What is the Maker and Taker Fee in Crypto Trading

Maker and taker fees are terms that are often found when we trade crypto. So, what are maker and taker fees? What is the difference between the two? Then, what is the calculation mechanism in crypto trading? Check out the explanation and simulation in the following article.

Article Summary

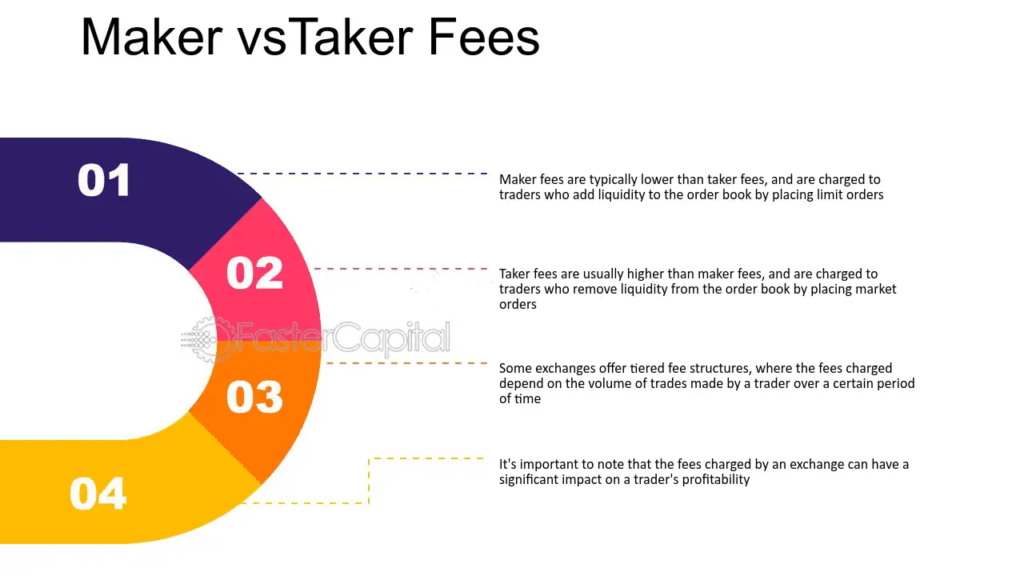

- 💪 Maker is someone who “makes” an order book by adding new orders to the order book. They do so by setting a specific price (limit order) when selling or buying crypto.

- ⚡ Taker is someone who “takes” an order out of the order book. They take liquidity from the order book by selling or buying at the market price

- 🤑 Typically, maker fees are lower than taker fees. This incentivizes traders to create liquidity in an exchange’s order book.

About Maker and Taker

Before we get into makers and takers, we must have a good understanding of the order book. The order book is a list that displays a breakdown of a crypto trading pair’s bid price (buy) and ask price (sell). It contains a queue of limit orders from traders who want to sell or buy crypto.

A maker is someone who “makes” an order book by adding new orders to the order book. They create an order book by setting a specific price (limit order) in the order book when selling or buying crypto. Meanwhile, a taker is someone who “takes” an order out of the order book. They take liquidity from the order book by selling or buying at the market price.

You can learn more about order books and how to read them in the following article.

The Difference Between Market Maker and Market Taker

Based on the explanation above, it can be concluded that the difference between market makers and market takers lies in how they work. A market maker is someone who adds liquidity to the order book. A market taker is someone who takes liquidity from the order book.

By becoming a market maker, you can get the crypto price at the level that you think is most ideal. However, your orders won’t be filled until the price is reached. It could take days, weeks, or even months. Meanwhile, by becoming a market taker, you can sell or buy crypto immediately.

What is the Maker Fee?

A maker fee is a fee charged to traders when they buy or sell at a price above or below the current market price. In other words, maker fees are charged to traders who use limit orders as they add liquidity to the order book.

For example, Gini wants to sell 1 ETH using a limit order with a target price of $3,750. However, at that time, the price of ETH was $3,680. Thus, Gini’s order will not be executed immediately. Instead, it will be added to the order book and executed only once the ETH price hits $3,750.

By placing the order, Gini will be considered a “maker” because it adds liquidity to the order book and will be charged a maker fee.

Typically, exchanges incentivize makers with lower fees for their orders. This is because they are providing liquidity to the exchange's order book.

Want to know how to stop the target price when using a limit order? Here is the guide to help you out.

What is the Taker Fee?

A taker fee is a fee charged to traders when buying or selling crypto using the market price in the order book. In other words, taker fees are charged to traders who use marker orders because they take liquidity in the order book.

For example, Gini wants to sell 100 ARBs using a market order. Using a market order, Gini’s ARB will be executed immediately at the current price in the order book. Gini will be charged a taker fee because she becomes a “taker” as she takes liquidity from the order book.

Sometimes, traders may be charged a taker fee despite using a limit order. This can happen when the crypto price suddenly rises or falls to the target price level set in the limit order. As a result, the limit order will be executed immediately instead of being queued in the order book.

Maker and Taker Fee Calculation

Remember that the maker and taker fees for each exchange will vary. In addition, the fee also depends on the number of transactions and activities of each user on the exchange platform.

In this simulation, Gini is an ABCDE exchange user. It is known that the ABCDE platform charges a maker fee of 0.05% and a taker fee of 0.1%.

Maker Fee Calculation

At this moment, the price of BTC is $65,000. Gini has decided to buy 0.5 BTC. However, she believes that the price of BTC will drop first, so she chooses to use the limit order option. Gini then placed a buy-limit order at $60,500.

Since Gini’s order was not executed immediately, it was added to the order book. In the ABCDE exchange order book, Gini’s order will be recorded as 0.5 x $60,500 = $30,250. As it turned out, three days later, the price of BTC fell to $60,200. As a result, Gini’s order was executed, and she was charged a maker fee.

The maker fee for Gini's BTC transaction is calculated as follows: $60,500 x (0.05/100) = $30.25.

Taker Fee Calculation

After the price increased, Gini decided to sell her 230 SUIs. At that time, the price of SUI was $2. Gini chose to use a market order to have her entire transaction executed at that very instant.

As Gini’s order was executed immediately and took liquidity from the order book, she was charged a taker fee. In the transaction, the total cost for Gini’s orders was 230 x $2 = $460.

The taker fee for SUI Gini transactions is $0.46 calculated as $460 x (0.1/100).

How to Optimize Maker and Taker Fees in Crypto Trading

Since maker fees are typically lower than taker fees, it is essential to act as a maker if you want to get lower fees. Therefore, if you want to sell and buy crypto, always use the limit order feature.

However, in practice, using limit orders does not guarantee that the order will be queued in the order book. As explained in the previous section, traders can be charged taker fees even if they use limit orders. Here is an example:

Gini placed a limit buy order on SOL at $134. The best ask price in the order book was $137 at that time. However, the price changed to $133 once the limit order was placed. In this case, Gini's limit order was considered a market order and executed immediately. As a result, Gini was charged a 0.1% taker fee instead of the 0.05% maker fee.

To avoid this, traders can use an additional option feature on limit orders, called post only. This ensures that the limit order is placed into the order book but will not be executed in the market order. Post only will become a maker in the order book, adding liquidity to the market.

If a limit order is set to post only, it will automatically be cancelled if the ask/bid price exceeds the placed limit order price. The cancellation is because the system cannot place the limit order into the order book. As a result, traders do not have to pay more expensive trading fees (not subject to taker fees).

In addition to post-only, find out about other types of time-in-force orders and their uses here.

CFX Fee

In addition to taker and maker fees, crypto trading in Indonesia is also subject to CFX fees. CFX or Commodity Futures Exchange, is a crypto asset exchange regulated by the Indonesian government that oversees various exchanges in Indonesia. Every trade, whether buying or selling, made on CFX member exchanges will incur a CFX fee of 0.02%. The fee is also included for clearing.

Conclusion

Makers and takers are important elements that ensure the crypto trading process can occur. A maker is the one who provides liquidity to an order book. Meanwhile, the taker is the one who will take the liquidity. The fees charged for makers and takers are also different, given their different roles. Typically, exchanges charge lower fees for makers as an incentive for filling order book liquidity.

However, limit order transactions (maker) will not be executed immediately. Meanwhile, taker orders (market order) will always be executed immediately. Therefore, it is essential to understand what makers and takers are to make better trading decisions.

Buy Crypto Assets on Pintu

Looking to invest in crypto assets? No worries, you can safely and conveniently purchase a wide range of cryptocurrencies such as BTC, ETH, SOL, and others safely and easily on Pintu. Pintu diligently evaluates all its crypto assets, highlighting the significance of being cautious.

Pintu is also compatible with popular wallets such as Metamask to facilitate your transactions. Download Pintu app on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

Aside from buying and trading crypto assets, you can expand your knowledge about cryptocurrencies through various Pintu Academy articles. Updated weekly, all Pintu Academy articles are made for knowledge and educational purposes, not as financial advice

References

- Andrew Bloomenthal, What Maker-Taker Fees Mean for You, Investopedia, accessed on 6 March 2024.

- Baby Pips, What are Maker Fees and Taker Fees? accessed on 6 March 2024

Share