Antam Gold Price Chart Today December 12, 2025: Up or Down?

Jakarta, Pintu News – Antam’s gold price recorded another significant gain towards the middle of December 2025. Based on data as of December 12, 2025 at 16:40 from HargaEmas.com, global and domestic gold movements show a consistent upward pattern, driven by a combination of external factors such as a weakening US dollar and increased investor hedging interest.

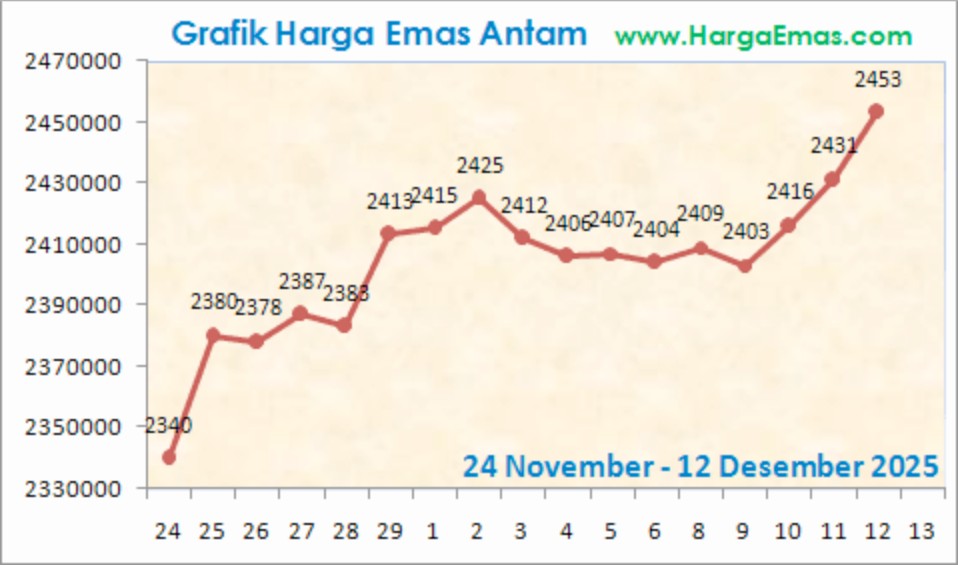

Daily gold charts and the November 24-December 12 range confirm that buying pressure is increasing, pushing prices to the highest level in three weeks.

The Rise in Spot Gold Prices and Its Impact on the Domestic Market

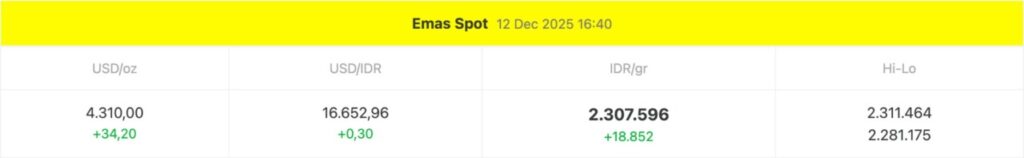

The USD-denominated world gold spot price increased to $4,310/oz, up $34.20 from the previous data. If converted using the USD/IDR exchange rate of 16,652.96, the value of this increase also lifted the price of gold in rupiah, which is now recorded at IDR 2,307,596/gram, growing IDR 18,852 in one day. The increase in the daily hi-lo level touched the range of IDR 2,311,464 – IDR 2,281,175, indicating limited volatility but with a stronger bias.

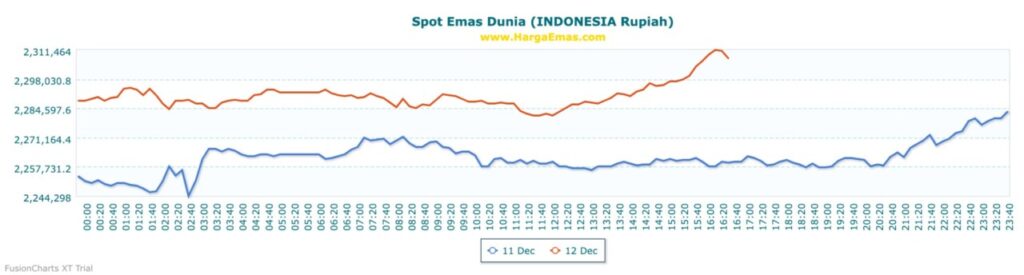

This strengthening pattern is evident on the Indonesian gold spot price chart, where the December 12 movement shows an upward trend from opening to close, in contrast to the previous day’s chart which shows stability tending to be flat. Intraday data illustrates a strong push in the afternoon to evening session, pushing prices through the daily short resistance area.

Also Read: 5 Strong Signals from Dogecoin: Price Resilience, New Adoptions, to Potential $1!

Antam Gold Price Chart Analysis November 24 – December 12, 2025

The Antam gold price chart for the period November 24-December 12, 2025 shows a firmer bullish pattern. The price on November 24 was around IDR2,340,000, then fluctuated up and down before entering a steady upward trend in early December. The price reached a temporary peak of IDR 2,425,000 on December 2, followed by a consolidation period from December 3-9 in the range of IDR 2,400,000-Rp2,410,000.

On December 10-12, buying pressure increased dramatically again. Prices rose from IDR 2,416,000 (Dec 10) to IDR 2,431,000 (Dec 11), before touching the highest level of the period at IDR 2,453,000 (Dec 12). These three consecutive days of gains indicate a strong momentum shift, signaling the market’s tendency towards a short-term bullish phase.

Factors Driving Gold’s Strength

The strengthening of Antam gold prices in mid-December was influenced by several main factors. First, global markets responded to US economic volatility and more accommodative monetary policy, encouraging investors to return to safe-haven instruments. Second, the relatively stable rupiah exchange rate strengthened the purchasing power of domestic gold. Third, year-end demand-both for investment needs and gifts-has historically increased transaction volumes.

Daily chart data also shows that buying activity increases at certain times, particularly the afternoon session, indicating greater retail investor participation at strategic price points.

Strengthening Trend Continues, Positive Momentum Maintained

Today’s Antam gold chart movement shows a strong upward trend, supported by macro factors and improved market sentiment. With global spot prices increasing and domestic charts showing bullish acceleration, the opportunity for prices to head higher remains open. Investors are advised to monitor daily chart developments and USD/IDR exchange rate movements as key indicators of Antam gold price determination in the local market.

Also Read: 5 Highlights of TRUMP Meme Coin’s $1 Million Game Campaign: New Strategy to Boost Token Value?

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ Antam Gold Price Today

What is the main cause of the increase in Antam gold price on December 12, 2025?

The increase in Antam’s gold price was triggered by the rise in global spot gold prices to $4,310/oz and strengthening domestic demand, exacerbated by market sentiment leaning towards hedging assets.

What is Antam’s gold price per gram today?

Based on data from December 12, 2025 at 16:40, the price of Antam gold is around IDR 2,307,596 per gram, up IDR 18,852 compared to the previous day.

What is the price movement of Antam gold during November 24-December 12, 2025?

The chart shows a continuous upward trend from IDR2,340,000 to a new peak of IDR2,453,000 on December 12, with a period of consolidation in early December.

What global factors influenced gold’s rise this week?

Global factors include the weakening US dollar, economic uncertainty, as well as rising safe-haven demand amid international monetary policy changes.

Is the gold price predicted to continue rising?

The chart shows strong bullish momentum, but gold’s movement is still influenced by the USD/IDR exchange rate and global economic policy so the trend may change at any time.

Why does the daily chart show spikes in the afternoon and evening sessions?

This pattern generally reflects increased domestic investor transactions coming in at liquid times, especially when global spot prices are also rising.

Is gold still an effective hedging instrument?

Yes. In a volatile global economy, gold remains a desirable hedge asset for both individual and institutional investors.

Reference:

- Gold Price. Gold Price Today. Accessed December 12, 2025.