deflationary asset and reduce Ethereum’s energy consumption, making it more environmentally friendly. The change that was previously called Ethereum 2.0 is now called The Merge. Then, what is Ethereum Merge? And how will this impact the price of ether and how much will this change cut Ethereum’s blockchain energy consumption? See the explanation in this article.

Article Summary

- 🔗The Merge, formerly known as Ethereum 2.0, is the transition from a proof-of-work consensus protocol to a proof-of-stake consensus protocol that will be run by Ethereum. The Merge aims to increase network speed, efficiency, and scalability.

- 💡 With proof-of-stake, Ethereum is no longer dependent on mining processes that consume a lot of energy to create blocks. The speed, efficiency, and scalability of the Ethereum network will improve.

- 💰 With The Merge, new ETH issuance is expected to fall by 90%. Over millions of ETH will be locked for months. This is expected to increase the scarcity of ETH and will trigger a price increase.

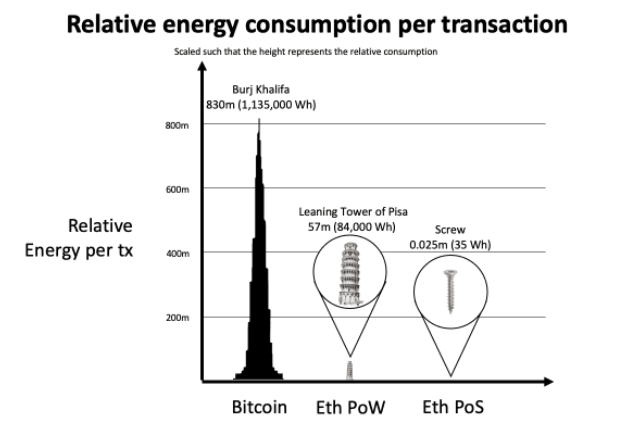

- 🌱 In addition, with proof-of-stake, Ethereum’s energy consumption will decrease by 99.9%, making it much more environmentally friendly than proof-of-work.

- ⌚ The Merge, which was previously planned to take place in June 2022, has been pushed back a few months and is likely to be implemented in Q3 2022.

What is The Merge?

The Merge is a transition from the proof-of-work (PoW) consensus process to the proof-of-stake (PoS) consensus mechanism, which will be used by the Ethereum blockchain. The consensus protocol itself is the process by which blocks are created, crypto transactions are validated and finalized–the system that underlies how blockchains work.

💡 Proof-of-work which also underlies the Bitcoin blockchain, is often criticized for consuming too much energy and not environmentally friendly. In order to maintain security and decentralization, proof-of-work on Ethereum consumes 73.2 TWh annually, energy consumption on par with a medium-sized country like Austria.

Ethereum is one of the busiest blockchains, following the increasing use of DeFi and NFT boom since 2021. The more transactions processed on the Ethereum blockchain, the more expensive gas fees users have to pay.

This upgrade from PoW to PoS aims to increase the speed, efficiency, and scalability of the Ethereum network, making it more environmentally friendly and able to process more transactions and reduce congestion.

With increased scalability or an increase in the number of transactions that can be processed at a faster time, the gas fee that must be paid will also decrease.

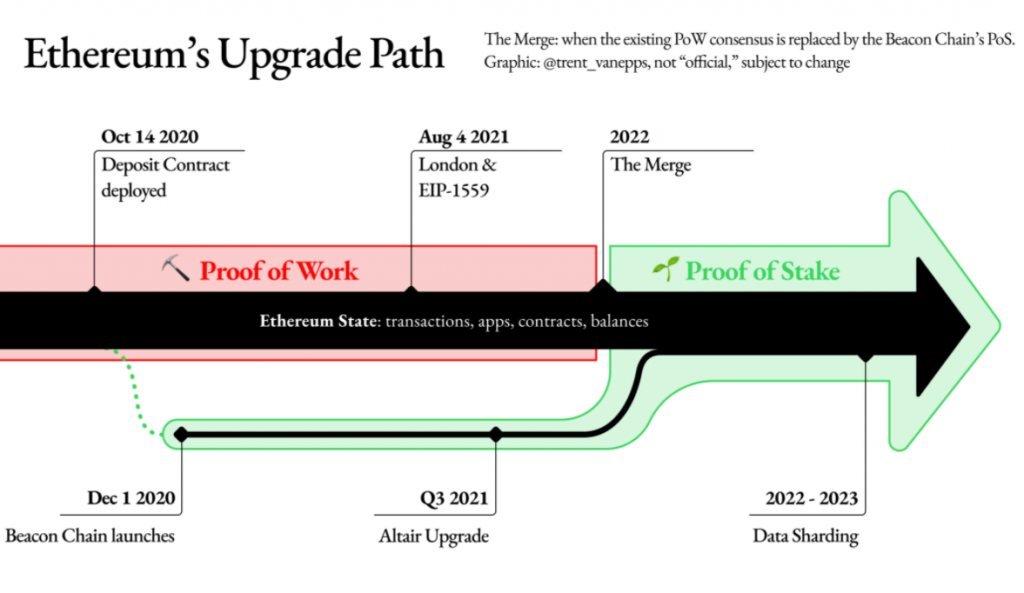

The switch from PoW to PoS does not happen overnight and takes time. Here are some stages of The Merge and the explanations.

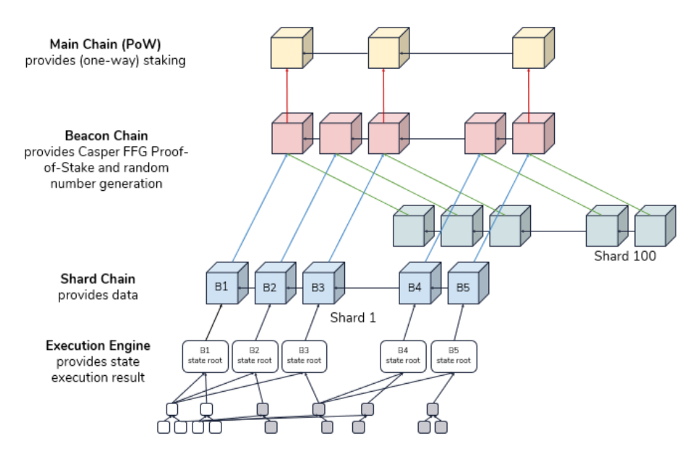

Beacon Chain

The first step towards The Merge occurred in December 2020 with the launch of the Beacon chain, which has been operating independently of the main proof-of-work chain. In this process, a one-way bridge has been operated that serves to accept deposits for users who want to stake or risk ether (ETH), as the first step in the transition to proof-of-stake.

As the name suggests, Beacon Chain is a blockchain separate from the Ethereum mainnet. Over 10.9 million ETH has been staked as of April 2022 on the Beacon chain with over 340,000 validators. However, it should be noted that the staked ETH is non-refundable until after the mainnet has been merged.

The Merge

The next stage is the Merge, which is when the Ethereum blockchain is fully proof-of-stake. In mid-March 2022, the Ethereum Foundation asked network stakeholders to run tests using the Kiln testnet, to ensure a smooth transition before the mechanism PoS is fully executed.

With the Kiln Ethereum testnet fully functioning as a proof-of-stake testnet, Ethereum is essentially one step closer to completing the transition from proof-of-work to proof-of-stake.

💡 Testnet is a prototype that serves to test a blockchain project, while mainnet is a fully developed blockchain platform for users to send and receive cryptocurrency transactions.

Why Ethereum upgrade its system from proof-of-work to proof-of-stake?

PoS has been a topic of research in the Ethereum community since 2014. This research is based on concerns about the high energy consumption required to process cryptocurrency transactions.

Data from Ethereum shows that the proof-of-work mechanism on Ethereum consumes about 73.2 TWh annually, energy consumption on par with a medium-sized country like Austria.

When the proof-of-stake is fully implemented, Ethereum’s energy expenditure will drop drastically and is roughly equal to the amount of energy running a home computer for each node on the network.

This upgrade from PoW to PoS aims to increase the speed, efficiency and scalability of the Ethereum network, making it more environmentally friendly and able to process more transactions, and reduce congestion.

With increased scalability or an increase in the number of transactions that can be processed at a faster time, the gas fee that must be paid by Ethereum users will also decrease.

Advantages of PoS over PoW

- 🌱 Environmentally friendly: PoS systems consume much less electricity and are more environmentally friendly than PoW systems.

- ️ 🏃♂️ Transaction speed and fees: A simple and easy PoS verification method can facilitate a fast blockchain network without expensive transaction fees.

- 💵 Users can do staking: Blockchain with a PoS system can involve users to do staking in order to earn passive income.

What does the merge mean for the value of ETH?

💡 ETH broke through the $3,300 price range at the end of March 2022 following the successful launch of Ethereum “the Merge” on the Kiln testnet which made the market excited for Ethereum’s switch to a proof-of-stake consensus method.

Ethereum is a crypto asset with the second largest market cap after Bitcoin. With the switch from PoW to PoS, the reward paid to validators will be reduced by about 90%. The ETH burned will often be higher than the amount spent, reducing the overall supply. This is because the network requires less energy, so less reward is required to incentivize the network.

Currently, with the PoW system, the Ethereum network issues approximately 13,500 ETH per day with an annual issuance of 4.3% of the total ETH supply. When “the merge” is complete, annual issuance will be drastically reduced to 0.3% to 0.4%.

The supply of ETH will be deflationary, which implicitly means that ETH as an asset will be more valuable. Overall, this upgrade will be a positive catalyst for the Ethereum network.

Not only that, quoted by Time, independent crypto analyst Armando Aguilar said that altcoins built on the Ethereum blockchain such as Polygon and Arbitrum also have the potential to experience price growth following the implementation of The Merge.

How does the Ethereum merge impact the environment?

As explained above, the current energy consumption of Ethereum with a proof-of-work mechanism is too high and unsustainable. Resolving energy consumption issues without compromising security and decentralization is a significant technical challenge and has been the focus of research and development for many years.

With proof-of-stake, puzzle solving as in proof-of-work is no longer necessary. Removing puzzle solving drastically reduces the energy expenditure required to secure the network. Miners are replaced by validators that perform the same function. The difference is, instead of spending money in the form of computing work, they stake ETH as collateral against dishonest behavior.

If validators don’t do their job (offline when they are supposed to fulfill some validator’s duties) the ETH staked can slowly leak, while behavior that proves to be dishonest results in staked assets being “cut”. This strongly encourages active and honest participation in securing the network.

Ethereum energy usage is expected to drop by 99.95% when PoS is fully implemented.

Reference

- The Merge, Ethereum.org, diakses pada 14 April 2022

- PROOF-OF-WORK (POW), Ethereum.org, diakses pada 14 April 2022

- Ethereum’s ‘Merge’ is Coming: Here’s What You Need to Know, Cryptopragmatist, diakses pada 17 April 2022

- Liam J. Kelly, Rene Millman dan Stephen Graves, What Is Ethereum 2.0? Ethereum’s Consensus Layer and Merge Explained, Decrypt, diakses pada 17 April 2022

- Rahul Nambiampurath, Ethereum ‘Merge’ Successfully Takes Place on Kiln Testnet, Beincrypto, diakses pada 17 April 2022

- The Merge, Messari Intel, diakses pada 18 April 2022

- Ethereum energy consumption, Ethereum.org, diakses pada 24 April 2022

- Why Investors Are Going to Love Ethereum 2.0, Nasdaq, diakses pada 24 April 2022

- Sam Kessler, Sage D. Young, George Kaloudis, Reminder: The Merge Won’t Solve Ethereum’s Scaling Woes by Itself, Cointelegraph, diakses pada 28 April 2022

Share

Related Article

See Assets in This Article

ETH Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-