Introducing Ethena: The First Native Synthetic Dollar Protocol

Ethena introduces a groundbreaking innovation to the stablecoin sector with USDe, a synthetic dollar token. It is the first entirely native on-chain dollar asset within the crypto ecosystem. This innovative approach has propelled USDe as the fastest stablecoin to reach $2 billion in supply. So, what is USDe? How does it work? Why is it so popular? Find out in the following article.

Article Summary

- 🗳️ Ethena is a synthetic dollar protocol (USDe) built on the Ethereum blockchain. Unlike stablecoins that use the US dollar as their underlying asset, USDe derives its value from collateralized ETH or short positions in futures.

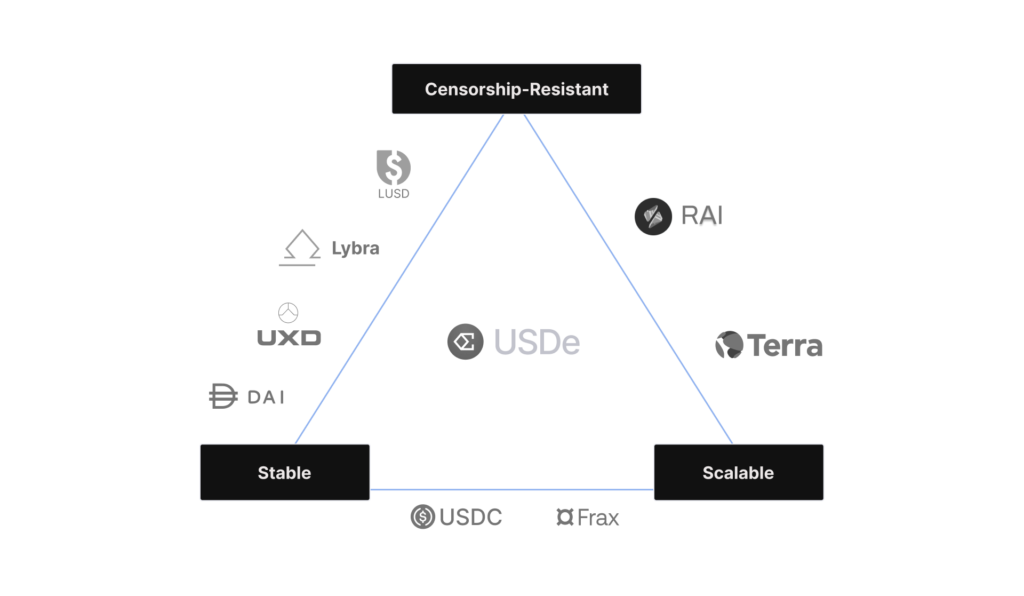

- ✨ USDe becomes a native dollar asset in the crypto ecosystem because it does not rely on traditional banking infrastructure. It becomes a censorship-free, transparent, scalable, and fully on-chain stablecoin.

- 💪 To ensure the stability of the USDe value, Ethena uses the delta hedging strategy and internet bond. Thanks to these two mechanisms, Ethena can generate dual yield for its users.

- 🪙 ENA serves as the native governance token on the Ethena platform. ENA holders can participate in decision-making related to protocol development.

What is Ethena?

Ethena is a synthetic dollar protocol (USDe) built on the Ethereum blockchain. As a synthetic product, USDe is unique compared to other stablecoins such as USDC or USDT. Instead of being pegged to the fiat US dollar, USDe derives its value by collateralizing crypto assets or shorting futures positions.

To ensure the stability of the USDe value remains the same as the US dollar, Ethena uses a delta-hedging mechanism by making staked Ethereum as collateral. In addition to maintaining stability, the mechanism also ensures the composability of USDe in various DeFi.

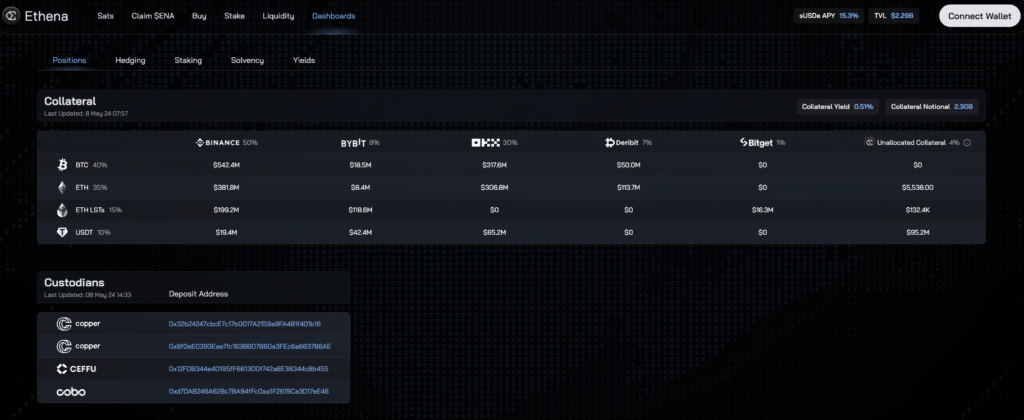

This approach makes USDe a native dollar asset in the crypto ecosystem because it does not rely on traditional banking infrastructure. USDe is now a censorship-free, transparent, scalable, and fully on-chain stablecoin. Users can access all data related to USDe collateral, funding rates, and so on through the following dashboard.

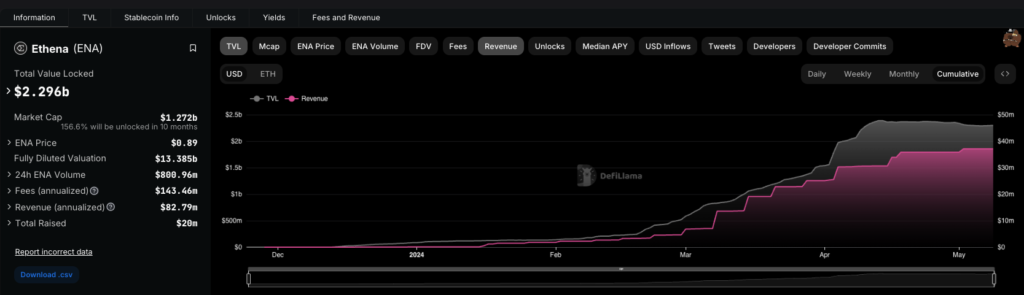

Ethena has emerged as one of the standout protocols in the industry. Its performance has been particularly impressive. Based on DeFi Llama, Ethena has recorded positive growth in terms of total value locked (TVL) and revenue. At the time of writing this article, Ethena boasts a TVL of $2.3 billion and has generated revenue of $37.6 million.

According to a report by Ethena Labs, USDe’s supply reached $2.359 billion as of April 15, 2024. With those numbers, USDe became the fastest stablecoin to break $2 billion in supply. USDe’s popularity is partly due to its integration with many prestigious institutions, including MakerDAO, Frax, Curve, and Aave.

{HTML Beli ENA}

How Does Ethena Work?

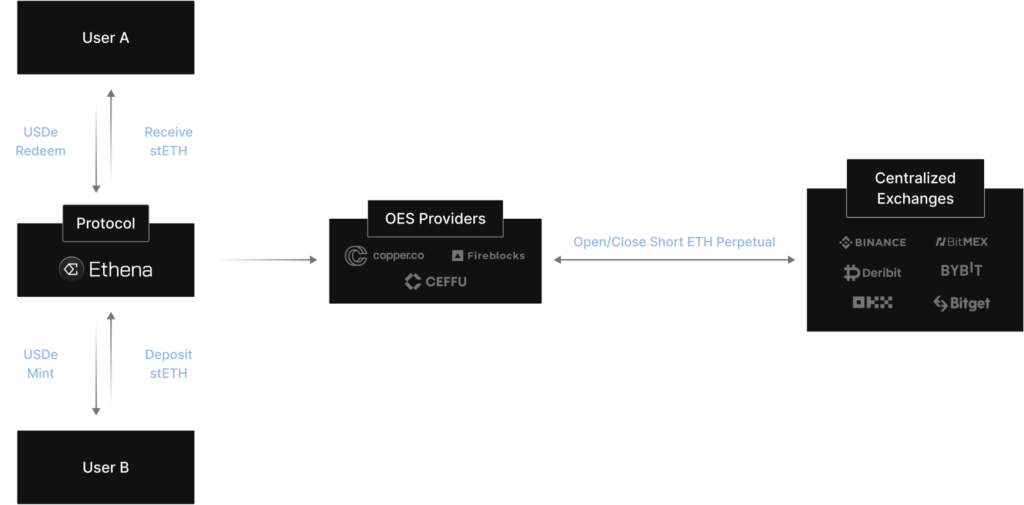

As mentioned, USDe uses a delta-hedging mechanism to maintain its peg to the US dollar. Here is an overview of how USDe works:

- Delta-Hedging Mechanism. USDe’s value is stabilized through real-time, programmatic delta-neutral hedging. It is a strategy created to neutralize the price volatility of a collateralized asset. This method involves taking an opposite position in the derivatives market, which is equal in size to the collateral asset (Ethereum). As such, the synthetic dollar’s value remains stable regardless of market fluctuations while capitalizing on the value growth potential of Ethereum

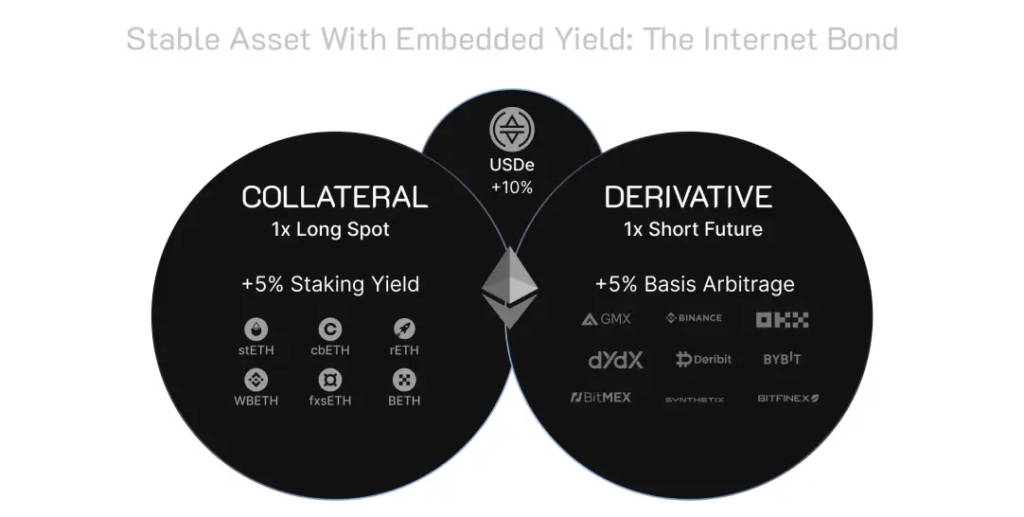

- Internet Bond. It is a financial instrument in the Ethena ecosystem that offers users a yield-generating asset. Leveraging the Ethereum blockchain as its underlying, the internet bond combines the return from staked Ethereum and delta hedging strategies in futures and perpetual markets. This combination not only aims to provide a stable return but also introduces a native dollar-denominated crypto option that is fully transparent and operates autonomously.

- Issuance and Redemption Process. Users can mint USDe by depositing liquid Ethereum tokens (stETH) and redeeming it back. By doing this, Ethena can adjust the supply to maintain its peg to the US dollar. Ethena Labs facilitates this process for parties that pass KYC/KYB checks to ensure controlled and compliant interactions.

- Yield Mechanism. Ethena generates yield for USDe holders by leveraging the staked ETH rewards and the funding and basis spreads from their hedging positions. These two sources of yield contribute to the ‘internet bond’, offering a new method of US dollar-denominated savings.

- Risk Mitigation and Transparency. Ethena Labs addresses operational, market, and smart contract risks through diversified hedging strategies and multiple custody solutions. It ensures transparency by providing on-chain proof of collateral assets and hedging positions.

These structures and mechanisms make USDe a stable, scalable, and censorship-free currency. By leveraging the Ethereum network and its composability to various DeFi, Ethena also paves the way for a new generation of financial products that align with the spirit of decentralization and user empowerment.

The other new innovation in the crypto world is the liquid restaking protocol. Read the explanation and its potential in the following article.

Ethena’s Features

- Dual Yield

Ethena generates yield from two primary sources: staked Ethereum rewards and funding and basis spread. The positive spread is derived from the imbalance in demand for digital asset exposure, providing additional yield for those who short the exposure. The yield rate will fluctuate annually according to market conditions.

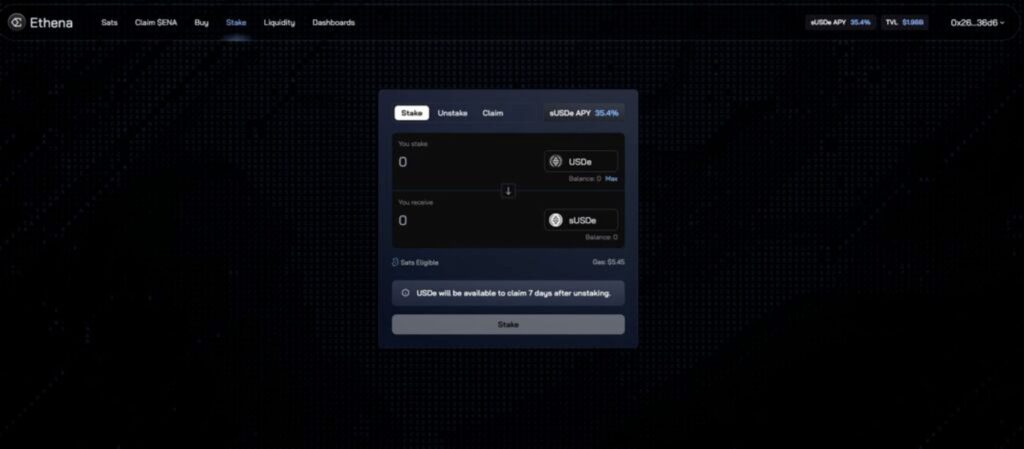

Users can participate in the yield mechanism by staking USDe for sUSDe. The “Token Vault” model ensures staked USDe directly generates yield without being rehypothecated. As a result, the value of sUSDe will continue to grow over time, reflecting the accumulated yield.

The model ensures users will benefit from the yield attached to the staked assets. So, the value of sUSDe will always grow in line with USDe as the Ethena protocol continues to deposit yield into the staking contract.

- Sats Point

Ethena has a campaign program called Sats that offers a reward system for Ethena users in its ecosystem. Users can earn Sats points by participating through USDe staking, becoming liquidity providers, and participating in DeFi integrated with Ethena. Users can exchange their Sats points for Ethena governance tokens .

- USDe sebagai Jaminan Perpetual

Stablecoins such as USDT and USDC are still the primary collateral choices for perpetual trading. However, USDe has paved its way to becoming a new stablecoin used as collateral for perpetuals. Traders who use USDe as collateral will also receive a yield and a bonus of 20x sats points per USDe.

By getting yields from assets used as collateral, users can increase the efficiency of their fund management. One of them is to cover funding costs through the yield obtained from pledging USDe for perpetual trading.

So far, Ethena has collaborated to make USDe as a perpetual collateral with Bybit. In the future, Ethena will add cooperation with other exchanges.

Yield farming is one way to gain profits from the DeFi protocol. Learn how to do it here.

Ethena’s Advantages

- 🌐 Native Stablecoin. USDe operates entirely on the blockchain, eliminating reliance on centralized entities like banks. By holding USDe and using Ethena’s DeFi services, users have more control and faster access to their assets. They don’t have to worry about external factors that may affect traditional financial institutions.

- 🔐 Transparent and secure. The entire process of issuing and redeeming USDe is done on-chain, promoting transparency. Users can track their assets and transactions on a public ledger, fostering trust and security.

- 🤑 Competitive yield. Ethena has an innovative yield generation strategy that combines staked ETH rewards and funding and basis spreads. This approach, using the DeFi mechanism, allows USDe staking to generate more favorable yields in the long run.

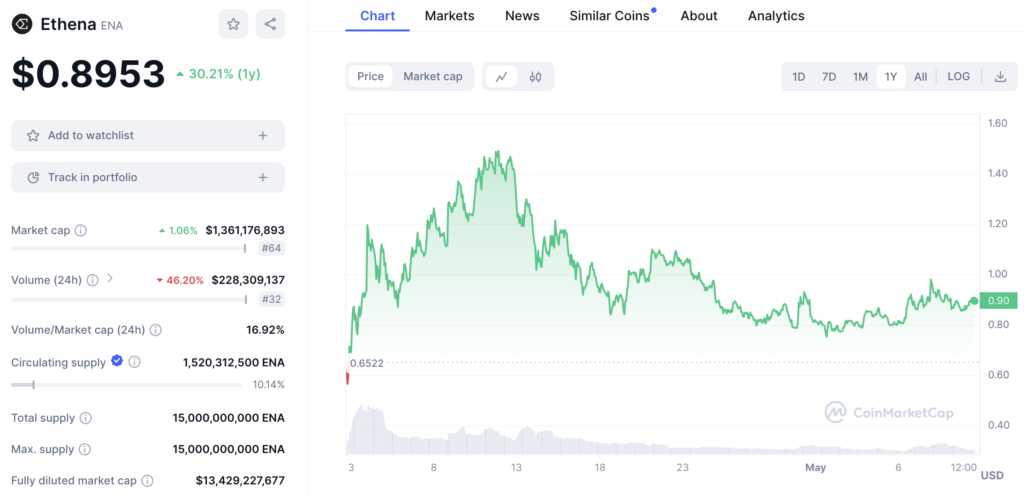

ENA Token as Investment

ENA is the native token of the Ethena ecosystem. It was recently launched through a Token Generation Event (TGE) on April 2, 2024. Only 1.52 billion ENA tokens have been circulating in the market since its launch, which is about 10% of its total supply of 15 billion ENA.

ENA serves as a governance token in the Ethena ecosystem. Some of its uses are voting right on proposals for adding new collateral assets for minting USDe, distribution allocation between sUSDe and its reserve fund, or even introducing new features to Ethena as a DeFi protocol.

Since its launch, the value of the ENA token has been volatile. On April 11, 2024, the ENA token reached its highest value of $1.49. However, since then, its value has declined, and it is currently valued at $0.89.

One thing to note from the ENA token distribution schedule is the 13% token unlock at the start of Q2 2025. This means that 2 billion ENA tokens will be released to the market, causing its market cap to increase by 150% from its current amount. A token unlock of this size could potentially benefit Ethena’s early investors and cause high volatility.

Ethena Airdrop Farming with Pintu Web3 Wallet

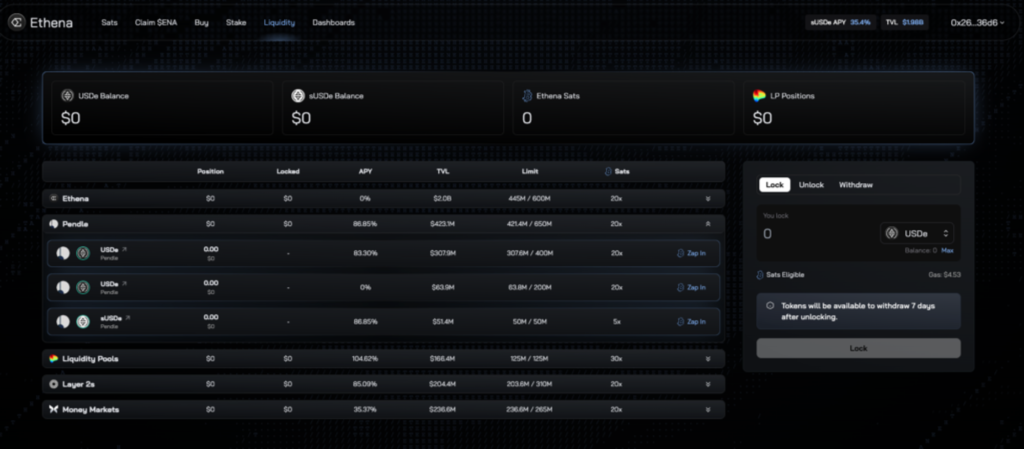

Ethena has launched the second season of its airdrop program, the Sats Campaign. This season, Ethena has collaborated with several other protocols, such as MakerDAO, Morpho, Mantle, Pendle, and EigenLayer.

By completing the Sats Campaign tasks, you can earn Sats points. Accumulating Sats points will help you meet the requirements for the Ethena airdrop by the end of the campaign.

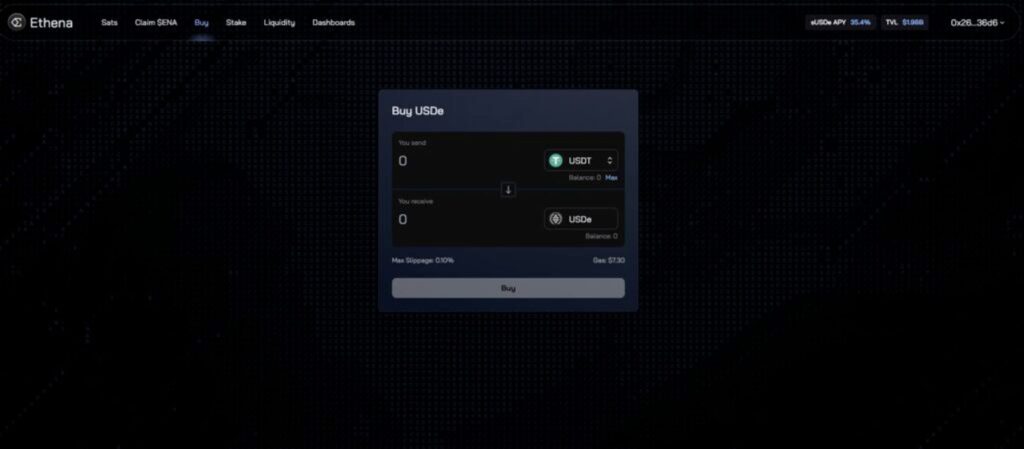

- Visit https://app.ethena.fi/ and connect your Pintu Web3 Wallet via WalletConnect.

- To join this campaign, make sure you already have USDT/USDC. You can buy it first on Pintu and send it to Pintu Web3 Wallet.

- Once connected, go to the Buy section to purchase USDe using USDT or USDC. Enter the amount you want, and don’t forget to leave some for gas fees.

- Once you have USDe, you will automatically earn 5x Sats points every day.

- You can earn 2x additional Sats points every day by staking your USDe tokens. Currently the APY for staking USDe tokens is 35.4%.

- Meanwhile, if you lock USDe tokens by becoming a liquidity provider, you can earn up to 20x additional Sats points every day.

- Apart from the Ethena protocol, you can also collect Sats points through protocols that have collaborated with Ethena. On Pendle, for example, the APY obtained can reach 80.73% with an additional 20x Sats points every day.

- You can check your progress and earn Sats points through the following dashboard.

In addition to Ethena, you can also farming for airdrops from other protocols using the Pintu Web3 Wallet.

Conclusion

Ethena has introduced an alternative stablecoin called USDe. USDe is a synthetic dollar and the latest innovation in stablecoins. It is a native stablecoin in the crypto ecosystem, meaning it does not rely on traditional banking infrastructure. As a result, it is censorship-free, transparent, scalable, and fully on-chain stablecoin.

USDe has been well-received by the crypto community, as evidenced by its rapid rise to $2 billion in supply. Ethena Labs is further fueling its adoption by developing innovative use cases, like collateral for perpetual trading. It will be interesting to see where USDe goes and how it will be used in the DeFi ecosystem.

How to Buy ENA on Pintu

After knowing what Ethena is, you can start investing in ENA by buying it on Pintu app. Here is how to buy crypto on Pintu application:

- Create a Pintu account and follow the process of verifying your identity to start trading.

- On the homepage, click the deposit button and top up the Pintu balance using your preferred payment method.

- Go to the market page and look for ENA.

- Click buy and fill in the amount you want.

- Now you have ENA!

In addition to ENA, you can safely and conveniently purchase a wide range of cryptocurrencies such as BTC, ETH, SOL, and others safely and easily on Pintu. Pintu diligently evaluates all its crypto assets, highlighting the significance of being cautious.

Pintu is also compatible with popular wallets such as Metamask to facilitate your transactions. Download Pintu app on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

In addition to buying and trading crypto assets, you can expand your knowledge about cryptocurrencies through various Pintu Academy articles. Updated weekly, all Pintu Academy articles are made for knowledge and educational purposes, not as financial advice.

References

- Ethena Docs, Ethena Overview, accessed on 8 May 2024.

- Jed Barker, What is Ethena? Data Wallet, accessed on 8 May 2024.

- 0xKira, $1.5 Billion TVL in Under 2 Months: What Is Ethena? CoinMarketCap, accessed on 8 May 2024.

- Ethena Labs, Custodian Attestations of Assets Backing USDe, Mirror, accessed on 8 May 2024..

- Ethena Labs, ENA Airdrop and Season 2: Sats Campaign, Mirror, accessed on 9 May 2024..

Share

Related Article

See Assets in This Article

0.0%

ENA Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-