Market Analysis Jul 8th, 2024: Bitcoin Price Plunges Amidst Rising Market Fear

Hitting its lowest point since February at $55,000, Bitcoin’s price faces headwinds from the Fed’s reluctance to cut rates, declining ETF inflows in the US, and recent actions by Mt. Gox and the German government. Check out the full analysis below.

As usual, the Pintu trading team has gathered critical information and analyzed the general economic situation and the crypto market’s movements over the past week. However, it should be noted that all information in this Market Analysis is intended for educational purposes, not as financial advice.

Market Analysis Summary

- 📉 With the total crypto market capitalization falling below $2.5 trillion, no positive factors are driving Bitcoin prices higher.

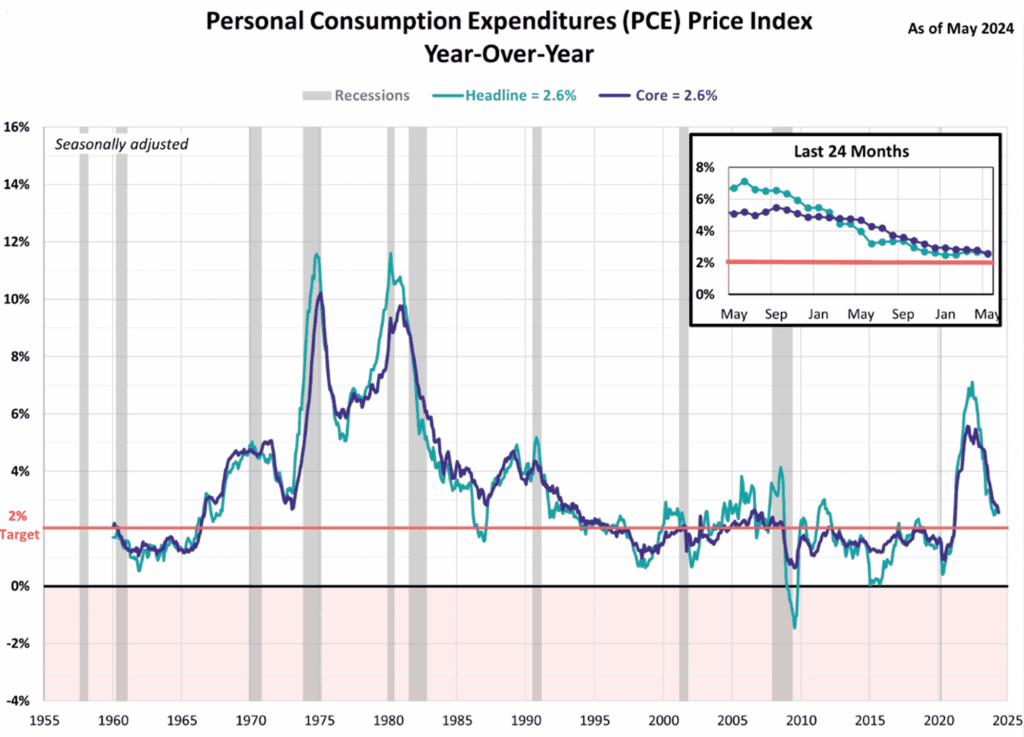

- 🏬 The Core Personal Expenditure Price Index (PCE) has shown slow growth since February, reaching its lowest level since March 2021

- 📈 Rising personal income and spending in the United States (US) could positively impact the economy by driving growth and affecting inflation.

- 🔻 Michigan consumer sentiment has fallen to its lowest level in seven months.

Macroeconomic Analysis

Core PCE Price Index

In May, the Fed’s preferred measure of inflation, the Core PCE Price Index, experienced its slowest monthly growth in six months. This index, which excludes volatile food and energy prices, rose by 2.6% year-over-year, down from 2.8% in April. This marks the first slowdown in core PCE since February and the lowest level since March 2021. Additionally, the overall PCE index also slowed to 2.6% in May, aligning with expectations. On a monthly basis, the overall PCE remained unchanged, while the core PCE increased by a mere 0.1% from April. These monthly changes are the smallest since November of last year. The latest PCE figures met expectations but indicate that inflation is cooling, offering some progress toward the Fed’s 2% target.

Other Economic Indicators

- Personal Income & Spending: According to the US Bureau of Economic Analysis, personal income rose by $114.1 billion, or 0.5%, in May, surpassing market expectations of a 0.4% increase and accelerating from April’s 0.3% growth. Disposable personal income, which is personal income minus current taxes, increased by $94 billion, or 0.5%, in May, up from April’s 0.3% rise. Personal spending, also known as personal consumption expenditures (PCE), climbed by $47.8 billion, or 0.2%, in May, a slight increase from eApril’s 0.1% rise but below market expectations of a 0.3% gain.

- Michigan Consumer Sentiment: Consumer sentiment declined to a seven-month low in June, as indicated by the final report of the Michigan Consumer Sentiment Index. The index fell by 0.9 points (a 1.3% decrease) to 68.2, down from the final reading in May. This latest figure was below the anticipated forecast of 65.6.

- Manufacturing PMI: Two reports released on Monday showed contrasting pictures of the US manufacturing sector. The Institute for Supply Management (ISM) index fell to 48.5 in June from 48.7 in May, indicating ongoing contraction. This drop, below the consensus of 49.1, suggests weak demand and decreased output. Conversely, S&P Global’s PMI climbed to a three-month high of 51.6 in June from 51.3 in May, driven by increasing new orders despite business confidence reaching a 19-month low. These reports highlight continued challenges for the sector, including shifts in demand, high prices, and economic uncertainty.

- JOLTs Job Opening: The U.S. Bureau of Labor Statistics reported today that the number of job openings remained relatively steady at 8.1 million on the last business day of May. Throughout the month, the figures for hires and total separations also showed little variation, standing at 5.8 million and 5.4 million, respectively. Within the separations category, quits were 3.5 million, and layoffs and discharges were 1.7 million, both of which saw minimal change. This report provides estimates on the number and rate of job openings, hires, and separations across the total nonfarm sector, categorized by industry and establishment size.

BTC Price Analysis

Recent BTC price movements have left market participants increasingly impatient, falling into a state of fear, uncertainty, and doubt (FUD). After failing to break past $64,000 during a recent rally, Bitcoin has printed its second consecutive bearish daily candle. This has led traders to anticipate a downward trend, with prices dropping below $60,000, resulting in a surge in short positions. Then it continued its spiraling downturn with the total market capitalization falling below $2.5 trillion, marking a 5% decline at the end of the week. BTC has notably declined by 5%, dropping from $63K to $57K.

Compounding the market’s unease, the likelihood of the Fed cutting interest rates is diminishing. This is likely contributing to BTC’s significant decline today. Fed Chair Jerome Powell has cautioned that we are entering a “critical period” for the Fed and described the current deficit levels as “unsustainable.” Powell’s warning underscores the growing financial instability, which is having a profound impact on the cryptocurrency market.

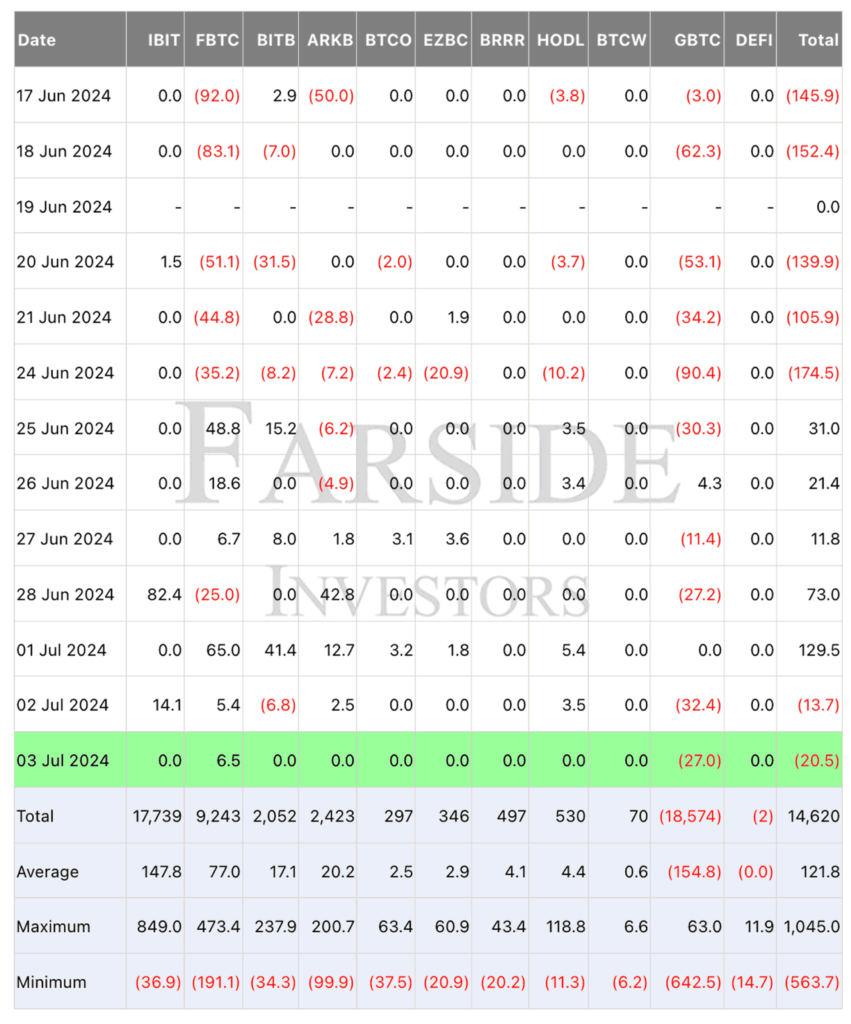

In addition to Bitcoin’s price decline, spot Bitcoin ETFs have exhibited weakness. On Wednesday, July 3, these ETFs recorded daily net outflows totaling $20.5 million. Notably, Grayscale’s GBTC experienced outflows of $27 million, while Fidelity’s FBTC was the only ETF to record inflows, amounting to $6.5 million. All other ETFs reported no inflows during this period.

On-Chain Analysis

- 📊 Exchange: As the exchange reserve continues to rise, it indicates higher selling pressure. Net deposits on exchanges are low compared to the 7-day average. Lower deposits can be interpreted as lower selling pressure.

- 💻 Miners: Miners’ are selling holdings in a moderate range compared to its one-year average. Miner’s revenue is in a moderate range, compared to its one-year average.

- 🔗 On-Chain: More investors are selling at a profit. In the middle of a bull market, it can indicate a market top. Long term holders’ movement in the last 7 days was lower than the average. They have a motive to hold their coins. Investors are in a Anxiety phase where they are currently in a state of moderate unrealized profits.

- 🏦 Derivatives: Long-position traders are dominant and are willing to pay to short traders. Buying sentiment is dominant in the derivatives market. More buy orders are filled by takers. As open interest increases, it indicates more liquidity, volatility, and attention are coming into the derivative market. The increasing trend in OI could support the current ongoing price trend.

- 🔀 Technicals: RSI indicates a neutral condition. Stochastic indicates neutral condition where the current price is in a moderate location between the highest-lowest range of the last 2 weeks.

News About Altcoins

- Telegram’s Durov Lauds Hamster Kombat as Fastest-Growing Digital Service, Signs Up 239 Million in 3 Months. Telegram founder and CEO Pavel Durov has lauded Hamster Kombat, a crypto game thriving on his platform, as “the fastest-growing digital service in the world.” On his Telegram channel, Durov hailed Hamster Kombat as a pioneer of a new wave of mini-apps that bring blockchain technology to the masses. These mini-apps, accessible to Telegram’s 900 million-plus users, include games like Hamster Kombat and Notcoin, which offer crypto rewards through The Open Network. Durov confirmed a staggering 239 million signups for Hamster Kombat in just three months, with its eagerly awaited airdrop set to happen this month, marking it as the most prominent among Telegram’s burgeoning crypto games such as Yescoin, TapSwap, Catizen, PixelTap, and W-Coin.

News from the Crypto World in the Past Week

- Bitwise Prepares for Mid-July Ethereum ETF Launch as SEC Approval Nears. Asset management firm Bitwise has updated its S-1 registration form with the SEC for its proposed spot Ether ETF, aiming for a mid-July launch as approval nears. This follows SEC Chair Gary Gensler’s suggestion that approvals for spot Ether ETFs could be finalized by this summer. Bitwise’s amended filing includes a six-month fee waiver for up to $500 million, with trading on NYSE Arca set to begin “as soon as practicable” after the registration’s effective date. Bloomberg analyst Eric Balchunas noted the filing was completed ahead of the July 8 deadline, suggesting minimal SEC comments and attributing potential delays to seasonal slowdowns. The crypto community eagerly awaits the SEC’s decision, following the May approval of Ether ETF filings from eight asset managers.

Cryptocurrencies Market Price Over the Past Week

Cryptocurrencies With the Best Performance

- Mantra (OM) +13,06%

- MultiversX +12,73%

- TRON +2,43%

Cryptocurrencies With the Worst Performance

- Notcoin (NOT) -29,68%

- Pendle -28,52%

- Ethena (ENA) -28,10%

- ORDI -26,60%

References

- Sander Lutz, Telegram CEO Calls Crypto Game Hamster Kombat World’s ‘Fastest-Growing Digital Service’, decrypt, accessed on 6 July 2024.

- Wayne Jones, Bitwise Files Amended Spot Ethereum ETF S-1 Form, cryptopotato, accessed on 6 July 2024.

Share

Related Article

See Assets in This Article

BTC Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-