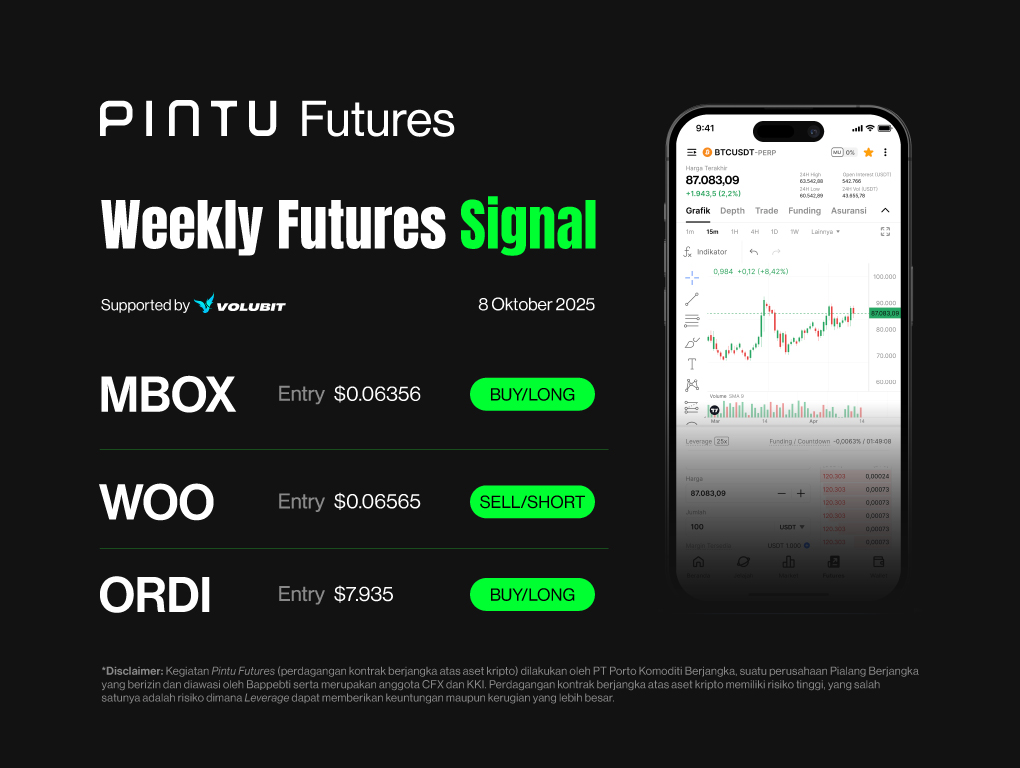

Weekly Signal Pintu X Volubit – October 8, 2025

Signal Summary Futures Trading:

- MOBOX (MBOX)

- Entry (Long) : $0.06356

- Stop Loss [SL] : $0.06027

- Take Profit [TP] :

- TP1: $0.06935

- TP2: $0.07098

- WOO

- Entry (Short) : $0.06565

- Stop Loss [SL] : $0.07031

- Take Profit [TP] :

- TP1: $0.05919

- TP2: $0.05434

- ORDI

- Entry (Long) : $7.935

- Stop Loss [SL] : $7.504

- Take Profit [TP] :

- TP1: $8.359

- TP2: $8.940

1. MOBOX (MBOX)

The price movement of MBOX is showing interesting technical signals after successfully breaking out from its consolidation range between $0.05202 and $0.06089.

This momentum could mark a trend reversal from a bearish phase to a bullish one. The $0.06089 level, which previously acted as the last lower high during the downtrend from September 14–25, has now turned into a key support area.

If the 4-hour candle closing at 3:00 PM WIB on October 8 closes in green, the likelihood of continued upward momentum will increase. This scenario presents an opportunity to enter a buy position with a well-measured risk-to-reward ratio.

Potential Buy/Long Setup MBOX:

- Entry (Long) : $0.06356

- Stop Loss [SL] : $0.06027

- Take Profit [TP] : TP1: $0.06935, TP2: $0.07098

2. WOO (WOO)

The price movement of WOO is showing bearish technical signals after breaking down from a rising wedge pattern, which typically indicates a potential trend reversal from bullish to bearish.

The $0.06903 level, which previously acted as both a horizontal support and the last higher low, has now been successfully breached. If the price manages to rebound and retest this area, followed by a rejection, it could present an opportunity to look for short-selling setups.

In this scenario, WOO’s downside momentum is expected to continue, with the next potential target area around $0.05919.

Potential Buy/Long Setup WOO:

- Entry : $0.06565

- Stop Loss [SL] : $0.07031

- Take Profit [TP] : TP1: $0.05919, TP2: $0.05434

3. ORDI (ORDI)

The price movement of ORDI is showing significant selling pressure after the price once again failed to break through the resistance area around $8.940. The rejection at this level has triggered an ongoing price correction.

This downward movement is expected to continue toward the support zone between $7.559 and $7.769. The price reaction within this area will be crucial in determining the next direction — if a strong rebound signal forms, ORDI could potentially regain strength and retest the $8.940 resistance level.

Potential Buy/Long Setup for ORDI:

- Entry : $7.935

- Stop Loss [SL] : $7.504

- Take Profit [TP] : TP1: $8.359, TP2: $8.940

Important Note

Always apply proper risk management and disciplined capital allocation. For trading, especially when using leverage, it is recommended to limit the risk per trade to 1% of total capital.

Disclaimer: Pintu Futures trading (crypto futures contracts) is conducted by PT Porto Komoditi Berjangka, a licensed Futures Broker supervised by Bappebti and a member of CFX and KKI. Trading cryptocurrency futures contracts carries high risk, including the risk that leverage may magnify both potential gains and potential losses.

Share

Related Article

See Assets in This Article

WOO Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-