Position Trading with Limit Order

When it comes to maximizing profits, position trading is often considered one of the most effective methods. To successfully execute the strategy, a trader’s ability to determine when a trend begins and ends is crucial. Utilizing limit orders is one way to maximize profits on position trading. But what do you need to consider when implementing position trading? How does it differ from the buy-and-hold strategy? Find out more in the following article.

Article Summary

- 📈 Position trading is a method where traders hold their positions for a long time, usually until a trend ends.

- 💸 The goal of position trading is to capitalize on a sustained trend, with traders paying less attention to short-term market fluctuations.

- ⏱️ The success of position trading depends on the timing of buying and selling assets at the right price. Limit orders will be beneficial in position trading, especially during volatile price movements.

- 💡 Some strategies in position trading include breakout trading, using moving averages, considering macroeconomic conditions, responding to blockchain network upgrades, and watching news sentiment.

What is Position Trading?

Position trading is a trading method where traders maintain their positions for an extended duration, often aligning with ongoing trends. This strategy primarily aims to maximize profits while an asset remains within a prevailing trend.

The underlying assumption is that when an asset embarks on a new trend, it will persist for a considerable period. Therefore, the investment period in position trading can extend to months or even years. Those who use this method are generally less concerned with short-term price volatility unless such fluctuations impact the asset’s long-term trend outlook.

It’s important to note that position trading differs from the buy-and-hold investment model, where investors have long-term objectives such as financing children’s education or securing retirement funds.

In position trading, the duration is only as long as the trend lasts. In other words, as soon as the trend shows signs of ending, investors sell their assets immediately. This makes position trading much more optimal when the market is bullish or bearish (placing shorts). If the market is sideways, range trading may be a more ideal choice.

Learn more about range trading and how to do it in the following article.

Position Trading With Limit Order

Timing is critical in successful position trading, enabling traders to manage risk and maximize profits. Limit orders offer an effective means of precise trade execution, particularly valuable during volatile trending conditions, ensuring you avoid unexpected prices.

Limit orders streamline the position trading process by automating it. Traders only need to determine and set the target prices. Then, the limit order will execute and complete the order when the market reaches the specified price point.

In setting a price target in position trading, traders can use the highest point in the previous trend for the sell limit price target. In addition, you can also use a price target based on the percentage of profit you want to get. As for the buy price target, ideally, use the nearest support point to get the best purchase price.

Example of Position Trading Using Limit Order

For example, Yoga decided to position trade Solana as its price plunged after being dragged down by the FTX issue. Based on fundamental analysis, such as on-chain metrics, Solana still has active users and many transactions. So, Yoga believes there is still an opportunity for the price to rise to its original level.

Yoga then calculated that SOL’s strong support point was at US$10. He then placed a limit buy order at US$11. As the level was reached, his order was executed. According to his calculations, the US$ 30 level was SOL’s strongest support point before falling to its lowest price. The assumption was that it would be a key resistance point for SOL in the future. Yoga then placed a sell-limit order for SOL at US$ 29.

After that, Yoga only has to wait for the price to be reached and the sell limit order to be executed. When it comes to momentum and trends, it’s possible to reach your target in a matter of weeks, months, or even years. But, not to worry, Pintu’s Limit Orders do not have an expiration date. This means that the order will not be deleted until it is fulfilled.

Position Trading Strategies

Position trading offers a variety of strategies, including those based on technical analysis to predict trend continuity and external sentiment for price trend determination. Here are some key strategies:

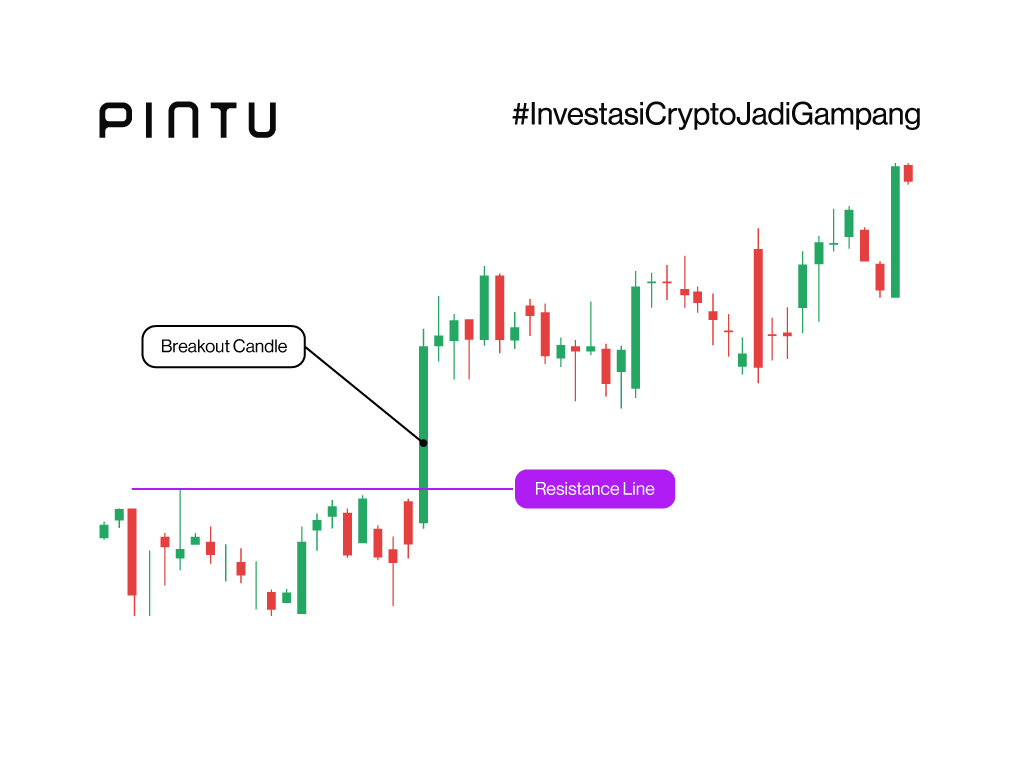

1. Breakout Trading

The first position trading strategy is to utilize breakout trading. It occurs when the price of an asset breaks out of its strongest support or resistance point, signaling the likelihood of the prevailing trend continuing. However, to confirm that a breakout occurs, ensure the price increase is followed by an increase in volume.

For example, take a look at the illustration above. A breakout candle forms when its price movement has crossed the strong resistance line of the previous trend. Once the resistance level is broken, the price will be in a positive trend and continue to move up. Position traders who are just about to take a position can immediately buy above the resistance line.

If traders enter the market using breakout trading, they will hold their assets for a shorter period. Meanwhile, if they enter using the previous trend’s support points, their profit will likely be much more significant. But they will hold their asset for a longer period.

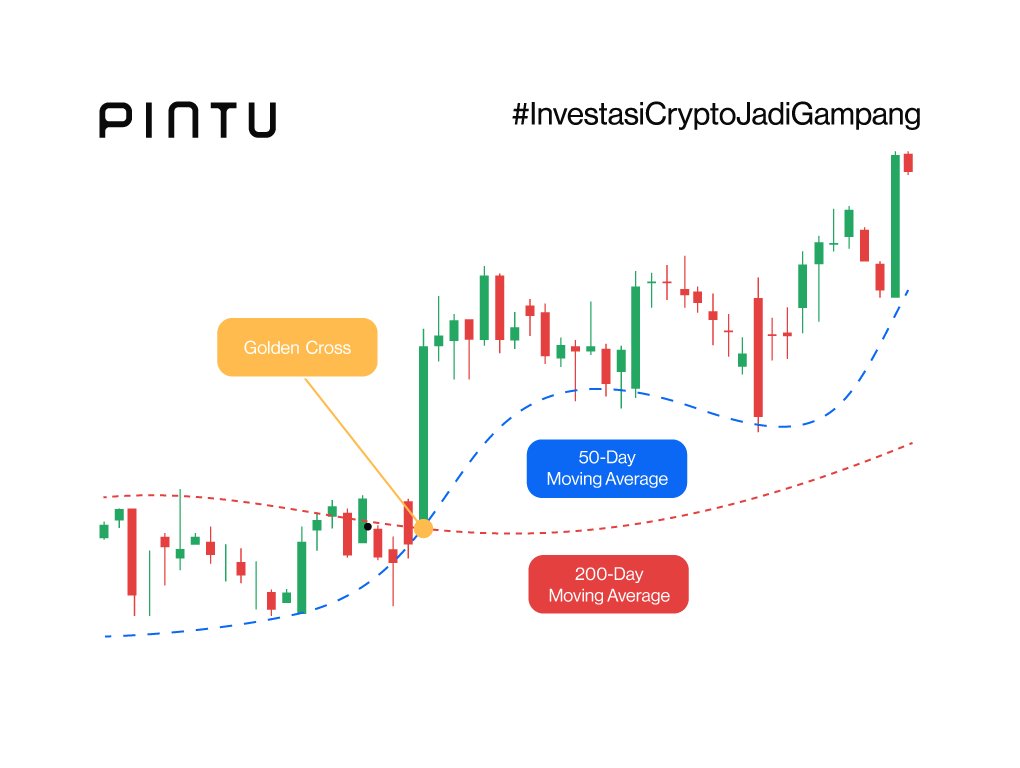

2. Moving Average Trading

The next strategy in position trading is using moving averages. This strategy identifies the continuation points after the price has reached its mean. The MA indicators often used in position trading are the 50-day MA and the 200-day MA, which can signal potential long-term movements.

When the 50-day MA crosses below the 200-day MA, it forms a death cross pattern. It is a bearish signal indicating that the correction trend is gaining momentum and will continue. Meanwhile, a golden cross pattern is formed if the 50-day MA crosses above the 200-day MA. This bullish signal indicates the upward trend is gaining momentum and will continue.

Thus, for traders who want to place a short position, the appearance of a death cross can be a signal to enter. Meanwhile, for those who want to put a long position, the appearance of a golden cross can be a sign to take a position.

Remember, technical indicators cannot be used alone. Also, there is no guarantee that the signals are 100% accurate. Make sure to combine them with other technical indicators, support and resistance, for example. In addition, fundamental analysis is also required to identify possible emerging trends.

3. Macroeconomic Condition

Macroeconomic conditions greatly influence the risk appetite of market participants. Today, as the Fed tightens its monetary policy, many market participants are cautious. This has led to a sideways trend in the prices of riskier assets like cryptocurrencies. Contrasting this with the 2021 period, when the Fed aggressively injected substantial stimulus, crypto assets enjoyed a bull market.

Therefore, one of the strategies in position trading is to look at macroeconomic conditions. Make sure the macroeconomic conditions are conducive so that it allows the creation of positive trends in crypto assets.

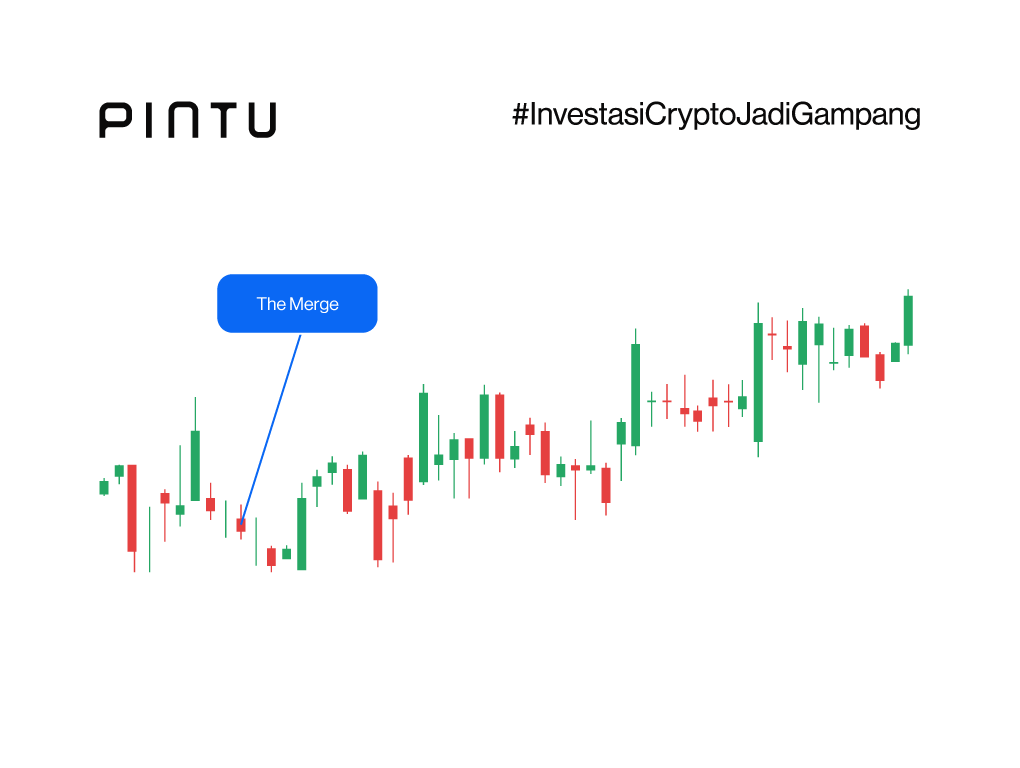

4. Network or Technology Upgrade

Any network or technology upgrades to a blockchain usually serve as a positive catalyst, especially if they are game-changing and has been anticipated by the market. An example is The Merge update on Ethereum in September 2022. In the June-July 2022, the ETH price was only around US$ 1,000. A month before The Merge, the price skyrocketed to US$ 1,900. However, post The Merge, as the market was priced-in, the price retraced to the US$ 1,300 range.

Capitalizing on a network’s planned update in position trading can be an ideal entry point. However, asset prices often rise before the launch and fall again when the update is rolled out. So, taking a position well before the update is a good idea. Then, exit and sell the asset when the trend peaks.

5. News Sentiment

The crypto asset market is highly responsive to relevant news developments. Recently, when there was a lot of news related to the Bitcoin ETF Spot, related assets such as BTC and BCH experienced a price surge. Within a week, BCH managed to increase by 187% due to the news. Position traders who carefully observe the market will immediately take a position when there is a potential price spike after the Bitcoin ETF Spot news.

Similar things have happened in the crypto market and will happen again. Each year, the crypto industry has a different narrative. Therefore, if you want to do position trading, remember to follow the latest developments and news related to the crypto market. With this strategy, you can choose crypto assets with the most potential to experience a positive trend. This strategy can also be referred to as narrative-based position trading.

Pintu Academy has prepared a special article on how to trade based on narrative.

Position Trading Pros and Cons

The following are some of the advantages of position trading:

- 🤑 Significant profit potential. Given its long-term nature, position trading offers the potential for substantial returns, particularly if you have ample capital to invest.

- 🏖️ Less Stressed. Position traders do not need to engage in frequent or active trading; it’s more occasional. Therefore, this method allows traders to maintain a calm and relaxed approach, since short-term price fluctuations are not their main focus.

The following are some of the drawbacks of position trading:

- 🔑 Loss of liquidity. Position trading locks up a trader’s capital until the order is fulfilled. Locked capital can limit traders’ participation when new opportunities present themselves.

- 💭 Hard to predict. No one can know when the specified price target will be reached. If it misses the initial calculation, traders who lose patience may close the position. This can lead to wasted time and an unfulfilled plan, whether the profit is far from the target or a loss.

Conclusion

Position trading is a trading method that relies on the ongoing trend of price movements. With this method, investors will hold their investment positions for a relatively long period. This strategy aims to take maximum advantage as long as the trend lasts.

In executing position trading, investors will focus less on short-term price fluctuations. They will focus more on long-term projections of asset. Although similar, position trading is different from long-term investments such as buy-and-hold.

Tools such as limit orders can be used to maximize the success of position trading. It can help traders by ensuring accurate buy and sale timing. Several strategies can be applied in position trading, including breakout trading, moving average indicators, paying attention to macroeconomic conditions, utilizing blockchain network updates, and monitoring news sentiment that affects the crypto asset market.

Buy Crypto Assets on Pintu

Want to try position trading? Perfect for you, with its Limit Order, Pintu can help you optimize your trading. You can safely and conveniently purchase a wide range of cryptocurrencies such as BTC, ETH, SOL, and others safely and easily on Pintu. Pintu diligently evaluates all its crypto assets, highlighting the significance of being cautious.

Pintu is also compatible with popular wallets such as Metamask to facilitate your transactions. Download Pintu app on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

Aside from buying and trading crypto assets, you can expand your knowledge about cryptocurrencies through various Pintu Academy articles. Updated weekly, all Pintu Academy articles are made for knowledge and educational purposes, not as financial advice.

Reference

- CMC Markets, Position trading, accessed on 18 October 2023.

- Baby Pips, Position Trader, accessed on 18 October 2023.

- Ashish Kumar, Position Trading, Wall Street Mojo, accessed on 18 October 2023.

- Akhilesh Ganti, Position Trader Definition, Strategies, Pros and Cons, Investopedia, accessed on 18 October 2023.

Share