Asian Billionaires’ Crypto Investment Increases Significantly, Here are the Key Facts!

Jakarta, Pintu News – The latest Sygnum APAC HNWI Report 2025 shows that wealthy investors in Asia are undergoing a drastic shift in their investment strategy towards digital assets such as cryptocurrencies.

The survey of High-Net-Worth Individuals (HNWIs) in the Asia-Pacific region revealed that the majority of respondents not only have crypto in their portfolio, but also plan to increase their allocation in the coming years. The findings reflect a paradigm shift from mere speculation to an important part of long-term wealth planning.

1. Majority of Asian Billionaires Already Own Crypto Assets

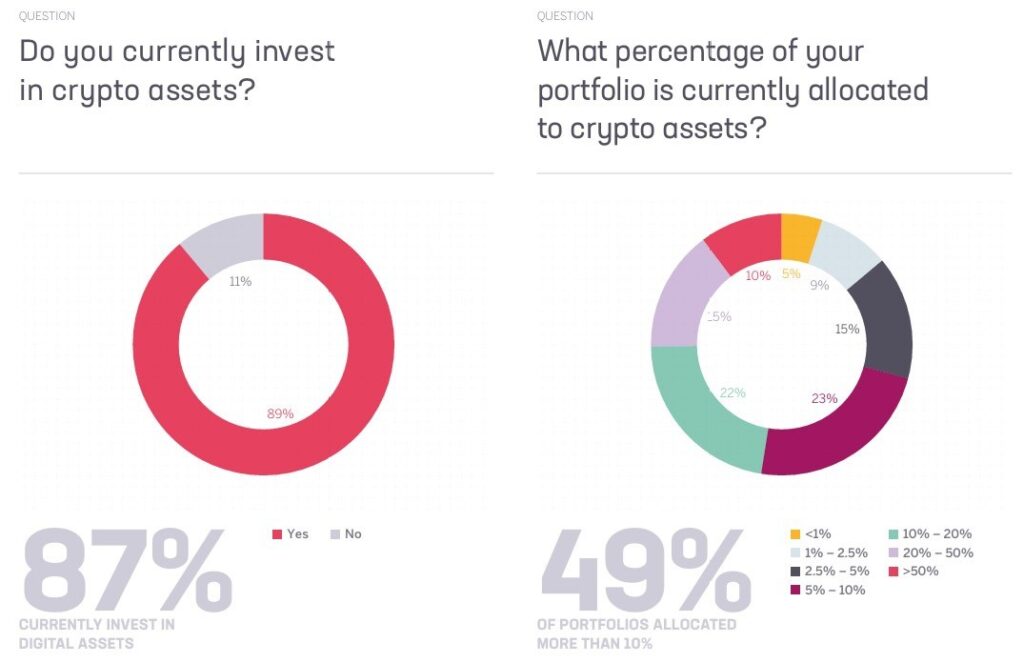

A Sygnum survey published by Cointelegraph noted that 87% of the HNWIs surveyed already have cryptocurrencies in their portfolio, with an average allocation of around 17%. The proportion of respondents holding an allocation of more than 10% was also high, signaling strong adoption among wealthy investors in Asia.

These results show that digital assets such as Bitcoin , Ethereum , and Solana are no longer exotic instruments but have been widely accepted by major investors in Asia. As many as 80% of respondents are actively investing in major blockchain protocols, demonstrating strategic diversification in their investments.

Also Read: 5 Strong Signals from Dogecoin: Price Resilience, New Adoptions, to Potential $1!

2. Asian HNWIs Poised to Increase Crypto Allocation

According to the Sygnum APAC HNWI Report 2025, 6 out of 10 wealthy Asian investors plan to increase their investment allocation in crypto based on a strong long-term outlook in the next 2-5 years. This reflects the belief that digital assets have a significant role to play in future personal wealth portfolios.

Respondents who plan to increase their allocations are showing a shift in mindset from speculative investments to diversification and wealth preservation strategies. They view crypto as an important asset class worth keeping in their investment portfolio.

3. Many Investors See Crypto as a Long-Term Wealth Preservation Tool

The report also reveals that 90% of respondents believe that digital assets are important for wealth preservation and legacy planning, not just as a speculative tool. This view suggests that wealthy investors are starting to see crypto as part of a cross-generational wealth strategy.

Gerald Goh, Co-founder and CEO of the Asia Pacific region at Sygnum, said that digital assets are now “embedded” or an integral part of the personal wealth ecosystem. This reflects the new professionalism among investors in managing their portfolios with market volatility and risk diversification in mind.

4. Demand for Crypto Services from Large Banks Increases

The Sygnum survey also noted that 87% of wealthy investors would ask their personal bank or advisor to add crypto services, if offered through an officially regulated partner. This indicates a growing demand for digital asset-based financial products and services.

This demand is expected to encourage traditional financial institutions to expand their crypto services, creating room for innovation and integration between traditional wealth management and digital markets.

5. Clearer Regulations in Asia Favor Crypto Adoption

According to this report, crypto regulation in Asia is getting clearer and stricter, creating a safer environment for large investors. The Monetary Authority of Singapore (MAS), for example, has set strict standards regarding asset custody, operational requirements, and investor protection.

A similar move is now being followed by Hong Kong, demonstrating the regional trend of creating a strong yet transparent regulatory framework. Such regulations can help foster institutional confidence in digital assets and attract more capital flow into the crypto market.

Cover: A New Era of Crypto Investment in Asia

Findings from the Sygnum APAC HNWI Report 2025 show that crypto is now not just a speculation tool but has become an important part of Asian billionaires’ investment strategies.

With the majority of HNWIs already owning crypto and many planning to increase their allocation, digital assets are seen as a long-term diversification and wealth preservation instrument. This shift reflects maturing adoption and could impact the direction of the crypto market in the next few years.

Also Read: 5 Highlights of TRUMP Meme Coin’s $1 Million Game Campaign: New Strategy to Boost Token Value?

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

What is HNWI in the context of crypto investment?

HNWI or High-Net-Worth Individual refers to individuals with more than $1 million in investable assets, many of whom now hold crypto in their portfolios.

What is the average crypto allocation in the portfolios of Asian billionaires?

The survey shows an average allocation of around 17% of their total investment portfolio.

Do Asian billionaires see crypto as speculation?

The vast majority of respondents-about 90%-see crypto as an important tool for wealth preservation and legacy planning, not just speculation.

What are the most widely held tokens?

About 80% of wealthy investors reported holding large protocol tokens such as Bitcoin (BTC), Ethereum (ETH), and Solana (SOL).

Why is the demand for crypto services from banks increasing?

A total of 87% of HNWIs said they would ask their bank or advisor to offer crypto services if they were available through a regulated partner, indicating a need for new institutional services.

Reference

- Cointelegraph. Asian Millionaires Bullish Crypto, 60% Raise Allocations: Survey. Accessed on December 11, 2025