Ethereum Spot ETF Approved: What It Means for the Crypto Market

The approval process for the spot Ethereum ETF was expected to be lengthy and complicated, with many believing it wouldn’t happen anytime soon. However, on May 23, 2024, the Securities and Exchange Commission (SEC) made a surprising turnaround by approving the Ethereum Spot ETF. What led to this change in the SEC’s decision? And what will be the impact of its approval? Discover all the answers in the following article.

Article Summary

- Spot Ethereum ETF is an investment instrument that tracks the price of ETH and can be traded on traditional exchanges. It can expose investors to Ethereum without needing to own the cryptocurrency directly.

- 👀 On May 23, 2024, the SEC approved eight Ethereum ETFs for BlackRock, Fidelity, Grayscale, Bitwise, VanEck, Ark, Invesco Galaxy, and Franklin Templeton.

- 🚀 The approval of spot Ethereum ETFs could significantly boost the money flow into crypto markets, increase the ETH price, and solidify Ethereum’s status as a recognized investment asset class.

What are Spot Ethereum ETFs?

Spot Ethereum ETF is an investment instrument that tracks the price of Ethereum and can be traded on traditional exchanges rather than crypto exchanges. It aims to provide access for investors who want to gain exposure to the price of Ethereum without owning it directly.

The Ethereum ETF is the second spot ETF product to use crypto as its underlying. On May 23, 2024, the SEC has approved eight Ethereum ETFs for BlackRock, Fidelity, Grayscale, Bitwise, VanEck, Ark, Invesco Galaxy and Franklin Templeton.

The approval of the Ethereum Spot ETF appears to be influenced by the political climate in the United States. With the election nearing, both presidential candidates are seeking support from the crypto community. The Biden administration, aiming to avoid an anti-crypto stance, is likely to approve the ETF to garner favour.

The approval of Ethereum spot ETFs follows the success of the first-ever crypto-based spot ETF – the Bitcoin Spot ETF – which began trading on a US stock exchange.

You can learn more about Bitcoin Spot ETFs and examples in this article.

State of Ethereum Spot ETF

The SEC has approved the Ethereum spot ETFs of eight investment management firms, after they began their attempts by registering their Ethereum Spot ETF products on November 9, 2023. At least five investment managers submitted proposals for Ethereum spot ETFs to the SEC at that time. These included Blackrock, VanEck, ARK 21Shares, Grayscale, and Hashdex.

Similar to Bitcoin spot ETFs, Ethereum proposals initially faced delays or rejections from the SEC, leading to market pessimism. Even industry leaders like Jan van Eck, CEO of VanEck, anticipated a rejection for their proposal.

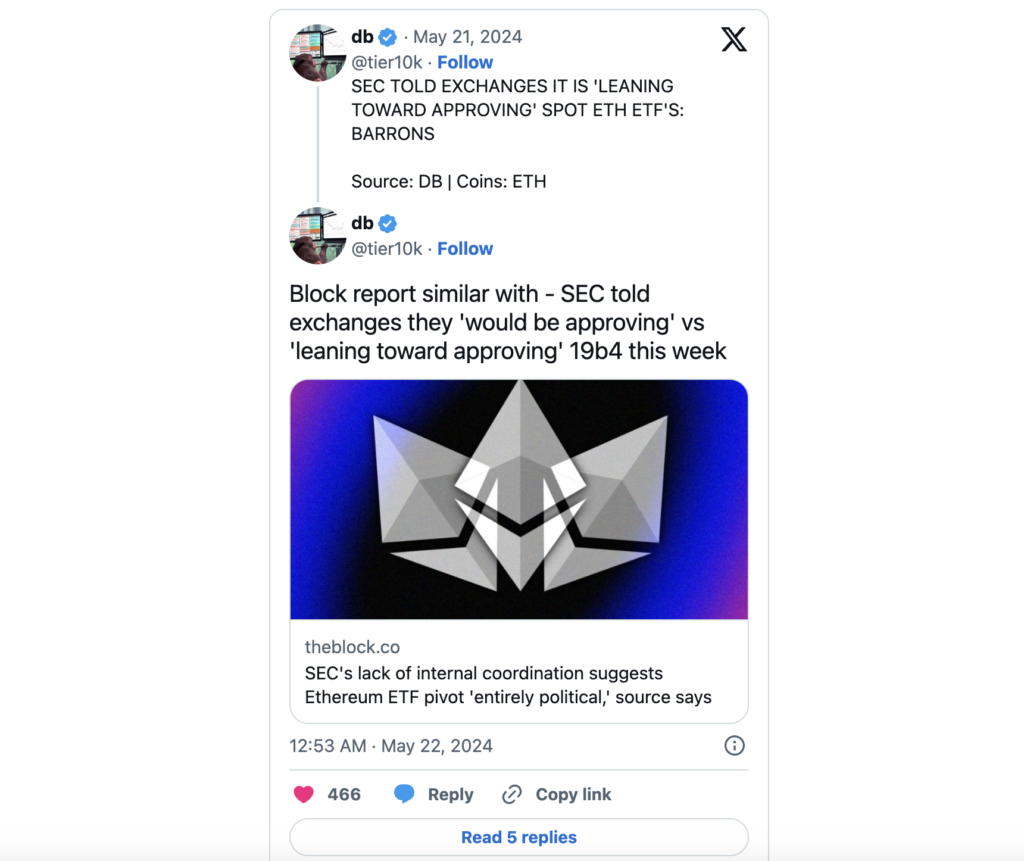

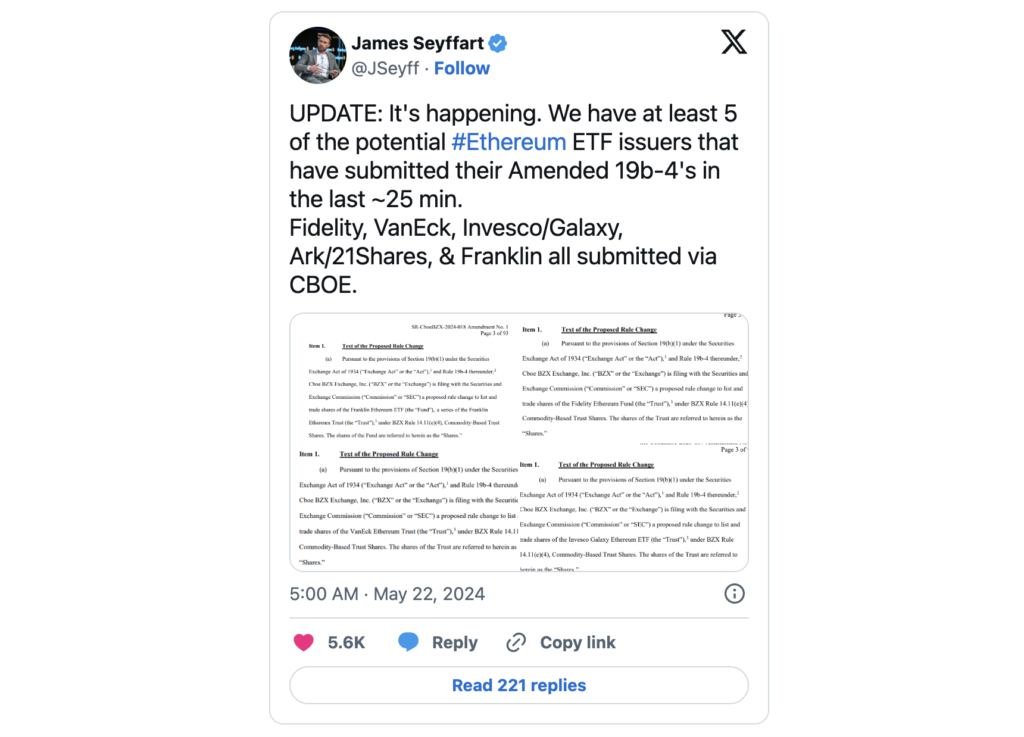

However, conditions surprisingly turned 180 degrees on May 21, 2024. Rumours surfaced that the SEC might approve the Ethereum Spot ETF as early as May 23, 2024. These speculations arose after the SEC requested investment management to update and complete their ’19b-4 filings.’

Responding to the news, Bloomberg analysts Eric Balchunas and James Seyffrat immediately changed their prediction of the spot Ethereum ETF’s approval from 25% to 75%. Not long after, various follow-up reports further confirmed that the SEC is likely to approve the Ethereum Spot ETF.

The positive sentiment regarding the Ethereum Spot ETF then boosted the ETH price from $3,100 to $3,757 at the time of writing. In other words, ETH has gained more than 20% in response to the situation.

Green Light Given: SEC Approves Ethereum Spot ETF

Polymarket, a blockchain-based prediction platform, illustrates market participants’ confidence in the approval of the Ethereum Spot ETF through the chart below. Initially, the confidence level gradually declined, but it reversed sharply when news emerged that the SEC would approve the ETF. Indeed, on May 23, 2024, the SEC approved the Ethereum Spot ETF.

On Wednesday (5/22) morning, James Seyffart reported that five investment management firms had filled out and submitted an “Amended 19b-4” to the SEC. This news confirms the recent rumours. The next step is to wait for the SEC to approve the “19b-4” file.

However, it is important to note that even with SEC approval, the Ethereum Spot ETF will still take several weeks or months to launch. Nonetheless, the SEC’s approval would be a significant milestone with the potential to impact the crypto market positively.

Impact of the Spot Ethereum ETF

Reflecting on the Bitcoin Spot ETF, the launch of the ETH Ethereum Spot will have a positive impact on Ethereum. The following are some of the potential impacts of the Ethereum Spot ETF launch:

1. Money Flow into Ethereum

The biggest impact is the money flowing into the Ethereum market. As we know, the Ethereum Spot ETF will open access to non-crypto investors and institutional investors. The money flow will help maintain liquidity and the balance between supply and demand for Ethereum.

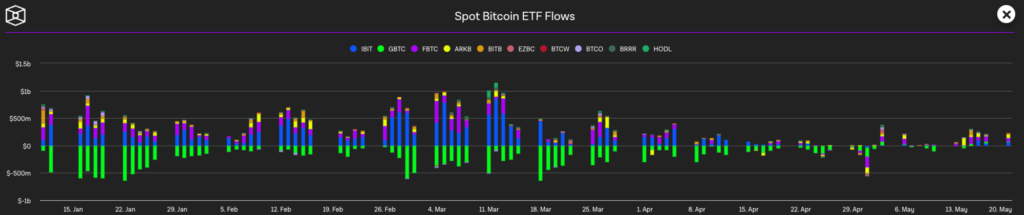

A clear example of money inflow can be observed with the Bitcoin Spot ETF. According to Farside data, when it was first launched on January 11, 2024, the Bitcoin Spot ETF attracted $1.09 billion in its first seven days. By May 21, 2024, the total inflow had surged to $13.175 billion.

There is no guarantee that the Ethereum Spot ETF will receive the same enthusiastic reception as the Bitcoin Spot ETF. However, as a diversification option, the Ethereum Spot ETF could be appealing to investors. It’s possible that the inflows could rival or even surpass those of the Bitcoin Spot ETF.

2. Ethereum Price Increase

Another impact of the Ethereum Spot ETF launch is the potential for ETH prices to rise. A sudden surge in demand could trigger an imbalance between supply and demand, thus raising the ETH price.

Following the launch of the Bitcoin spot ETF, BTC underwent a correction attributed to a “sell the news” event. However, once selling pressure eased, BTC surged, reaching a new all-time high of $73,835. Prior to the ETF launch, BTC was trading in the $42,000-$43,000, implying a significant increase of 69.76% post-launch.

Spot ETF products not only have the potential to cause price spikes but also to uphold stability in the underlying assets’ prices. For instance, following BTC’s ATH, its price has corrected to around $59,000, marking a decrease of approximately 19%. ETH could exhibit a comparable trend to BTC, though the impact on its price movement might vary, either weaker or stronger.

3. Ethereum as an Asset Class

Most investors prefer ETF products over conventional products for their portfolios. ETFs are considered to provide more optimized returns, provide exposure without direct ownership, and act as a portfolio automation solution. Once the spot Ethereum ETF is launched, ETH will be approved as an asset class. This can support its use in a portfolio’s investment strategy.

According to data from Fintel, the introduction of a spot Bitcoin ETF product seems to have attracted the interest of institutional investors. The data reveals that over 1,500 institutions hold Bitcoin spot ETF positions totalling $10.6 billion. A similar trend is anticipated with the spot Ethereum ETF.

Conclusion

After a long and intricate approval process, the SEC has finally approved the Ethereum spot ETF for eight investment management firms. These firms include BlackRock, Fidelity, Grayscale, Bitwise, VanEck, Ark, Invesco Galaxy, and Franklin Templeton. This shift is largely due to the SEC’s request for investment management firms to finalize their ’19b-4 filings’ for spot Ethereum ETFs.

However, it’s important to note that even if the spot Ethereum ETF product gets approved, it doesn’t guarantee immediate trading. There are still several stages to go through, which could take weeks or even months before the spot Ethereum ETH product is available for trading. Nonetheless, this development is a promising sign and could serve as a positive catalyst for the long-term growth of the crypto industry.

How to Buy ETH on Pintu

After learning about the spot Ethereum ETF, you can start investing by buying ETH and other assets like BTC, SOL, etc. on the Pintu app. Pintu carefully evaluates all its crypto assets, emphasizing the importance of caution.

Pintu is also compatible with popular wallets such as Metamask to facilitate your transactions. Download the Pintu app on the Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

Aside from buying and trading crypto assets, you can expand your knowledge about cryptocurrencies through various Pintu Academy articles. Updated weekly, all Pintu Academy articles are made for knowledge and educational purposes, not as financial advice.

References

- Nikhilesh De, Helene Braun, & Jesse Hamilton, Ether ETFs Filing Process Sees Abrupt Progress, Though Approval Not Guaranteed: Sources, Coindesk, accessed 22 May 2024.

- Adam Hayes, Understanding Spot Ethereum ETFs: A Comprehensive Guide, Investopedia, accessed 22 May 2024.

- Vivian Nguyen, Q1 Bitcoin ETF holders: 1500 entries reported, Millennium leads with nearly $2 billion in holdings, Crypto Briefing, accessed 22 May 2024.

Share

Related Article

See Assets in This Article

ETH Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-