Institutions are interested in Bitcoin again, what will be the impact? (18/12/25)

Jakarta, Pintu News – In recent weeks, there has been a significant change in the Bitcoin market characterized by an increase in purchases by institutions. Recent data shows that institutional purchases of Bitcoin have surpassed the amount of Bitcoin mined on a daily basis. This is the first time this phenomenon has occurred since early November and signals a change in the dynamics of market demand.

Increased Institutional Demand

Data from Capriole Investments, a digital asset investment fund, shows that institutions are now buying more Bitcoin than the amount mined each day. This is a 13% increase over the newly mined supply. This comes after Bitcoin searched for its lowest point, more than 30% below its October high.

This shows that institutions are starting to see Bitcoin as an attractive investment asset again. In the last three days, purchases by institutions have consistently outpaced newly mined supply.

This is the first time since November that corporate demand has net reduced the supply of Bitcoin in the market. Although the numbers are still modest compared to the peak of the bull market two months ago, this trend indicates a change in institutional attitudes towards Bitcoin.

Also Read: Bitcoin, Ether, and XRP Decline Increases Toward the End of 2026, Why?

ETF Outflows and Strategic Accumulation

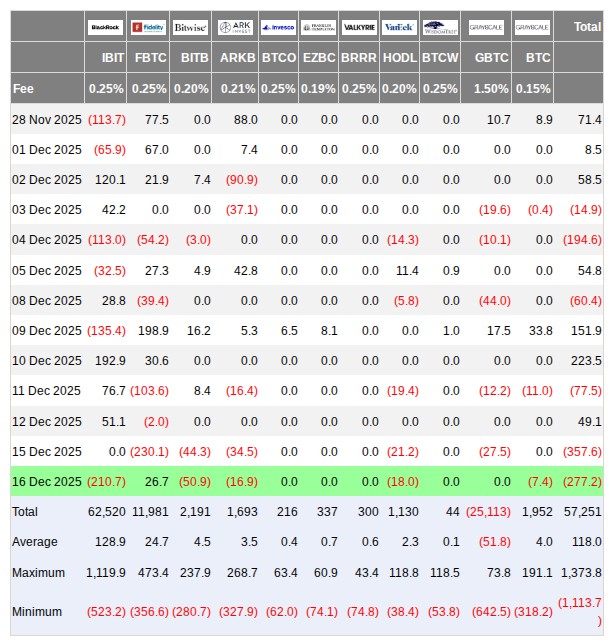

CryptoQuant, an onchain analytics platform, describes the current market as a “market in transition”. The short-term pessimism contrasts with the strategic accumulation undertaken by some market participants. Despite capital outflows from investment vehicles such as the US spot Bitcoin ETF, network fundamentals favor market entry.

Data from Farside Investors, a UK-based investment firm, records the ETF’s net outflows since Monday at $635 million. Despite the massive outflows, this was also offset by strategic buying by some institutions who saw this as an opportunity to accumulate Bitcoin at lower prices.

Long-term Implications for the Bitcoin Market

Increased institutional buying can have a long-term impact on Bitcoin’s price and stability. When large institutions get involved, they not only increase Bitcoin’s legitimacy as an asset class, but also add stability to the market through massive investments.

This could reduce the price volatility often associated with cryptocurrencies. Additionally, with institutions holding larger amounts of Bitcoin, the supply circulating in the market becomes more limited. This could push the price of Bitcoin up if demand continues to increase. However, it also raises questions about ownership concentration and how it may affect market dynamics in the future.

Conclusion

With institutional interest in Bitcoin returning, the market may witness a change in price trends and volatility. While there are some risks associated with the concentration of ownership by institutions, their presence is generally considered a positive signal indicating wider acceptance and adoption of Bitcoin as an investment asset.

Also Read: 7 Bitcoin (BTC) Facts Drop to Around $85,000, New Losses in the Global Crypto Spotlight

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

Q1: What has led to the increase in institutional purchases of Bitcoin?

A1: The increase in institutional purchases of Bitcoin is due to the significant price drop, which makes Bitcoin more attractive as an investment asset.

Q2: How much Bitcoin is bought by institutions compared to the newly mined supply?

A2: Institutions buy 13% more Bitcoin than the amount mined daily.

Q3: What is the impact of ETF outflows on the Bitcoin market?

A3: ETF outflows, which totaled $635 million since Monday, suggest capital withdrawal, but this was also offset by strategic buying by other institutions.

Q4: How can institutions affect the volatility and price of Bitcoin?

A4: Institutional involvement can reduce volatility and increase price stability of Bitcoin through massive investment and reduction of circulating supply.

Q5: What are the risks of institutional concentration of Bitcoin ownership?

A5: Concentration of ownership by institutions can affect market dynamics and cause problems if the institutions decide to sell their holdings in bulk.

Reference

- Cointelegraph. Bitcoin Institutional Buys Flip New Supply for First Time in 6 Weeks. Accessed on December 18, 2025