How to Use Limit Order Like a Pro

Limit Order is an essential feature when buying and selling crypto assets. It enables investors to enhance their profitability by ensuring that their buying or selling price aligns with their trading strategy. But how does one determine the target price? Interested in learning how to use limit orders like a professional trader? Discover all you need to know in the article below!

Article Summary

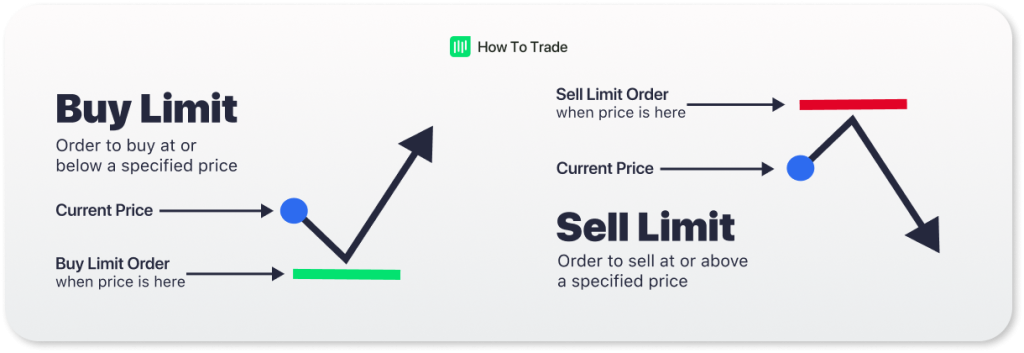

- ⏳ Limit Order is a feature that allows users to buy (buy limit order) or sell (sell limit order) crypto assets at a predetermined price.

- ♟️ By using this feature, investors would simplify the transaction process and use it as a trading strategy to optimize profits.

- 📈 Ideally, users should use Limit Orders when the crypto asset’s price is moving quickly. This helps users avoid unexpected prices that may occur when using market orders.

- 🔍 In determining the target price on a Limit Order, users can use support and resistance points and other technical indicators. In addition, fundamental analysis is also required to determine when to enter and exit more accurately.

About Limit Orders

Limit Order is a feature that allows users to buy or sell an asset at a specific price. With a Limit Order, the transaction execution will be done automatically through the system when the asset price matches the predetermined price. There are two types of limit orders: buy limit orders and sell limit orders.

You can learn more about limit orders in the following article.

When to Use Limit Order?

In addition to making the transaction process automatic, Limit Orders can also be used to optimize trading. So, when is the most ideal time for a trader or investor to use a Limit Order? The ideal time to use a Limit Order is when the price moves quickly, either strengthening or weakening.

If the user uses a market order, then there is a possibility that he gets a price that does not match expectations. This is because market orders will prioritize speed to fulfill the orders immediately. By using limit orders, users can buy or sell their assets at the price they want.

In a bullish phase, using a sell limit order can help investors sell their assets at the highest price. While in a bearish phase, investors can use buy limit orders to get assets at the lowest price. Limit Orders can also be used long-term if investors already have a specific buy or sell price target.

How to Set Limit Order Price

The Limit Order feature is straightforward, as we only need to set the price we want. However, the difficult part is determining the most precise target price.

In determining the price of a sell limit order, the easiest way is to use the percentage of how much profit you want to make. However, relying entirely on this method is quite tricky. Ideally, it should be followed by careful calculation to increase the chance that the target price can be achieved.

For example, let’s say you buy SOL at US$19 and want a 40% profit. Thus, you only need to set a sell limit order at US$ 26.6 or 40% higher than the purchase price. However, without any calculations, the time when the order is filled will be more difficult to predict. Because it is possible that, in one moment, the SOL price may only strengthen by 30%. This method is more suitable for long-term investors who are not concerned about the duration of their limit orders.

Determine the Sell Order Limit Price

Monica is a short-term trader and recently purchased BTC at US$25,500. Shortly after the purchase, BTC was on a positive trend. She prepared to take profits using a Limit Order so the execution could go according to her plan.

The indicator below shows that BTC is bullish, but the last two candles show high selling pressure. This could signal the end of the upward trend. To confirm whether there will be a downtrend, Monica used the Exponential Moving Average (EMA) indicator.

In determining the target price for a sell limit order, in this case, she uses the 55-day EMA as a support point. The idea is that if BTC closes past the 55-day EMA at US$27,120, it will confirm a downtrend. This also shows that BTC has difficulty breaking through 27,200, making it a resistance area.

That way, Monica can set a price target for a sell limit order around the 55-day EMA point, the US$ 27,100 level, for example. So, if BTC moves past the 55-day EMA and returns to the US$ 26,000 area, Monica has successfully utilized a sell limit order in the resistance area and maximized her trade.

Determine the Buy Order Limit Price

Another indicator that can be used to predict support and resistance areas is the Fibonacci Extension. It’s pretty easy to use. Just plot the highest and lowest points. For this case, we will use the movement of ETH. In the chart below, US$ 2,029 is the highest, and US$ 1,510 is the lowest. This range is now the 0-100% range.

Fibonacci extensions consist of all Fibonacci retracement levels that exceed the standard 100% level. Fibonacci extensions predict that a move will go up until it reaches the 161.8% or 261.8% Fibonacci level and then reverse.

It can be seen that the 100% level of the following Fibonacci extensions is at US$ 1,510 (a gray area). Considering that the price of ETH at the previous week’s close was US$ 1,602, the level of US$ 1,510 can be used as a target price for a buy limit order. If the correction trend continues, there will be a possibility of ETH heading to the support area, making it the right spot to buy. If the initial support level is exceeded, the following buying area can also be US$ 1,190 – US$ 1,510 (161.8% Fibonacci).

TradingView is one of the go-to weapons for traders who want to do some technical analysis. Find out how to use it here.

Tips for Using Limit Order

Now that you know how to set a target price for a limit order, the next question arises: how to use limit orders effectively? Don’t worry; here are some tips on how to use it:

1. Set Your Goals

As with any investment and trading strategy, it’s essential to set your goals and trading plan first. Investors must know how long they want to hold the asset. Whether they want to sell the asset in the short, medium, or long term. The timeframe will determine the strategy used.

2. Analyze The Market Condition

Analyze market conditions to understand the optimal situation, whether the time is right to enter or exit. Combine technical and fundamental analysis. It is important to know fundamental conditions such as macroeconomics or central bank monetary policy as they will determine the market’s direction. Technical analysis, such as support and resistance, can be used to determine entry and exit points.

3. The Order Size

It’s a good idea to break the order into smaller chunks when using Limit Orders. Instead of buying an asset at US$1,000 with all the capital you have, you can split it into smaller orders. For example, 50% of the money to place a limit buy order when the price is at US$ 1,000, then 25% for each price of US$ 975 and US$ 950.

The same can be applied when setting a sell order. This way, you can get a lower average buy price or a higher average sell price.

4. Ensuring The Liquidity

Limit orders can only be executed with sufficient liquidity (supply and demand). For example, the current price of a Synthetix asset is US$ 2, and a trader places a sell limit order at US$ 3.5 worth US$ 10,000. When the price of the Sythetix asset reaches that level, it turns out that the buy demand is only worth US$ 12,000. As the order placed earlier was not filled, the sell limit order was not executed. Therefore, look for assets with high liquidity so the limit order can work.

5. Combine with Stop Loss

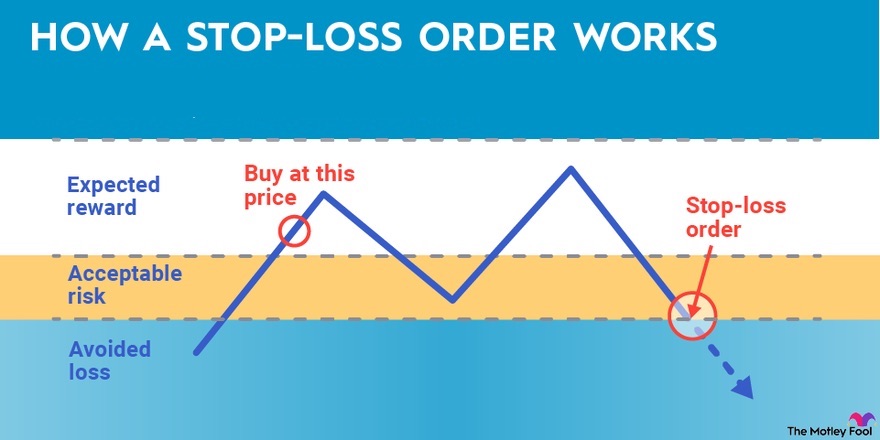

Don’t just set a target price when using a sell limit order. Remember to put a stop loss as a preventive measure in case the market reverses. Especially if you’re an investor whose risk tolerance is low.

For example, you have bought BTC at US$18,000 and then placed a sell limit order at US$22,000. But suddenly, the trend reversed, and the price of BTC fell below US$ 18,000. If you set a stop loss at US$ 17,800, you can avoid the risk of more significant losses if the downtrend continues.

6. Don’t Rely on Limit Order

No one can predict the market. There is always the possibility of prices moving drastically, especially in the crypto market. Over-reliance on limit orders can limit the opportunities that can be obtained.

For example, a guy named Reno placed a buy limit on Uniswap at US$4. The asset’s price fell from US$4.5 to US$3 shortly after due to negative sentiment. As the target price is reached, Reno gets Uniswap at US$4. However, if he had canceled the limit order immediately, Reno could have gotten Uniswap at a lower price.

Sometimes, the sell limit order is not filled, but the trader is in a profit position. For example, Reno buys an asset at US$ 200 and places a sell order of US$ 300. If the asset's price stays in the US$280 range for a long time and has difficulty rising, opportunistic traders may sell their assets at US$280 to realize their profits, even though this is below his sell limit price.

When your trades are losing, stay calm and take these steps to recover from a significant setback.

Conclusion

Limit Order is more than a convenient feature for buying and selling crypto assets. It can also be used as a tool to optimize trading strategies, especially when the price of a crypto asset is rapidly changing, either up or down.

Users can use support and resistance areas and other technical indicators to determine the target price on a Limit Order. However, it is also important to conduct fundamental analysis to understand the market situation and momentum trends.

It is also important to divide the order into smaller chunks, ensure liquidity, and integrate it with stop loss and other trading methods to use effectively. Given the volatility of the crypto market, investors should not entirely rely on Limit Orders.

Buy Crypto Assets with Limit Order on Pintu

Pintu now has a Limit Order feature that can maximize your trading experience. You can try to set a target price and the tips above.

Currently, you can use Limit Order for the following 17 tokens: PTU, BNB, GALA, LPT, SNX, APT, REN, WLD, XRP, DOGE, ACH, COMP, AUCTION, CRV, LTC, MATIC and LDO. Is your favourite crypto asset missing? Don’t worry, Pintu will continue to add gradually more tokens.

Pintu is also compatible with popular wallets such as Metamask to facilitate your transactions. Download Pintu app on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

Aside from buying and trading crypto assets, you can expand your knowledge about cryptocurrencies through various Pintu Academy articles. Updated weekly, all Pintu Academy articles are made for knowledge and educational purposes, not as financial advice

References

- Michael J Kramer, What Is a Limit Order in Trading, and How Does It Work? Investopedia, accessed on 21 September 2023.

- James Royal, Market Order vs. Limit Order: When to Use Which, Nerd Wallet, accessed on 21 September 2023.

- Kanika Agarrwal, Stop Loss Meaning: What Is Stop Loss And Its Benefits, Forbes, accessed on 21 September 2023.

- Crypto Cred, Support/Resistance Trade Setup, Youtube, accessed on 22 September 2023.

Share