Cardano Spot Market Plunges 95% – Here’s Why the Whales Bought in the Collapse

Jakarta, Pintu News – Cardano is trying to stabilize after a difficult period. In the past 24 hours, ADA is up about 1.8%, but the broader picture still shows weakness. The token is still down nearly 9% over the past seven days, and Cardano’s price continues to sit below crucial short-term trend levels.

Cardano Loses Trend as Spot Market Interest Plummets

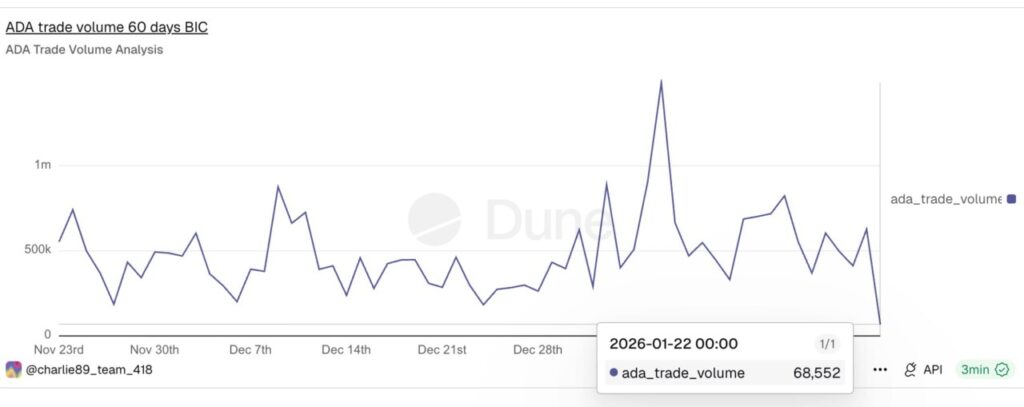

This weakness starts with participation, not just price. On January 6, Cardano’s spot trading volume on decentralized exchanges peaked near $1.49 million. On the same day, ADA also recorded its highest price in 2026. Since then, both price and activity have decreased together.

On January 22, spot trading volumes plummeted to around $68,552, down more than 95% in just over two weeks. This data reflects only spot trading, meaning real (exchange) buying and selling, not leveraged betting. A sharp drop in spot volume usually signals that retail participation has retreated.

Also Read: Is Gen Z Investing Only in Crypto a Smart Decision or Not? Here’s What Analysts Say!

Whale adds holdings amid market weakness

While spot traders exited, large holders did not. Addresses holding more than 1 billion ADA began accumulating around January 14, even though Cardano’s price continued to slide. The group increased their combined holdings from 1.92 billion ADA to 2.93 billion ADA, adding about 1.01 billion ADA during the correction. At the current price, that means about $360-$380 million was accumulated while the price momentum was still negative.

Most importantly, they continued to hold the asset despite the collapse. A second group of whales followed shortly after. Wallets holding between 10 million and 100 million ADA started adding on January 17, the same day that Cardano completely lost its 20-day exponential moving average (EMA). Their holdings rose from 13.61 billion ADA to 13.64 billion ADA, an addition of about 30 million ADA, or about $11 million at current prices.

Cardano Price Levels that Determine Whether Bears Are Trapped

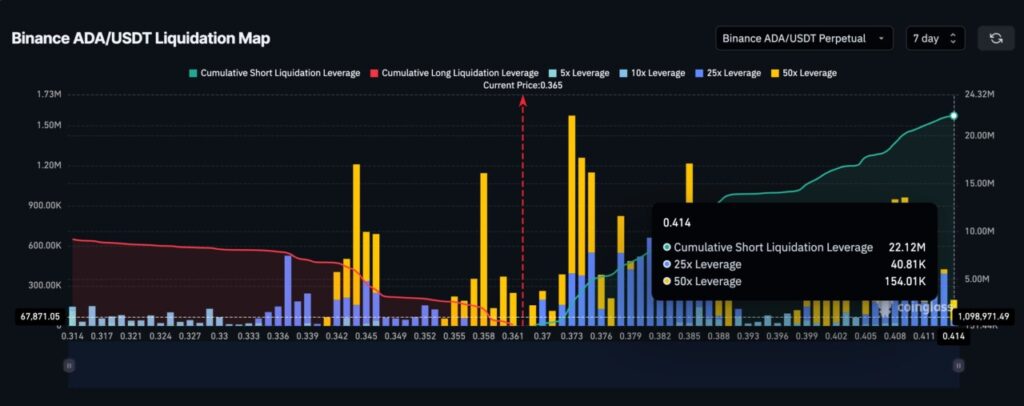

On the 12-hour chart, Cardano did experience a decline from the head and shoulders structure around January 20th. The decline likely triggered the last wave of spot selling and prompted a surge in short positions. However, momentum no longer confirms a further decline. The Money Flow Index (MFI) started to rise while the price held near the recent low. The MFI tracks buying and selling pressure using price and volume.

When the MFI rises as prices stabilize, it often signals buying on dips rather than panic selling. This could mean the return of spot buyers as the MFI breaks the downtrend line, leaving only short positions at risk. Short liquidation pressure is starting to build near $0.37.

Movement above that level will start to force the closure of short positions. Above $0.39, liquidation pressure increases significantly. A push towards $0.42 would put most of the near-term short exposure at risk. The bearish case regains full control only if ADA breaks and holds below $0.34. A sustained move below that level will thwart the stabilization thesis and reopen the risk of a drop towards the previous low.

Conclusion

Until then, Cardano remains caught between waning retail participation and growing whale confidence. Spot traders may have pulled back, but the positioning below suggests that the movement may not be complete.

Also Read: XRP price slumps, will it surge at the end of January 2026?

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Cardano Price & Volume Whale Divergence. Accessed on January 23, 2026