A Guide and Strategy to Short in Futures Trading

Most crypto investors think there is nothing they can do during a bearish market. In fact, they can perform shorting through the Futures market. So, what is a short position? How do you short sell correctly? Find out more in the following article.

Key Takeaways

- Definition of Short: Shorting is a trading activity in which a trader sells a futures contract on the open market, expecting its price to fall. The trader profits when the price continues to fall. This strategy allows traders to gain profit during a bearish market, but it carries high risks such as overleverage and liquidation.

- Chart Patterns for Short: Three main chart patterns can be used as a reference for opening a short position: Double Top, Descending Triangle, and Head and Shoulders. These three patterns generally indicate a bearish reversal signal.

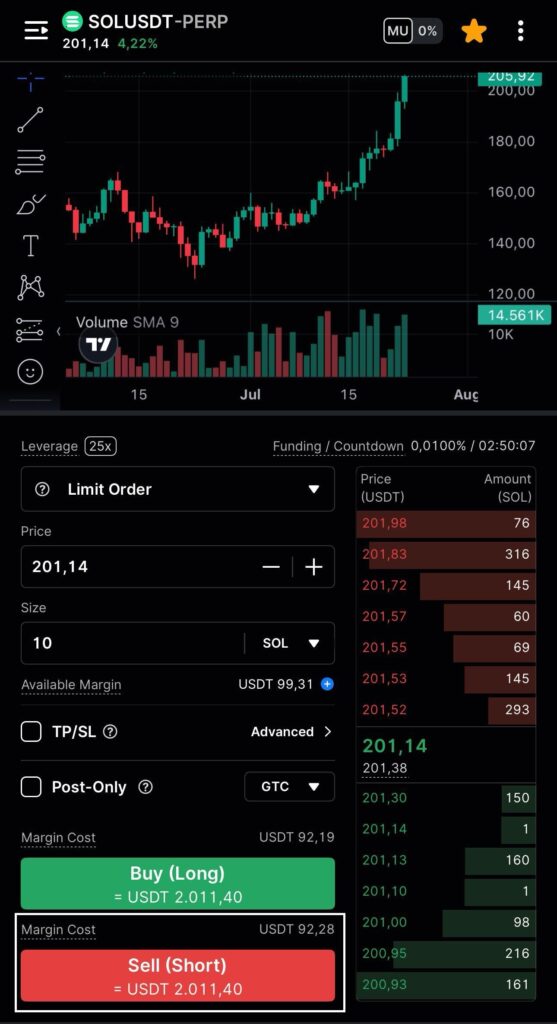

- Shorting Tutorial on Pintu: Shorting can be done on Pintu Futures. The steps include opening the Futures page, selecting the leverage level (ranging from 1x to 25x), and opening a Sell (Short) position while setting Take Profit (TP) and Stop Loss (SL) to manage risk.

What is Shorting?

Shorting is a trading activity in which a trader sells a futures contract on the open market, expecting its price to fall. The trader profits when the price continues to fall. Additionally, traders can use leverage to further increase their potential profit.

With shorts, traders can still gain profit amidst a bearish market. However, like other Futures trading, there is a risk of overleverage and liquidation if the trader’s analysis is wrong. The analysis for shorting is also very different from the long strategy more commonly used by many Futures traders.

Shorting in crypto generally uses perpetual contracts. This is different from the stock market, which usually has a time period.

Learn more about how the futures market works in Pintu Academy.

3 Strategies for Shorting

The following are several chart patterns that can be used as a reference for entering a short position:

1. Double Top

A double top is a bearish reversal pattern in which an asset attempts to break through a resistance level but fails on the second attempt. After that, the asset experiences a sharp correction. The double top pattern is confirmed when the price breaks below the low point of the previous pullback (neckline).

The double top pattern usually precedes a sharp correction, with the asset reaching the next support point. A trader can employ the strategy of opening a position at the second peak (second top) or below the neckline. Then, the trader can set a stop-loss above the neckline and determine the take-profit level at the next support point.

Find out more about the double top and other chart patterns in Pintu Academy.

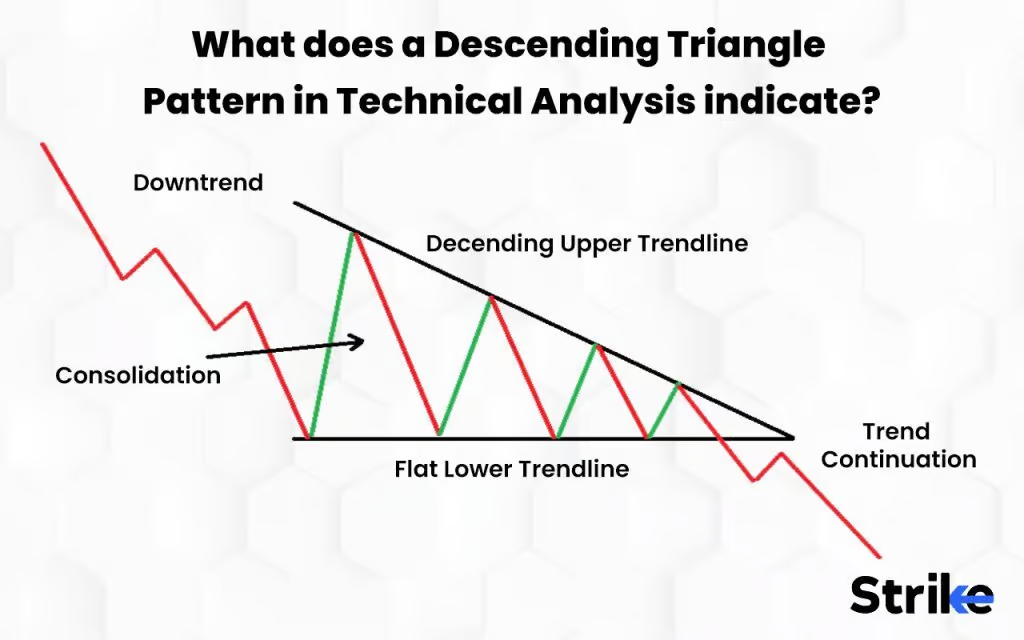

2. Descending Triangle

The descending triangle is a pattern that occurs in a downtrend, formed by a series of lower highs that are getting progressively lower. In addition, this pattern has a series of equal support points. Then, this support will be tested several times until it finally fails to hold. This pattern will form a downward diagonal triangle.

The meeting point between the two lines is then used as a reference for opening a short position. If the price finally breaks through the horizontal support line, a further price correction can be expected. Therefore, the area below the support level on the descending triangle can be an ideal entry point.

A descending triangle does not always signal a bearish trend. If the asset price experiences a breakout at the right side's end, the bearish trend could turn into a bullish one. You can set a stop-loss target at the resistance point or the peak of the last lower high as a risk mitigation measure.

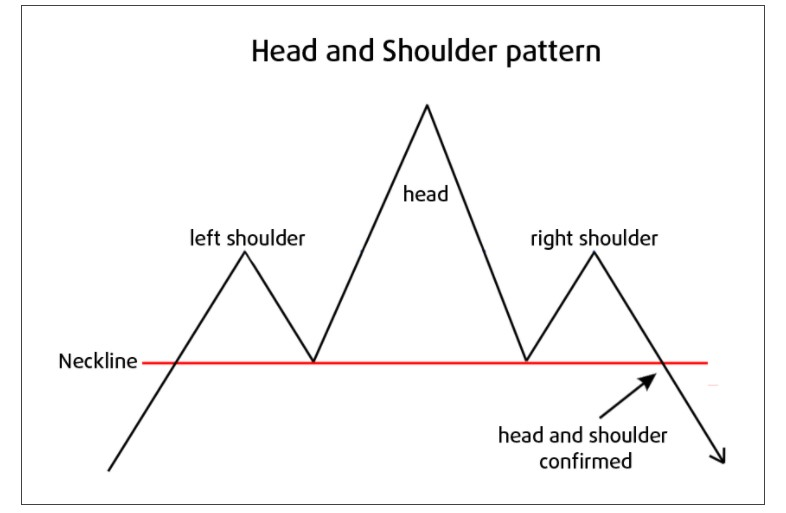

3. Head and Shoulder

Head & Shoulders is a bearish reversal pattern that can signal an opening short position. It starts with the price movement reaching a high point (left shoulder), dropping, then rebounding and forming a second, higher high (head). Finally, the asset price drops again, forming a final high point (right shoulder).

These three points will form three peaks, with the middle peak higher than the others, like a head with left and right shoulders. The important thing in the head-and-shoulders pattern is the neckline, which is a straight line drawn as support. If the price breaks below the neckline, the head-and-shoulders pattern is confirmed.

Traders can use the neckline area as an entry point. Another alternative is to enter after the third peak has formed.

How to Open A Short Position in Pintu

You can perform shorting or shorting on Pintu Futures! The following are the steps to open a short position, assuming you already have assets on Pintu Futures.

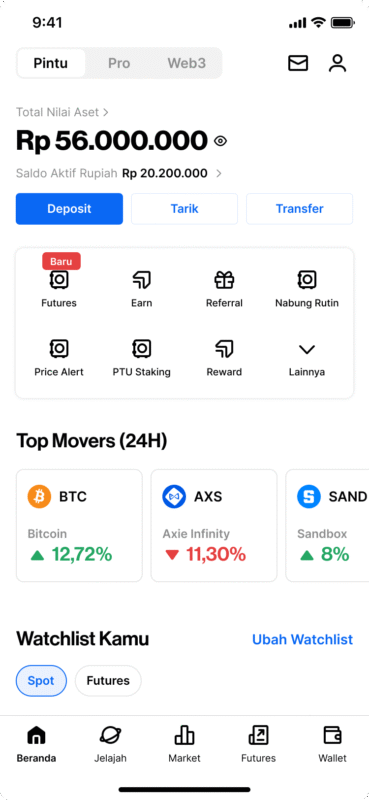

Step 1: Open the Futures Page

Open the Pintu application and click “Futures” to access the perpetual futures market page. You can select the asset directly from the top tab. In the example below, we are looking at the ETHUSDT-PERP chart.

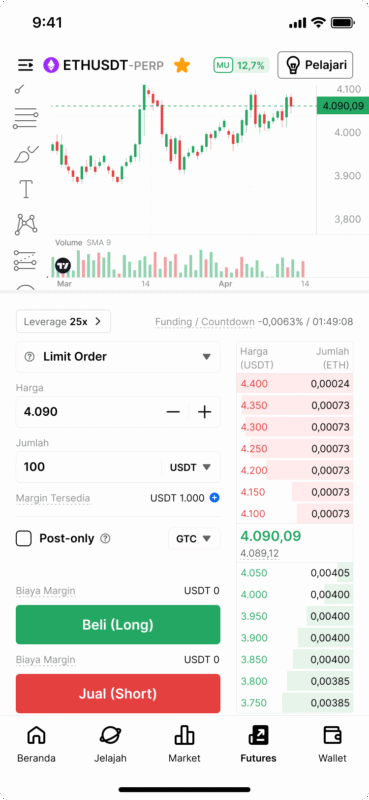

Step 2: Determine Your Leverage

Now, you can choose the leverage you will use on Pintu Futures, ranging from 1x to 25x! The higher the leverage, the higher the liquidation risk.

After you decide, click confirm.

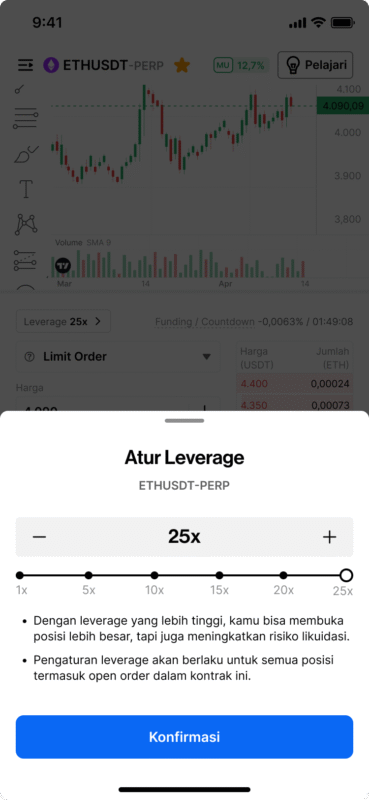

Step 3: Open a Short Position

On the Futures page, you can see the buy (long) and sell (short) buttons. Before opening a position, check the order type you want (the image below shows a limit order). Also, don’t forget to determine TP/SL as part of risk management.

Every position you have will appear at the bottom, along with profits and losses (PnL). A short position will profit as the price falls and lose if the price rises.

How to Use Pintu Futures Web

Besides trading Futures on the Pintu application, you can also trade Futures on Pintu Web:

- Open https://pintu.co.id/

- Click the Futures button.

- Click Trading Futures on Desktop.

- Then click Register or Login if you have already registered.

You can also access Pintu Futures directly through the Pintu application by selecting the Futures tab on the main page or accessing it through the Market page on Pintu.

Disclaimer: All articles from Pintu Academy are intended for educational purposes and do not constitute financial advice.

Conclusion

Isn’t it easy to short-sell on Pintu Pro Futures? In addition to opening short positions, you can also open long positions on Pintu Pro Futures! So what are you waiting for? Try Pintu Pro Futures and enjoy 5x leverage, risk management, cross-margin, and top-quality security.

You don’t need to worry about any fraud or scams on Pintu. This is because all crypto assets on Pintu diligently evaluate all its crypto assets, highlighting the significance of being cautious. Download Pintu app on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

Aside from buying and trading crypto assets, you can expand your knowledge about cryptocurrencies through various Pintu Academy articles. Updated weekly, all Pintu Academy articles are made for knowledge and educational purposes, not as financial advice.

References

- James Chen, Descending Triangle: What It Is, What It Indicates, Examples, Investopedia, diakses pada 30 Oktober 2024.

- James Chen, Double Top: Definition, Patterns, and Use in Trading, Investopedia, diakses pada 30 Oktober 2024.

Share